EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

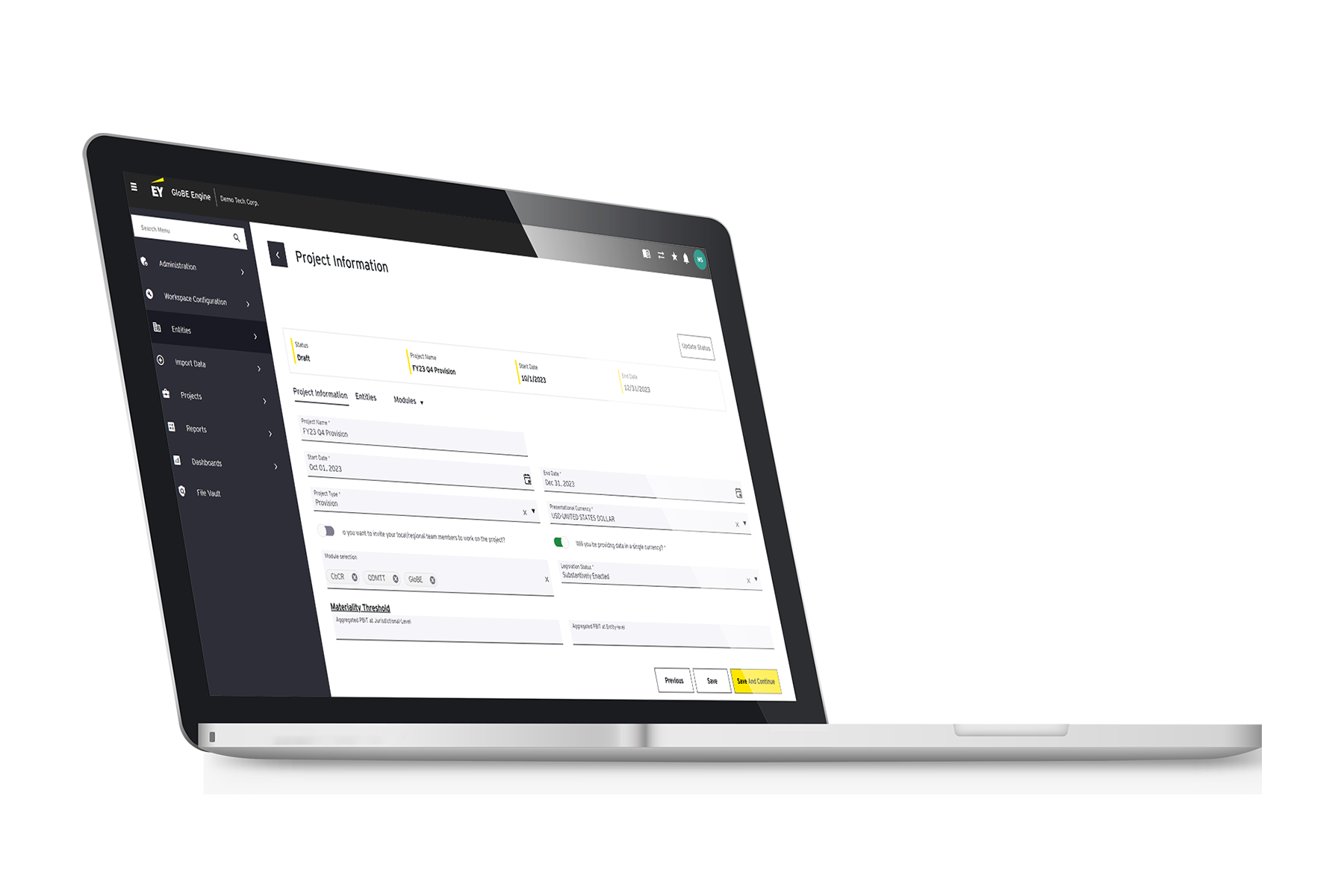

EY GloBE Engine: global minimum tax management tool

Manage your BEPS 2.0 Pillar Two compliance and reporting obligations

BEPS 2.0 Pillar Two rules are transforming the international tax landscape, prompting organizations to prepare for global minimum taxes. The EY Globe Engine offers cloud-based, scalable, and ERP-agnostic solutions for Pillar Two reporting and compliance.

Flexible data ingestion

Offers flexibility in data extraction, using sub processes to generate global minimum tax calculation data points.

Strong controls and governance

Helps with data completeness, transparency, and accuracy for reporting and calculations.

Calculation coverage

Provides calculation coverage with top-up tax and Qualifying Domestic Minimum Top Up Tax (QDMTT) in accordance with local law.

Set the foundation

Delivering on Pillar Two reporting and compliance requirements means developing new business processes and controls. Multinationals will need to adapt internal processes and systems to help manage the new computations and data requirements needed to calculate their global minimum tax liabilities and satisfy reporting obligations.

Ingest and cleanse data

The system-agnostic feature of the EY GloBE Engine facilitates it to handle various data formats such as flat files, connect to organizations’ systems through APIs, and source unstructured data from different parts of the organization efficiently.

Set rules and logic

The rules and logic in EY GloBE Engine are built in accordance with local legislation and maintained by our extensive network of international tax professionals.

Report with confidence

The EY GloBE Engine helps organizations manage compliance and reporting obligations and provide support for the provision process.

Deliver reports in compliance

The tool will create the GloBE Information Return in accordance with local law (e.g., as data points and XML format). Information for local tax returns is provided in a standard template (e.g., as data points).

Calculate provisions

The EY GLoBE Engine provides businesses with support for quarterly and annual provisions calculations.

Plan for the future

The tool offers forecasting and scenario analysis in relation to organization structural changes, different jurisdictional legislative scenarios and GloBE election choices.

Forecast future scenarios

EY GloBE Engine permits the user to either extrapolate or change existing data or import forecasts to identify the additional taxes arising to assist with scenario analysis.

Identify insights

The tool provides filterable dashboards and visualizations to help users digest information by displaying additional tax arising, tax payable, and safe harbor coverage by jurisdiction and entity.

Download the EY GloBE Engine slipsheet (pdf)