EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

We help you effectively harness the power of technology to simplify, rationalize and centralize your firm’s operations, clearing the way to improve efficiency and extend product capabilities to attract new investments.

Read more

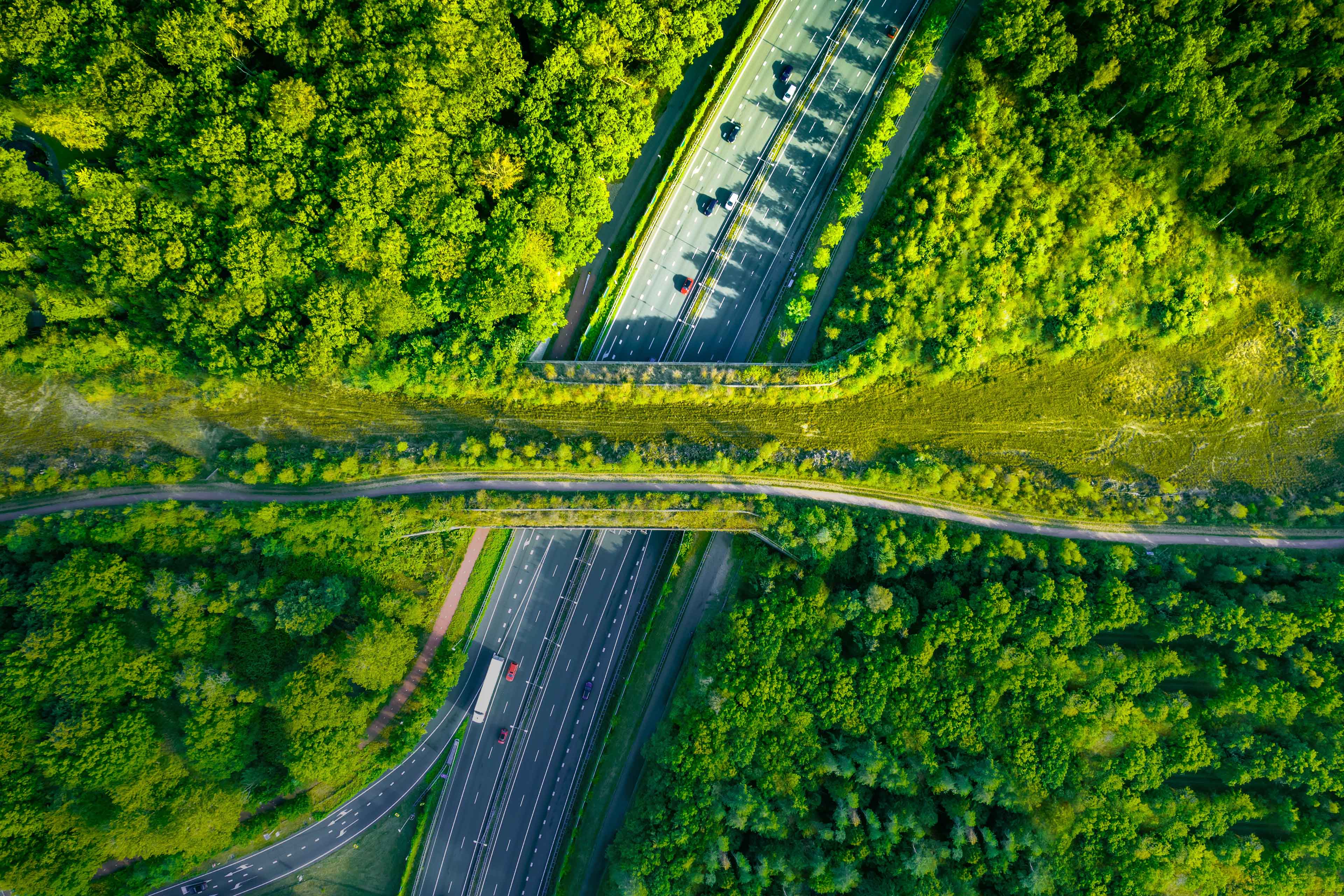

Activate the organization to deliver

Creating customer-centric ways of working is the elusive last mile for the industry. FIs have talked for years about pivoting to the customer, but few have embraced the organizational change required to achieve it. Redesigning the way people work, incentive structures and how the culture is organized can help maximize value from personalization efforts.

The most effective way to pursue activation is often to take the same tools that are used to guide the customer transformation — journey mapping, service-design composition, targeted KPIs, goal-management frameworks — and turn them inward. For example, a service-design blueprint approach that is used to organize, deliver and execute customer-based functions can be modified and employed to manage the internal transformation.

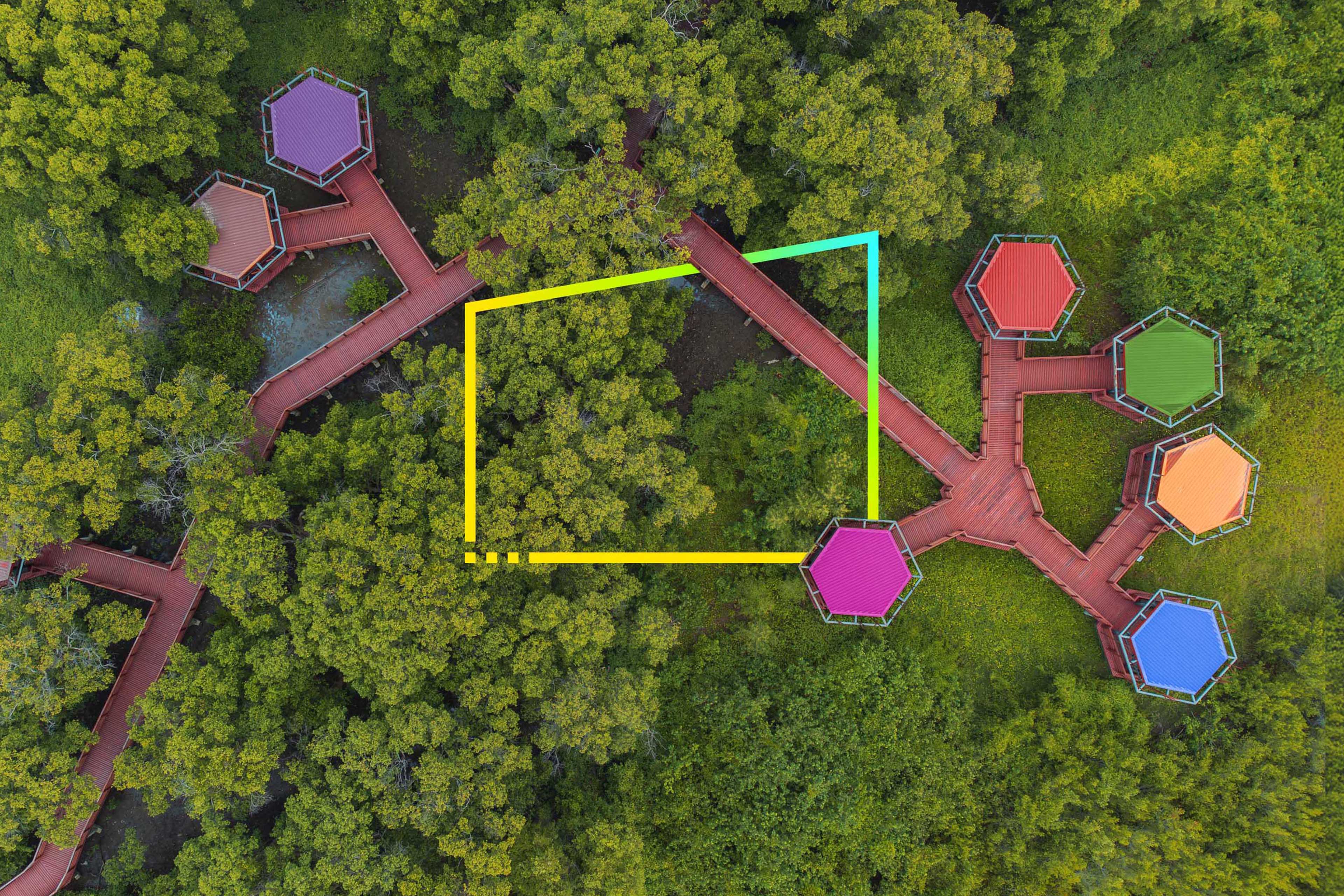

Enable platforms to accelerate the transformation

Without a robust platform approach, it is difficult to deliver the benefits of personalization to create superior customer experiences and drive growth. Platform enablement is about embracing what we call the mechanics of scale to accelerate the transformation to customer-centric business models while also maintaining reliability and resiliency.

To respond effectively, FIs can embrace a three-step learning process:

- Start small with precise, agile experiments that can provide rapid insights into the moments that matter the most along the customer journey

- Fail smart in ways that encourage continuous, iterative learning in real time

- Scale fast by building the mechanisms and agile-decisioning frameworks to apply the best learnings quickly across the enterprise to create holistic customer experiences