EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

- Strengthen the balance sheet to support investment strategies that will create lasting value for stakeholders.

- Maximize newly available capital — such as funding through grants and tax credits — to accelerate the energy transition for power and utility companies.

- Modernize technology to progress the business.

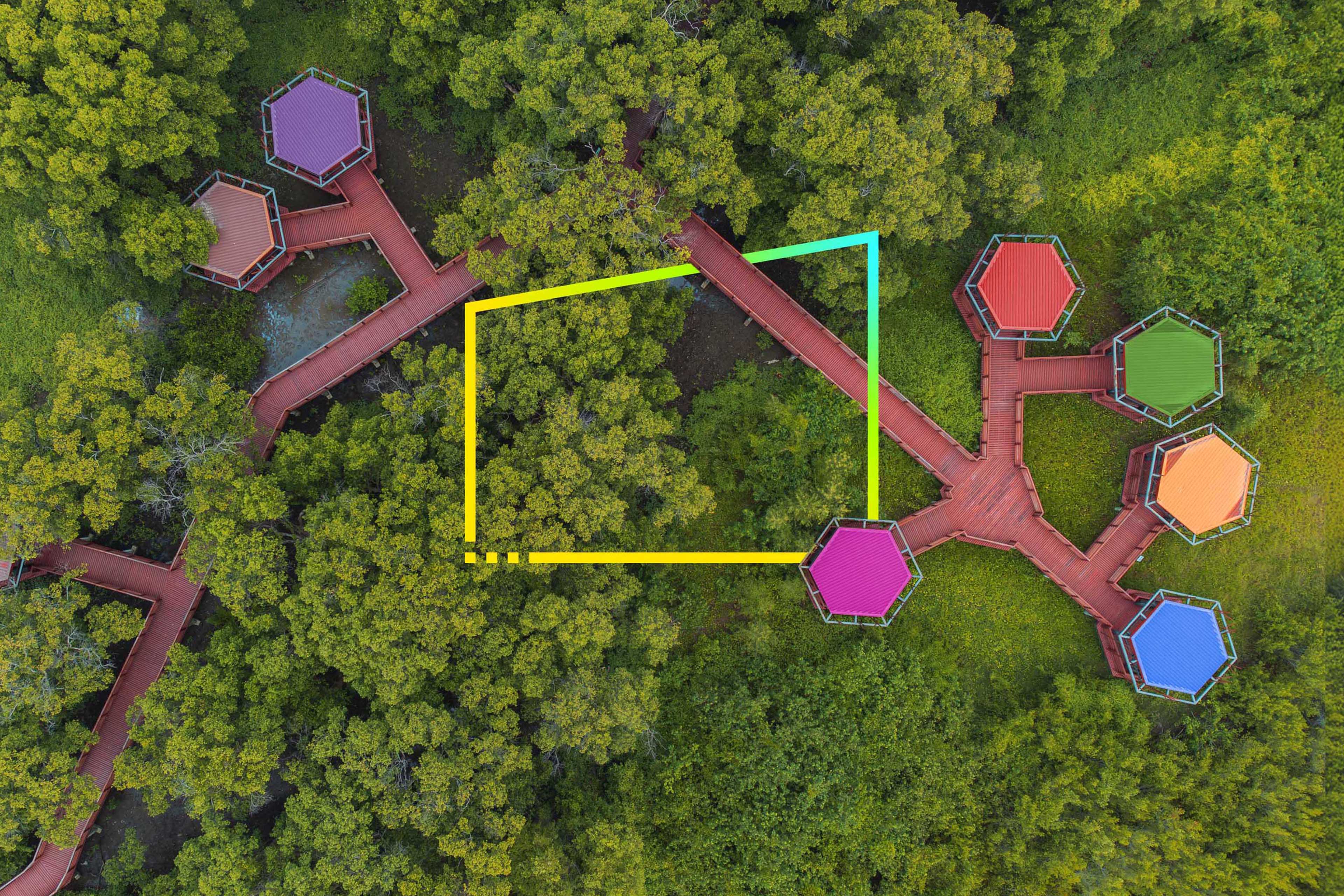

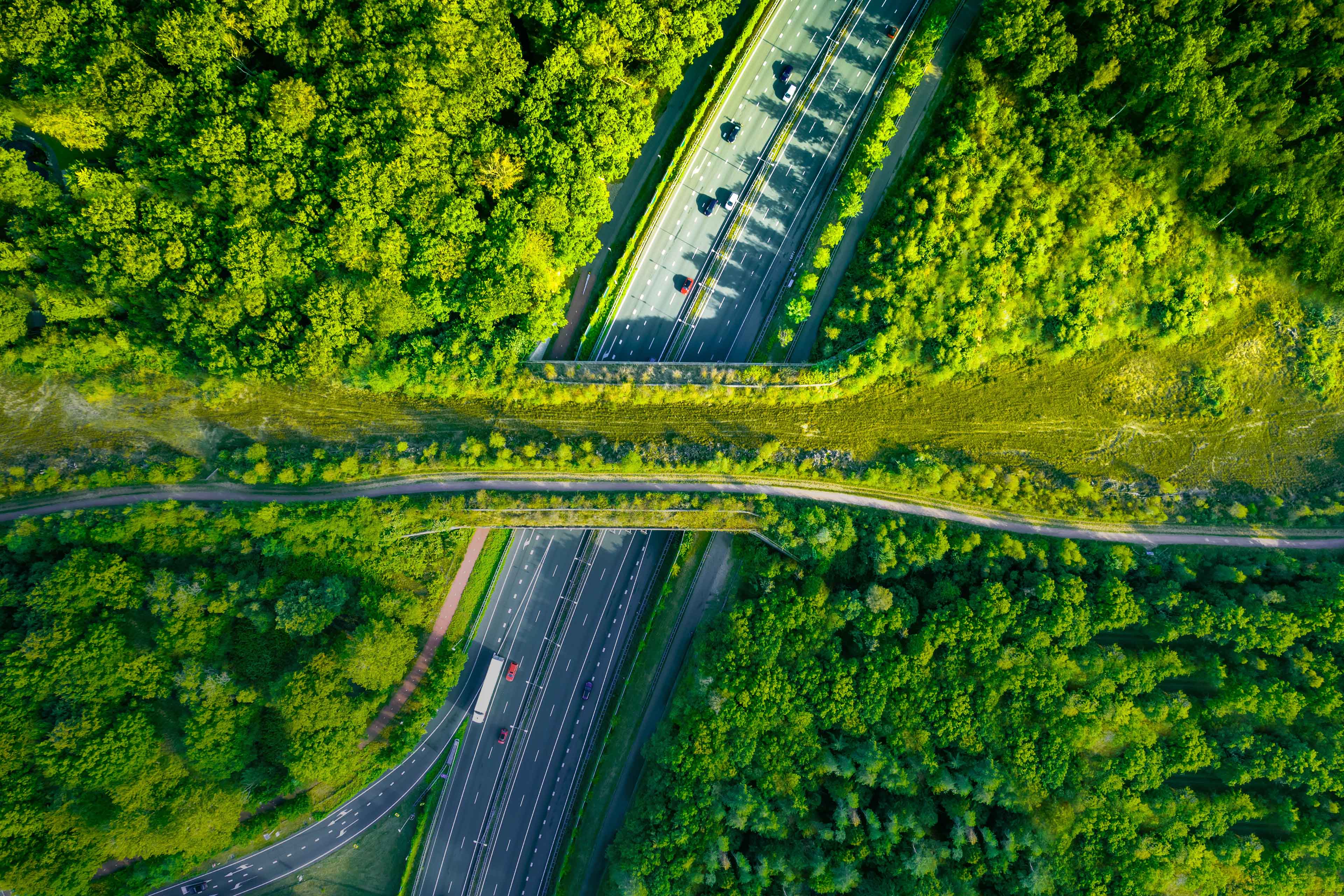

While there is a clear route for success, the operating environment continues to produce hurdles. For example, reliability is threatened by severe weather, aging infrastructure, the risks of cyber attacks in an increasingly geopolitically fraught environment and even trends in energy transition, such as increasing electrification and deployment of distributed energy resources. Meanwhile, rising capital costs and continued high inflation threaten the affordability of energy. And simultaneously, though the demand for renewables and electrification continues to grow, infrastructure and technology delays, along with competing priorities, threaten the progress toward sustainability.

These challenges will continue to test the focus of utility leadership, making long-term strategic planning more difficult but more important. Ultimately, the pathway to overcoming these hurdles in order to enable affordable, reliable and sustainable energy will require transformation in multiple areas.

Step 1: Strengthen the balance sheet to support investment strategies that will create lasting value for stakeholders.

In a challenging economic environment, utilities will continue divesting non-core assets and even portions of their transmission and distribution portfolios, strengthening the balance sheet for future investments.

As utility industry trends reshape around new business models and strategies, these types of asset shifts can play a major role in helping companies build capital, streamline their operations, reduce overhead, create new partnerships and sharply refocus their efforts on more value-added areas of the marketplace where they choose to participate.

It’s also a time to be creative about operations and maintenance costs. While many utilities have launched broad cost-reduction efforts, one approach increasingly being considered is the adoption of managed services structures, in which support functions are utilized in a flexible, on-demand way. Managed services, especially in back-office functions like finance, procurement, tax and cyber, can help utilities drive innovation and reshape spending to better manage through the energy transition.

As companies streamline, they are investing with a more forward-looking lens, evidenced by several hundred alternative and renewable energy projects announced and at least 170,000 new clean energy jobs created in the US since the Inflation Reduction Act (IRA) of 2022.