EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Family Office Advisory Services offer domestic and cross-border tax services to high net worth individuals and families.

Read more

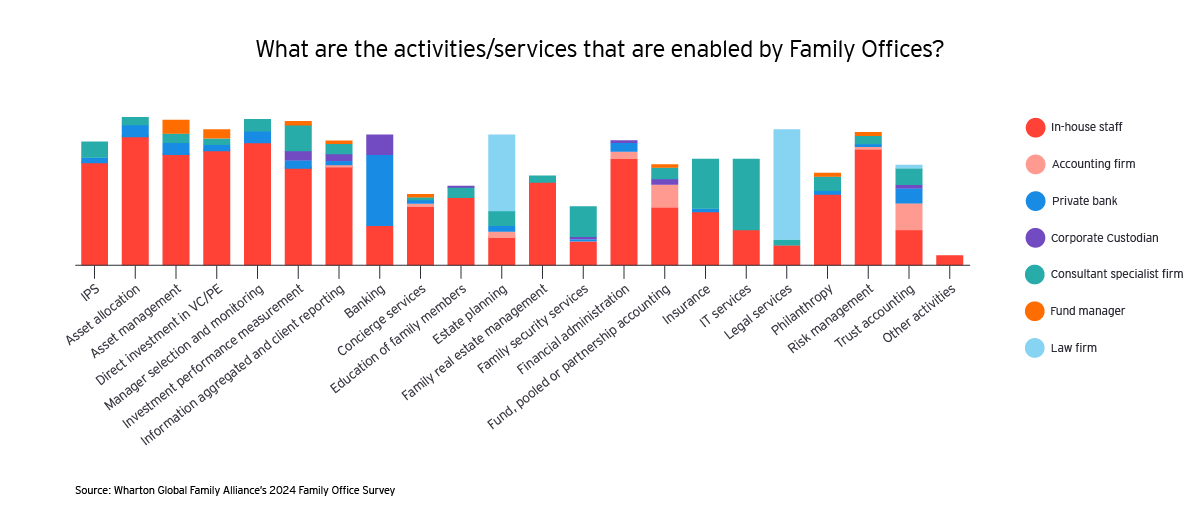

Family offices face the need to re-evaluate their operating models over the near and long term, and they are increasingly choosing to leverage external providers specialized in a particular area of need. But new research in the Wharton Global Family Alliance’s 2024 Family Office Survey shows the inherent obstacles to making the change from a do-it-yourself group to a lean, flexible organization capable of selecting and managing world-class partners.

It’s an exciting time for family offices to reframe potential challenges as competitive advantage. These relatively small organizations are tasked with implementing and working successfully with a huge array of disruptive new technologies. They must address a complex world that demands access to better information, as well as young workers who expect to be freed from low-value tasks by automation, outsourced services and increasingly AI. Leveraging and controlling information means balancing risk and opportunity — AI, for example, promises to deliver extraordinary results, but users quickly realize that managing it requires a deep understanding of its inherent biases and opaque decision-making processes. And as family offices forge new relationships, each one exposes the family to new privacy concerns, and it requires management focus on collaborating with firms that are often vastly larger than their family office clients.

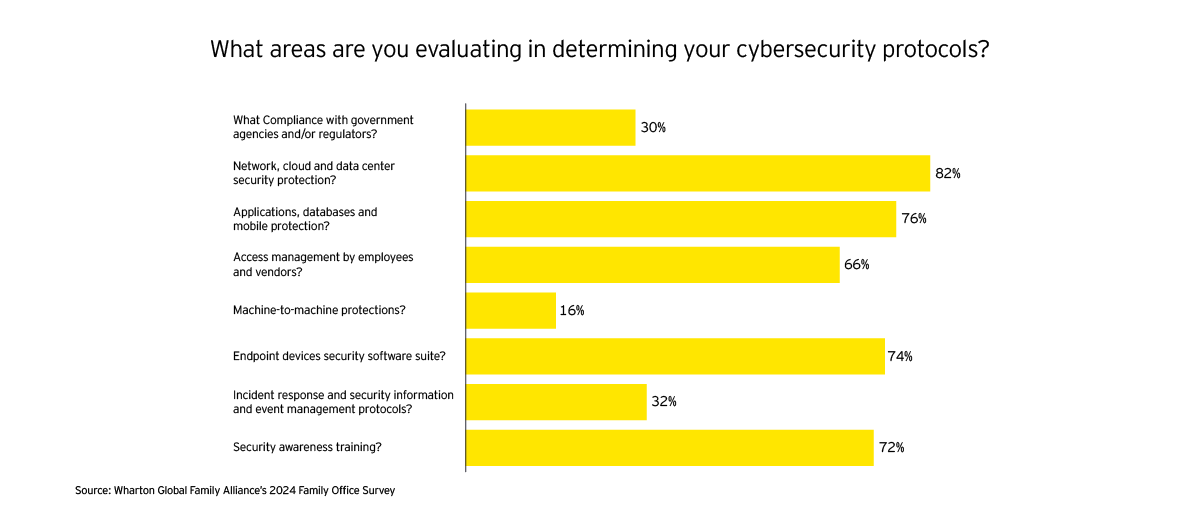

It is therefore no surprise that family office respondents in the Wharton survey say their main priority currently, aside from driving higher investment returns, is managing risk. And when asked about their main risks, they cite information security and cyber risks, reputation management and privacy, and financial fraud and identity theft — all of which are part of the technology risk profile and supported by the back office. They are reflections of how much family offices have evolved in the past few years, as well as how much more that they can achieve with proactive consideration.

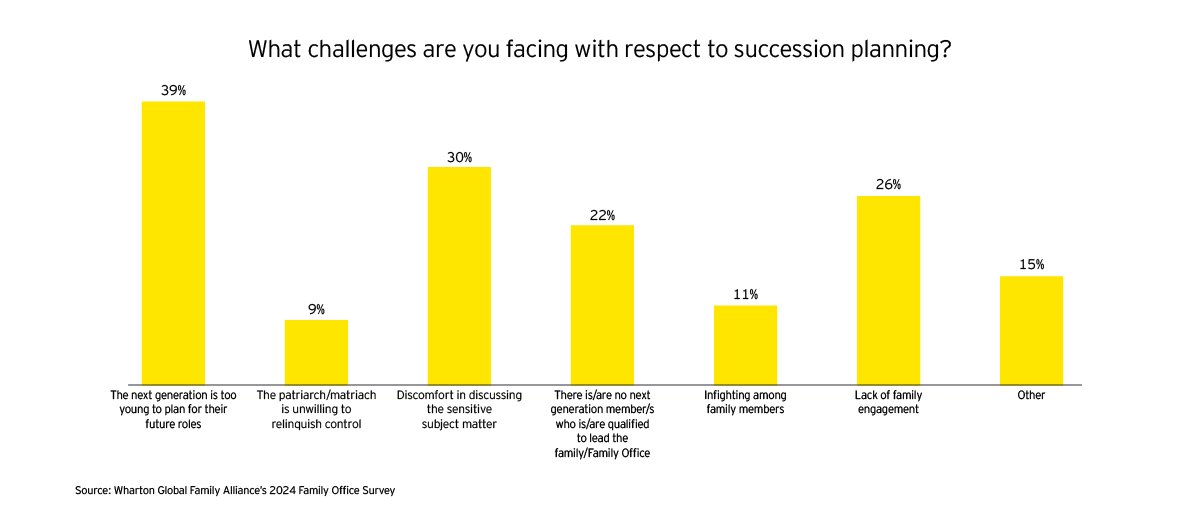

In this environment, technology, people and processes all must evolve in parallel. If a family office is working with new technology, they are confronted with the challenge of marrying it with existing staffing, governance and processes. Given the difficulty of hiring, we are forced to consider hybrid operating models that create access to different pools of talent, including outsourcing to service providers that have equal if not better capability and scalability, creating a new paradigm of sophisticated co-sourcing. Yet if handled improperly, such new operating models expand risk, not manage it. And with so much disruption in the present, it’s easy to lose sight of the future in the form of succession plans.