How to create more value through M&A

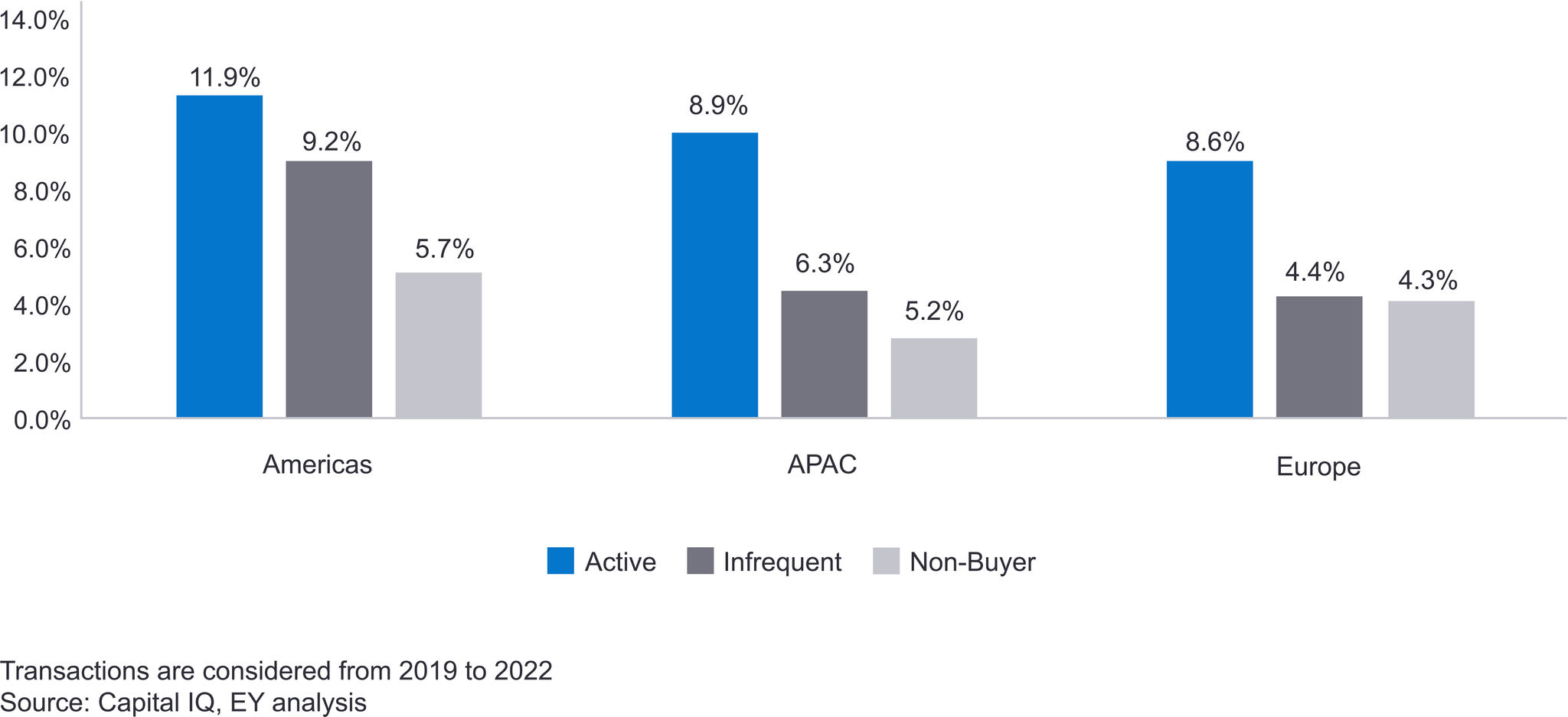

While the updated EY research clearly shows that M&A activity drives excess growth in EV and TSR, strong execution remains critical to success. There are four ways that companies can drive value through M&A:

1. Follow strategy-driven discipline – Successful M&A begins with identifying the “right” target that closely fits a buyer’s growth strategy. In essence, it’s critical for companies to pursue the right deals at the right time, based on clearly defined strategic priorities and long-term growth plans. Successful buyers tend to be highly disciplined executives who resist succumbing to “deal fever.” In addition, management should define clear, measurable objectives for what they hope the acquisition will achieve. Examples often include access to new markets and distribution channels, creation of new and innovative technical capabilities, the addition of differentiated skills and expertise, and scale-related cost advantages.

2. Perform due diligence and synergy estimation – Two key factors often observed in failed M&A transactions are the underestimation of costs and overestimation of synergies. Once a target has been identified, it is imperative to develop a sound understanding of its business, operations, industry and competitors. Estimating all one-time costs, synergies and dis-synergies is also critical to effectively value a target. Experience from frequent acquisitions helps to improve the estimation process. Furthermore, frequent buyers understand clearly when a target’s valuation no longer generates an attractive return for shareholders. Executives may need to be willing to potentially walk away or renegotiate the price when a strategic transaction’s deal economics no longer make sense.

Deal synergies and costs should be quantifiable and measurable over time. For example:

- Cost synergies are typically easier to identify, capture and realize, vs. revenue synergies. Revenue synergies are normally more difficult to measure and are typically achieved during a longer-time period.

- One-time costs should continually be refreshed to justify the deal model and investment thesis.

- Dis-synergies (e.g., loss of operating scale, incremental technology costs, employee attrition) should also be carefully considered.

3. Execute effective M&A integration – It is important for the integration program to be detailed and transparent to promote efficient decision-making and rapid execution. Companies can clearly define how they plan to achieve synergies and how the combined business will be run to enhance value. Strong governance may need to be in place so that different vertical leaders are aligned with the deal objectives and work toward effective integration.

The M&A integration approach further involves selection of an effective management team, efficient internal and external communication, and management of cultural change. The decision to retain or rationalize acquired managers, and the eventual rebalancing of an acquisition’s management team, also play an important role in the success of an integration. Similarly, effective communication with investors can help build positive sentiment and enhance shareholder value.

Other common themes of successful M&A integrations include:

- The adage “Don’t break the business” applies. Carefully consider how much transformative change is feasible to pursue for the acquired business, particularly in the first three to six months following transaction close.

- A strong governance framework promotes quick and effective decision-making.

- Clearly defined integration strategy and guiding principles drive integration planning.

- Leadership maintains consensus on strategic priorities and “big bets” for the newly combined company.

4. Develop robust M&A processes and roadmaps for the future – Active buyers establish strong foundational capabilities to sustain consistent, repeatable M&A activity. This typically involves developing playbooks and building teams of highly skilled M&A professionals to execute future transactions. Such teams generally include a mix of internal executives and external advisors.

Conclusion

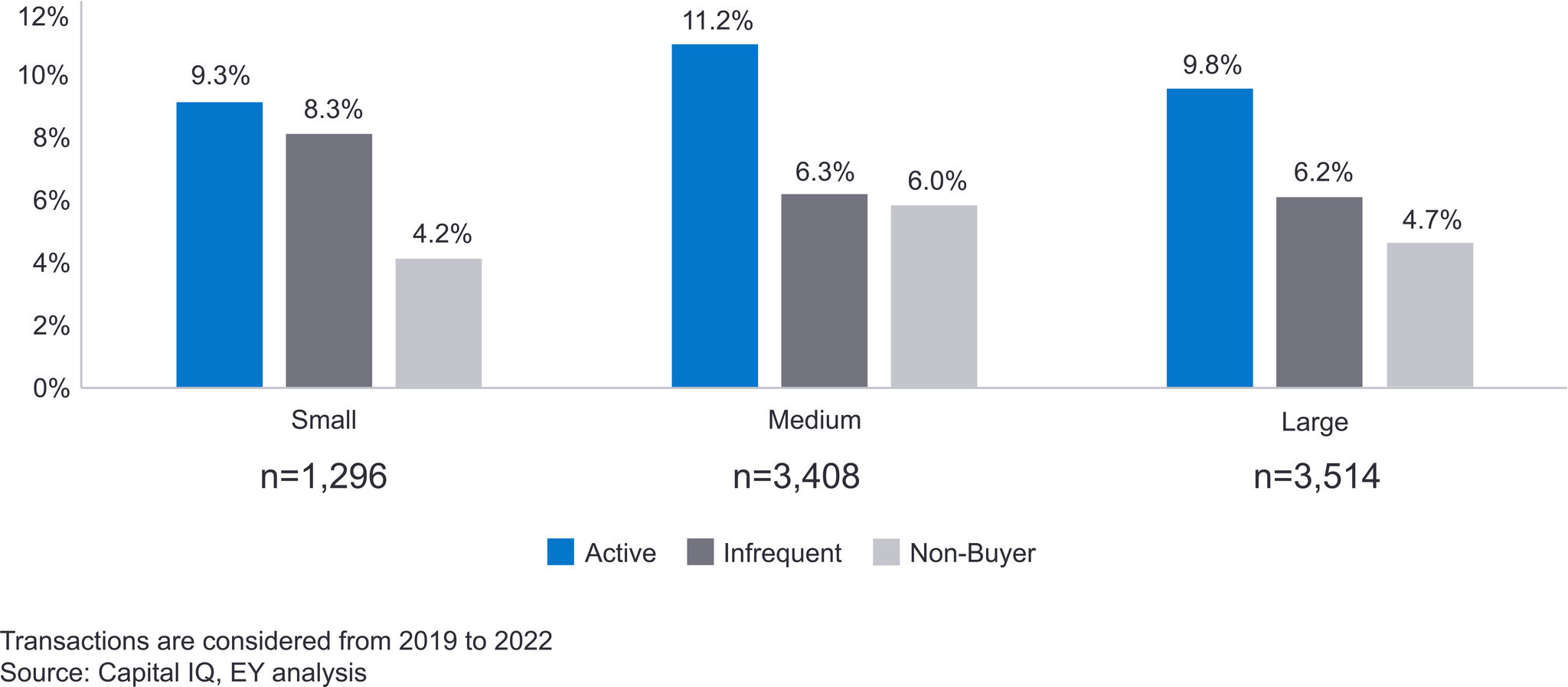

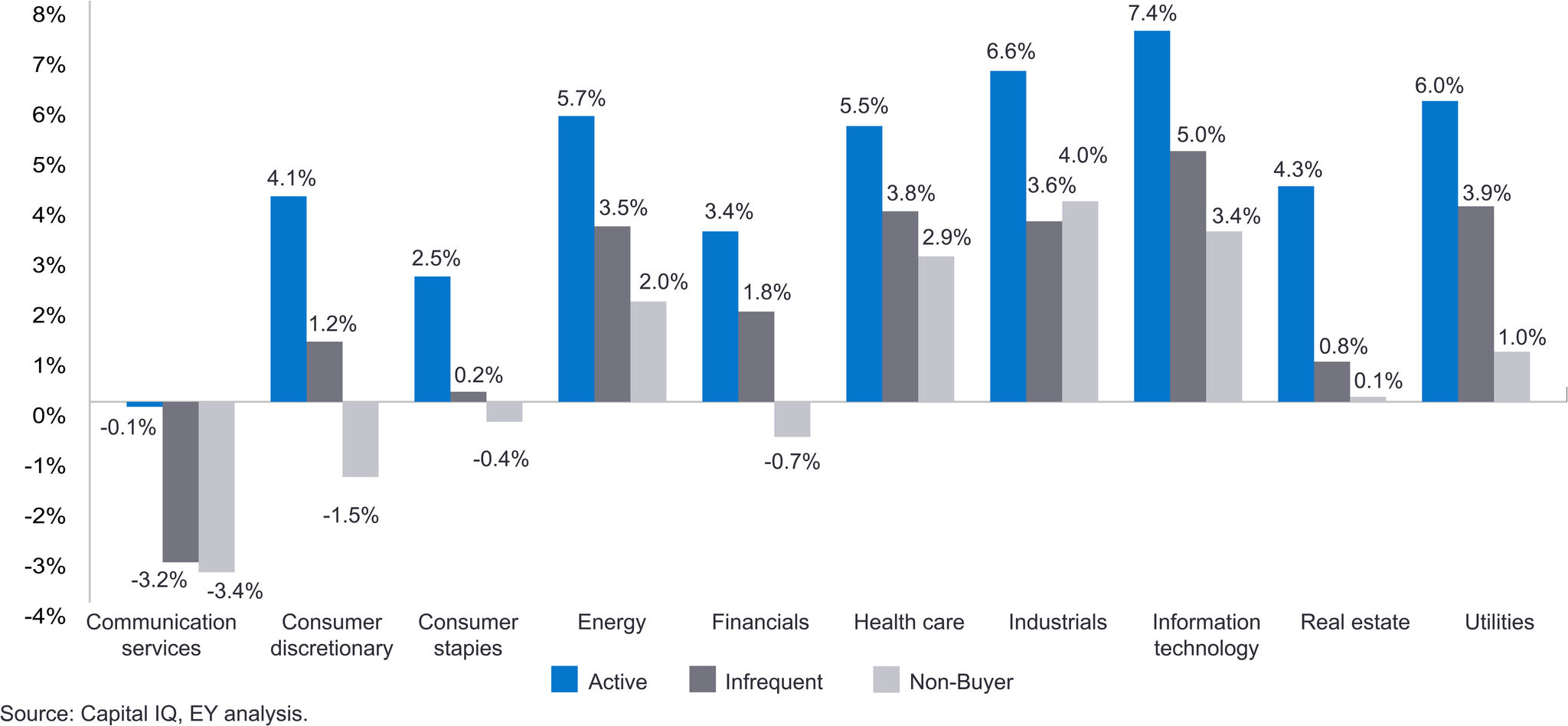

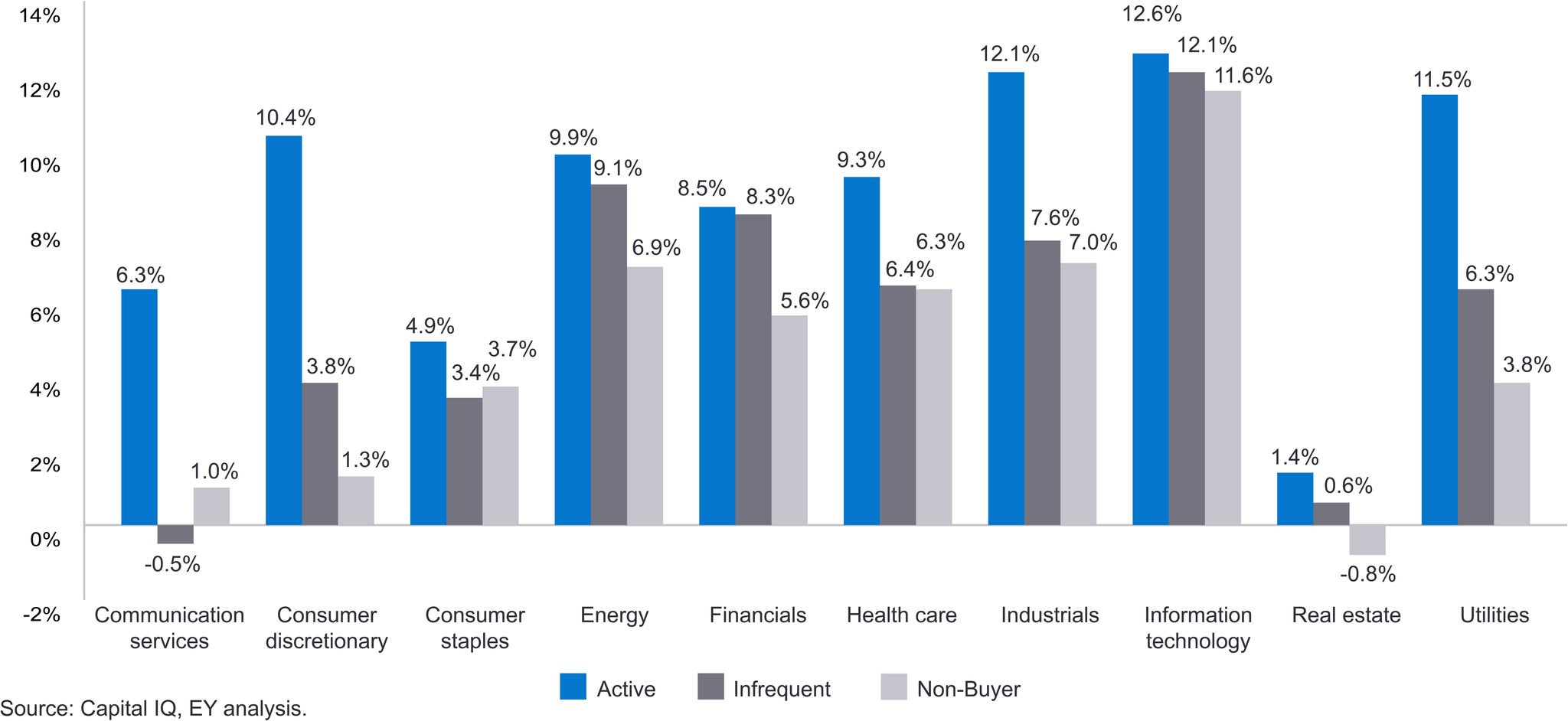

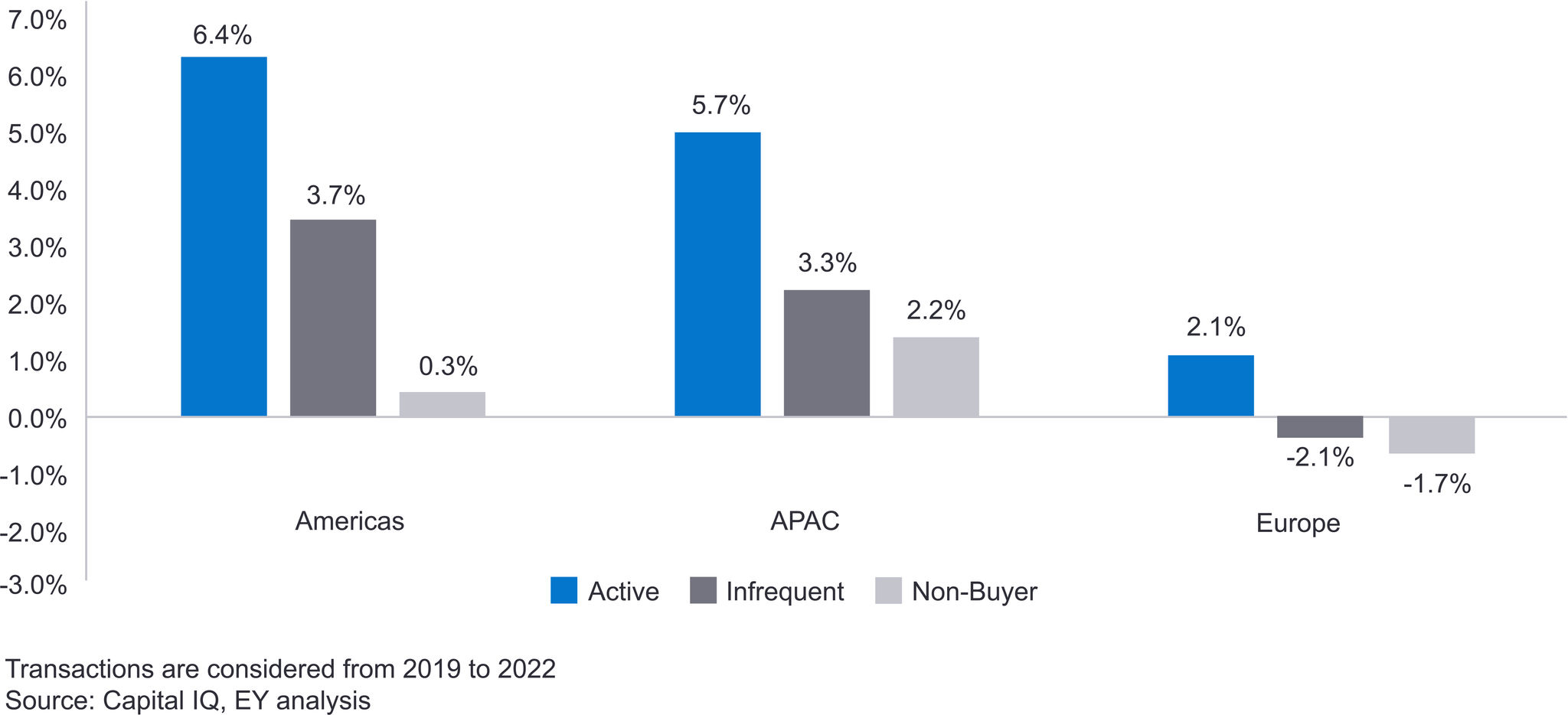

Our updated analysis challenges the myth of M&A’s waning influence, underlining its enduring significance in boosting shareholder returns and enterprise value. The research clearly indicates that more frequent M&A activity by companies of all sizes can boost enterprise value and shareholder return. To be successful, companies can consider key factors that contribute to successful M&A transactions, such as a disciplined approach to due diligence and deal integration. Armed with a clear vision, meticulous planning and a strategic approach to integrations, companies can emerge from any economic storm with elevated TSR and EV.