EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY sustainable finance teams helps financial services companies define sustainability goals that create value and make a measurable difference. Learn more.

Read more

Our speaker panel, comprising asset owners and consultants, gave some specific ESG-related advice to the asset managers on the call, with their top six takeaways summarized below.

1. Clearly define ESG within your organization and when talking to clients and prospects

The term “ESG,” short for environmental, social and governance, can and is being used as a catchall phrase, creating a kind of “linguistic anarchy” among industry participants. For some, ESG may be used to mean the consideration of material, pre-financial factors in investment analysis, while others may use it interchangably with sustainability, which is more commonly defined as behaving or investing in a way that meets your needs, yet does not compromise the ability of future generations to meet theirs — a subtle, yet important, distinction. Still others may use ESG as a catchall term that encompasses everything from divestment to impact investing. Therefore, specificity is critical when developing and marketing investment products to asset owners. Pension funds, in particular, may only be able to pursue ESG as it relates to the incorporation of material pecuniary environmental, social and governance topics into investment decisions, both direct and those made by outside asset managers. Endowments and foundations may have more latitude when it comes to “ESG.” Funds or products that confuse definitions or blend responsible investment techniques could slow or even prevent investments.

2. Understand ESG sentiment

In the US in particular, there is a certain degree of polarization around the topic of ESG. For example, a growing number of states have now introduced laws attempting to restrict the use of ESG considerations in investment and business decisions, and 20 states have introduced bills changing the fiduciary duty laws around investing and proxy voting for state retirement systems. Still other states may have laws specific to fossil fuels, firearms or other sectors that can complicate the marketing and asset-raising processes. As a result, it is critical that asset managers understand state and federal sentiment to maximize results. We have mapped applicable proposed and passed legislation and can help asset managers understand the complex dynamics associated with state and federal regulation, so be sure to reach out if you’d like to discuss this issue further.

3. Understand the asset allocators’ stance

Related to broad ESG sentiment, asset managers should also consider their organizations’ ESG “temperature” before pitching a fund or strategy. They should make an effort to understand their organizations’ ultimate beneficiaries, including demographics and generational factors, as well as how they think about investment time horizons and any state and local considerations related to ESG. Getting this information before making a pitch will help asset managers understand an asset allocator’s “why,” which will help them explain their “what.”

4. Carefully evaluate public commitments

There are a host of ESG, sustainability, net-zero and other initiatives with which asset managers can align, not all of which may be universally acceptable to asset owners. Before making public commitments, it is critical that asset managers think through their existing and potential client base and how each initiative may impact those investors. Commitments that require rapid divestment from or complete avoidance of fossil fuels, for example, could hinder investment from state-aligned investors in Texas, Oklahoma and Kentucky, to name a few. As a result, asset managers may want to weigh the pros and cons of making firm-wide ESG and sustainability commitments and determine whether fund- or separate account-level actions may allow them to continue to serve both ends of the ESG spectrum.

5. Establish appropriate processes and controls

The considerations above may lead asset management firms to create different versions of pitch books, tear sheets and other marketing collateral. If a firm chooses to go down this route, it is imperative that asset management firms develop a robust ESG disclosure operating model with strong document management and review. Firms should be mindful of overhyping ESG capabilities or actitivies to one set of investors while significantly “greenhushing” to another, opting instead for a balanced presentation with minimal deviation, where possible.

6. Don’t forget DEI

While ESG factors generally encompass diversity, equity and inclusion (DEI), some asset owners may pursue diversity separately, making specific allocations to diverse managers or tracking diversity within “majority-owned” or non-diverse firms. Since 2020, there has been a tremendous amount of attention focused on diversity, particularly among asset owners, and calls for transparency continue to accelerate. Organizations such as the Institutional Investing Diversity Cooperative, Investment Diversity Advisory Council, National Association of Insurance Commissioners and others continue to organize and push for diversity data and action. It is important then for asset managers to be prepared with diversity figures for their firms and investments, as well as measurable targets where improvement is needed.

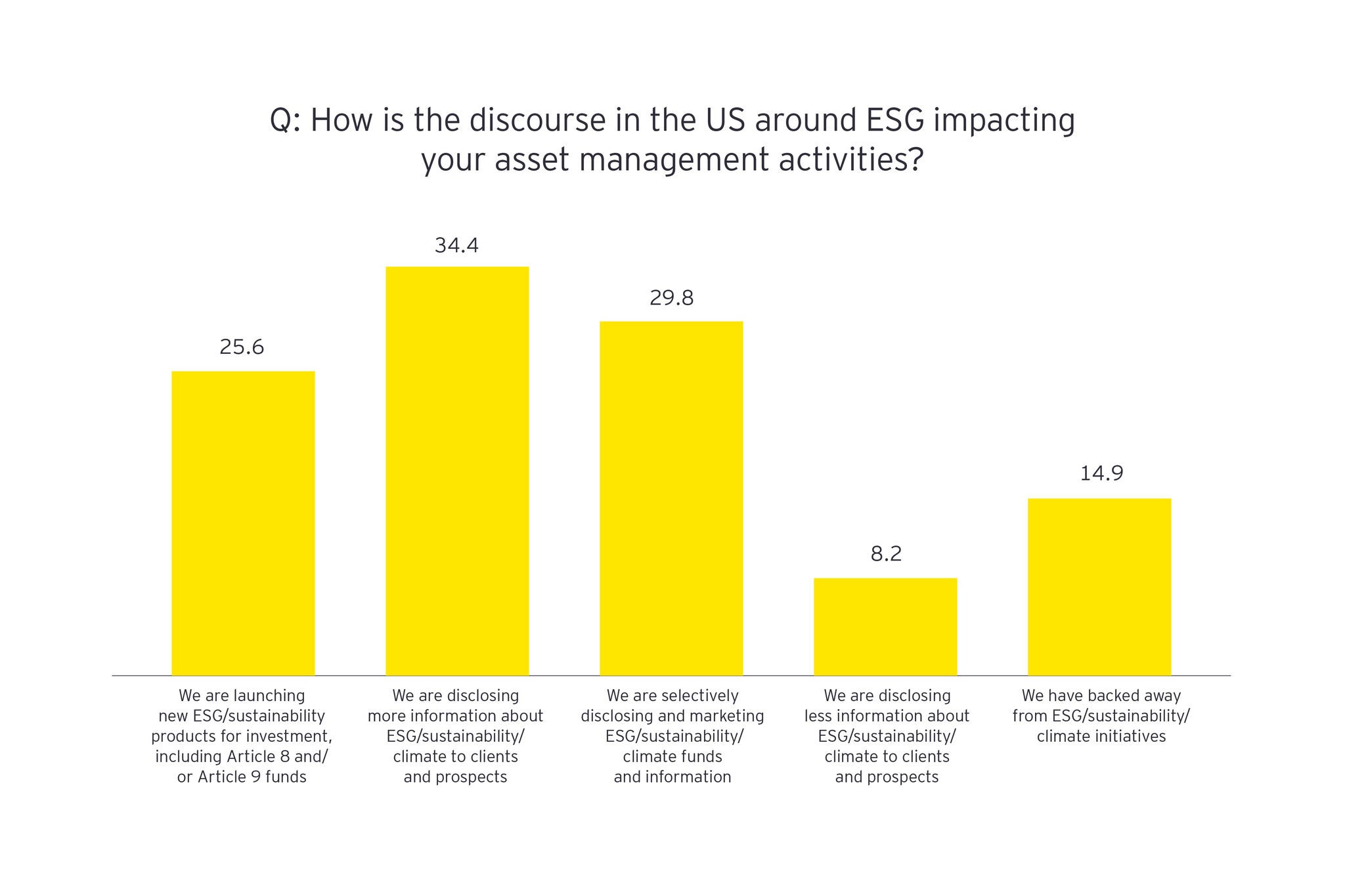

Finally, we polled the asset managers on the call to determine what actions they were taking within their firms to help guard against greenwashing (and greenhushing). While more than 38% of those surveyed had not taken any of the listed actions, 24.5% had added dedicated ESG investment resources, while another 19.9% had reviewed investment policies and procedures for consistency.