What EY-Parthenon can do for you

CEOs and business leaders make difficult decisions every day. But when you are facing complex choices with far-reaching and long-lasting impact on your entire organization, there’s a greater need for an independent point of view.

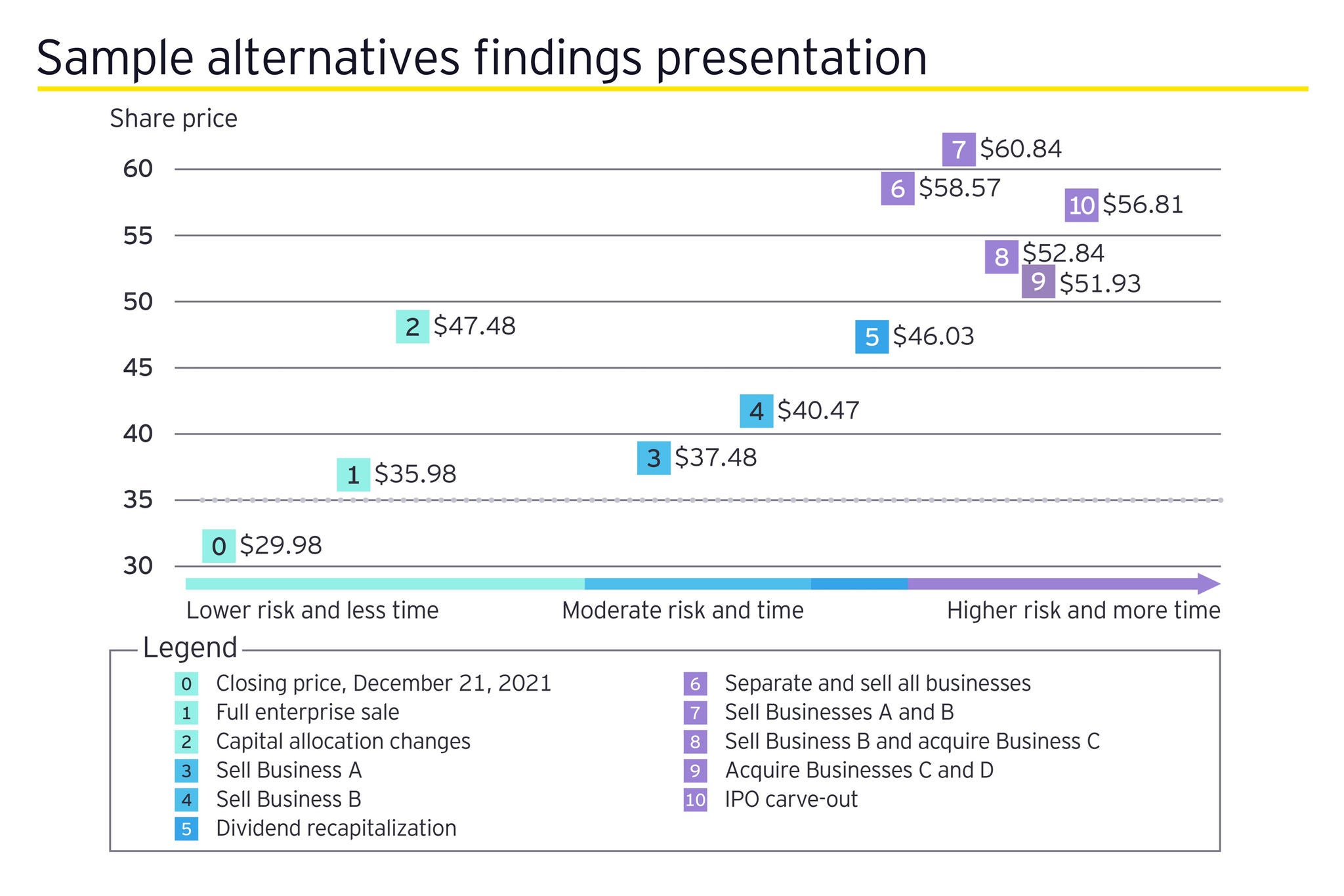

Using our structured framework, our experienced finance professionals can help identify, quantify and compare the impact of potential alternatives, considering time and risk among many factors. The results can help management objectively allocate capital to drive shareholder returns and overall stakeholder value.

We can help you answer key questions when evaluating strategic alternatives:

- Do we have the right mix of businesses?

- Should we consider strategic acquisitions or divestitures?

- Are share repurchases the best use of capital?

- Should we return capital to investors?

- Do we have internal unfunded opportunities?

- Is our capital structure appropriate?

- Can we disrupt our own business before a competitor does?

When do companies need more rigorous strategic alternatives analyses?

As a leading practice, companies regularly evaluate their strategy and the decisions that will drive it. However, there are certain conditions and initiatives that may trigger the need for a more structured, in-depth, and objective process that helps decrease decision-making bias. Examples include:

- Digital transformation

- Shareholder activism

- Restructuring

- Excess returns

- Market opportunity assessment

- Strategic reviews

- Leadership changes

- Negative performance relative to market or competitors

- Analyst or credit downgrade

- Rapid industry consolidation or deconsolidation

- Geopolitical or economic disruption

How our strategic alternatives framework works

Situational analysis

Drawing from client and external data, we can work with you to develop a point of view on how specific strategic alternatives can create value for your business. We can perform analyses from outside-in and inside-out to provide perspectives on business performance, market opportunities and relative positioning compared to industry competitors, including:

- Market trends and industry outlook

- Competitive benchmarking

- Financial health

- Firepower analysis to measure a company’s capacity for conducting M&A deals (considering cash and equivalents, market value and debt)

Strategic alternatives analysis

We can quantify the economic value associated with each alternative and present the results using dynamic data visualizations that provide quick perspectives on value creation opportunities and highlight specific scenarios. This considers:

- Valuation methodologies

- Time and risk

- Synergies

- Stranded costs

- Leverage and return

- Financial feasibility