EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Family Office Advisory Services

What EY can do for you

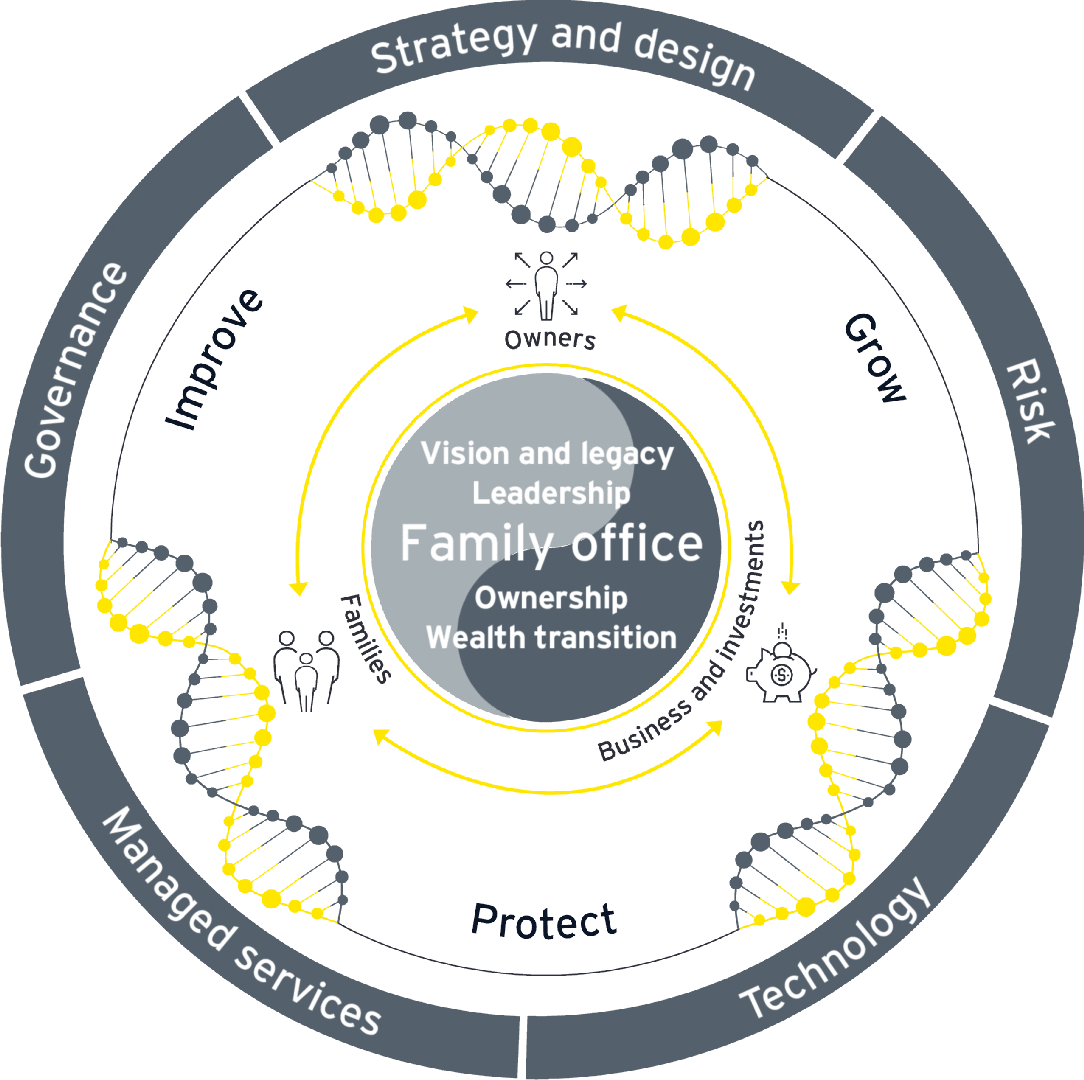

EY Family Office Advisory Services provide a holistic approach to your legacy preservation. Whether you are creating a new family office, separating an office from the family business or enhancing an existing office, it is important to ask how you are securing your family’s financial future and legacy for the next and future generations. We deliver seamless advice and service through all phases of development and execution. And we do so with an emphasis on long-term sustainability and legacy preservation.

Understanding your needs

EY Family Office Advisory Services focus on areas that, if addressed effectively, support and elevate your office to help achieve the goals and objectives of the family and the family office towards long-term success. This integrated approach enables us to uncover hidden opportunities and risks that might have been missed if we were to assess each area separately.

We fully understand that no two family offices are alike. Specific family considerations drive decisions and the way forward. Our job is to support the legacy of your family office through our customized research, reports and analytics. We focus on the following areas to support you in identifying key challenges, defining and implementing processes for improvement, and charting a path to future family success and sustainability.

Why choose EY Family Office Advisory Services?

Our Family Office Advisory Services practice professionals have the depth of skills, knowledge and experience to bring a high level of quality in support of our clients. Leading practices guide our work, including a defined control environment, regular and recurring risk assessment, and dual controls to maintain quality.

We are recognized as a trusted advisor to the world’s largest family businesses. The EY organization serves 93% of the world’s top 500 family businesses and has helped enable families to succeed for generations during the last 100 years.

Our latest thinking

How to prepare heirs for tomorrow’s family business

Future-ready leaders can be fostered through strategic development and diverse experiences.

The value creation advantage: boosting cash flow in family offices

Discover how family offices can unlock additional cash flow through targeted value creation without disrupting their investment strategies. Read more.

Understanding the value (and values) of Gen Z

Key strategies family enterprises can implement to connect with Gen Z for long-term success. Read more.

How the world’s 500 largest family businesses build and sustain value

The 2025 EY and University of St.Gallen Global 500 Family Business Index ranks the world’s largest family businesses. Read more.

How an advanced materials player successfully enters new markets

SAES transformed its high vacuum business and grew revenues by 300% with the support of EY. Now they’re taking on the cosmetics space. Learn more.

How strong capital planning helps protect a family business’s legacy

Family enterprises need a structured capital strategy to address the various needs of the business and shareholders. Learn more.

How family businesses can build a resilient shareholder liquidity plan

Discover how to strategically balance the short- and long-term capital needs of your family-owned business and the growing liquidity needs of your owners.

Why the family office of the future needs refreshed operating models

Tech and talent need highlight opportunities for family offices to evolve, Wharton Global Family Alliance survey shows. Here are actions to take today.

5 megatrends shaping the world: how to stay ahead of the curve

The world is transforming, and megatrends are helping shape it. To thrive in a global economy, family enterprises must be forward-looking and resilient.

How a family office can support family needs

From wealth management to succession planning, embedded and single family offices can strategically coordinate needed services. Read more.

How family businesses can prepare for cybersecurity threats

Family businesses are attractive targets for cybercriminals. Learn more about proactive measures that family businesses can take against cyber attacks.

How family offices can maximize the upside of tech and minimize risk

A recent Wharton survey highlights fears in this fast-evolving era. Cybersecurity is vital — but it must be a facet of a broader strategy. Learn more.

Seven capital planning questions for family businesses

In a tough capital-raising environment, family enterprises are revising their approach to budgeting, forecasting and financial decisions. Read more.

How family offices can broaden their risk mindset in a volatile time

Leaders are focused on financial risk but are overlooking ways to gain agility and confidence before the next crisis. Here are nine steps to consider.

How to manage risks and protect family offices

Single family offices should implement a risk framework and management system to recognize potential areas of concern. Learn more.

Top four wealth planning considerations for high net worth individuals

A changing financial landscape and a global pandemic have led wealthy individuals to review succession, purpose, tax and global mobility. Learn more.

Private market feels ESG pressure

Private companies should consider ESG as a value driver and opportunity for competitive advantage.

Explore more

Download Worldwide Estate and Inheritance Tax Guide PDF

New insights

Family Business magazine, “The Single Family Office” with Bobby Stover

Family Business magazine, “What is a Family Office?” with Bobby Stover

Family Business magazine, “The Multi-Family Office” with Fred Gluckman

Family Business magazine, “The Embedded Family Office” with Catherine Fankhauser