Die internationale EY-Organisation besteht aus den Mitgliedsunternehmen von Ernst & Young Global Limited (EYG). Jedes EYG-Mitgliedsunternehmen ist rechtlich selbstständig und unabhängig und haftet nicht für das Handeln und Unterlassen der jeweils anderen Mitgliedsunternehmen. Ernst & Young Global Limited ist eine Gesellschaft mit beschränkter Haftung nach englischem Recht und erbringt keine Leistungen für Kunden.

So unterstützen wir Sie

What is „Exchange Traded Crypto”?

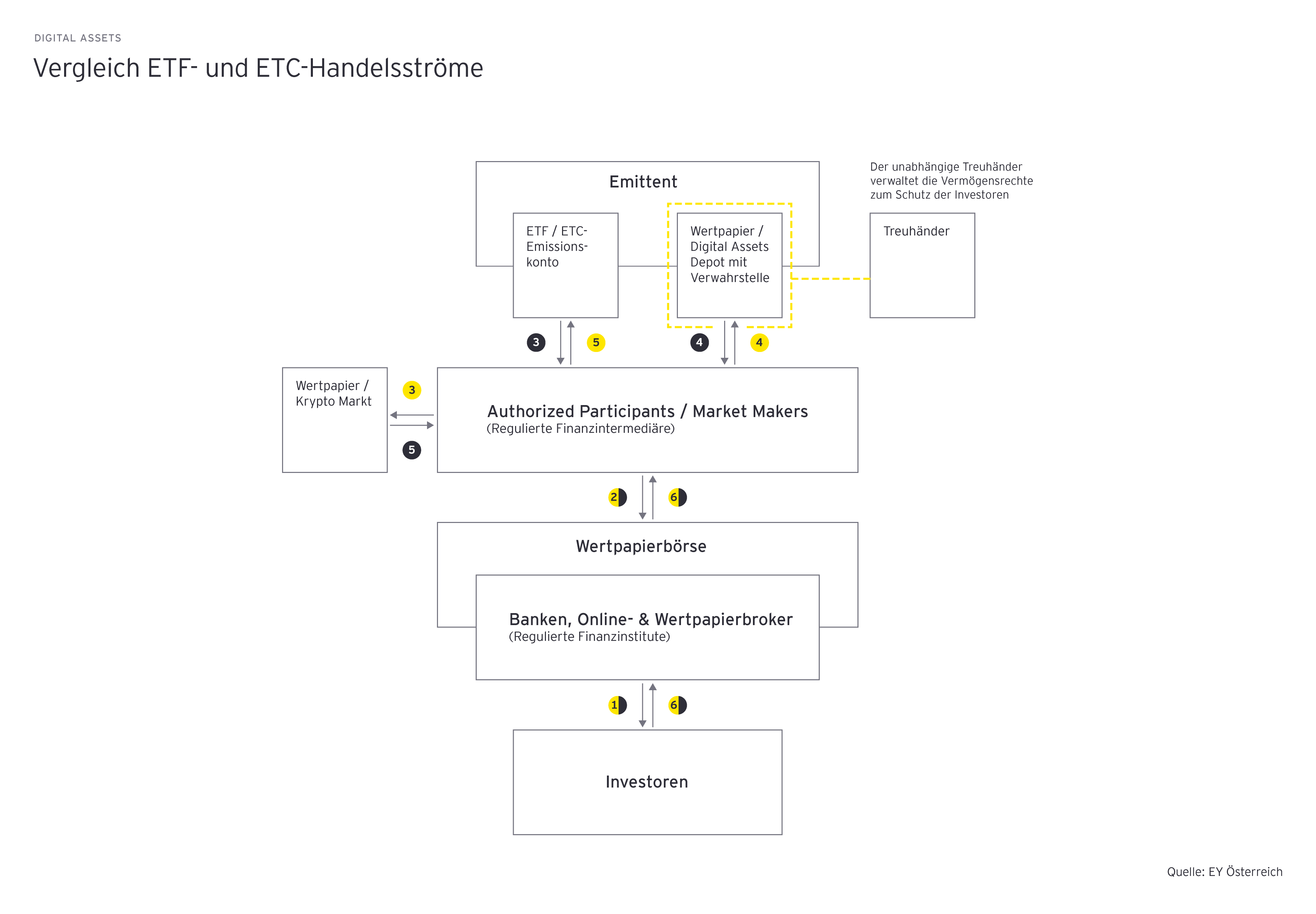

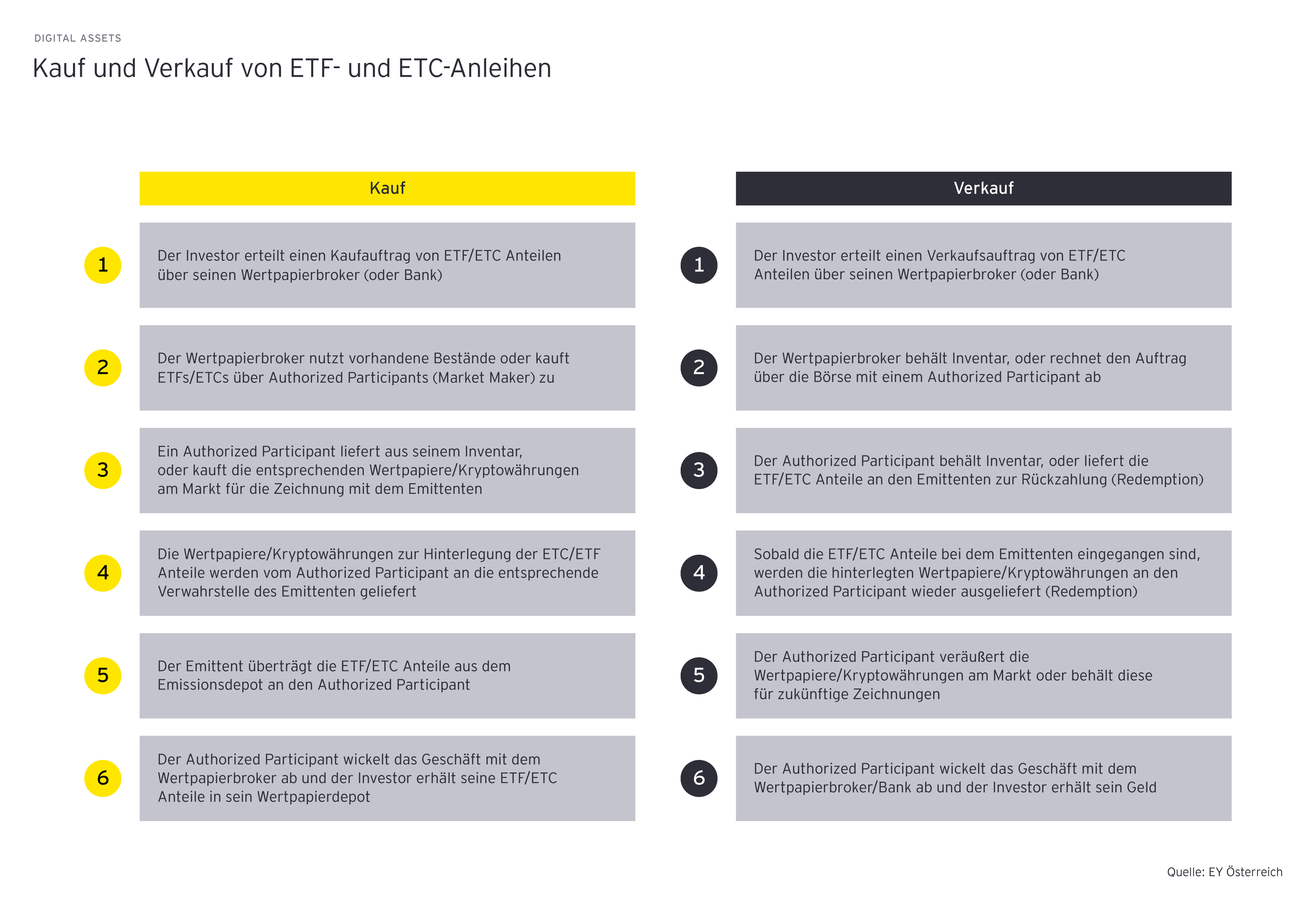

Exchange Traded Crypto, or ETC, is a simple and seamless way to invest in digital assets through a traditional stock exchange. The product class enables any investor to efficiently participate in the growth of digital assets while using secure, institutional-grade products traded on major stock exchanges, just like stocks or ETFs.

Simply put, Bitcoin and other digital assets now have an ISIN number .

From a technical point of view, crypto-ETCs are very similar to the popular physical gold exchange traded commodities, but instead of a certain amount of gold, each ETC unit is backed by a predefined amount of cryptocurrency. Therefore, the price of the underlying asset is closely tracked on exchange.

So how do investors access Exchange Traded Crypto?

Just like buying a stock such as Amazon, Apple, Tesla, or any ETF, investors can search for the ticker or ISIN on their online trading platform or bank, purchase e.g., Bitcoin ETC and add it to their existing stock portfolio. The shares are securely held in one’s own securities account like any other security and there is no need for a so-called digital wallet.

What is the difference between crypto ETCs and direct investments in bitcoin and other cryptocurrencies?

Many investors want to invest through the traditional financial markets they also use for their stock or ETF portfolios and are simply not clear about security or regulatory standards of online crypto platforms and exchanges.

In addition, fees on traditional stock exchanges are very transparent. Investors face product management fees in a similar fashion to ETF annual fees and trading spreads can be as low as 0,05% for entering and exiting a position.

Furthermore, digital asset custody and safekeeping is a hot topic. While some investors do not want to engage with the challenges of setting up their own cryptocurrency wallet, others have been rattled in the past by reports of wallet hacks, forgotten or lost passwords, as well as hacks and fraud targeting cryptocurrency exchanges. Crypto-ETCs therefore offer a straightforward and safe alternative, as the underlying crypto assets are deposited with a specialized and regulated custodian.