EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Related content

How can energy companies create carbon transparency?

Accurate emissions data capture is crucial for building carbon transparency and winning stakeholders’ trust. A digital carbon ledger might help. Read more about it here.

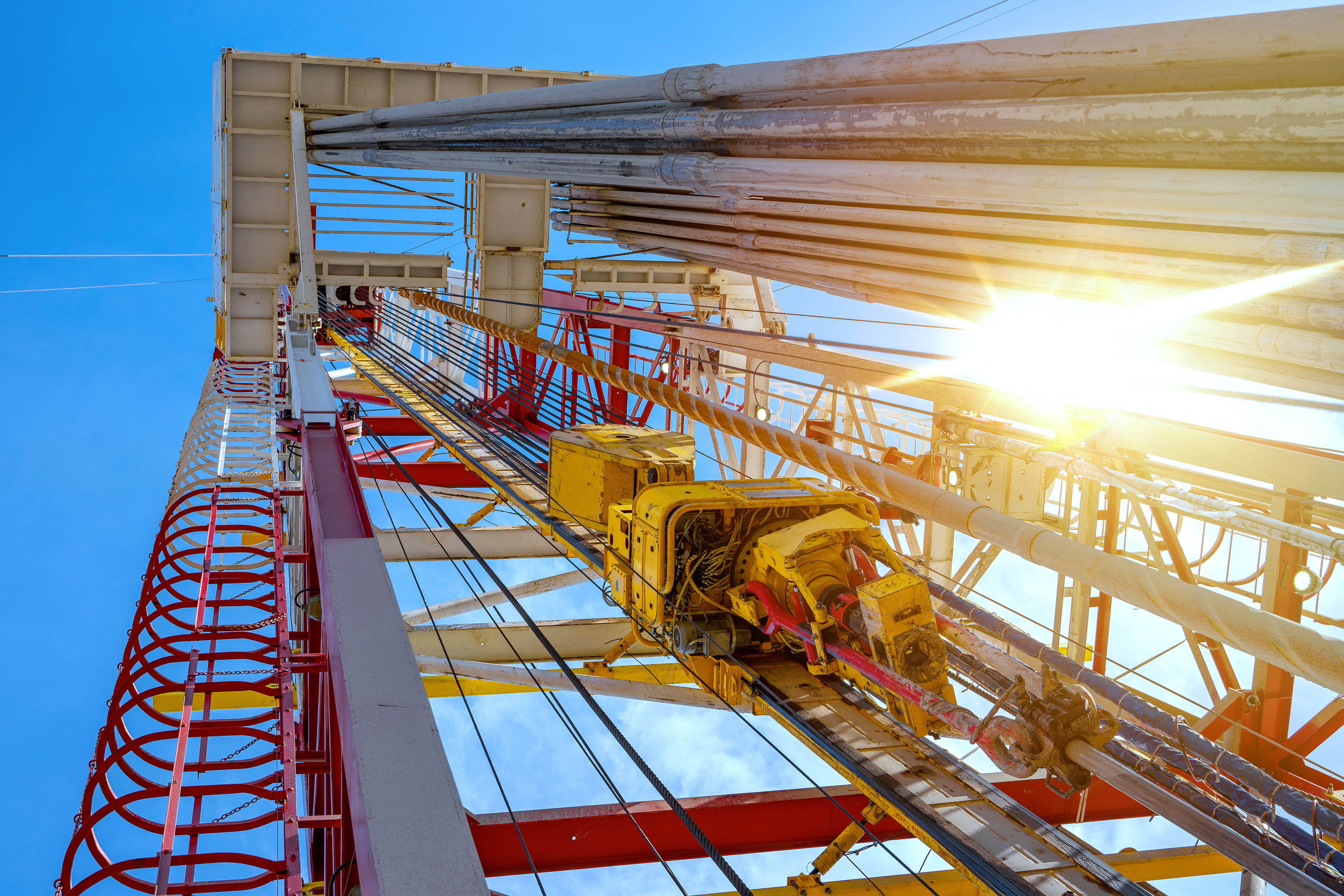

Whatever the shape final reporting guidelines take, US hydrocarbon assets can continue to be advantaged even with a greater focus on carbon intensity. Many of the core US oil and gas reservoirs are among the least emissions-intensive oil production globally, and companies continue to make improvements in addressing venting and flaring concerns throughout the sector. But the major operators in the United States are also advancing plans to develop carbon capture and storage projects in the United States, underscored by the recent acquisition of the largest operator of CO2 pipelines by a leading oil and gas company. The reduction of GHG industrial emissions, especially from hard-to-abate sectors, is core to many of these projects but will also present an opportunity to further decarbonize the operations of their own oil and gas operations and those of others in the sector.

“From geologic, production, logistical and geopolitical perspectives, unconventional US oil and gas production will continue to be advantaged from an ESG perspective, notes Ryan Bogner, EY Americas Digital Sustainability Leader. “Combine these structural advantages with significant improvements in other environmental aspects, like drastic decreases in surface water consumption, and you get a business highly resilient to drivers of the energy transition.”

Coupled with one of the more open and transparent investment regimes among large oil and gas producing countries, the US oil and gas space is set to figure as a core holding for any company intent on producing the oil and gas requirements for the global economy as the energy transition continues to unfold.