EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Americas and US Tax Policy

Direct to your inbox

Find out how we help industry leaders solve their toughest business challenges.

What EY can do for you

Our tax policy leaders, many of whom have held senior positions at the US Treasury Department, the Internal Revenue Service and on Capitol Hill, provide forward-looking views on today’s most important tax policy and fiscal issues. EY tax policy professionals can help businesses track and assess tax policy and tax reform proposals, providing services that range from monitoring legislation and strategic planning to representation and economic modeling.

A framework for ESG funding

Opportunities for sustainability funding are out there – if you know where to look. We can help reveal the possibilities in recent tax laws.

Our latest thinking

Trump, taxes and ’25—what to expect on TCJA, tariffs and tax policy

Tax changes affecting businesses will happen in 2025. The question is how quickly they will be enacted and how expansive they will be.

The outlook for IRA tech-neutral tax credits

Businesses question what the future may hold for the clean energy production and investment tax credits enacted under the Inflation Reduction Act.

Prospects for budget reconciliation in 2025

If either political party sweeps both Congress and the White House, they may use budget reconciliation to advance their tax priorities.

EY QUEST Economic Update examines latest economic trends

The QUEST Economic Update summarizes the latest key economic and employment trends.

Navigating 2025 tax policy uncertainty in mergers and acquisitions

Tax policy changes [in 2025] will have an important impact on the M&A market. Companies should stay abreast of upcoming policy activity.

Six actions for tax teams before year-end 2024

As year-end 2024 nears, tax accounting teams face new challenges from evolving tax laws and economic pressures. Learn six key actions to prepare now.

How a decade of transparency forever changed the tax world

A decade of increased tax transparency has changed businesses, who will need more data management to keep up with new developments. Learn more.

How to alleviate BEPS 2.0 Pillar Two data challenges

Advanced data aggregation tools can help with BEPS 2.0 Pillar Two compliance. Read our insights to stay compliant and reduce risks. Learn more.

Six steps to prepare for the operational impact of Pillar Two

Get ahead of operational and technology considerations for BEPS 2.0 Pillar Two reporting. Understand what to assess, plan, operate and monitor. Learn more.

2025 GOP trifecta: Trump's return, TCJA and other tax reforms

2025 GOP trifecta: President-elect Trump plans to enact major tax reforms likely through budget reconciliation.

The uncertain future of TCJA's IRC Section 199A

IRC Section 199A may expire at the end of 2025, causing tax implications for business owners.

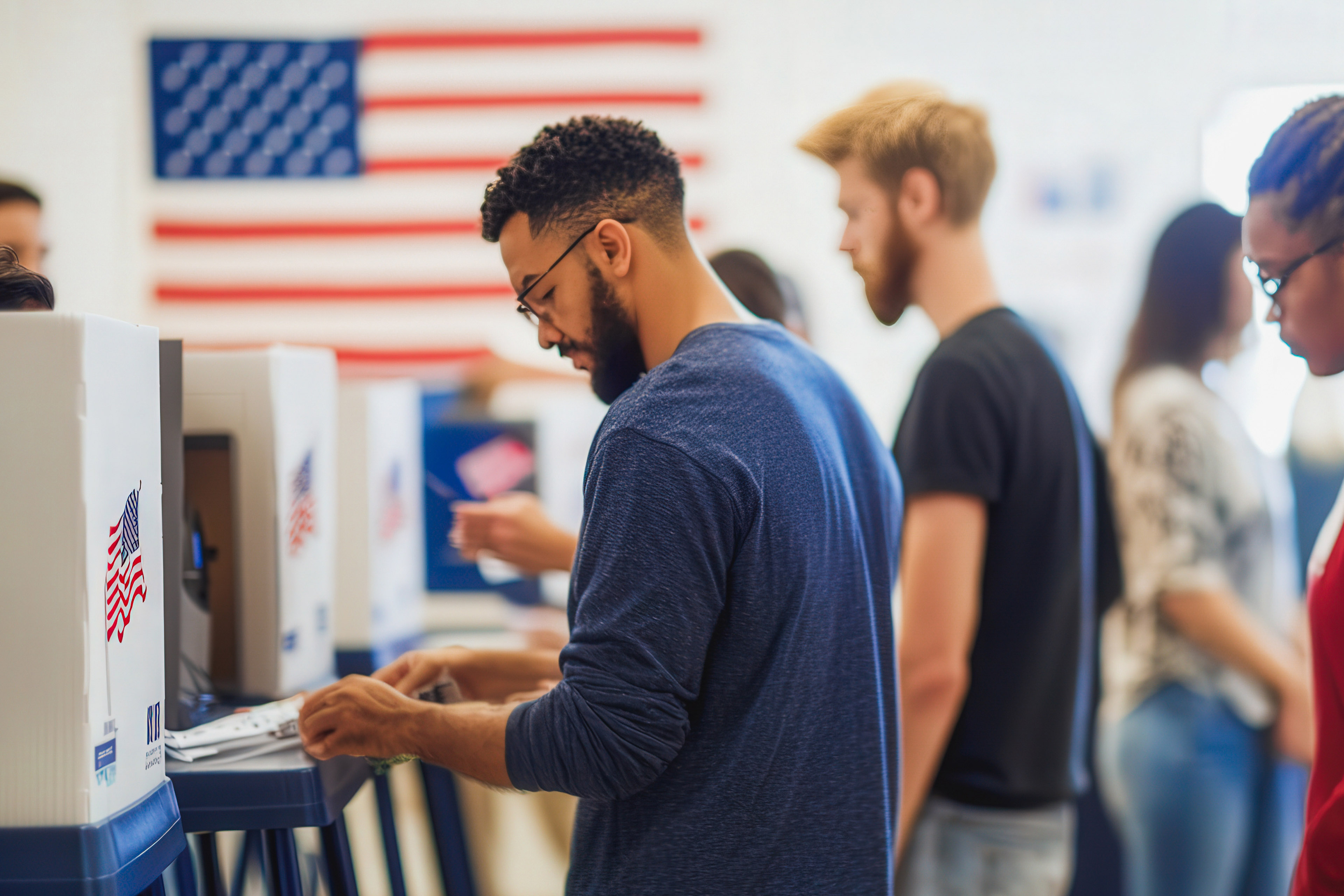

Developments in state and local tax-related ballot measures

EY Indirect, State and Local Tax examines select state and local tax-related ballot measures.

Treatment of US multinational IP transfers in a Pillar Two world

This article discusses implications of the OECD's Pillar Two GloBE rules for US MNEs engaged in domestic and cross-border IP transactions.

State tax policy: potential impacts of the 2024 election

Results of the US elections are expected to impact state fiscal conditions and tax policy decisions in the years ahead.

Steps companies should take now to prepare for major tax legislation in 2025

Companies should prioritize their tax planning, advocacy, and modeling now to effectively navigate anticipated major tax legislation in 2025

How the 2024 US elections may affect the energy industry

EY's industry leaders discuss four 2024 election outcome scenarios shaping US energy tax policy and regulation.

Geostrategic Analysis: November 2024 edition

Read the November 2024 Geostrategic Analysis for our take on geopolitical developments and the impact of these political risks on international business.

Outcome of US presidential election will impact trade and tariffs

The outcome of the 2024 election is pivotal to global trade and could have a significant impact on trade policies, global partnerships, tariff structures.

Five tax issues to watch heading into 2025

The party that wins in November 2024, may lead to big changes in the tax code. Read about what the tax cliff means and what is expiring in 2025.

2024 elections and TCJA tax cliff: Analyzing 3 major scenarios

3 major scenarios that may determine TCJA tax cliff based on the 2024 elections.

A look ahead: President Donald Trump’s second term

A look ahead: President Donald Trump’s second term

Energy with EY: Enabling the energy transition with capital and workforce

Whether in energy or other industries, the energy transition will require different capital, financing, operations, technology and skills. Here’s why.

Budget reconciliation allows 51-vote Senate passage of revenue and spending bills under certain parameters.

Why public disclosure will require renewed focus on CbC reporting

Public disclosure of country-by-country tax data is set to create new risks for affected multinationals. Learn more.

How to find certainty amid tax policy transformation

EY 2024 Tax Policy and Controversy Outlook explores what you should act on now and what you should keep an eye on next. Learn more.

Why ICAP participation could help with BEPS 2.0 Pillar Two compliance

A voluntary tax-risk assessment project could become an important tool for Pillar Two reporting. Learn more.

Key ways BEPS 2.0 Pillar Two may impact US multinational entities’ M&A transactions

US MNEs considering M&A transactions will want to keep their tax department connected. Prepare for BEPS Pillar Two.

New OECD Guidance Gives Relief for US Renewable Credits

The OECD’s new guidance on the global minimum tax provides relief to US multinationals, but significant technical issues remain outstanding.

Shifting gears to develop a proactive BEPS 2.0 approach

In this case study, a change in focus leads to informative insights on the implications of Pillar Two for one tech company.

Three steps to future-proofed customer tax withholding and reporting

Re-engineering data flows is key to holistic and efficient customer tax withholding and reporting, as demand for transparency mounts.