EY si riferisce all'organizzazione globale, e può riferirsi a una o più delle società membri di Ernst & Young Global Limited, ciascuna delle quali è un'entità legale separata. Ernst & Young Global Limited, una società britannica a responsabilità limitata, non fornisce servizi ai clienti.

Co-author - Maria Fusco, EY Buy & Integrate Italian Member

The buyer’s Management views due diligence as the toughest stage in the pre-deal process, now made more difficult by today’s intricate M&A market. This complexity has lengthened due diligence, allowing for deeper analysis before finalizing a deal. Innovations in due diligence are becoming increasingly vital to provide Top Managers with a comprehensive, early understanding of the target. This aids in internal discussions, negotiations, and spotting potential risks and opportunities, such as synergies and integration challenges, paving the way for efficient post-deal planning.

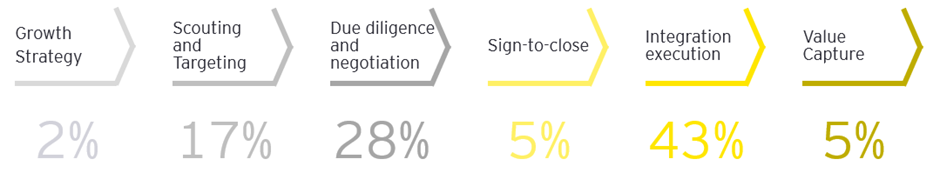

While the due diligence (DD) process is commonly considered an opportunity for the buyers to identify potential transaction risks and hidden deal-value drivers, this is also perceived as the most challenging activity on the pre-deal phase, per the EY 2023 EUW B&I Barometer.

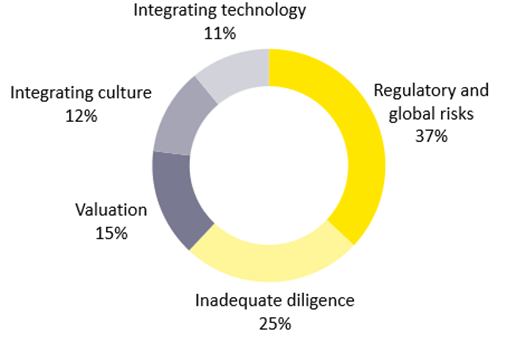

In particular, according to the recent EY Global B&I Pulse, almost 20% of top managers interviewed recognized their limited satisfaction with the due diligence results. The most common causes are (i) the compressed timeline, (ii) the limited access to information, and (iii) the inadequate Target technology.

In addition to these usual DD threats, the current hard M&A market is pushing the buyers to extend the due diligence phase, enriching it with additional streams: high-interest rates, price expectation mismatches, and projections complex to be validated in volatile markets made necessary deeper and more variegated due diligence analyses.

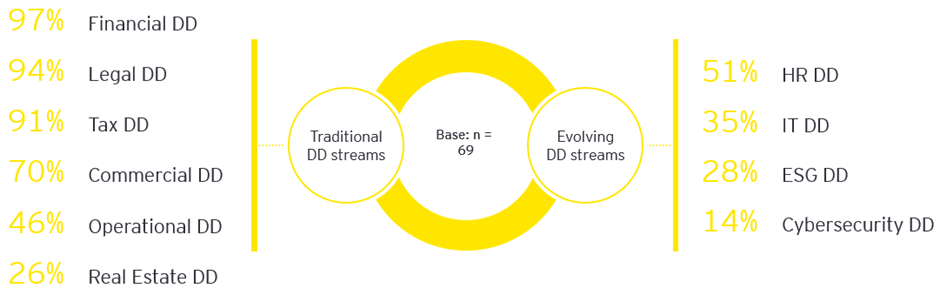

In this sense, together with the traditional DD streams usually aimed at covering aspects mostly related to pricing and contractual negotiations, in the last 18-24 months, we observed the increasing request for innovative due diligence streams (e.g., HR, ESG, Cybersecurity, etc.) aimed at improving the buyer investment comfort by covering sensible topics for the Investment Committees, getting a robust understanding on the post-deal opportunities/challenges, and planning better the exit options.

The relevance of these innovative due diligence activities has also been clearly flagged by the EY 2023 EUW B&I Barometer, showing how the top managers commonly deal with new DD streams.

The evolving nature of due diligence raises three important questions for every M&A practitioner:

- Which parameters need to be considered while performing due diligence to mitigate risks?

- Do the organizations possess internal capabilities to address the evolving due diligence needs?

- What are the interdependencies between target risks and functions?

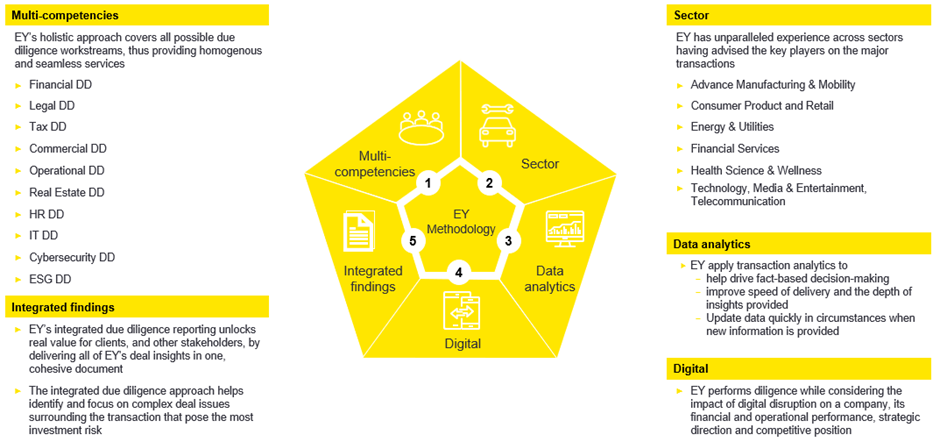

The answer to these questions leads to having an integrated approach while performing due diligence on potential targets. Integrated diligence — a holistic view of a target's risk profile — can be the springboard for accelerating value creation and avoiding blind spots, particularly when companies pursue targets outside their core sector.

In our experience, the holistic approach benefits include:

- Mitigation of the transaction risks by anticipating business threats and weakness

- Improvement in reputational risk management

- Crystal-clear view on the value creation drivers leading to a more precise deal strategy

- Higher comfort of financing parties and stakeholders

- Avoided overpricing by having a more accurate valuation of the target company leading to more informed negotiations

- Lower risks of transaction delays and post-closing risks

In this context, EY developed an integrated approach to add value by bringing a holistic point-of-view to engagements: in particular, this is aimed at delivering deeper deal insights by connecting the (i) diligence dots – across financial, tax, commercial, operations/, legal, human resources, IT, cyber, ESG – and embedding sector, digital and analytics expertise in the engagements.

The benefit of this approach has been recently demonstrated by the successful project run by EY to support Reno de Medici (RdM) in the acquisition of the Swedish operator Friskeby.

In this context, EY could flank the traditional financial and tax due diligence streams with some pioneering HR and ESG services, assisting the RdM Management to strengthen their investment thesis and (ii) anticipate several deal risks and opportunities.

About it, Andrea Bettinelli (Head of M&A at Reno de Medici) commented:

"Sustainability is a key aspect of our strategic direction. Our business demonstrates a strong correlation between financial and ESG (Environmental, Social, and Governance) performance, which are interconnected and mutually reinforcing. We call this correlation "Collinearity. When evaluating potential targets, we consider companies that support the achievement of our long-term sustainability goals. During the due diligence phase, we use a collinear approach to reduce operational risks and identify additional cost-saving opportunities, with the ultimate goal of creating value for our stakeholders."

On the other hand, more recently we observed several transactions failed due to the underestimation of the non-traditional aspects; amongst others:

- Cultural gaps: we assisted buyers who skipped any cultural assessment over the DD phase to focus on the conventional transaction topics and postpone other Operating Model and Organization discussions to the integration phase. The result of this approach led to unexpected and complex matters to deal with in the post-closing, (i) slowing-down the realization of the synergies, (ii) generating conflicts among key roles (resulting in a talent leak in some cases) and (iii) ultimately undermining the overall integration process.

- Cyber matters: nowadays, cyber threats are becoming more relevant and might generate important operating and reputational damages if not timely identified and managed. This is the case of some recent transactions we have been involved, when the buyer did not perform the relevant cyber DD activities and had to lately face (i) severe data-breaches during the post-closing IT integration, together with the associated (ii) operational disruptions and (ii) stakeholders’ claims

- IT matters: issues within the IT environment (e.g., outdated HW, highly-fragmented IT platforms, inadequate ERPs, etc.) might substantially reduce the buyer capability of capturing the synergies when not properly managed during the pre-deal phase. This is the case of a recent transaction we covered in the Technology sector, where the buyer could not unlock the full transaction values due to (i) the operating matters caused by the IT integration failures and (ii) the resulting additional unbudgeted investments needed to solve the situation.

Conclusion

Companies that merely view diligence as a cost to obtain financing & insurance or comply with the internal Investment Committee requirements only focusing on traditional DD streams like finance and tax will miss some of the key risks in today's market.

Integrated due diligence — a holistic view of a target's risk profile — can be the springboard for:

- Accelerating value creation,

- Avoiding blind spots, especially when the potential investment is out of its core business, and

- Refining the negotiation and post-deal planning approach.

Summary

The due diligence phase is considered by the buyer's Management as the most challenging step of the pre-deal phase. The latter is worsened by the current complex M&A market environment, leading to an extension of the diligence timeframe to improve the level of analyses ahead of the signing.

In this context, the relevance of innovative diligence streams is increasing as an answer to the Top Managers' needs to get a full and detailed picture of the target early in the transaction process, supporting its work with the internal Investment Committee and negotiations with the counterpart but also the identification of hidden risks and opportunities (e.g., synergies, integration complexities. etc.) and the consequence efficient planning of the post-deal activities.