Analysis finds working capital performers suffer less volatility in downturns

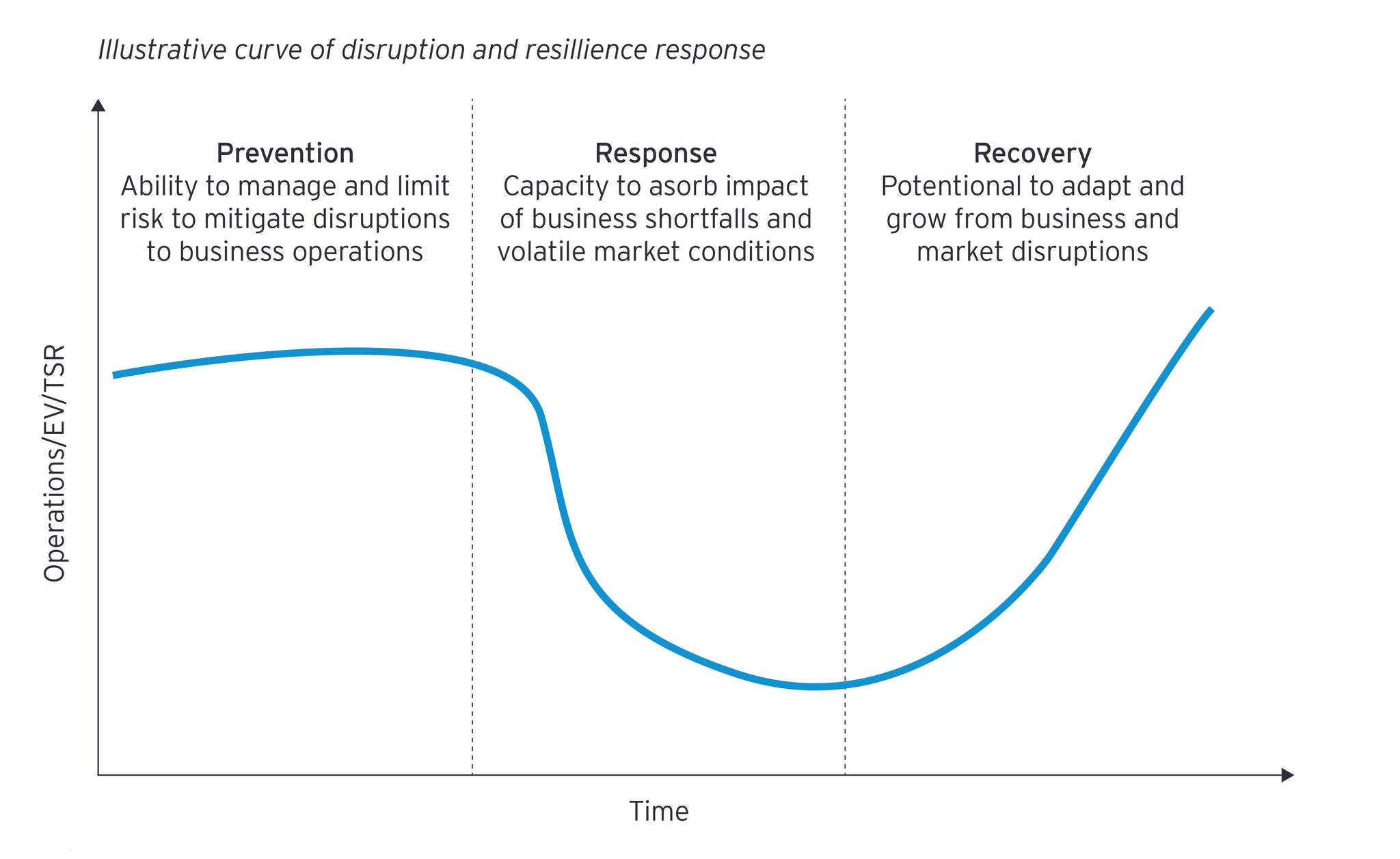

Prevention

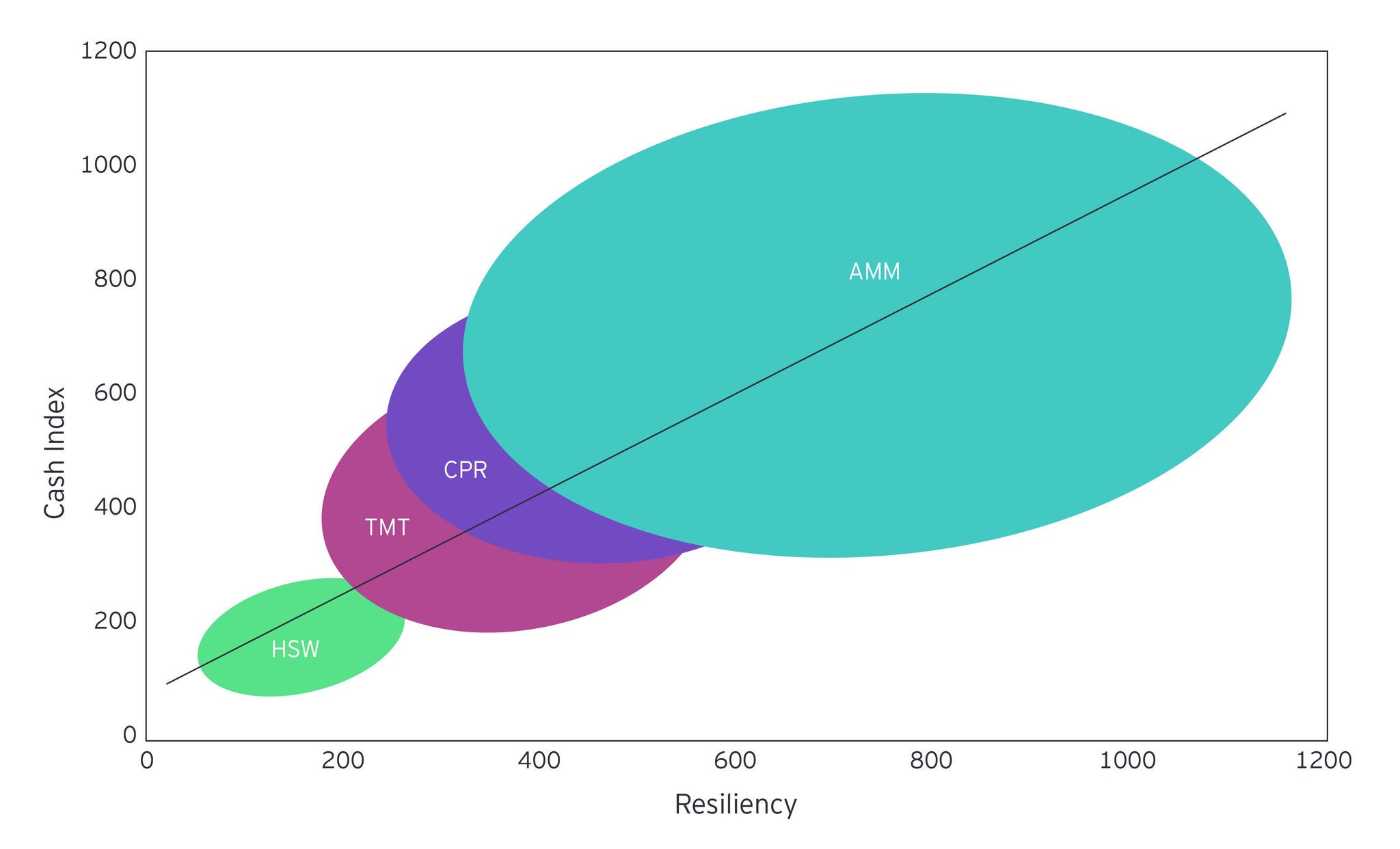

The findings confirm our thesis that companies with better cash management are more resilient, with an average resilience score 19% better than the low performers. The logical expectation is that high performers in cash management should excel in the response and recovery stages by having cash on hand to react to a given market setback. While such companies are indeed better in these categories, a more intriguing finding is the significantly greater preventive advantage demonstrated by companies that excel in cash management. High performers in cash management led low performers by 21%, in prevention, compared with a narrower advantage of just 2% in recovery.

The lesson: while it’s undoubtedly good to have available cash during a crisis, the indirect benefits for the business of superior cash management practices are even more valuable because they help companies limit their exposure to risks in the first place.

This is because the high performer scores are measuring total business health—not only the top and bottom line, but also the balance sheet. The high performers’ leaner business operations gave them better access to credit (as seen in their 23% advantage in credit score), allowing them to experience lower volatility in downturns compared to peers.

Response

Results in the response category demonstrate that companies that are cash efficient are better able to withstand financial downturns, supply shortages and industry-specific challenges, and therefore have more options when downturns occur. This is because their comparatively strong balance sheet, again, enables them to access credit, when needed. For example, a better-managed company can borrow to invest in more inventory to meet a short-term market need, such as a supply shortage or a sudden rise or drop in demand; or a company with cash may be able to afford additional air freight for needed raw materials in an emergency.

The results also indicated that high performers are economically more efficient in the response stage of a given downturn, with higher operating cash flow (OCF) per employee than low performers, on average. These measures help explain their stronger market performance during downturns, where they remained 13% above the poorer cash performers, giving them a 14% advantage in the overall response score.

Stronger cash management performers benefit by being able to absorb business shocks without laying off workers or downsizing. Thus, they are not only more efficient when times are good, they are able to avoid painful choices during downturns.

Recovery

High cash management performers outscored low performers by 5% in the third category, recovery, due to a much stronger rebound (35%) in their operating margin score. This is an indication of the greater profitability of companies with better cash management.