Data center development stage 2 — managing formation

The unique challenges of data center development — especially their power, water and connectivity needs; difficult permitting; and supply chain bottlenecks of critical equipment — make this stage particularly fraught. The experience of EY US in helping clients successfully plan for and navigate these obstacles can facilitate construction.

For example, researching and compiling detailed new market entry studies — with insights into key considerations such as utility capacity and land use regulations — can jumpstart a successful project.

“We’re seeing a real shift where ease of permitting and the availability of power and other supporting infrastructure are the deciding factors on where to build, rather than choosing a specific geographic location and working to make it happen,” says Vantzelfde. “Developers are increasingly opting for more rural locations where power is readily available and there is a need for economic growth vs. established markets where they can wait months for approvals and years for utility connections. Trying to build in a location with overly restrictive environmental or zoning regulations, or where excess power or water is unavailable, is costly and time-consuming.”

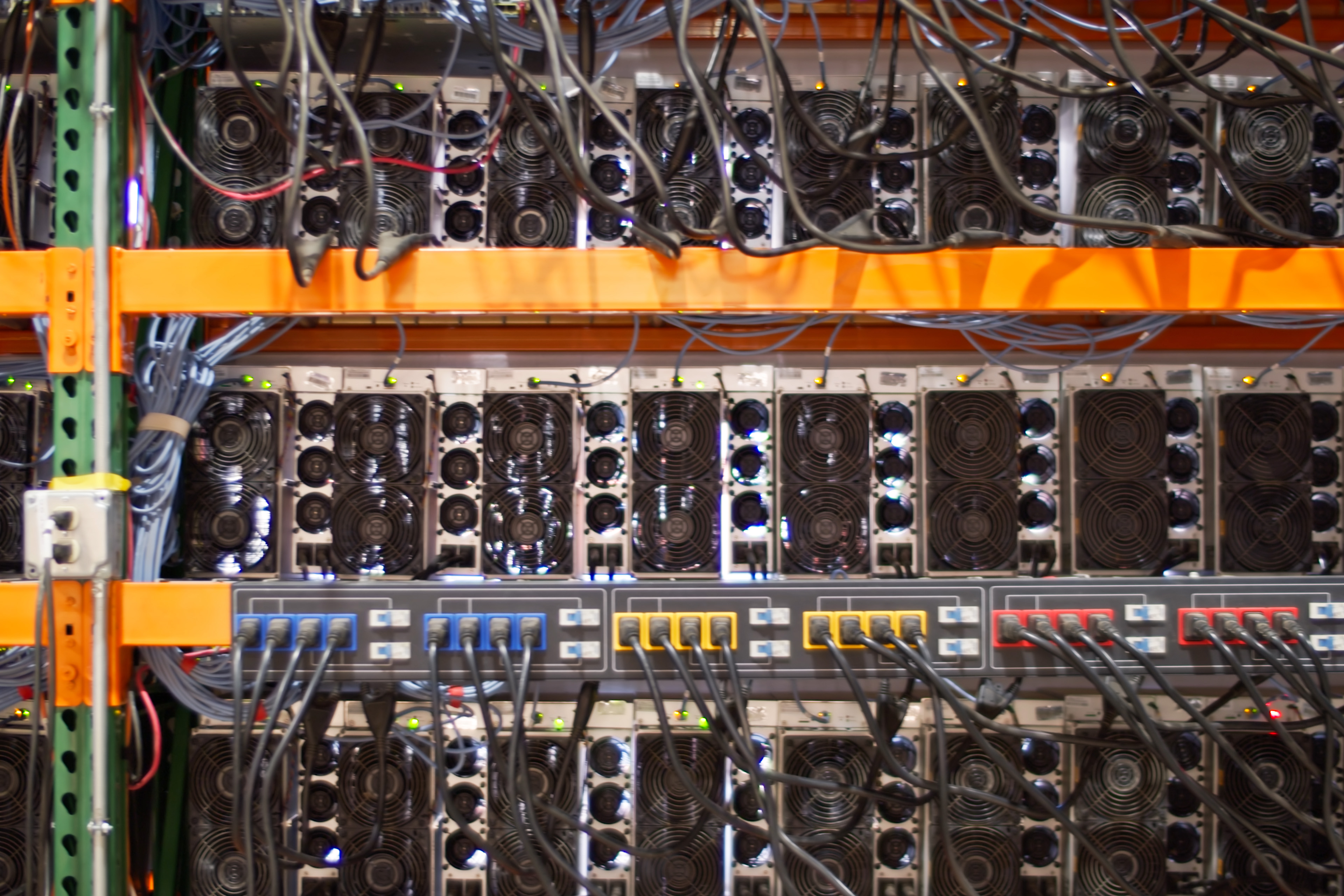

In some cases, developers are looking for brownfield redevelopment solutions, repurposing existing locations — such as manufacturing plants or crypto mining operations — that are already connected to power.

And some are turning to behind-the-meter solutions to meet power needs, developing their own on-site power generation assets — typically natural gas generation, with some potential for renewables as well.

These types of development and financial decisions — and many more like them — add significant complexity to a project. Understanding and comparing various scenarios and making a well-informed choice is essential. How will leasing be impacted? What are the tax implications? How will our decisions change the ongoing cost structure or the project’s market attractiveness?

Considerations

- Take a big picture, multidisciplinary view of project formation. Data center complexity requires significant up-front study and planning. Small decisions can have a major impact on project viability.

- Be open to different approaches. Local challenges in site selection and utility availability require flexibility in decision-making.

Data center development stage 3 — exiting the project

Ideally, exit planning should be done prior to construction. The right economic structure — designed with the exit in mind — can attract long-term investors, simplify deal-making and make it easier to sell the property.

When it’s time to sell, determining valuation; understanding macro- and microeconomic trends and market timing; managing legal, tax and financing issues; and other key decision points can be difficult. With proper financial, tax and logistical planning and strategy support, developers and investors can be confident they have the proper plans and safeguards in place to maximize their return.

Considerations

- Don’t rush the sales process. Take time to develop a strategy that uses your project’s unique capabilities and market position.

- Ask for help. Third-party assistance can be beneficial in getting a 360-degree view of all relevant financial elements to a deal.

Don’t overlook critical tax considerations

The tax implications of a structured asset strategy are significant and impact each stage of development, especially structure and exit. Developers should consider the following key elements: