EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Global location investment, credit and incentives services

What EY can do for you

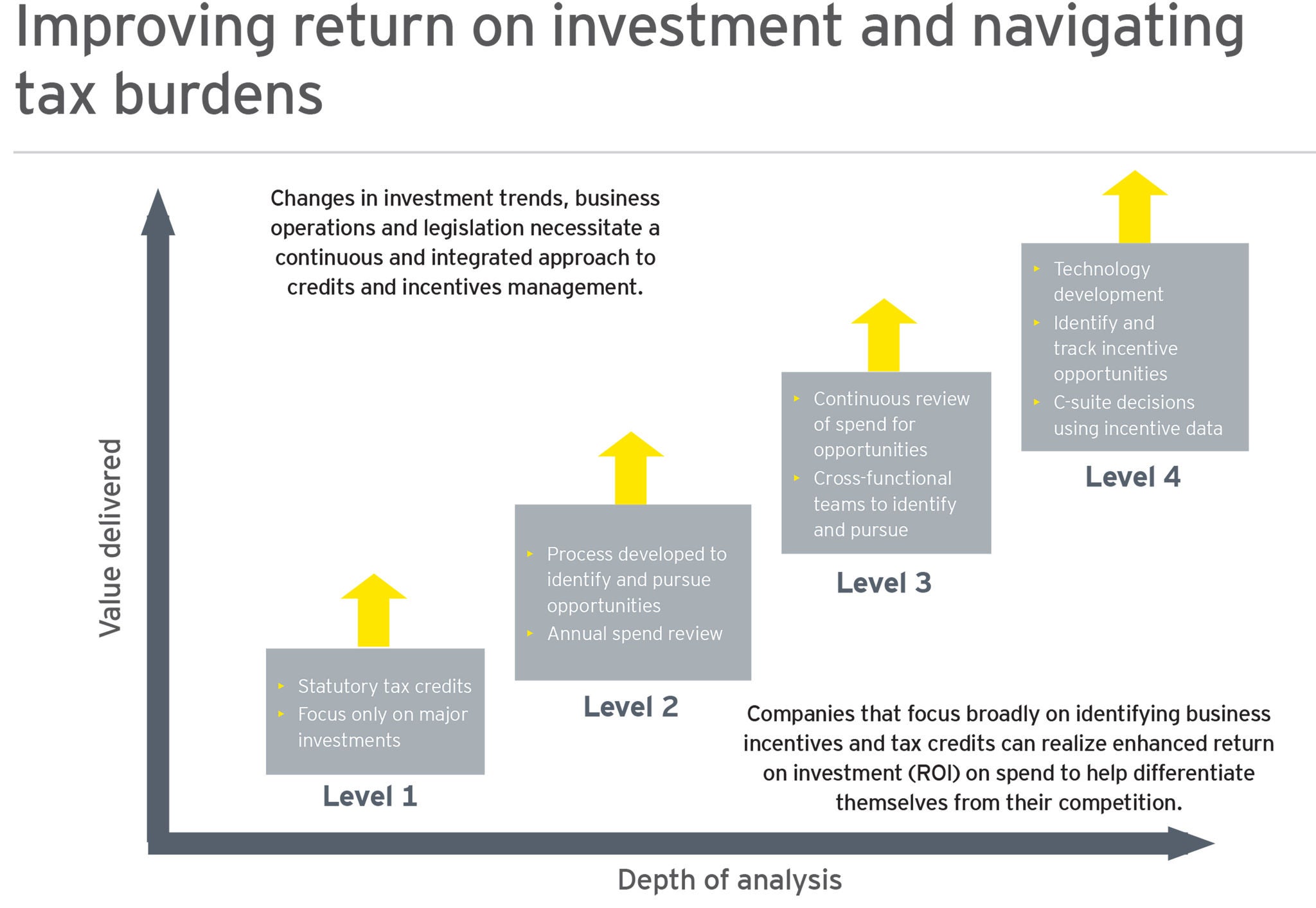

Developments in global trade, US tax reform, the onset of the global COVID-19 pandemic, numerous large-scale and well-publicized economic development projects, and other geopolicital events have disrupted the status quo for companies and governments. Companies are increasingly reconsidering their global footprint to meet the challenges impacting their global operations and discover commercial opportunity amid this disruption. Meanwhile, governments are evaluating how to maintain revenue and attract investment in their communities.

Location investment services

Location advisory starts with the selection of a site. Determining the most suitable location is critical to a successful project and can have lasting effects on an organization’s operations.

Ernst & Young LLP works with global companies to identify the most suitable locations and available credits and incentives. We can work with governments on a global basis to negotiate and help secure incentives and assist companies in completing required compliance documentation and provide ongoing support.

Our location investment services include:

- Location advisory and site selection

- Tax modeling

- Cost modeling

- Supply chain analysis

- Location analysis

- Economic impact studies

- Global incentives

- Domestic state and local discretionary incentives

- Global incentives

- New markets tax credits

- Discretionary federal grants

- Tax increment financing

- Investments in tax credits

- Low income tax credit due diligence

- Renewable energy credits

- Opportunity zones

Tax credit services

Tax credits are generated by business activity such as employment changes, research and development, capital investments and workforce training and are available at the federal, state, local and global levels.

Leveraging our globally integrated incentives practices, we have developed a streamlined process for information collection and credit calculation to assist companies in identifying and capturing current, future and retroactive credits that may be available.

Available credit opportunities include:

- Work Opportunity Tax Credits

- Federal Empowerment Zone Credits

- Global tax credits

- State point-of-hire tax credits

- State research and development credits

- State investment tax credits

- State training and employment tax credits

- Disaster zone employee retention credit

- Business assistance related to government response to COVID-19 pandemic

Sustainability services

Sustainability has become an essential component of business planning. Ernst & Young LLP can analyze and improve a company’s sustainability strategies, including renewable energy investments, energy efficiency improvements, recycling initiatives, advanced manufacturing and green buildings.

Our sustainability team can work with companies to identify and secure relevant incentives and tax relief for sustainability investments at the global, federal, state and utility levels. Once secured, our sustainability professionals can assist with compliance, preparing relevant tax opinions and audit support documentation.

Sustainability services include:

- Diesel Emissions Reduction Grant

- Leadership in energy and environmental design for new construction and existing buildings

- Environmental Mitigation Trust

- Federal energy credits

- Federal sustainability grants

- State energy program grants

- Global energy and taxes

- Global sustainability incentives

- Section 179D

- Global environmental taxes

- Utility incentives

Compliance and technology

Compliance reporting is an integral part of all incentive agreements. Ernst & Young LLP has a wide range of innovative technology we can incorporate in order to work with companies to determine compliance needs for existing agreements and help realize incentive claims.

Our subject matter professionals can continue analyzing compliance over multiple reporting periods. Using our advanced technology we are able to identify potential shortfalls or clawbacks and help confirm deadlines are met.

Compliance and technology services include:

- Incentives IQ®

- Global Incentives Engine®

- Global incentives benchmarking and mapping

- Discretionary tax credits for job creation, investment, research and development and training

- Property tax abatement and tax increment financing Incentives

- Federal and state tax credits

- Energy and utility rebates and grant

Economic development

Economic development advisory services empowers government clients to stabilize their existing operations, drive investment in the jurisdiction’s most valuable resources and grow their economy comprehensively.

We provide clients with the resources and relevant perspective on what private-sector businesses are looking for in site selection decisions.

Economic development advisory services include:

- Benchmark competitiveness and attractiveness

- Create economic development strategies

- Supply chain mapping

- Analyze assets and liabilities

- Advise on competencies, resources, tools, and partnerships and collaborations

- Assess overall organizational performance

- Community

- University/education

- Workforce plan

- Custom research

- Cast study and service discussion