EY refere-se à organização global e pode se referir a uma ou mais das firmas-membro da Ernst & Young Global Limited, cada uma das quais é uma entidade legal separada. A Ernst & Young Global Limited, uma empresa britânica limitada por garantia, não presta serviços a clientes.

Insights

Descubra as informações necessárias para tomar melhores decisões hoje e moldar o futuro com confiança.

Saiba mais

Destaques

Private Equity Pulse

Private Equity Pulse: cinco conclusões do terceiro trimestre de 2025

23 out. 2025EY Global

Serviços

A EY ajuda seus clientes a criarem valor a longo prazo para todos os envolvidos. Orientados por dados e tecnologia, nossos serviços e soluções fornecem confiança por meio de assurance e ajudam os clientes a se transformarem, crescerem e operarem.

- Veja mais

- 1||Sobre a EY-Parthenon

- 2||Sobre a EY-Parthenon

Destaques

Indústrias

Descubra como os insights e serviços da EY ajudam a reformular o futuro do seu setor.

Saiba mais

Estudos de caso

Consultoria

Como a inovação em IA impulsiona a jornada financeira da Microsoft

30 out. 2025EY Global

Energia e Recursos Naturais

Como a IA impulsionou a otimização de dados para projetos de capital no setor de petróleo e gás

06 ago. 2025EY Global

Estratégia e Transações

A Rivada está reinventando a internet sem fio como um produto básico.

11 jul. 2025EY Global

Carreiras

Reunimos pessoas extraordinárias, como você, para construir um mundo de negócios melhor.

Sobre nós

Na EY, nosso propósito é construir um mundo de negócios melhor. Os insights e serviços que fornecemos ajudam a criar valor a longo prazo para clientes, pessoas e sociedade, e a construir confiança nos mercados de capitais.

Saiba mais

Principais notícias

Comunicado de imprensa

10 set. 2025EY Global

Comunicado de imprensa

18 set. 2025Emile Abu-Shakra

Comunicado de imprensa

04 ago. 2025Emile Abu-Shakra

Pesquisas Recentes

Tendências

-

E se a disrupção não for o desafio, mas a oportunidade?

Transforme sua empresa e prospere no mundo NAVI de mudanças não lineares, aceleradas, voláteis e interconectadas. Descubra como.

26 jun. 2025 EY wavespace™ -

Análise Geoestratégica: Edição de Dezembro de 2025

Leia a Geostrategic Analysis de Dezembro de 2025 para saber nossa opinião sobre os acontecimentos geopolíticos e o impacto desses riscos políticos nos negócios internacionais.

10 dez. 2025 Geostrategy -

Como reimaginar a força de trabalho atual pode ajudar os bancos a moldar seu futuro?

Ao se concentrarem em quatro imperativos de destaque, os bancos podem se diferenciar na concorrência pelos melhores talentos e gerar retornos mais altos sobre os investimentos em pessoas.

09 set. 2025

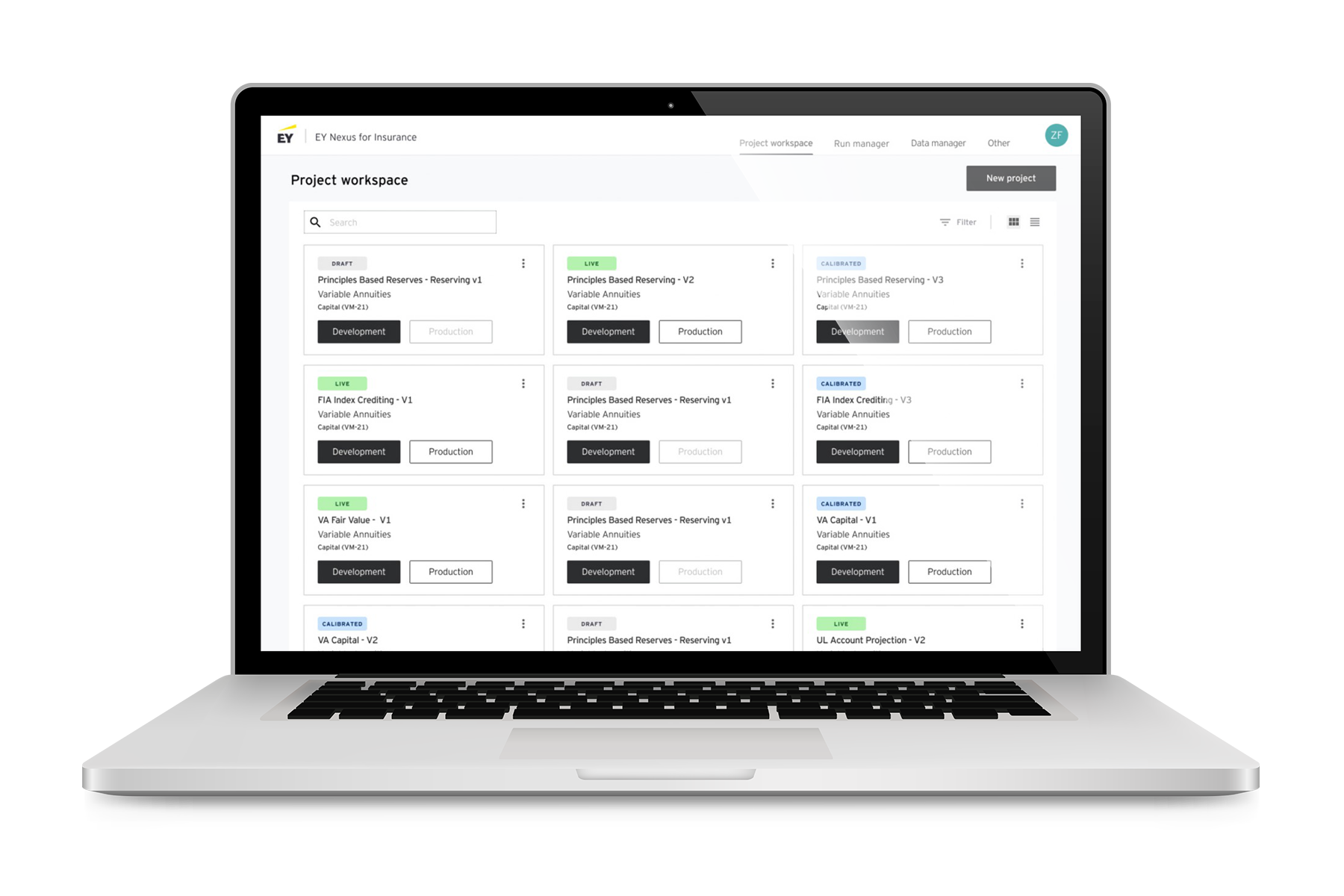

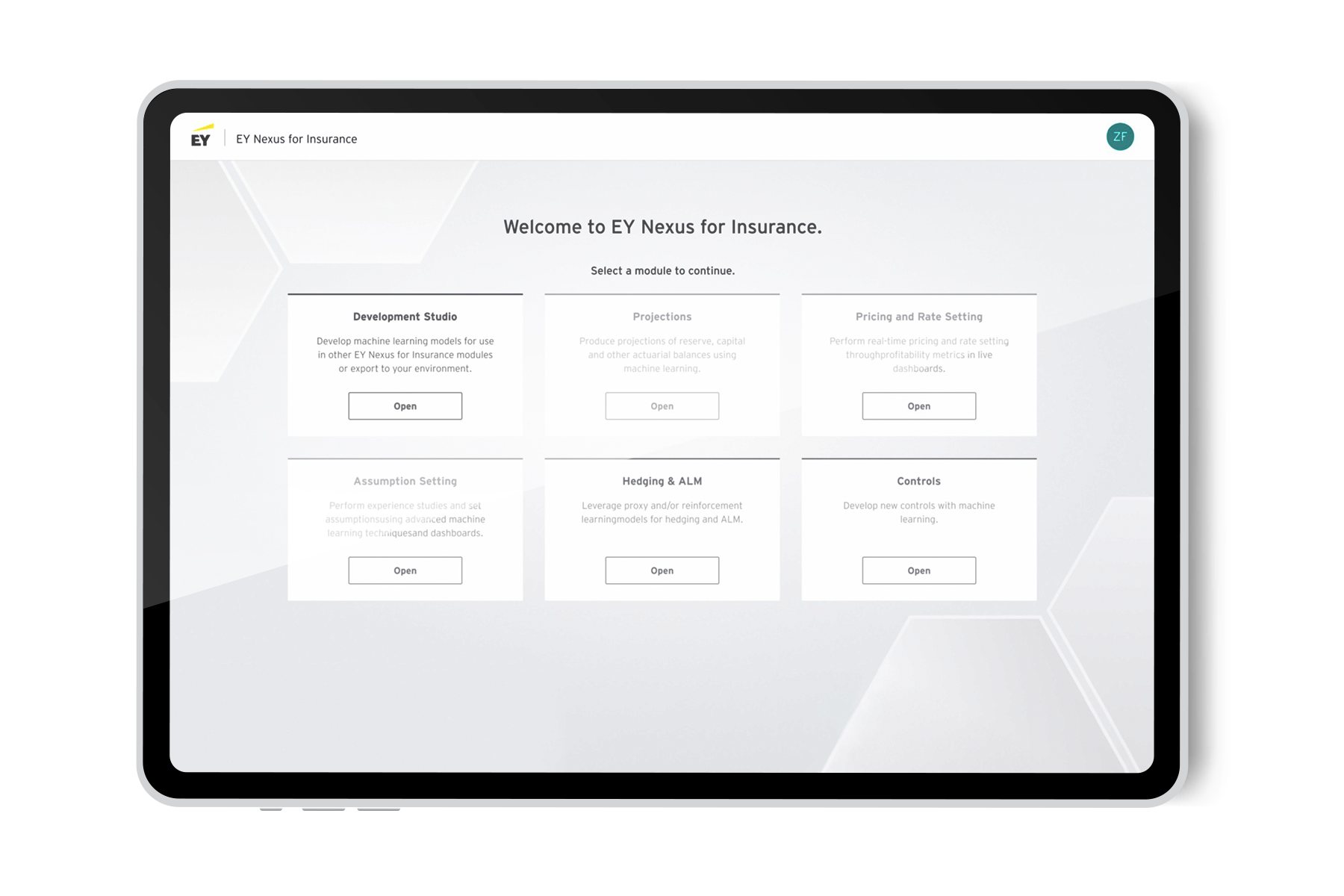

EY Nexus para seguros

Descubra o EY Nexus for Insurance

O EY Nexus for Banking é uma plataforma de transformação de negócios otimizada para serviços financeiros que acelera a inovação, libera valor em ecossistemas e potencializa experiências de cliente sem atrito. Ele ajuda você a ultrapassar os limites de novas ideias e serviços mais rapidamente para atender às necessidades de seus clientes.

Transformando o seguro

O EY Nexus apresenta um conjunto de componentes tecnológicos em constante evolução que são rápidos de criar e fáceis de adaptar. Esses componentes se encaixam perfeitamente nos sistemas e canais existentes para atender às principais necessidades dos clientes. Você também pode desenvolver seus produtos e serviços usando a plataforma central do EY Nexus, que é uma estrutura versátil, pronta para a nuvem, com blocos de construção prontos para uso de ativos de tecnologia que ficam dentro de um ecossistema de parceiros com curadoria.

Lançamento de novos produtos com rapidez

Lance novos produtos de seguro com opções para criar protótipos rapidamente e adaptar seu produto ao longo do tempo. Esses produtos ajudam você a explorar novos modelos de receita ou mercados em setores adjacentes, aprimorar uma marca existente ou lançar uma nova marca, ou explorar novos modelos de negócios.

Criando experiências sem atrito

Crie experiências mais fáceis, intuitivas e ricas em nossa plataforma EY Nexus que aumentam a confiança do cliente e melhoram as vendas e o atendimento. Esses produtos ajudam a permitir que o marketing de estímulo catalise a próxima melhor ação usando insights e análises orientados por nossas ferramentas EY Nexus.

Crescer em categorias e parcerias adjacentes

Com o EY Nexus, você pode romper as barreiras tecnológicas, ir além do conceito e lançar um novo negócio de seguros como uma extensão natural de suas ofertas existentes ou construir novas experiências por meio de parcerias com outras empresas do seu setor.

Modernize seus principais sistemas operacionais

A plataforma EY Nexus inclui um ecossistema com curadoria dos principais fornecedores de software comercial integrados a uma infinidade de InsurTechs e provedores de dados. Ampliamos ou substituímos seus sistemas atuais com rapidez, com uma arquitetura à prova de obsolescência que ajuda a permitir mudanças futuras mais rápidas.

Solicite uma demonstração hoje

Veja como o EY Nexus pode proporcionar negócios sem atritos.

Explore nossos estudos de caso