EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY Tax and Finance Operate Managed Services teams can help your business manage risk, realize value from data, drive innovation and improve efficiencies.

Read more

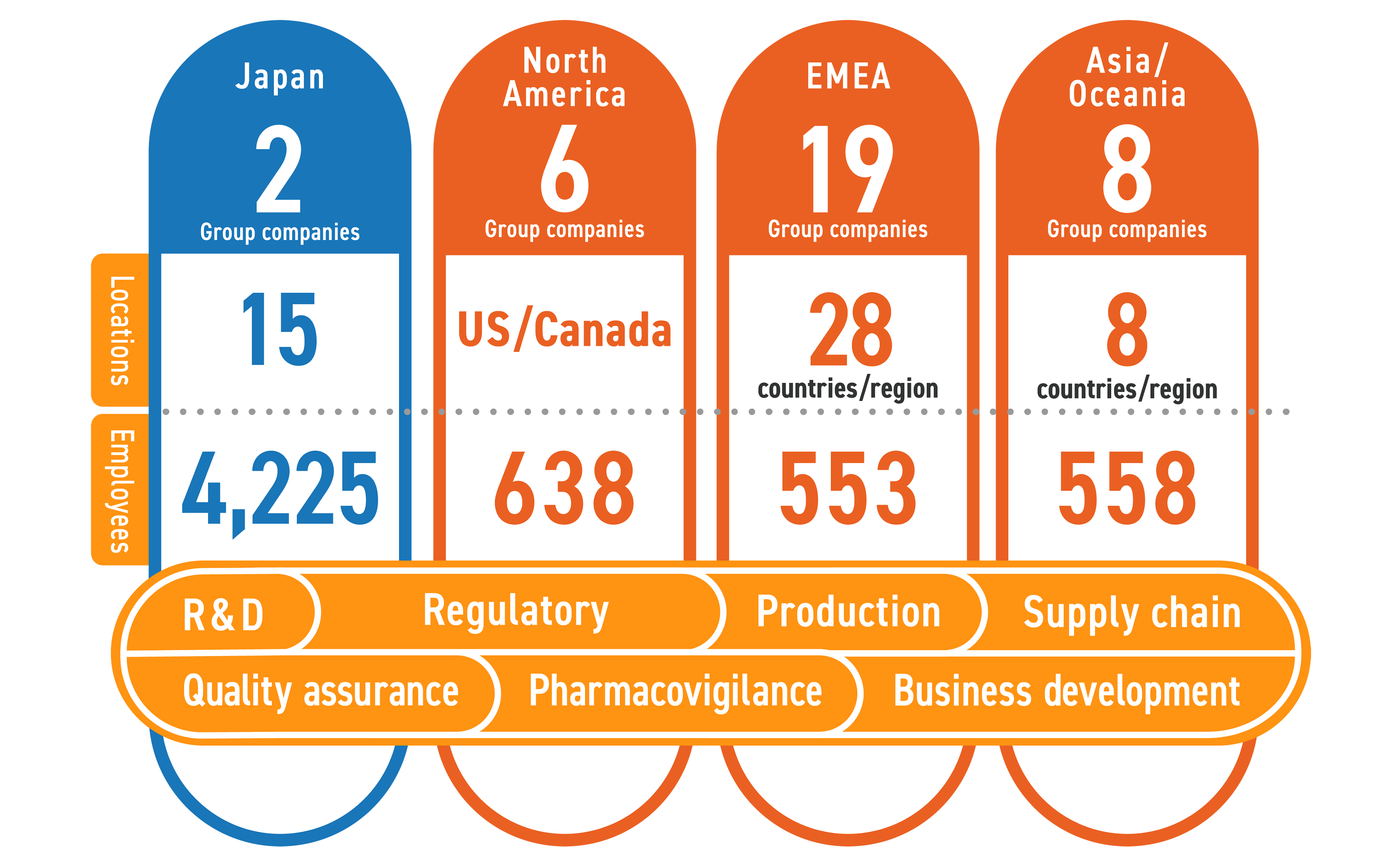

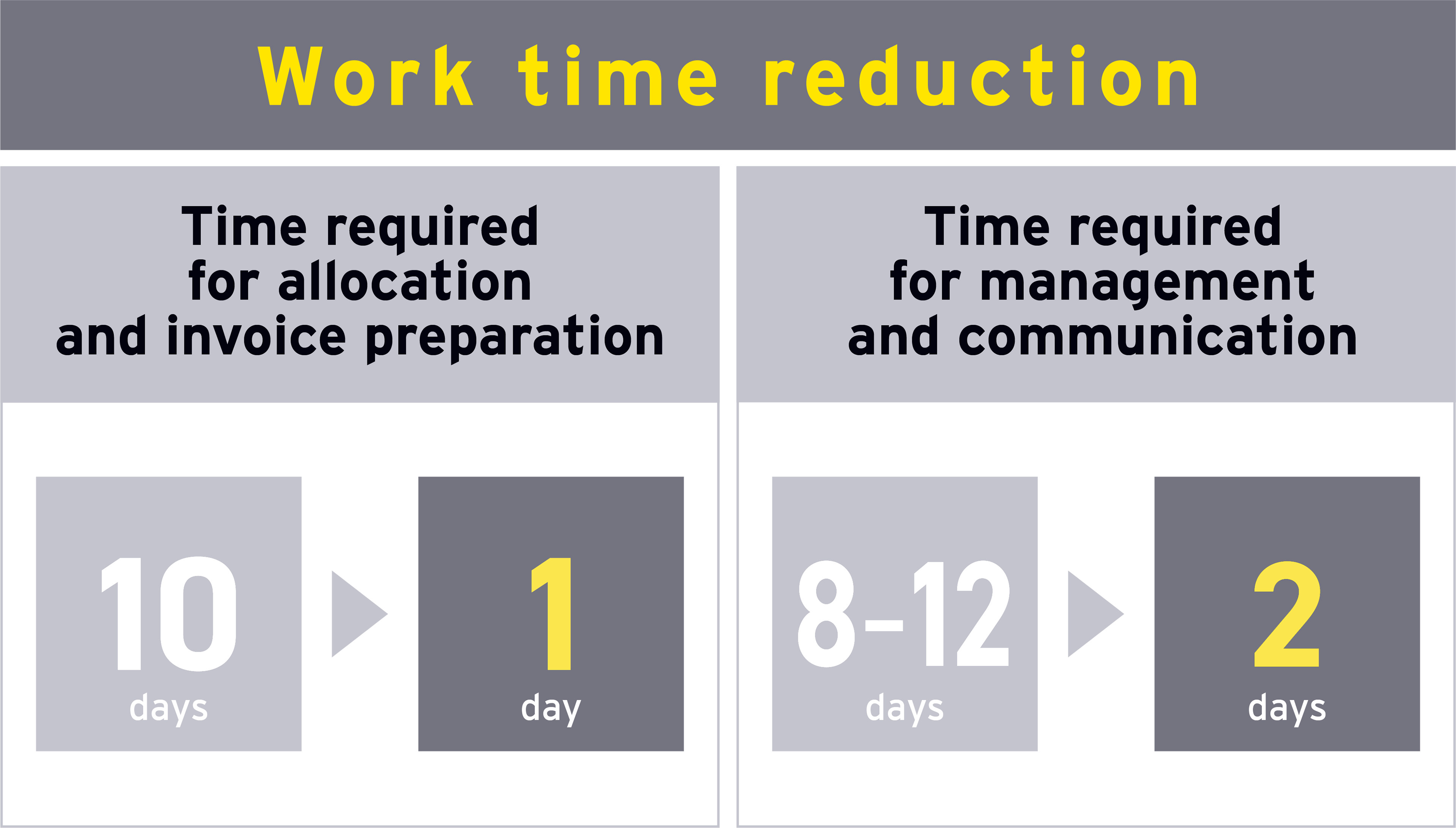

This highlighted the need for Kyowa Kirin to channel its effort into global business management and group tax governance as a means of optimizing overall costs, thereby establishing a foundation for allocating internal resources to expeditiously provide treatments to patients with diseases lacking effective treatment, and in turn, upholding Kyowa Kirin's vision.

Noriko Ishizaka, Finance, Global Tax Planning Group Head of Kyowa Kirin Co., Ltd., recalls, “The situation had become complicated to the extent that we would joke with the operational departments when aligning our approaches that it would be great if there was a country named ‘Global,’ and we could be their taxpayer. However, we were aware that what we were seeing could potentially become a critical issue and had begun to give serious consideration to a solution.”

“We needed to bridge the gap between management’s vision of promoting global collaboration, and the obligation to address tax compliance through extremely effort-consuming tasks to accurately analyze and invoice consideration for services provided by each of our entities,” she said. “In order to resolve this issue, we concluded that we would need, first a deep understanding of the latest tax systems, and second an effective system design.”

Before the collaboration within this project and the implementation of the BEPS international taxation framework, Kyowa Kirin and the EY team had already worked together in an advisor-advisee relationship and were gaining knowledge of each other’s business and experience.