Copper miners’ current focus

Exploration expenditures reached a nine-year high of US$2.8b, despite declining grades and a lack of new discoveries

Copper exploration budget in 2022 was up 21% year over year to US$2.8b, with budget in LATAM witnessing the highest rise, at 34%, to reach US$1.2b. Exploration spend is expected to rise 12% to US$3.1b in 2023, with activities focused towards established assets through mine site and last-stage projects, compared to grassroot ones.³

LATAM will continue to be the dominant region. However, the declining grade of copper remains a key concern in the region, resulting in higher costs of operations. In Chile, the grades fell from 0.72% in 2012 to 0.63% in 2021. The global average grades also declined from 1.08% in 2012 to 0.9% in 2021.

Moreover, a lack of recent significant new discoveries is expected to impact supply growth. Between 2001 and 2010, new global discoveries were 86, compared to only 19 in the decade following that. This is mainly due to a decline of grassroot exploration budgets, which can impact the long-term supply pipeline.

M&A in the first half of 2023 equated to 87% of 2022’s total deal value, driven by the supply deficit outlook

Though the copper deal count dipped from 27 in 2021 to 22 in 2022, the deal value increased 91% to US$12.7b in 2022. The deal value of completed copper deals in the first half of 2023 increased to US$11.1b.⁴ This is primarily due to the pivotal role of copper in energy transition and concerns over copper supply, compounded by a lack of new significant discoveries despite healthy exploration budgets.

One of the major deals include Rio Tinto’s acquisition of Turquoise Hill for US$3.3b to simplify its ownership and increase output from the Oyu-Tolgoi project in Mongolia.⁵

Rising regulatory and political challenges are impacting key mining operations

a. Chile’s new mining royalty law aims to generate US$1.5b in revenue for the state, with a maximum tax burden for large miners set at 46.5%⁶

LATAM continues to face regulatory uncertainty, with a mining tax law introduced in Chile in May 2023. The law considers a combined cap of tax burden of 46.5% and 45.5% for operators with production above 80 kt and 50-80 kt of fine copper, respectively.⁷ In addition, mining operators will be subject to an ad valorem component of 1% for miners with annual sales of copper above 50 kt, and taxes on the sale of copper will increase to a range of 8% to 26% of operating mining margin effective January 1, 2024 compared to the prior range of 5% to 14%.⁸

As a result, some miners such as Freeport-McMoRan were re-evaluating their investment plans in Chile.⁹ However, the government is actively engaging in discussions with mining companies and other stakeholders to provide investment incentives to compensate for the uncertainty and encourage investments in the region.

b. Political unrest in Peru and Panama to disrupt short-term copper supply

Widespread protests in Peru have disrupted copper output, leading to a surge in prices. President Dina Boluarte’s resignation and protestors’ demand for early elections have impacted mining operations, resulting in production slowdowns.

For instance, MMG’s Las Bambas mine, which contributes approximately 2% to global production, suspended its production temporarily due to transport disruptions.¹⁰ Similarly, Freeport-McMoRan decreased ore extraction at Cerro Verde mine by 10% to 15% to 350 kt per day.¹¹

Protests against First Quantum’s Cobre Panama mine emerged after the government approved a long-term license to operate for the mine without public consultation. The mine was shut down after the Panamanian Supreme Court declared First Quantum’s contract unconstitutional, leading to disruptions in supply of the mine that accounts for 1% of the global production.¹²,¹³ Such protests are likely to impact new project pipeline over the coming years.

Next steps for miners to steer the transition

Miners to focus on ESG initiatives to manage their overall sustainability profile

a. Water scarcity crisis demands action as approximately 66% of the world’s largest mines are located in water-stressed countries ¹⁴

Several mining activities, such as mineral processing, equipment cooling and dust control are water intensive, leading to significant water extraction from local sources, exacerbating the scarcity in already water-stressed regions.

Several miners are implementing measures such as water recycling and reuse methods, responsible mine design and planning, water assessment studies and smart mining to address water management challenges. For instance, Rio Tinto started a database platform to increase transparency on its water usage.¹⁵

Moreover, technologies such as desalination and membrane filtration can further help in reducing the mining industry's reliance on freshwater sources.

b. Key miners are focusing on lowering their carbon footprint to reduce emissions by 30% to 50% by 2030¹⁶

Electricity and diesel fuel remain two major sources of operational emissions for miners, accounting for an average of 32% and 25% of emissions, respectively.¹⁷ Miners are actively working to reduce their carbon footprint through the use of decarbonized electricity and alternative fuels.

Several miners are deploying renewable energy sources for mining operations. For instance, Teck finalized an agreement with AES Corporation to secure 100% renewable energy for the newly expanded Quebrada Blanca copper mine in Chile, commencing from 2025.¹⁸

Some mining companies are exploring alternative fuel sources, such as Rio Tinto, which completed a renewable diesel trial for haul trucks to reduce their fleets’ environmental footprint.¹⁹

Miners are also considering fleet and equipment electrification to reduce carbon emissions. For instance, Glencore partnered with Epiroc for delivery of 23 battery-electric haul trucks and other mobile equipment for the Onaping Depth nickel and copper mine in Canada.²⁰

c. Increasing human rights violations in DRC²¹demand more pressing action from both miners and governments

The Democratic Republic of the Congo (DRC), one of the top five copper producers, accounted for 10% of global mine production in 2022 and has the world’s seventh-largest copper reserves.²²,²³

Cases of human rights abuses were reported emphasizing the need to address such issues. For instance, in July 2023, the DRC Government cancelled operating rights of 29 mining companies due to a lack of compliance relating to social and environmental actions.²⁴

Miners need to address human rights violations by strengthening their corporate cultures to create safe and inclusive workplaces.

d. Sustainable products will gain traction, especially as demand from the energy transition is expected to increase threefold by 2030²⁵

Currently 32% of copper used per year comes from recycling.²⁶ Theoretically, copper is fully recoverable, but the actual recycling rate is 46% due to the complexity of extracting copper from some applications such as electronic scrap.²⁷

Companies are making new investments to increase scrap extraction. For instance, Hindalco announced a US$240m investment to setup a copper and e-waste recycling facility.²⁸

As the demand for sustainable copper grows, companies are launching low-carbon products. For instance, European miner Boliden launched low-carbon copper products, defining it as metal produced with less than 1.5 kg CO2/kg Cu, which is approximately 38% less than the average global copper emission rate.²⁹

Looking ahead, the lack of a universally accepted definition of green copper, the determination of premium charges, and limitations in accounting and reporting carbon footprint across the value chain remain key challenges.

Copper miners will increase their adoption of responsible mining guidance to meet sustainability targets

As copper gains popularity due to the energy transition, miners are increasingly expected to enhance their ESG reporting practices. The members of the International Copper Association (ICA) mainly adhere to the Global Reporting Initiative (GRI) standard to report ESG data.

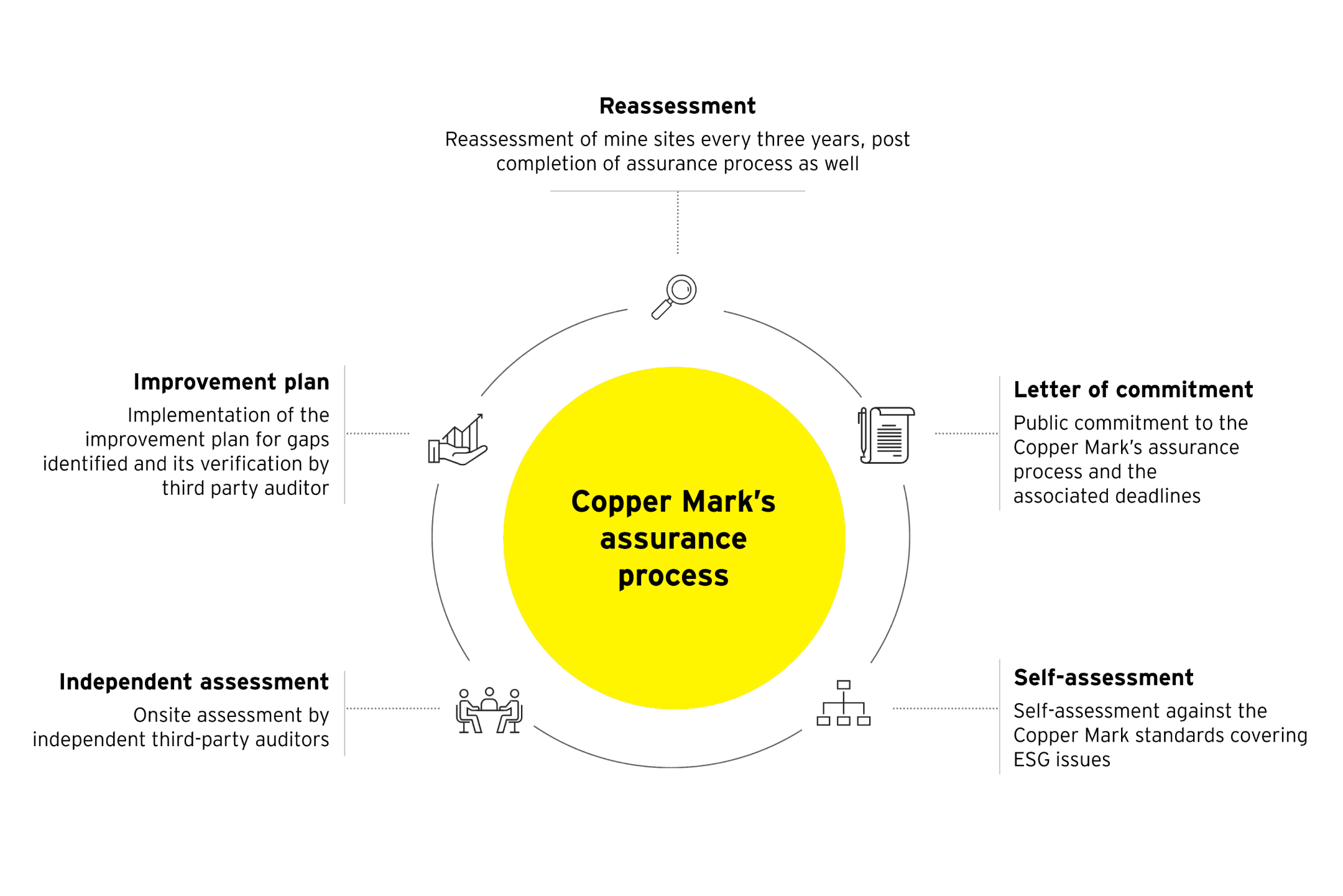

In 2019, the ICA created the Copper Mark, an assurance system for responsible copper production. More than 25% of globally mined copper is currently produced by Copper Mark-assured sites.³⁰