Gold miners’ current focus

Profitability is propelling miners in the direction of aggressive M&A

Though the gold deal count dipped from 133 in 2021 to 118 in 2022, overall deal value increased 58% year over year to US$21.5b in 2022.² With slight moderation in inflation rates compared to the previous year and changes in interest rates in 2023, mid-cap gold miners are aiming to scale up and capitalize on operational synergies, banking on high gold prices and robust margins.

Major gold deals in 2023 included Pan American-Agnico Eagle’s acquisition of Yamana Gold with a cash and stock offer worth ~US$4.8b to expand its operations in Latin America and consolidate Yamana’s ownership of its Malartic, Québec operations.³

Annual average AISC surpassed all-time highs of 2012 to reach US$1,276/oz

Higher inflation than before the pandemic, along with supply disruptions, influenced mine-site costs such as labour, fuel and electricity over the past quarters. The average all-in sustaining costs (AISC) for gold increased 18% year over year to US$1,276/oz in 2022, surpassing the previous records of 2012.⁴

These costs further rose and averaged at US$1,337/oz in the first half of 2023 increasingly putting high-cost gold mines under operational stress of temporary closure or production cuts.⁵

On a regional basis, the Americas is expected to remain a high-cost region, with AISC to average at US$1,299/oz in 2023 due to rising labour and fuel costs.⁶

Gold is likely to dominate exploration, with 46% total budget allocation

Overall gold exploration budget in perspective is expected to reach US$5.9b in 2023, down 16% year over year from the nine-year highs of 2022, yet comprising 46% of the overall exploration budget.

The major companies’ gold allocations are likely to total to US$2.9b, just above the juniors’ budget of US$2.3b, with both accounting for 87% of total gold allocations.

Exploration activities in the year continue to be more focused towards mine site and last-stage projects compared to grassroot ones.

Regionally, Canada is expected to record the highest share of 23% of the total 2023 gold budget, amounting to US$1.4b, followed by Australia and Latin America.⁷

Central bank purchases registered 14% year-over-year growth to 800 t in the first nine months of 2023, driving another notable year of net buying

Central bank purchases recorded 55-year highs, with 140% year-over-year growth to 1,082 t in 2022, primarily supported by emerging markets, including Turkey and China. Continuing the trend, central bank buying increased 14% year over year to 800 t in the first three quarters of 2023. The investment demand increased 12% year over year to 1,113 t in 2022, with sustained bar and coin demand and a slowdown in net ETF selling. However, investments declined 21% to 687 t year to date with ETF outflows.

In terms of physical demand, jewelry consumption declined 3% to 2,090 t in 2022 due to high local prices of gold in markets like India and Turkey, and COVID-related lockdowns in China.

Jewelry demand remained flat in the first three quarters of 2023 compared to the same period in 2022, with persistent economic uncertainty and price pressures on consumers.

While technology demand for gold dropped 6% in 2022 and 9% in the first nine months of 2023, with trade restrictions, supply chain issues and dipping consumer demand amid a deteriorating global economic backdrop.⁸

Miners are advancing ESG reporting to increase transparency for primary and secondary investors

As gold gains popularity as an investment asset, miners are increasingly expected to enhance their ESG reporting practices. To avoid errors in sustainability reporting, miners actively track and analyze high-quality ESG data, with strong governance and controls to ensure appropriate signoffs.

Some miners have adopted ESG tracking solutions to collate and validate data digitally; for instance, Eldorado Gold has employed an ESG solution that helps the company log, approve and report datapoints in a manner relevant to various reporting frameworks.⁹

Next steps for miners to steer the transition

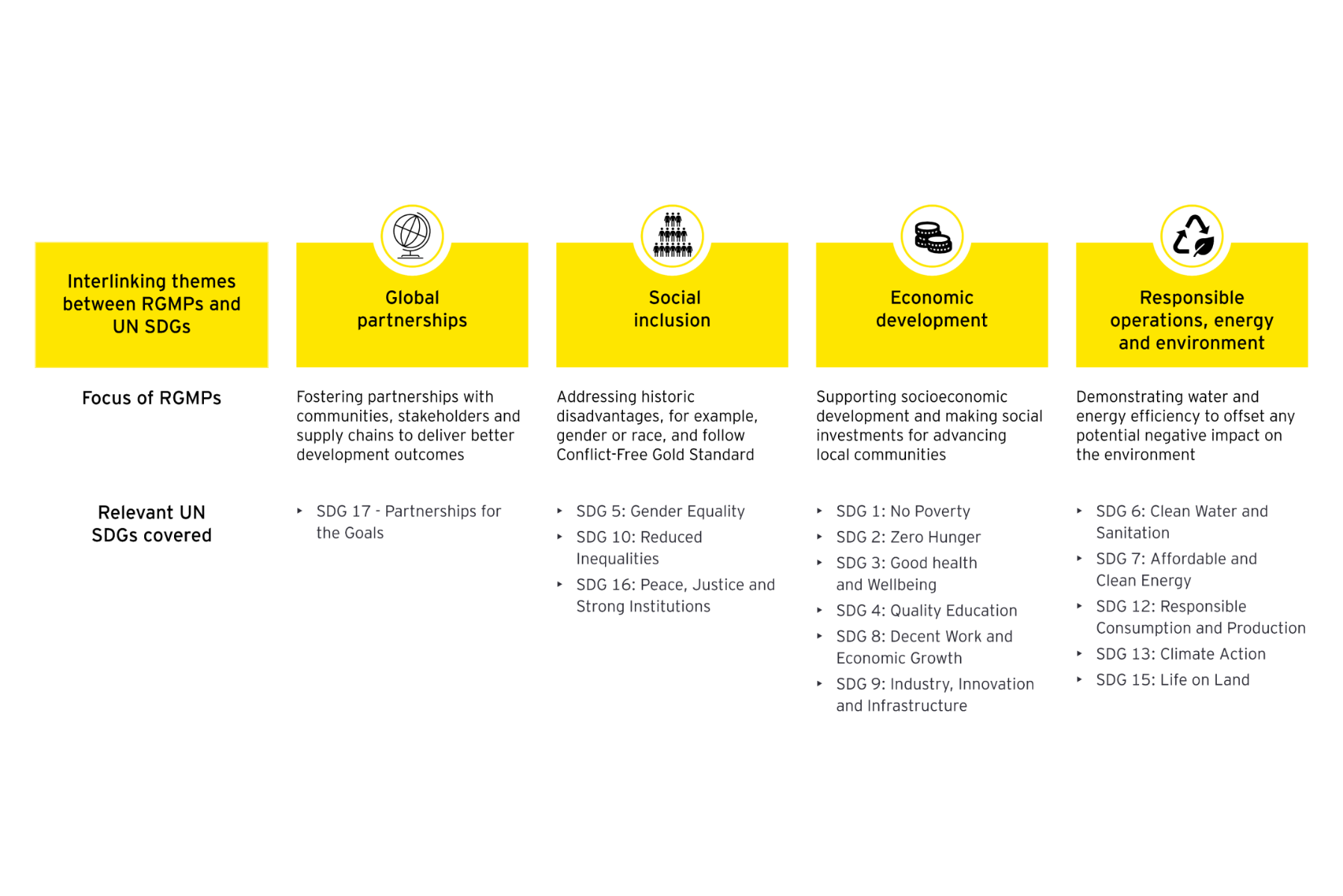

Adoption of responsible gold mining principles drives adherence to sustainable development goals

Gold companies that implement the World Gold Council’s Responsible Gold Mining Principles (RGMPs) , indirectly contribute to a variety of the UN Sustainable Development Goals (UN SDGs) due to close interlinkage between the two standards.¹⁰