EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Investment Banking

The Team

What we can do for you

The global EY network offers a comprehensive suite of services, and EY firms consistently rank among the leading investment banking firms based on the number of completed transactions globally.

EY’s global network has:

- More than 1,600 investment banking professionals providing M&A, Debt Capital Markets and Equity Capital Markets advice throughout more than 65 countries globally¹

- Closed more than 2,000 deals over the past five years²

- Global breadth and access to financial sponsors and corporates offering unique cross-border transaction execution and deal opportunities for our clients

- Consistently ranked as one of the leading M&A advisors in the emerging markets of Brazil, Russia, India and China (collectively, BRIC countries)²,³

Industry focus

EYCA offers investment banking services in the US and utilizes a comprehensive and well-structured approach that help clients increase value and mitigate risk. Our investment banking professionals are focused on the middle-market and bring deep industry knowledge to each transaction. Our professionals are well-versed in each industry’s growth and value drivers and offer decades of combined experience across sectors, including:

Representative transactions

Explore our services

Our team

Our latest thinking

Equity capital markets: Rate cycle and market performance review

This article examines rate cycles and market performance over the past 25 years

How can a strategic transformation mindset unlock long-term value?

Confident CEOs embrace corporate transformation mindset, using M&A and technology to navigate challenges and create long-term value. Read more.

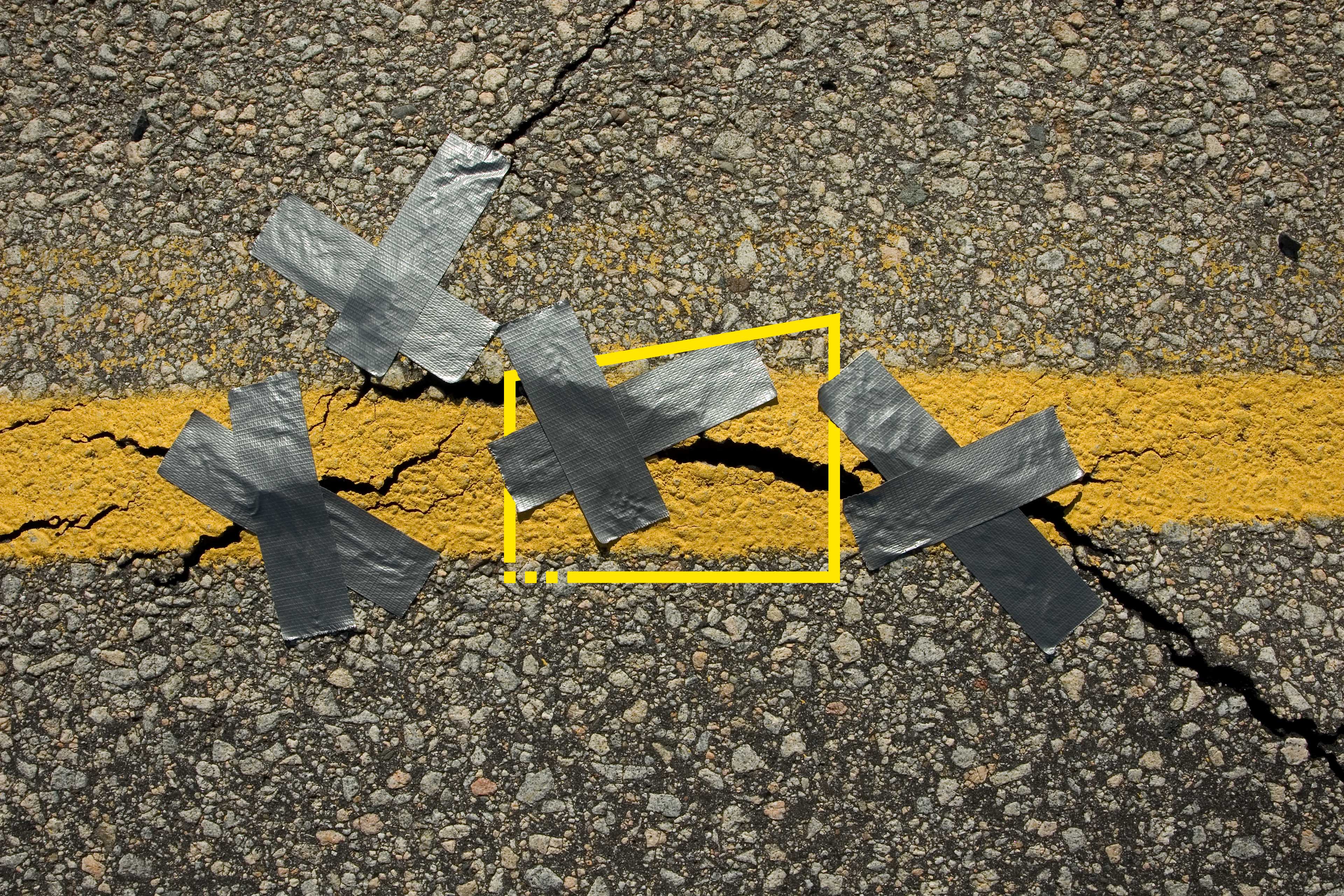

Is your capital allocation strategy a long-term plan or a short-term fix?

CFOs are rethinking capital allocation strategy in order to remain agile as well as focus on long-term value. Read our report.

The new corporate strategy playing field

Corporate strategy is being upended by new stakeholders, competitors and the need to quickly add differentiating capabilities.

EY Equity Capital Markets Update - IPO market conditions continue to improve

With rising confidence in the IPO asset class, indicators suggest momentum from 1H 2024 carried over into the third quarter and beyond. Read more.

Footnotes:

- As of May 31, 2022.

- Source: Mergermarket (as of May 31, 2022). Middle-market includes transactions below $500 million

- Deals whereby either the bidder or target is geographically located in the BRIC countries: Brazil, Russia, India or China.

EYCA Business Continuity Planning Disclosure Statement

Check the background of this firm or its investment professionals at FINRA’s BrokerCheck.

Ernst & Young Capital Advisors, LLC (EYCA) is a registered broker-dealer and member of FINRA providing sector-specific advice on M&A, debt capital markets, equity capital markets and capital restructuring transactions. It is an affiliate of Ernst & Young LLP serving clients in the US.