EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

M&A

M&A, divestitures and JVs can fuel growth. A clear strategy, sourcing the right deal, sound diligence and smooth integration are crucial.

Merger Monthly Newsletter

Subscribe to receive monthly M&A activity insights as soon as they’re released.

Our latest M&A thinking

M&A activity insights: December 2024

Read the latest Merger Monthly, with insights on recent US M&A activity insights and what to expect as we look ahead.

M&A outlook shows firming US 2025 deal market activity

Based on economic and market indicators, the EY-P Deal Barometer — our M&A outlook — forecasts a steady boost in deal volume.

Macro Bites: M&A deal activity in 2024’s nuanced macroeconomic environment

A nuanced macroeconomic environment provides opportunities for increased M&A deal activity in 2024.

Why Europe’s CEOs are confident but cautious, pushing AI and pausing ESG

The latest EY European CEO Outlook survey finds country variation in resilience, but solid AI strategy remains elusive for many. Read more.

The Navigator: perspectives on financial services M&A

Financial institutions are building competitive advantage through M&A. Read on to learn more.

How cloud can drive value in M&A transactions

A robust strategy can bring value to both buyers and sellers throughout the M&A lifecycle. Read more.

How bolder CEOs take charge to shape their future with confidence

EY CEO confidence index assesses CEO sentiment across sector growth, price and inflation, business growth, talent, and investment and technology. Read more

Learn how to approach digital business by building a unicorn with a venture mindset and succeed with your digital investment.

Dealmaking amid uncertain monetary cycles: Lessons from history

The key to proactive dealmaking lies in past trends and in innovative approaches to navigate future economic shifts. Learn more.

Banking M&A Quick Takes: merger of equals

Banks are considering mergers with similar-sized institutions to create more resilient entities. Learn more about banking M&A trends.

Tech M&A Quick Takes: Plan early for M&A integration strategy

In the Tech M&A Quick Takes video, EY leaders discuss the year of growth, M&A integration strategy and value drivers. Watch the video to learn more.

Sector M&A insights

How to be a savvy technology M&A dealmaker

The EY-Parthenon Technology Corporate Development Survey confirms seven key traits of companies that succeed with mergers and acquisitions (M&A). Read more.

Energy M&A Quick Takes: How companies are transforming deal structures

In the Energy M&A Quick Takes video, EY leaders discuss oil and gas consolidation, and integrations that require more due diligence.

Private Equity Pulse: key takeaways from Q3 2024

The PE Pulse is a quarterly report that provides data and insights on private equity market activity and trends. Read the latest report.

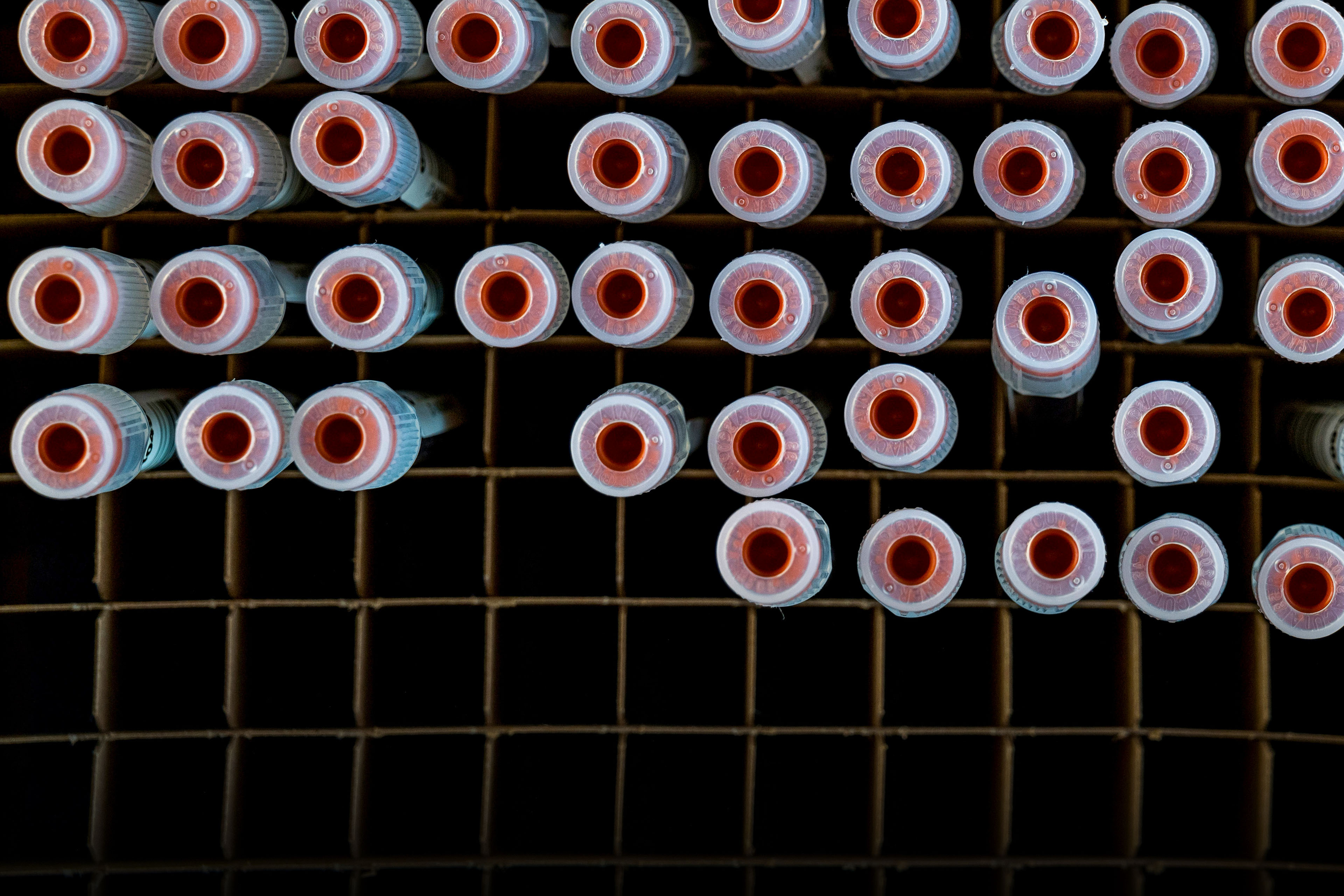

How ecosystems can help fill the life sciences innovation gap

An expanded ecosystem can help life sciences companies replenish their pipelines ahead of a looming patent cliff. Read our report.

Is there more than one path toward long-term value?

An evolving portfolio strategy is integral to generating returns and competing in the energy transition. How can companies make no regret decisions?

How the right M&A can help hospital CEOs cure shrinking margins

M&A is an important tool for US hospitals to address increasing costs and the continuing pressure to reduce reimbursements.

M&A case studies

How an acquisition helped Orifarm prepare a prescription for growth

EY teams help founder-run Orifarm, a Danish pharmaceuticals company, embark on the path to transformation.

Case study: How a Nordic SaaS player unlocked potential in a global lockdown

A bold strategy and deep, multi-disciplined M&A experience turned “it can’t be done” into a sale that facilitated outstanding outcomes. Learn more.

How the right buyer helped a family grow global plant-based food production

Innovation in plant-based meat could have a major role in promoting healthier food alternatives and sustainable environmental practices.

Growth strategy through M&A

How M&A revenue synergies can sweeten digital transactions

EY-Parthenon research shows digital deals that focus on revenue synergies can lead to higher valuations and premiums.

Three important digital M&A product strategy questions for the c-suite

Product development can be transformed with digital M&A if leaders articulate how technology and innovation leads to growth and value. Read our insights.

The new corporate strategy playing field

Corporate strategy is being upended by new stakeholders, competitors and the need to quickly add differentiating capabilities.

Three ways c-suite execs can enhance digital M&A commercial strategy

Learn how traditional companies acquiring digital assets can embrace and interact with digital natives and can create outsized returns

Digital M&A valuation: How CFOs and CDOs can get it right

Investors can use unique digital M&A valuation tools during due diligence to reduce overpayment risk.

How bolder CEOs take charge to shape their future with confidence

EY CEO confidence index assesses CEO sentiment across sector growth, price and inflation, business growth, talent, and investment and technology. Read more

M&A integration insights

Beyond the deal: accurately estimating M&A integration costs

Discover key drivers of M&A integration costs and ensure deal success. Learn how to plan strategically for long-term value. Read more.

Key steps CIOs can take to supercharge an M&A technology integration

Prepare for an M&A technology integration by upgrading your methodology.

Three ways a data clean room can help you realize M&A synergies faster

The three main benefits to using an M&A deal clean room. Read our report.

Four talent challenges in digital M&A culture integration

Tech company acquisitions may include talent: founders, engineers and technologists whose knowledge can drive digital M&A culture integration. Learn more.

How rapid M&A IT integration can cut costs and boost M&A cybersecurity

M&A IT integration strategies can speed up deal synergies, reduce costs and free capital for growth and value creation. Read more

How EY can help

Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures and alliances.

Read moreService Leader

-

Elizabeth Kaske

Elizabeth KaskeEY Americas Strategy and Transactions Buy & Integrate Leader

-

Barak Ravid

Barak RavidEY Americas Strategy and Transactions Technology Sector Leader

-

Ranu Carroll

Ranu CarrollEY Americas Strategy and Transactions Life Sciences Leader

-

EY-Parthenon professionals recognize that CEOs and business leaders are tasked with achieving maximum value for their organizations’ stakeholders in this transformative age. We challenge assumptions to design and deliver strategies that help improve profitability and long-term value.

Read more -

Our M&A integration services help you integrate assets while preserving value, accelerating synergy realization and minimizing transaction risk. Learn more.

Read more -

Learn how EY M&A due diligence teams can help your business identify transaction value drivers, improve deal structures and mitigate risks.

Read more -

Our M&A strategy teams design and deliver IT, cyber and digital strategies to improve your enterprise value whether buying, merging or divesting a business.

Read more -

Find out how EY teams can help with joint ventures and strategic alliances. Contact the EY joint venture team to help your business respond to change.

Read more -

Discover EY M&A Technology and solutions that help deliver real-world results across strategy, transactions and transformation. Learn more.

Read more -

Learn how EY teams can help you identify vulnerabilities, quantify cyber risks as they relate to the deal and manage mitigation or remediation of cybersecurity in M&A.

Read more -

Whether it’s an M&A integration or a divestment and separation, a transaction provides a unique opportunity to transform your supply chain. Learn more.

Read more -

EY and EY-Parthenon can help you devise a strategy to realize your ambition: powered by technology, shaped by your portfolio and executed by transformation.

Read more -

EY Competitive Edge enhances M&A and deal-making strategies by generating relevant market intelligence and company insights at pace. Learn more.

Read more -

AI strategy consulting teams can enable better and faster ROI for new products and services and help accelerate M&A. Find out more.

Read more

Buy and integrate: M&A advisory team

Careers in Strategy and Transactions at EY

At EY, you’ll have the chance to build a career as unique as you are, with the global scale, support, inclusive culture and technology to become the best version of you. The exceptional EY experience. It’s yours to build.