EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Let EY help you claim your PWA bonus credits

Find out how EY teams can help with the complex filings of the prevailing wage and apprenticeship (PWA) credits.

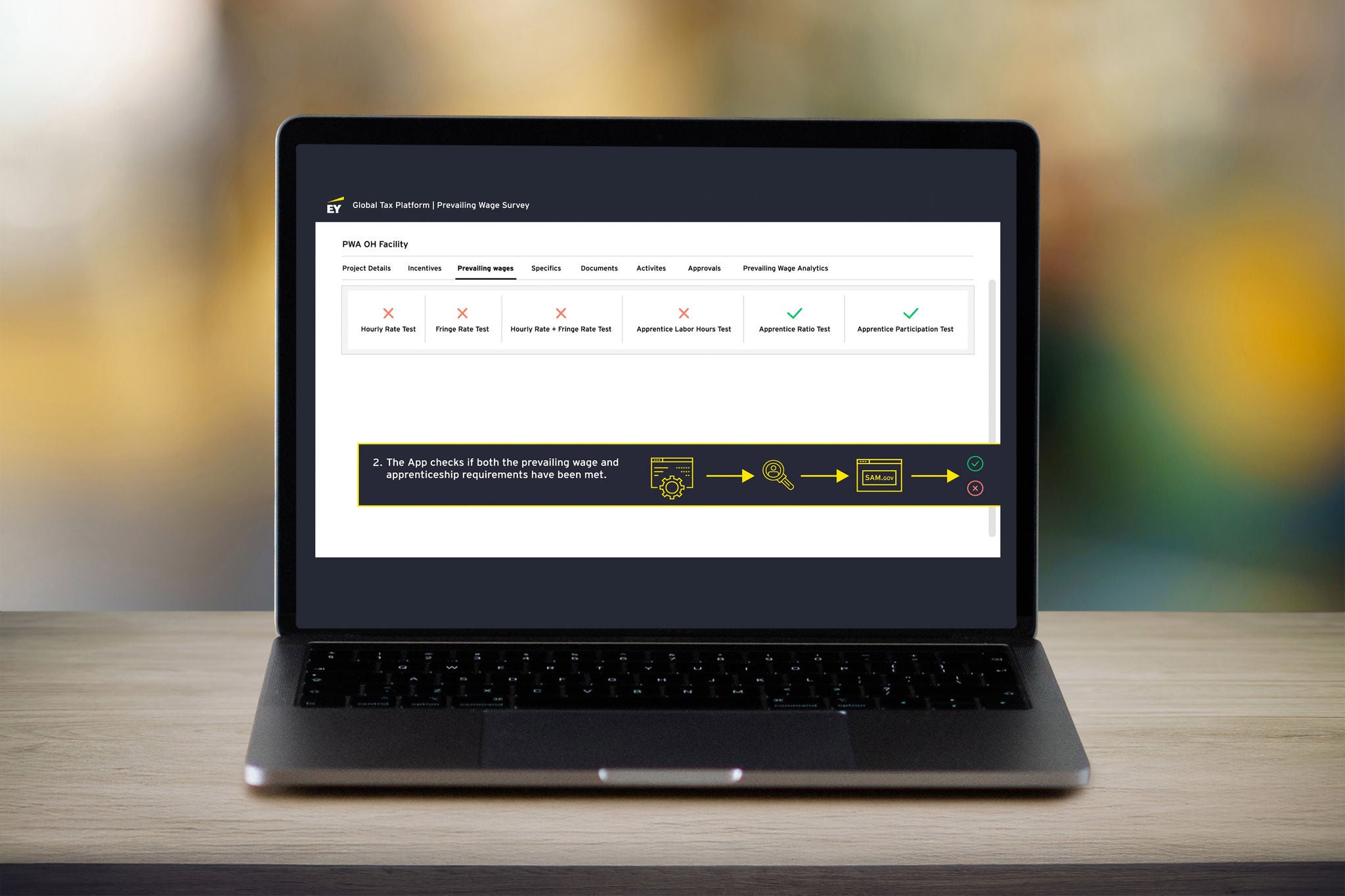

Streamline PWA compliance data collection with the PWA app

The PWA app makes it easy for contractors working on your renewable energy project to provide you with the compliance data you need. In just a few clicks, tax teams can:

What tax leaders need to know about PWA

PWA incentives are key components tied to the tax credits and funding available for clean energy projects and infrastructure investments under the IRA.

Eligible clean energy projects under the IRA

Enacted in 2022, the IRA incentivizes projects that reduce carbon emissions, increase renewable energy production and support energy efficiency.