EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Players across the ecosystems are being asked to do more in an ever-changing global community.

Three questions to ask

- How are consumer interactions affected by the availability of data?

- Are consumers willing to pay for change or more information?

- How will costs be shared across the value chain?

Shifting consumer trends are driving fundamental change across the entire food and agriculture industry. The traditional farm-to-fork model has evolved to fork-from-farm and today is better described as a connected ecosystem. This raises questions about the role that companies across the value chain — processors, manufacturers, distributors, and retailers — will play as this new, more connected ecosystem emerges.

And yet, while the system experiences consumer-led disruption, players across the ecosystem must prepare for multiple operating scenarios. The mindset of planning for now, next and beyond could not be more critical to embracing disruption than it is now. The expectations of what food and ag companies provide – to individual consumers and the global community – drive home the need for a more connected food ecosystem. When you look at the impact of these shifting consumer preferences, it becomes clear that as goes the consumer, so goes the rest of the value chain. What follows is a look into how we see individual consumer preferences driving change throughout the food and ag sector and what it means for the future.

For the last several decades, producers based their decisions primarily on commodity prices, whereas in the future, they will need to be more in-tune with consumer preferences, industry trends and other market opportunities. Sustainability, climate change and new advancements in digital technology have prompted many producers to put everything on the table as they assess their future and search for ways to optimize production. Farmers are taking a deeper look at how digitization can create new opportunities for their business. They are also evaluating alternative income sources such as carbon credits and e-commerce that could serve their financial needs going forward.

Focus is shifting from a linear feedback path between producers and consumers to a system where connectivity across the value chain is more important than ever. Producers are exerting more control over their operations, utilizing new tools and capabilities in pursuit of greater profitability and efficiency.

As a result, players in the middle, between the producer and the consumer, will need to evaluate their own business models to see where they fit in the new, connected ecosystem where agility and resiliency have become imperative.

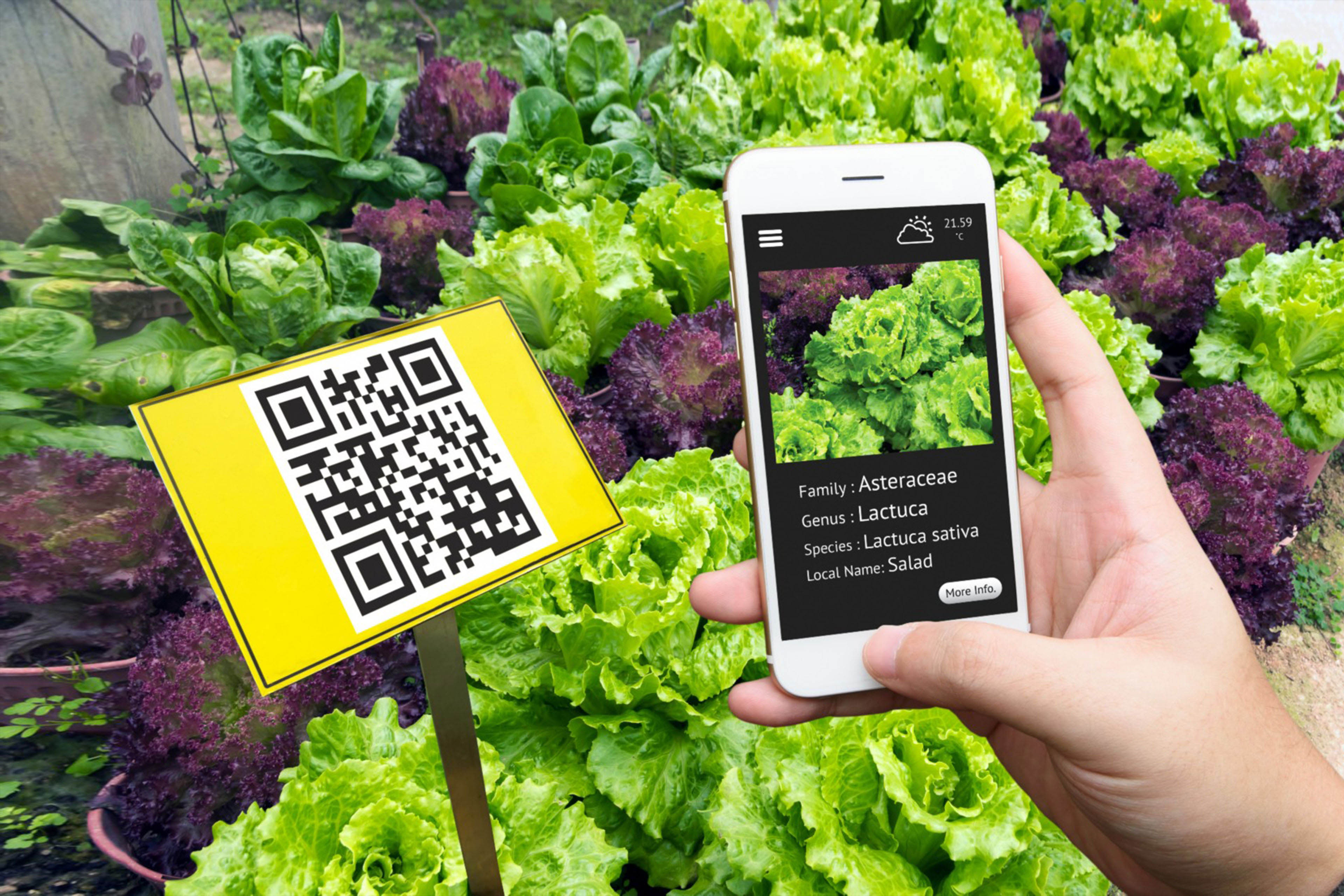

Consumers are changing too. They want visibility into where and how food is produced, packaged and delivered. As transparency of physical production methods and the value systems of producers and manufacturers become baseline consumer expectations, opportunity is emerging for those who can deliver their product with authenticity to command greater trust and value with the consumer. This was possible previously due to the geographic proximity between consumers and producers. In a reimagined food system, data will be critical in addressing consumer preferences. Will this wave of change ultimately recreate the way that food is produced and sold, or will it just be a specialty production niche?

Change is already causing ripples across the value chain. Companies in the middle are looking for ways to adapt and stay aligned with market shifts in supply chain, technology and sustainability. Decisions are being made that could accelerate disruption of the entire ecosystem, and create new opportunities for asset optimization, growth and a deeper connection between producers and consumers.

On the supply side, CSCOs (Chief Supply Chain Officers) are contending with limited visibility of the end-to-end supply chain, along with complicated and hard-to-analyze Emerging technologies are poised to improve supply side visibility – when paired with upskilling in data analytics and are implemented thoughtfully and strategically.¹

Bridging the gap to create food transparency

Consumers have more buying power in today’s market, which enables them to nudge the food industry toward a focus on nutrition, sustainability and products that align with their daily preferences. Evidence of these changes can be found everywhere from the re-emergence of farmers’ markets to fresh menu options to heightened awareness of local sourcing and food transparency. According to the Future Consumer Index (FCI), 31% of respondents plan to spend more on fresh food, 35% say local sourcing of food has become more important and 57% say the behavior of a company is as important as what it sells. Food is a defining characteristic for most people, and they like being associated with brands that match their view of the world.

However, it’s not that simple. A noticeable gap remains between consumer intention and consumer action. FCI found that 83% of respondents would NOT pay a premium for more sustainable goods and services and 39% are happy to travel farther for groceries if there is better parking. These are data points that give producers, and those companies in the middle of the value chain, pause as they consider what’s next and where to invest, while questioning disruptions like the impact of last mile delivery and the shift of consumers going to food versus food going to consumers. Trends such as sustainability and the desire for fresh food and transparency are likely here to stay. How do you create a business model that can deliver on the expectations from a spectrum of consumers, while addressing a more connected ecosystem? Could we eventually see a bifurcated system in which both affordability-minded consumers and those willing to pay a premium for traceability and sustainably produced food can be served?

Here are some key questions that will need to be considered:

- How does the availability of data impact interactions with the consumer?

- Are consumers expecting change or more information, and are they willing to pay for it?

- In a connected ecosystem where roles are shifting, how will costs be shared across the value chain?

Producers have a lot more to think about in the face of ever-shifting consumer trends and value chain disruption. However, they also have a wealth of resources and strategic options they can pursue to respond to these market shifts.

How the future producer persona will drive a connected ecosystem to create food transparency

Farms focused on a primary crop or animal product for generations continue to uproot established operating plans in response to changing climates, rising production costs and shifting consumer preferences. For example, century-old dairy farms continue to supplement their milking parlors with diverse sources of income, such as crop production or, as of late, carbon sequestration. Changes like this present both challenges and opportunities that a connected ecosystem will need to address.

Open production capacity on farms could provide downstream customers the chance to partner directly with farmers to raise a new product and solidify a supply line that might be underserved by producers – generating a symbiotic relationship across the ecosystem. ² It is equally important to understand how consumer preferences drive upstream changes (all the way to farmers) and how they might reposition themselves with their customer and consumers in a reimagined food system.³

There is certainly a risk of profit pool shifts within the value chain. If more consumers want to get closer to their food and midstream to downstream companies are not willing to facilitate that connection, a portion of consumers may choose to find alternative options. Processors are developing their own branded products to put on the shelf and create new value for their own businesses. The relationship between producer and processor continues to evolve.

There was a time when processors held all the data and thus, greater control. Now and into the future, producers will have valuable data at their fingertips, enabling their own efficiency and profitability. Thus, the dynamics of the market could change dramatically. Traditional farmer and rancher suppliers, along with new suppliers like controlled environment agriculture and alternative protein processors, could become competitors due to their proximity to the consumer. The need to be nimble and flexible to changing roles in this connected ecosystem is only going to be more crucial in the years ahead.

Key questions to consider when developing future strategies in a highly connected ecosystem:

- How will the producers’ willingness and/or ability to pay, learn and implement the technology impact midstream and downstream companies’ decisions?

- In an asset-intensive industry, how must business models change to enable agility and efficiency while considering new methods of production like where the food is produced?

- What is more economically feasible – specialization or diversification?

Here is a look at how producers are beginning to leverage a more connected ecosystem to create additional value and more profitable operations, as well as what the embrace of market disruptors and emerging technology could mean for the rest of the value chain. These are just a few of the ways producers are beginning to shift, offering an indication of new ways of working.

Summary

As consumers place greater focus on where their food comes from and how it was produced, producers are exploring options to enhance profitability and better utilize their assets, such as changing the type of crops grown or incorporating technology to manage animal health.

How EY can help

Related articles

US Future Consumer Index 8: Do consumers drive the market or does the market drive consumers?

In the eighth edition of the US Future Consumer Index, we take a hard look at the short- and long-term importance of price and availability. Read more.

How to advance food safety for a more connected and digital food system

The US FDA’s “New Era of Smarter Food Safety” requires a more modern, technological approach to food safety. Read more.