Innovation hubs will focus on technology-enabled solutions to key challenges

Innovation and venture arms of health care organizations are likely to prioritize partnerships and solutions to address market challenges, including cost and margin pressures, holistic management of chronic diseases, pushes for consumer centricity, workforce shortages and the continued migration of care to lower acuity settings. Technology-enabled solutions, such as GenAI, VR and digital health, are expected to be investment areas. A recently formed venture coalition across three large health systems has indicated its phase one investment areas will follow this theme, with specialty pharmacy, value-based specialty care and consumer financial experience being initial priorities.

Payers are likely to position themselves for success in value-based health care models

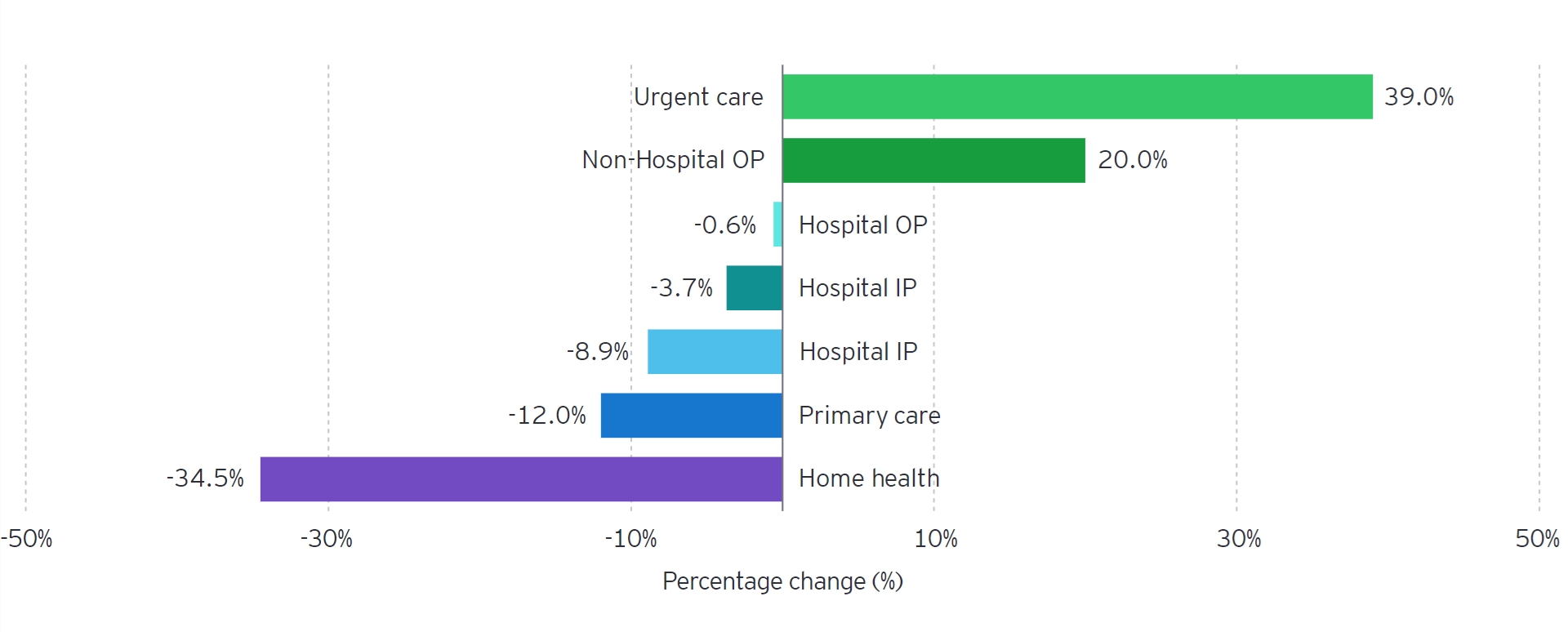

Payers have demonstrated they will continue to explore investments in care delivery assets over the next several years. These vertical integration investments will create new revenue streams for payers, but most importantly will position them to manage risk-bearing populations: home health, ambulatory surgery, primary care and virtual care.

Vertically integrated chronic disease management shows promise

Businesses that seek to treat the end-to-end needs of patients in certain diseases, such as musculoskeletal, women’s health and oncology, are gaining traction among investors. Such businesses are differentiated by treating patients’ holistic needs using technology-supported care models that may result in a superior product for patient consumers, and some achieve profitability.

Effective capital and operating partnerships will be critical for success

Partnerships remain an efficient way for market players to diversify services and geographies with investment and operational flexibility along the care continuum.

3. Investment in AI as adoption ramps up

AI as a part of health care transformation has the potential to increase patient access, reduce care costs, streamline administrative processes, create more consumer-centric care models and mitigate workforce shortages.

When it comes to AI transformation in health care, however, risk, trust and capital limitations may impede adoption. There is an optimism-adoption disconnect, according to chief information officers (CIOs) from across the country who answered the 2024 EY CIO Sentiment Survey.5 While 49% of those surveyed see GenAI technology as enhancing organizational value and driving 2x return on investment (ROI), only 13% have implementation plans established. Health leaders cite barriers to adoption including data infrastructure concerns, cybersecurity risks, lack of responsible AI standards, IP protection risks and compliance and ethical risks. Patients also have voiced mixed enthusiasm for AI used in clinical applications. Near-term AI priorities are likely to be infrastructure development and nonclinical, ROI-generating applications.

- Absence of regulatory and risk frameworks is likely to limit commercial opportunities. Given the sensitivity of patient data and the immense liability associated with care delivery, rigorous regulatory and risk management standards will be needed to broaden AI adoption. In the absence of such guardrails, opportunities to develop new commercial care delivery products in the sector will be limited.

- Near-term AI priorities are likely to be infrastructure and cost suppression. Many current AI use cases center on its ability to integrate and cleanse data across disparate platforms, or are point solutions (e.g., ambient listening for writing notes, prior authorization review). Further investments over the next several years will enable AI to drive deeper financial returns in the form of administrative task automation (e.g., call center, claims adjudication). Studies indicate AI has the potential to drive $200b to $300b in annual cost savings by creating more efficient processes.6

- Solution partnerships are likely to proliferate. EY experience shows partnerships will become more common among provider organizations to purchase AI technology. Furthermore, as was evidenced with digital health solutions over the last decade, buyers and adopters in the sector are likely to favor seamless, integrated solutions.

4. Expanding and fortifying physician networks

As different health sector players evaluate growth opportunities and health care transformation over the next several years and position themselves for success in value-based models, physician recruitment and alignment will be central to strategic plans.

Physician practices have been acquisition targets across the sector, with large retail health corporations, value-based enablement companies, private equity, health systems, payers and now drug distributors all vying for them. EY market experience has shown that physician alignment has been a common theme across the sector and that competition will only increase in the years ahead as physician workforce shortages loom.

Creating durable, expansive physician networks will be a strategic priority across the sector. Whether the strategic objectives are geography expansion, increased scale, improved access, higher quality care, or new value-based model adoption, physicians will be critical. In addition, the strategic focus will continue to be across different parts of the subsector. Despite health systems employing more than 55% of physicians across the country, private equity, payers and other corporate entities have been assertive in acquiring physician groups over the last number of years.

Sustained physician workforce shortfalls will intensify competition. Several studies have concluded that the physician workforce shortage will deepen over the next decade. Organizations such as the Department of Health and Human Services (HHS) and the Association of American Medical Colleges (AAMC) have cited a current shortfall of roughly 65,000 physicians that could grow to roughly 86,000 by 2036. Use of advanced practitioners certainly can mitigate the impacts of shortfalls; however, this will not be a full substitute for gaps across specialties.

New value propositions will continue to emerge. Retail health, private equity, health systems and other corporate organizations are likely to continue to explore new ways to differentiate themselves as a physician employer and partner over the next several years. The slow expansion of value-based care has provided new opportunities to engage with physicians around innovative care models, episodes of care management and different economic incentives. Several themes have emerged in creating a differentiated physician value proposition:

- Equity interest in a broader range of care delivery assets

- Enhanced physician voice in governance and oversight

- Flexible employment and alignment models

- Autonomy in management of clinics

- Alleviation of administrative burden through technology and support staff

- Empowerment to participate in new types of value-based models

What the next decade holds

Three trends are likely to reshape health care businesses over the next five to 10 years.

- Market consolidation driven by value-based models: value-based care is likely to become the predominant reimbursement model in health care, driving unprecedented consolidation and integration across the sector.

- Targeted clinical AI adoption: care delivery organizations are likely to opportunistically use AI in care models within the next 10 years, mitigating clinical workforce shortages and accelerating the consumerization of health.

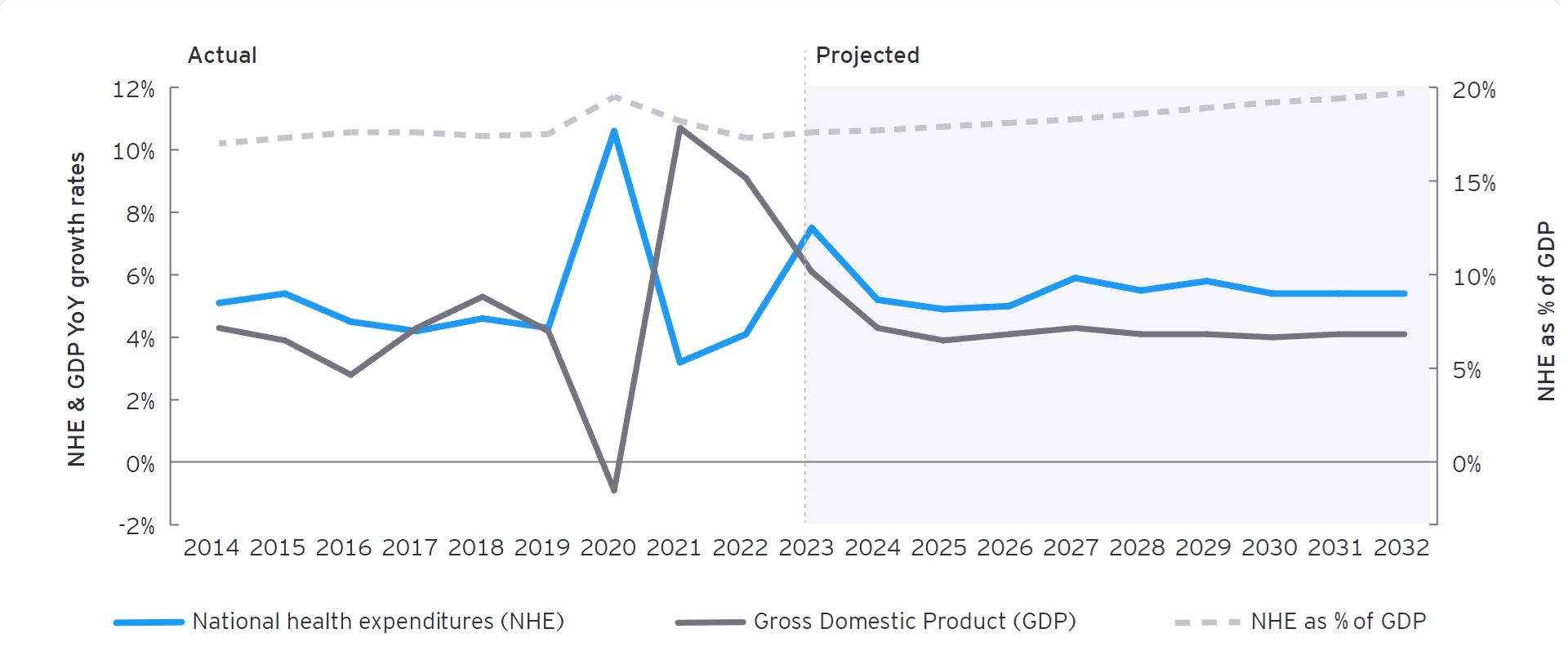

- New breakthrough therapy developments: technology advancements are likely to pave the way for new breakthrough therapies to be developed that can aid in reducing national health expenditure growth.

Each of these trends, hypotheses at this point, could have significant impact but face significant barriers.