Proper execution requires broad resources

To confirm they are maximizing their resources and protecting existing customers, utilities need to evolve their thinking in several specific areas — moving from a “project” to a “portfolio” approach, embedding a formal project management model into the data center development process and creating a collaborative mindset with developers that transcends core data center stand-up.

These three cornerstones can aid hosts in establishing a firmer footing for execution, increase the visibility and rigor of performance delivery, and enable an expanded relationship with developers that provides mutual benefits to both entities.

Traditionally, large capital projects — for example, those costing more than $1 billion — do not have a strong track record around costs and schedule. The issue is that in many cases, large projects are not well-conceived, and executive management is insufficiently engaged throughout the project lifecycle. That combination often means that execution discipline falls below expected levels, resulting in delays and massive cost overruns.

To avoid this, utilities need to reassess their current delivery models and challenge whether the organization’s experience and capabilities are sufficient in a new era of simultaneous, synchronized and sustained investment.

Modern, enhanced project management models require comprehensive engagement and integration of internal functions across the business to bring critical resources to the effort — including legal, finance and accounting, tax, regulatory, economic development, real estate, risk management, technology, and human resources, along with engineering, construction, distribution, project controls and project management.

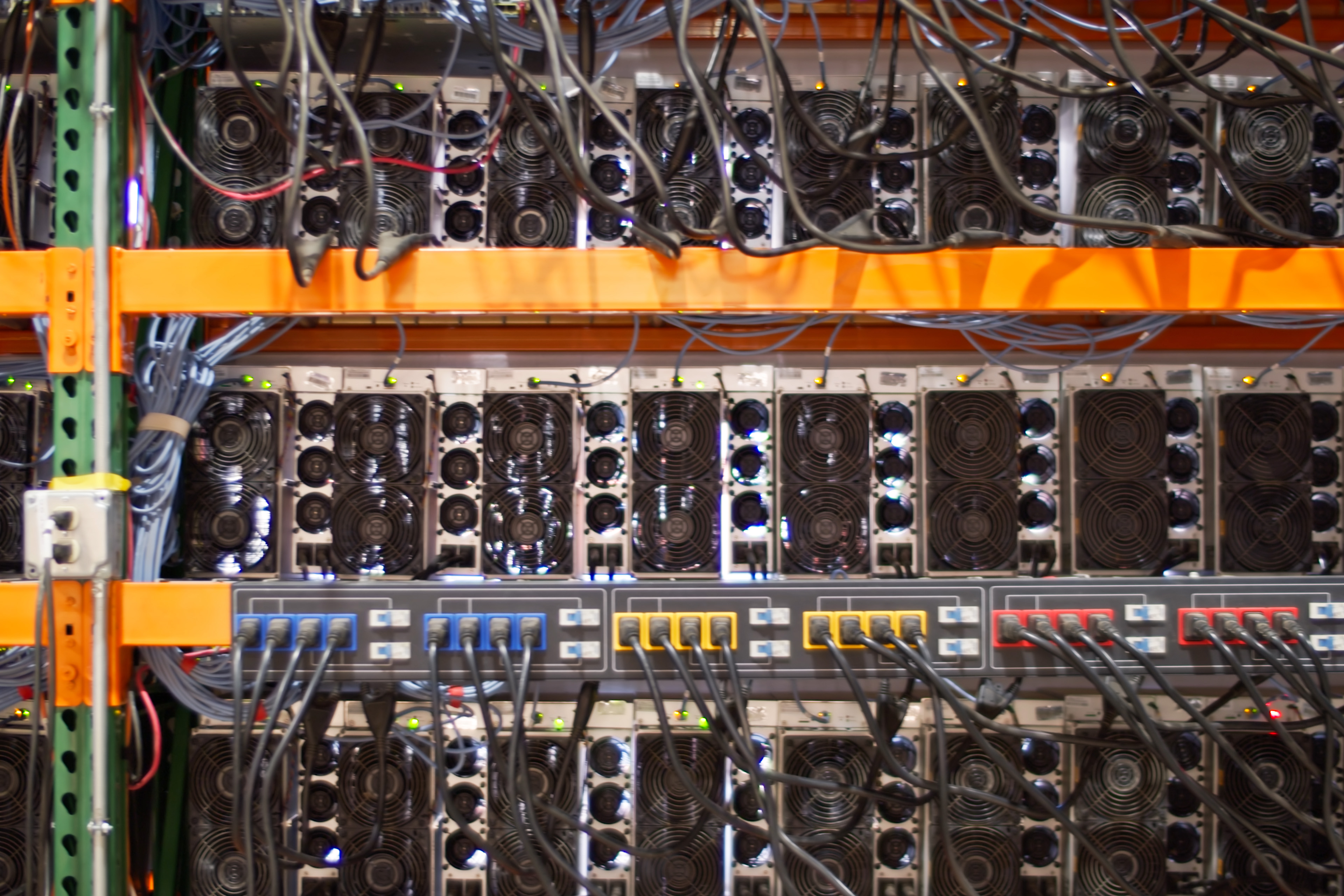

As utilities enhance their approaches to fulfillment of data center stand-up, they also need to rethink their long-term positioning with developers — particularly the group of hyper-scalers building the largest and most power-hungry facilities. Utilities need to step back and consider the implications of advancing relationships within the sponsor group — pursuing tangible and intangible value through elevating sponsor-host relationships from transactional to collaborative.

Build an ecosystem – not a project

A “digital hub” enables developers and utilities to enhance a portfolio of data center projects from inception through stand-up and activation. Thinking of future data centers from this perspective introduces a broader value dimension extending beyond activation of a single facility.

Already, multi-facility digital hubs are being built out in stages at concentrated sites and staggered over succeeding years of activation. Adopting this type of approach captures natural economies available — for example, building four 250-megawatt units is less expensive than constructing 10 100-megawatt facilities, leveraging more efficient infrastructure, increased power supply build-out, larger contract vetting, faster delivery of key equipment and higher site productivity.

An ecosystem-based model can become a natural source of value if the developer and utility evolve from enablers of outcomes to sources of value that leverage joint abilities to capture available economies, create additional value to each entity and sustain an overall focus on value throughout the course of an individual project or a portfolio of projects.

A range of value benefits can be derived from a robust ecosystem implemented to enhance what a single data center can produce through its purpose, operation and positioning. For example, an ecosystem can be created with the digital hub at its center, and secondary and tertiary value can flow to financiers, fiber, water and industrial solutions providers, grid providers, municipalities, regulators and customers. Through this ecosystem, meaningful jobs will be created; additional property taxes will be collected; power supply, grid and network utilization will improve; electrification will be expanded; financing costs can be lowered; and regulatory policies can be advanced.

Eight actions for better outcomes

Additional data center growth opportunities exist from requests for service and interconnection not yet contracted, or where utilities have higher uncertainty about request validity or developer capacity to move to a contracting stage in the near term.

As potential data center requests for service backlogs increase and cost and speed to power scale-up, utilities would be wise to focus on eight key actions to elevate their market positioning to effectively execute and benefit from a growing inventory of projects in future years: