EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Energy transition funding: insights for leaders

Explore traditional and innovative funding and financing for decarbonization and sustainability investments.

Improve returns on sustainability investments

Energy transition, decarbonization and sustainability-related investments have seen significant growth in recent years due to the Inflation Reduction Act of 2022 (IRA), as well as US and global climate regulations. To propel success, understanding and optimizing the commercial and business models, including the funding and capital stack for these investments, is vital. This requires considering various capital options, tax-funding methodologies federal and state grant and incentive programs, and regulatory nuances. This also requires a solid grasp of the ever-changing geopolitical environment and potential looming changes.

There’s tremendous opportunity for organizations to invest in decarbonization-related technologies, as well as renewable and alternative energies. But identifying applicable funding sources and programs, interpreting eligibility criteria, navigating the application process and even claiming tax incentives can be too overwhelming for many teams to tackle on their own.

EY professionals help businesses capitalize on energy transition-related investments and sustainability incentives with confidence.

Energy transition financing options

IRA Tax Incentives

The IRA offers a wide array of programs aimed at accelerating the transition to a more sustainable, resilient and clean energy economy in the face of climate challenges. Tax leaders should weigh the potential tax savings and benefits against the operational and compliance costs to decide which IRA funding models align with their strategic goals. Working with IRA funding professionals can help drive effective management.

EY IRA and government program services

Explore our tax advisory, strategic planning, and compliance services, technologies and tools.

Our Latest Energy Transition Insights

5% safe harbor for wind and solar project construction eliminated

IRS Notice 2025-42 updates wind and solar tax credit rules, eliminating the 5% safe harbor and requiring physical work to begin construction.

Final reconciliation bill offers benefits for oil and gas industry

H.R. 1 updates for oil & gas: changes to leasing, royalties, bonus depreciation, carbon credits, and tax provisions.

Nuclear revival: getting future projects right

How a nuclear revival in the utilities industry and nuclear power plant construction can address project management, cost, risk and regulation challenges.

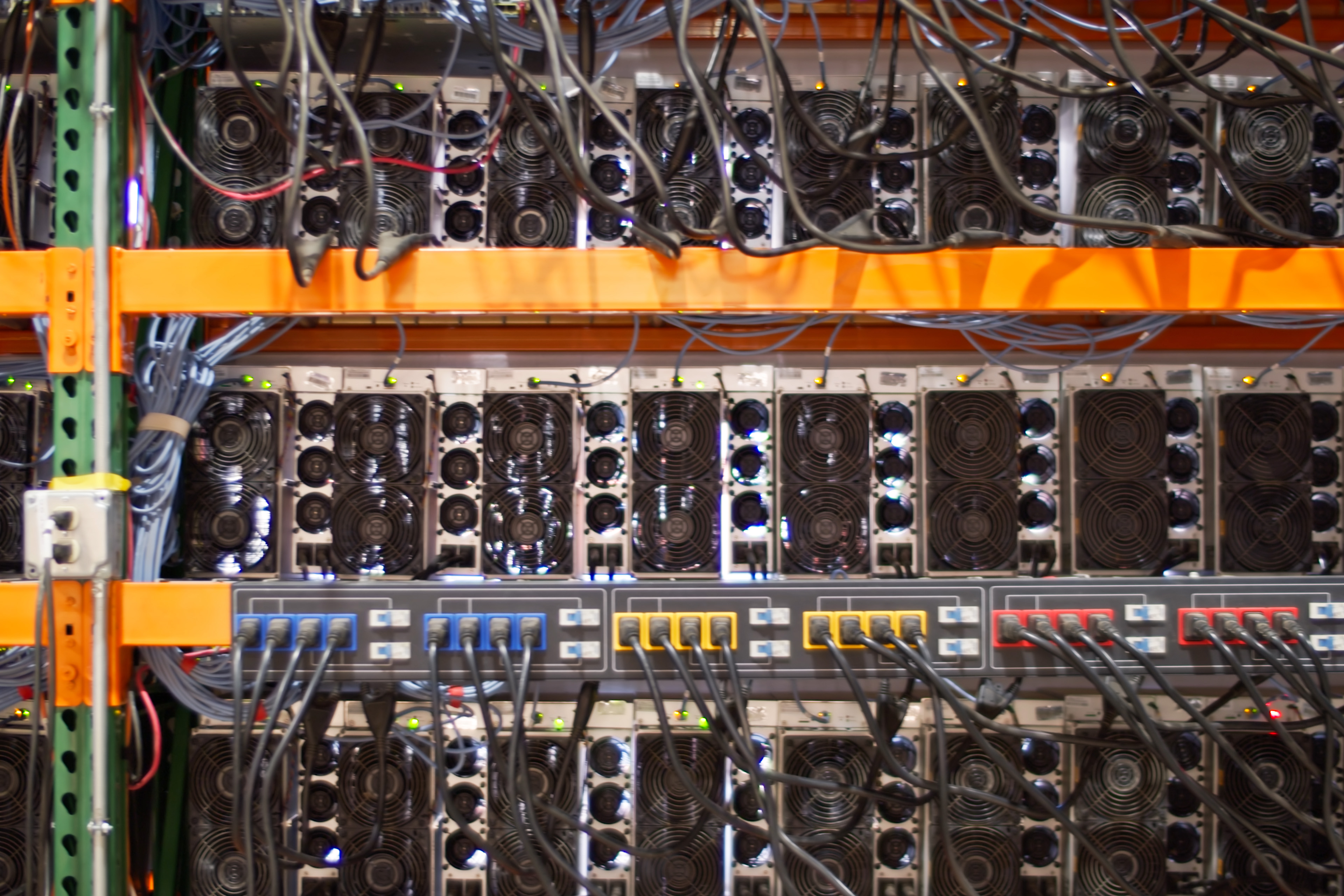

How to enable data center growth and advance sustainability simultaneously

Building the data centers sustainability necessary for AI and emerging technology shouldn’t require sacrificing environmental and climate goals. Read more.

How the 2024 US elections may affect the energy industry

EY's industry leaders discuss four 2024 election outcome scenarios shaping US energy tax policy and regulation.

How bold action can accelerate the world’s multiple energy transitions

Our energy system is reshaping at speed, but in different ways across different markets. Three accelerators can fast-track change. Learn more.

Will local ambition fast-track or frustrate the global energy transition?

The Inflation Reduction Act has triggered competition in renewables, but could unbalance international capital allocation. Read more in RECAI 61.

The new “performance frontier” for the utilities sector

The new performance frontier for the utilities sector requires aligning outcomes with value. Read more.

Why wavering consumer confidence could stall the energy transition

The Energy Consumer Confidence Index reveals that the impact of the energy transition is hitting home. Discover more.

How can energy companies create carbon transparency?

Accurate emissions data capture is crucial for building carbon transparency and winning stakeholders’ trust. A digital carbon ledger might help. Read more about it here.

How employee experience insights can help utilities serve customers

Placing employee experiences insights at the center of a utility’s transformation can improve the customer experience, too. Find out how.

US Tax Incentives for Hydrogen: A Clean Energy Solution

Learn how the government is incentivizing US companies to focus on hydrogen production as it’s a growing alternative energy source since the IIJA and IRA were enacted.

Four factors to guide investment in battery storage

RECAI 63: Demand for battery energy storage is growing amid grid volatility. The EY ranking of investment hotspots highlights opportunities. Learn more.

Our Energy Transition Case Studies

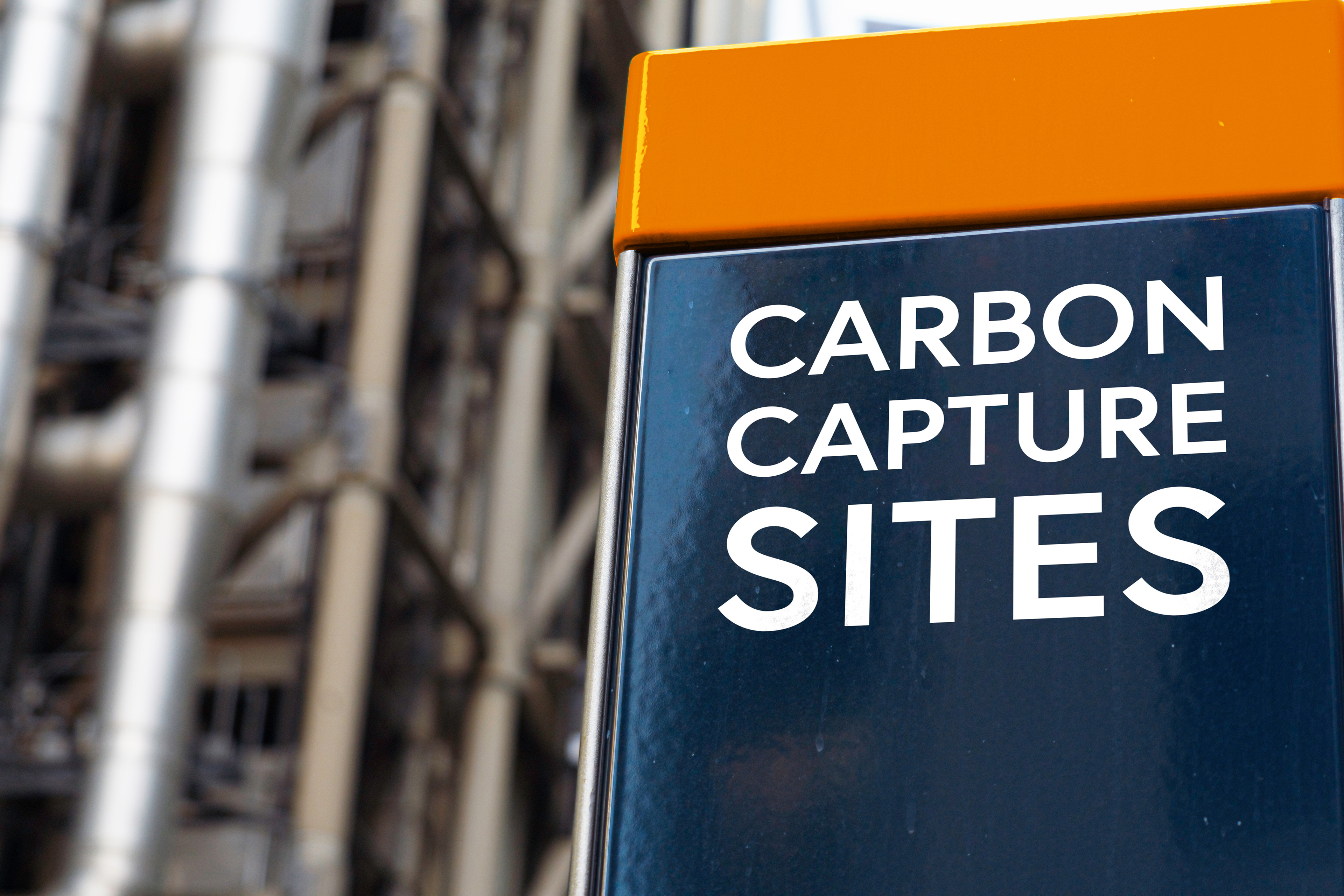

How an industry newcomer is helping decarbonize the refining industry

An EY team helped a private company make their make CCS commercialization plans a reality. Learn how in this case study.

How a digital ledger helped one plastics company champion circularity

Building trust and transparency with customers starts with an irrefutable sustainability certificate. Learn more

An energy company’s transformation for the 21st-century customer

Learn how Xcel Energy is building trusted relationships with customers and helping lead the energy transition through innovative products and services.

How the energy sector can extract value from emissions data

Fueled by human collaboration and the latest technology, we helped one company find opportunity in sustainability. Learn more in this case study.

Get the latest energy updates

Stay up to date with our monthly Energy resources newsletter.

How EY can help

-

Sustainability and ESG services that help protect and create value for business, people, society and the world. Explore the depth and breadth of EY services and solutions.

Read more -

Discover how EY's global renewables team can help your business transition to the world of renewable energy.

Read more -

EY Sustainability Tax professionals can help your business realize your corporate sustainability strategy. Learn more.

Read more