EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Copper supply is lagging increased demand, even as it has a crucial role to play in the energy transition.

In brief

- Copper miners are investing in exploration, expansion and sustainability for long-term success.

- In rethinking mining business models, sustainability frameworks are top of mind.

- Miners are looking to digital and electric innovations and collaboration to drive resilience.

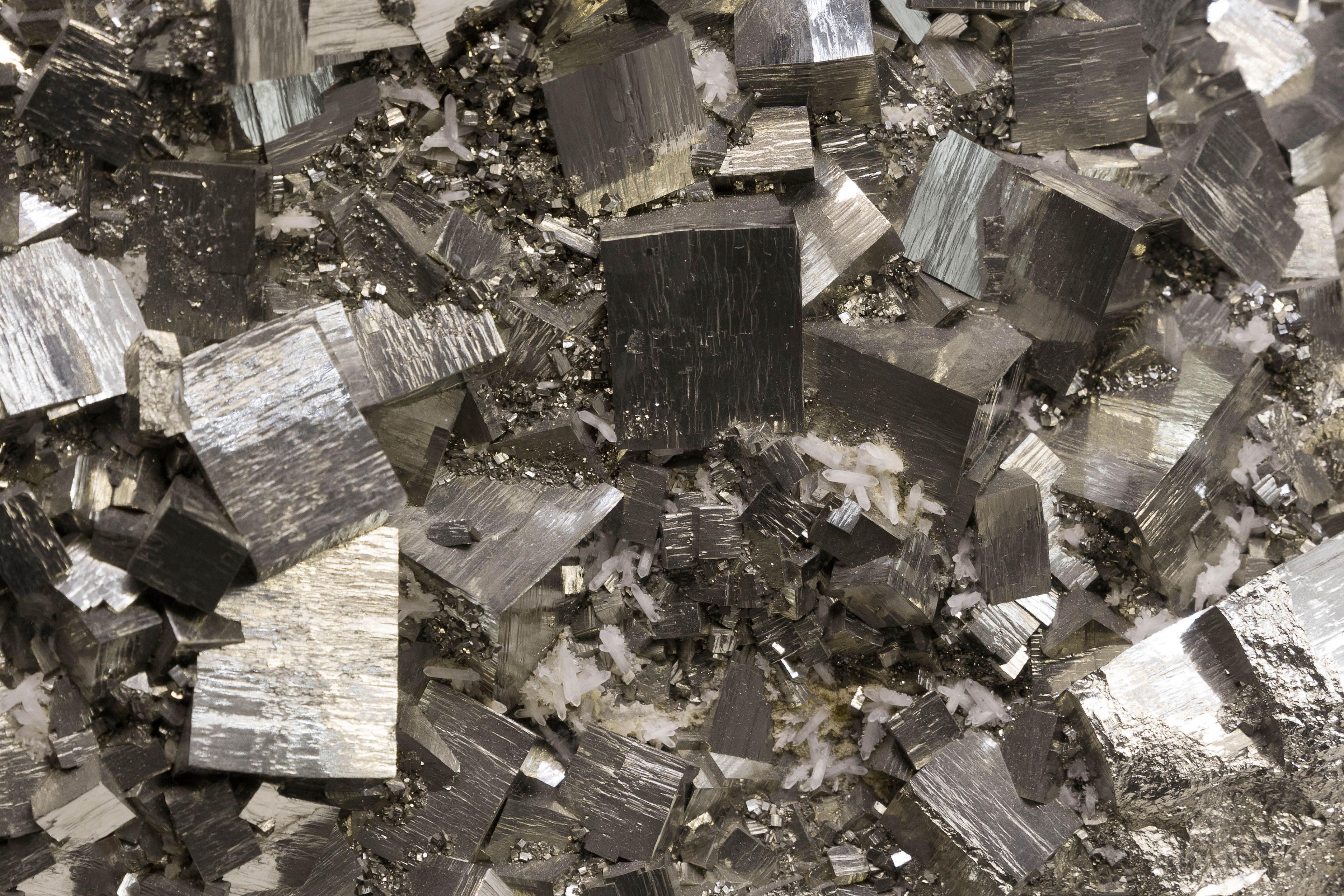

Copper, one of the most critical metals required in energy transition, is gaining attention not only in the mining sector but with society and policymakers. The transition toward e-mobility and renewables are the primary demand drivers for new copper growth. Despite that, supply remains subdued due to underinvestment in copper over the past decade, resulting in muted growth in project pipelines.

However, copper price resurgence in 2020–21 combined with a strong demand outlook have led to advancement of key projects, especially in South America. Expansion projects that got delayed due to the energy crisis, the higher cost of operations and geopolitical uncertainty are expected to progress in 2022, with renewed focus of miners on project capital allocation. Despite some new supply growth in the near term, the underinvestment in the project pipeline means that supply will struggle to keep up with the heightened demand from the energy transition.

Sustainability continues to be the top priority on miners’ agendas. Companies are investing to comply with ambitious environmental, social and governance (ESG) targets and stringent government regulations. Investments reveal that from 2018 to 2020, the value of total assets in sustainable investment portfolios in major markets of Europe, the US, Japan, Canada, Australia and New Zealand grew by 15% to reach about US$35t, and 82% of those portfolios are based in European and US markets.¹

Chapter 1

Current trends

Exploration, expansion and sustainability are top of mind for copper mining companies.

Exploration and expansion activities on the rise

In 2021, the overall copper exploration budget reached pre-COVID-19 levels at around US$2.31b, up around 32% year over year (YOY). This is primarily due to high cash at disposal for miners, with record-high copper prices averaging US$9,741 per ton.²

Mine expansion activities rose in 2021, with some major announcements in Chile, Indonesia and Mongolia that will add 3 million tonnes (mt) over the next four years. Most miners continue to allocate a major portion of budget to expansion of existing mines, while grassroot share was 34% in 2021.³ Over the last decade, there have been 19 major grassroot discoveries but only three in the past five years, adding just 5.6mt to the total production. ⁴ Latin America (LatAm) remains the top region in terms of total discoveries; however, over the past decade, new supplies have come more from Africa and Asia. In particular, between 2012 and 2021, around 56% of the top 10 discovered deposits were added by the Kamoa-Kakula deposit in the Democratic Republic of the Congo in 2014 and the Onto deposit in Indonesia in 2013.⁵

As grades decline, miners are also increasingly investing in underground mines to increase production and other technologies to enhance recoveries — notably enhanced leach techniques. Though the cost of production is higher in underground operations, it has long-term value for most miners — often extending the life of a former open-pit mine. Some major copper players are proactively targeting these reserves to achieve higher production.

Focus on ESG initiatives

According to the 2021 EY business risk report, ESG and decarbonization remain the top business risks for miners.⁶ Several copper miners have set ambitious targets to achieve net zero emissions. For instance, Antofagasta plans to reduce Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 30% by 2025, relative to 2020, and achieve carbon neutrality by 2050.⁷

Sustainability analysis of major miners over the past year reveals that the key focus has been on adopting innovative technologies and solutions to address climate change and sustainability along with investments on the development of local communities in and around the mine regions. However, there is still room for improvement in areas like health and safety, and diversity and inclusion in mining operations. Water management and biodiversity are the next areas of responsible production focus.

Demand for green copper

Copper miners are now considering the impact of green initiatives to reduce emissions at every stage of the value chain. As end consumers face increased pressure to report and reduce Scope 3 emissions, there is a growing expectation of low-carbon copper supplies. Increased demand for sustainable products from end consumers is pushing miners toward greater adoption of sustainable production techniques, including improving process efficiencies and electrification of mining operations.

Miners are focusing on new technologies to produce copper sustainably. For instance, BHP is using data analytics to reduce copper supply chain emissions. In parallel, metal recyclers are also working on techniques to maximize scrap usage. For instance, copper recycler Aurubis has been using copper scrap, electronic scrap and residues as inputs for processing, smelting and refining processes in its Lunen plant.⁸

End consumers, especially from the electric vehicle (EV) sector, are increasingly preferring copper with a lower-emission footprint. However, the premium to be paid for green copper remains a topic of discussion. The price parity between conventional and green copper will be key in determining the incentive for mining and smelting companies to produce green copper.

Geopolitical uncertainty and resource shortage

The changes in LatAm royalty taxes add to the regulatory uncertainty prevailing in the region. The Chilean government is considering a modified version of a 2021 bill to impose a 1% sales tax for copper companies producing less than 200 kilotonnes per annum (ktpa) and up to 3% for companies with output exceeding 200ktpa. However, the companies producing under 50ktpa are exempted from this tax. Similarly, tax changes and local community protests in Peru have impacted production from major mines in the region. This is likely to impact new project pipeline over the coming years.⁹

Freshwater usage is another major concern for copper mines, especially in Chile, Peru and the southwest United States. Companies are investing in desalination technology to minimize freshwater consumption along with investing in access to additional water rights and water re-use measures to reduce pressure on water supplies.

Chapter 2

Next steps

Miners are aligning with sustainability frameworks, such as The Copper Mark, as they prepare for the future of the industry.

Rethinking business models

The International Copper Association (ICA) has begun several initiatives aligned with United Nations Sustainable Development Goals to address sustainability challenges the mining industry faces. In 2019, ICA created The Copper Mark, an assurance system for responsible copper production. It aims to assess miners’ performance on various sustainability parameters and help investors make informed decisions about responsibly produced copper. It has not developed a new copper-specific standard; rather, it recognizes existing industry standards and establishes a credible assurance process for miners.¹⁰

ICA is also trying to promote the use of innovative technologies in mining, which will not only improve efficiency but also increase worker safety levels. For instance, use of robotics and automated vehicles for riskier tasks and use of artificial intelligence (AI) to monitor equipment malfunctions will significantly help in raising the safety standards in copper mines.¹¹

The Copper Mark sustainable mining principles

Companies will be assessed on a set of responsible production criteria meeting industry norms defined by the Responsible Mining Initiatives’ Risk Readiness Assessment. The assessment covers five areas: environmental, governance, community, business and human rights, and labor. These factors are broken down into 32 different norms. The Copper Mark will require all norms to be fully met at copper-producing sites. Any copper mine, smelter or refiner can apply for The Copper Mark. Stakeholders such as traders and end users can also participate. This will provide a comprehensive assessment framework for all value chain partners.¹²

Several miners have already received The Copper Mark for responsible production at their mine sites. For instance, BHP’s Chilean operations Escondida and Spence, and Olympic Dam in Australia were awarded The Copper Mark in November 2021.¹³ Codelco has committed to have all its sites participate in the framework by the end of 2023.¹⁴

Rising popularity of EVs and shift toward renewables support long-term demand

The transition toward EVs and associated charging infrastructure will continue to drive the demand for copper. For instance, about three times more copper is required in an EV than in a conventional internal combustion engine vehicle. A shift toward renewables will also aid the demand in terms of overall capacity installation. The copper intensity for solar-powered capacity is 4 tonnes per megawatt (t/MW), which is approximately two to five times the copper intensity of coal or oil-based power generation capacity, further adding to the consumption levels.¹⁵

China has been accelerating investment in renewable energy over the last decade. The country’s installed renewable energy capacity reached 1,063 gigawatt (GW) in 2021, accounting for about 45% of total power generation capacity. Newly installed capacity reached 134GW, which accounts for about 76% of the total newly installed power generation capacity in that year. In the beginning of 2022, China State Grid announced a record budget of more than US$74.5b for power infrastructure, which accounts for half of Chinese copper consumption, further supporting demand over coming years.¹⁶

Chapter 3

What will drive business resilience?

Mining companies are looking toward digital and electric innovation to drive business going forward.

Digitalization and electrification unlock long-term value for miners

Copper is essential for the successful transition to a cleaner, greener and more sustainable future. However, there lies a paradox as to how the production of copper needed for a green energy society can be increased without adversely impacting the environment. A leap in technological innovation is required to allow already-known, lower-grade, complex ores to be mined both economically and in a manner that is environmentally sustainable. Digitalization and electrification of mines is likely to play a key role in unlocking long-term value.

Increased collaboration with METS businesses

Mining equipment, technology and services (METS) companies play a key role in helping miners address various sustainability challenges. Miners have been increasingly collaborating with companies to incorporate digitalization and automation in operations that helps in monitoring and efficiency improvements. It is becoming a critical lever in reducing maintenance costs and enabling improved health and safety at mine sites.

For instance, Codelco announced an agreement with Sandvik to introduce predictive analytics and fully automated loaders to its underground mining operations. The company is also working with Uptake to develop and implement an AI-based system for the management and predictive maintenance of most of infrastructure.¹⁷

Electrified mines critical in technology roadmap

Electrification of mines can enable a shift to green energy consumption as miners seek to reduce costs, increase energy efficiency and maintain licenses to operate. By 2028, the market value of EVs in global mining operations is expected to reach US$9b.18 The continued focus of stakeholders to reduce emission levels is pushing miners toward electrification. In line, miners are adopting cleaner energy sources in fleets and embedding renewable technology to power mine site operations. In addition to reducing GHG emissions, electrification may benefit safety levels for the employees, as it eliminates the noise, vibration, excess heat and exhaust gases making for better working conditions at the mine sites.

Summary

Increasing focus on energy transition and sustainability is likely to keep copper demand high over the next decade and beyond. Exploration activities continue to be on the rise but will need to be incentivized by higher copper prices. Sustainability will remain the key focus area for miners as they progress toward net zero emissions. Adoption of new and innovative technologies while growing supply levels would help the transition toward more sustainable operations and build long-term competitiveness.

Related articles

How silver miners can build long-term competitiveness

With the highest demand for silver since 2015, mining companies are looking to increase production and do so with sustainability in mind.

How gold miners can build long-term competitiveness

With price resurgence and forecasted demand for gold, mining companies are looking to increase production with sustainability in mind. Learn more here.

Critical minerals supply and demand challenges mining companies face

An intense focus on reducing carbon emissions is driving increased electrification around the world.