EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Process allows 51-vote Senate passage of revenue and spending bills under certain parameters.

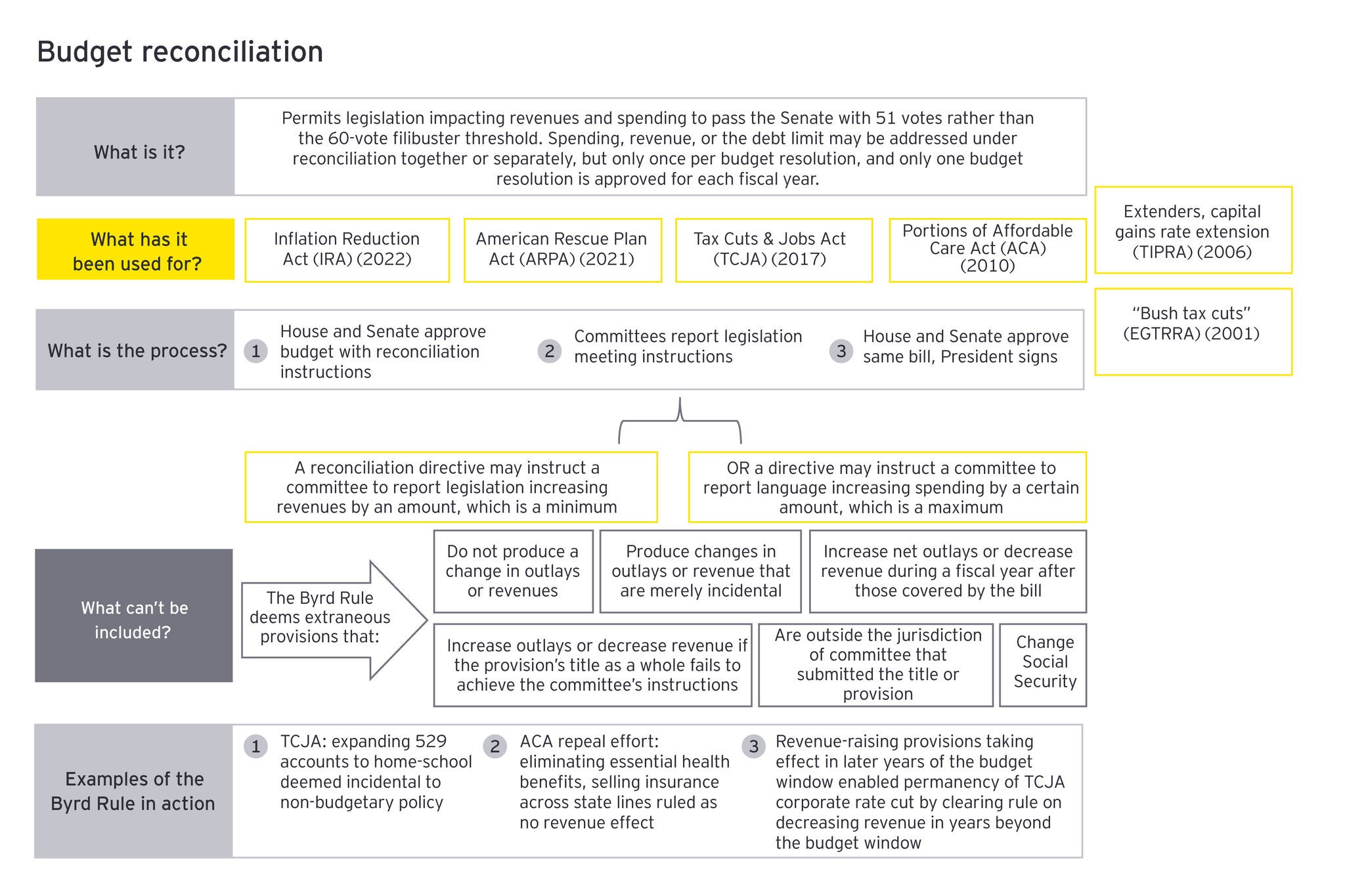

Budget reconciliation is a process that permits legislation impacting revenues and spending to pass the Senate with 51 votes rather than the 60-vote filibuster threshold for most other legislation. Spending, revenue, or the debt limit (though rare) may be addressed under reconciliation together or separately, but only once per budget resolution, and only one budget resolution can be approved for each fiscal year. If either party sweeps in the 2024 elections, the process could be used to enact tax legislation.

Summary

Reconciliation is a complicated process that can offer procedural advantages, particularly in a Congress with slim margins.

How EY can help

-

Washington Council Ernst & Young (WCEY) is a tax, legislative and regulatory group within Ernst & Young LLP that combines the power of a leading professional services organization with the on-the-ground knowledge, personal relationships and attention to detail of a boutique Washington-insider firm.

Read more -

The EY Center for Tax Policy helps businesses assess tax policy impacts, manage risks and prioritize changes to prepare for the future.

Read more