Macroeconomic impact of a looming fiscal cliff

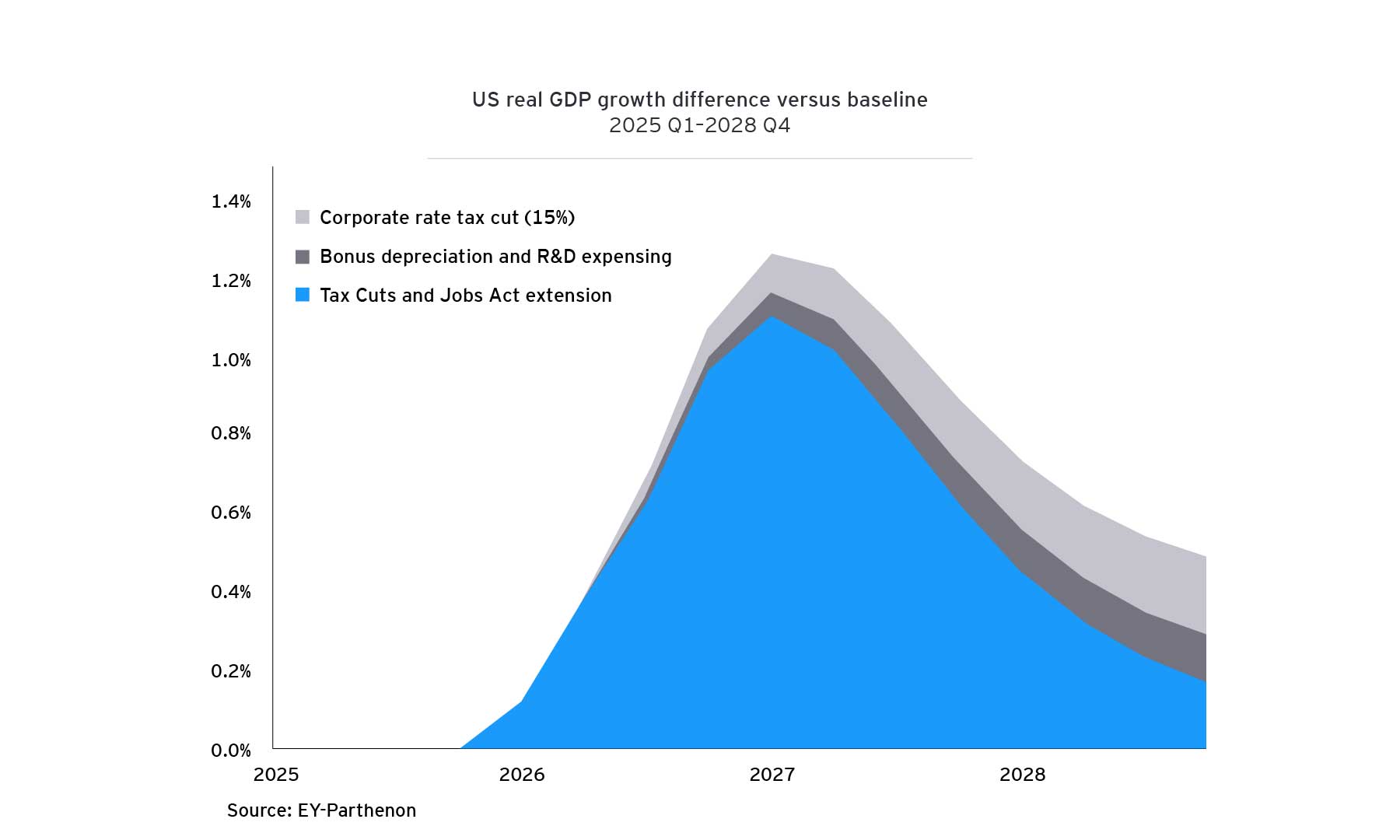

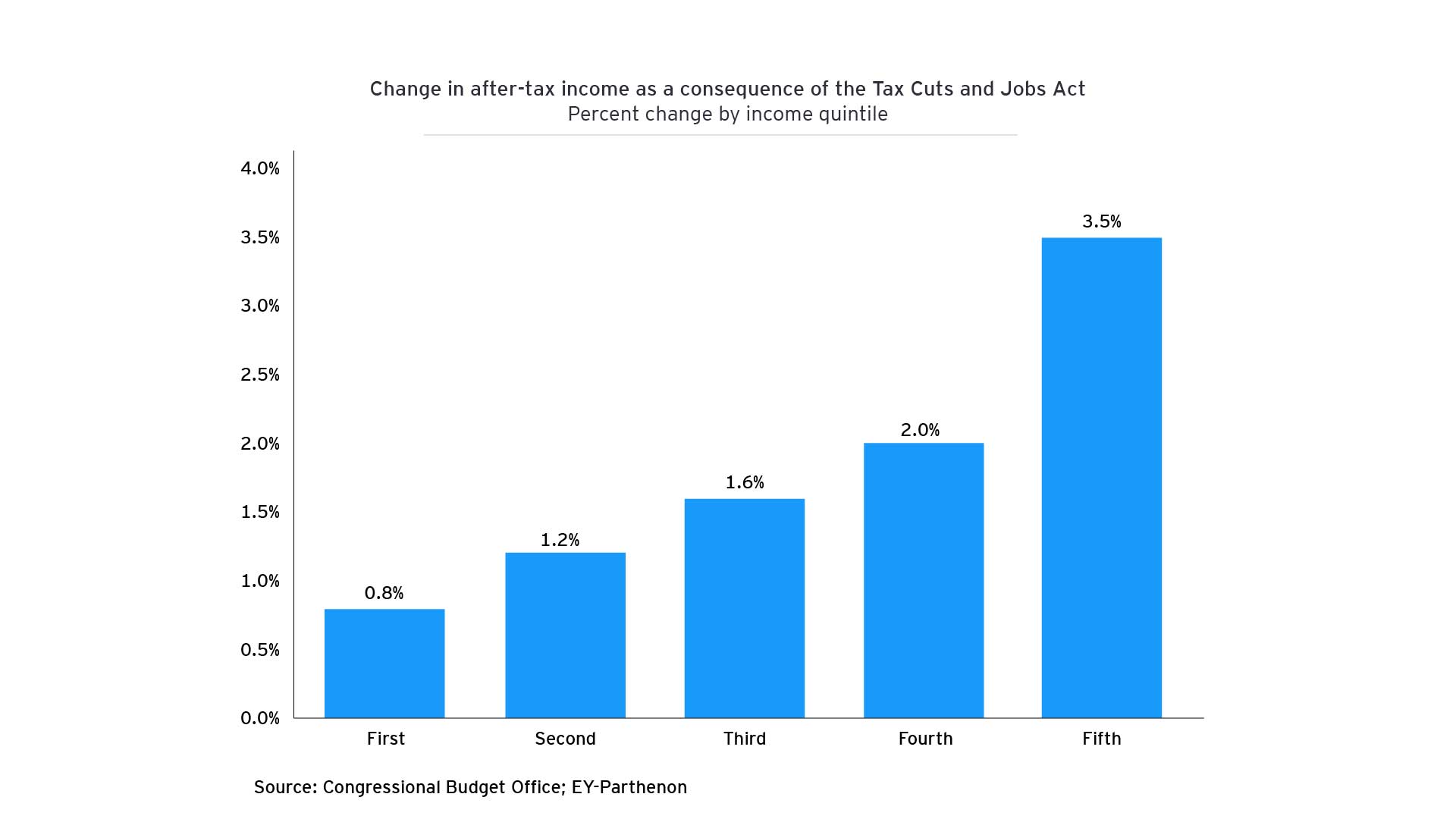

- Extending the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA) could boost real GDP growth by 0.5 percentage points (ppt) in 2026 and raise the level of GDP by 0.9% in 2027 compared to a fiscal cliff scenario, but it would cost around $4 trillion through 2034. This extension would boost disposable income for those in the top income quintile by $3,125 but only lift disposable income by $100 for those in the bottom income quintile.

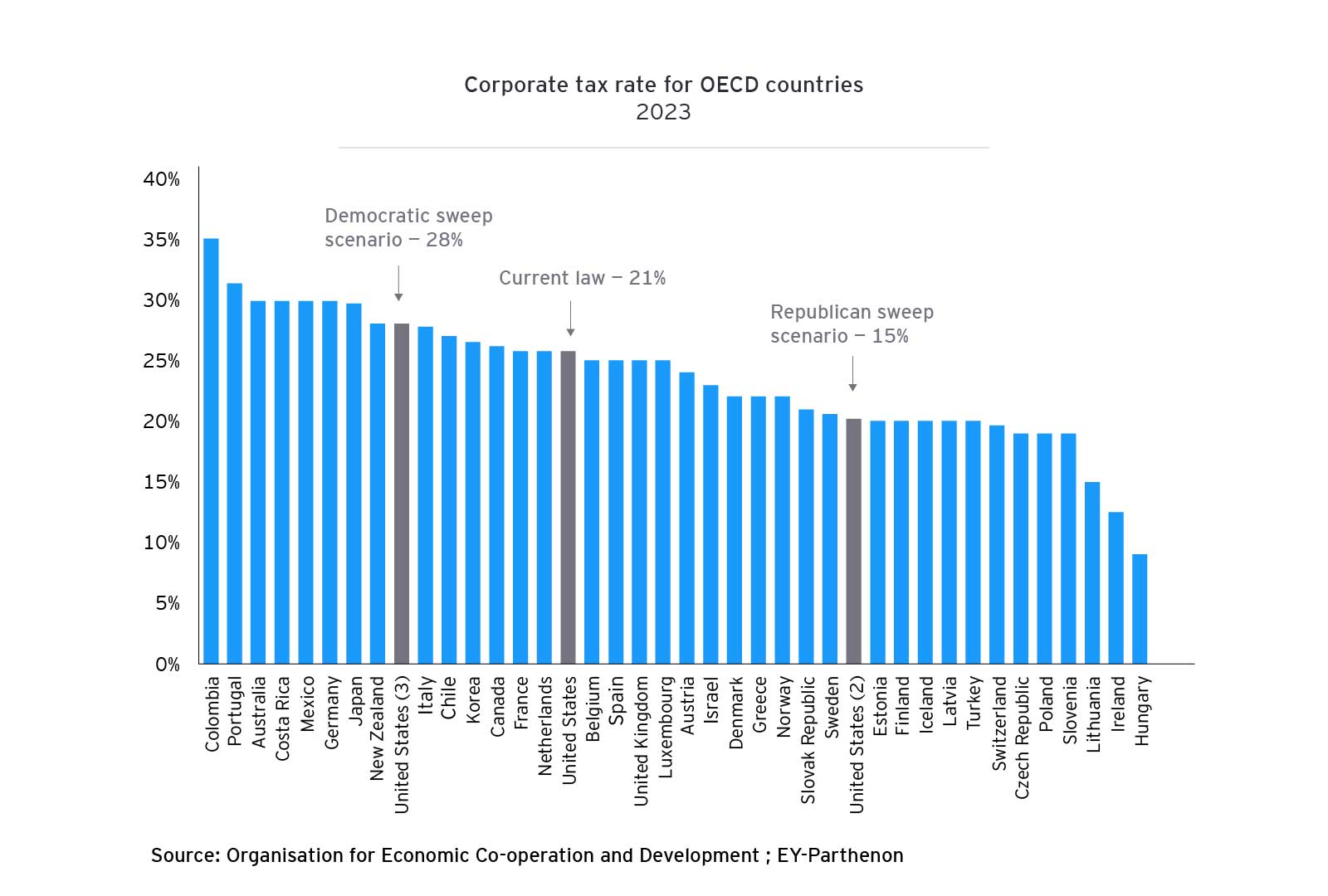

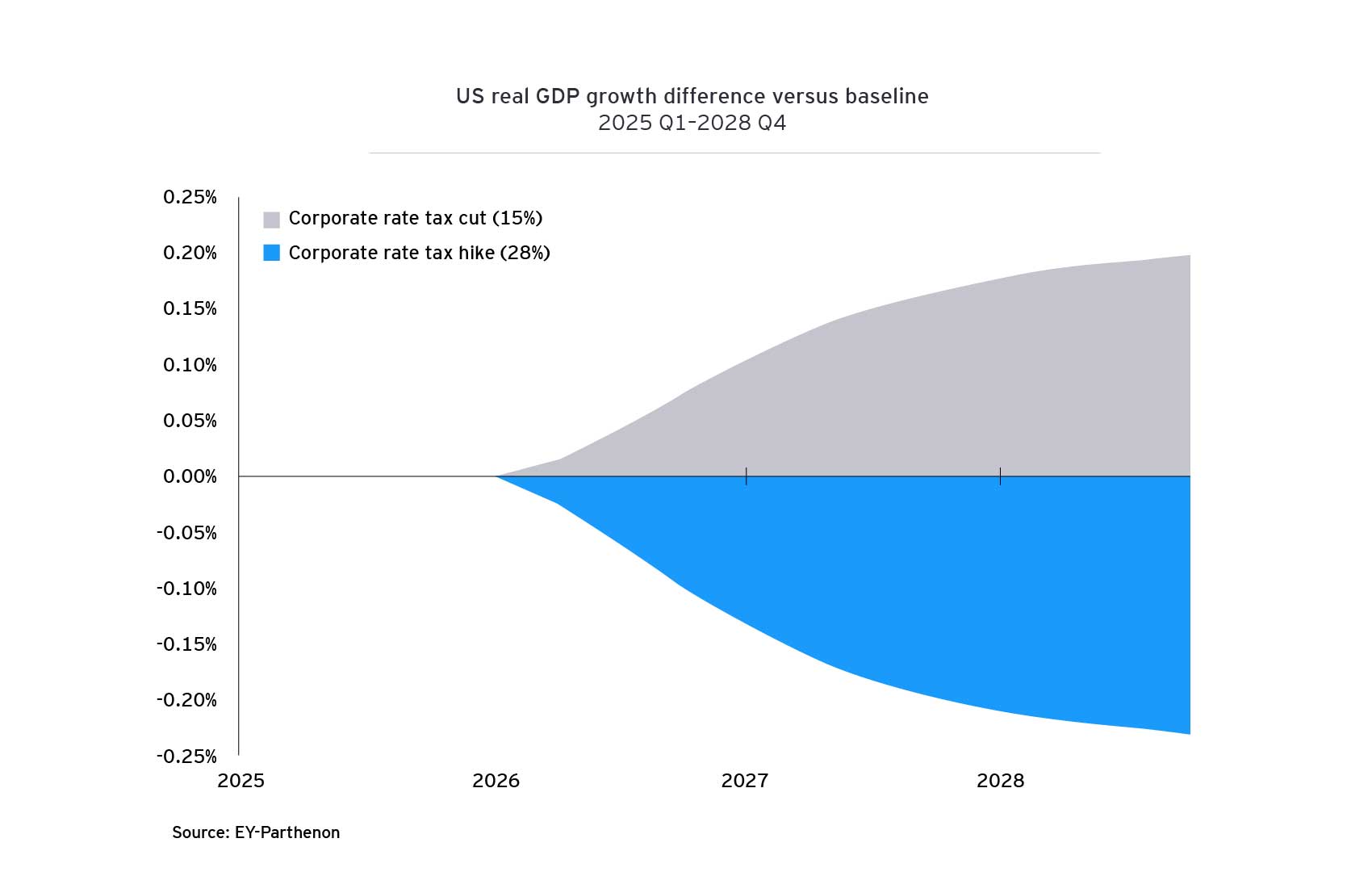

- Changes to the corporate tax rate could have substantial economic impacts. An increase in the statutory corporate tax rate from 21% to 28% would weigh on capital investment and reduce real GDP growth by 0.1 ppt in 2027 while a rate cut to 15% would stimulate greater capex and lift GDP growth by 0.1 ppt. These changes would also boost federal revenues by $880 billion and reduce revenues by $750 billion, respectively.

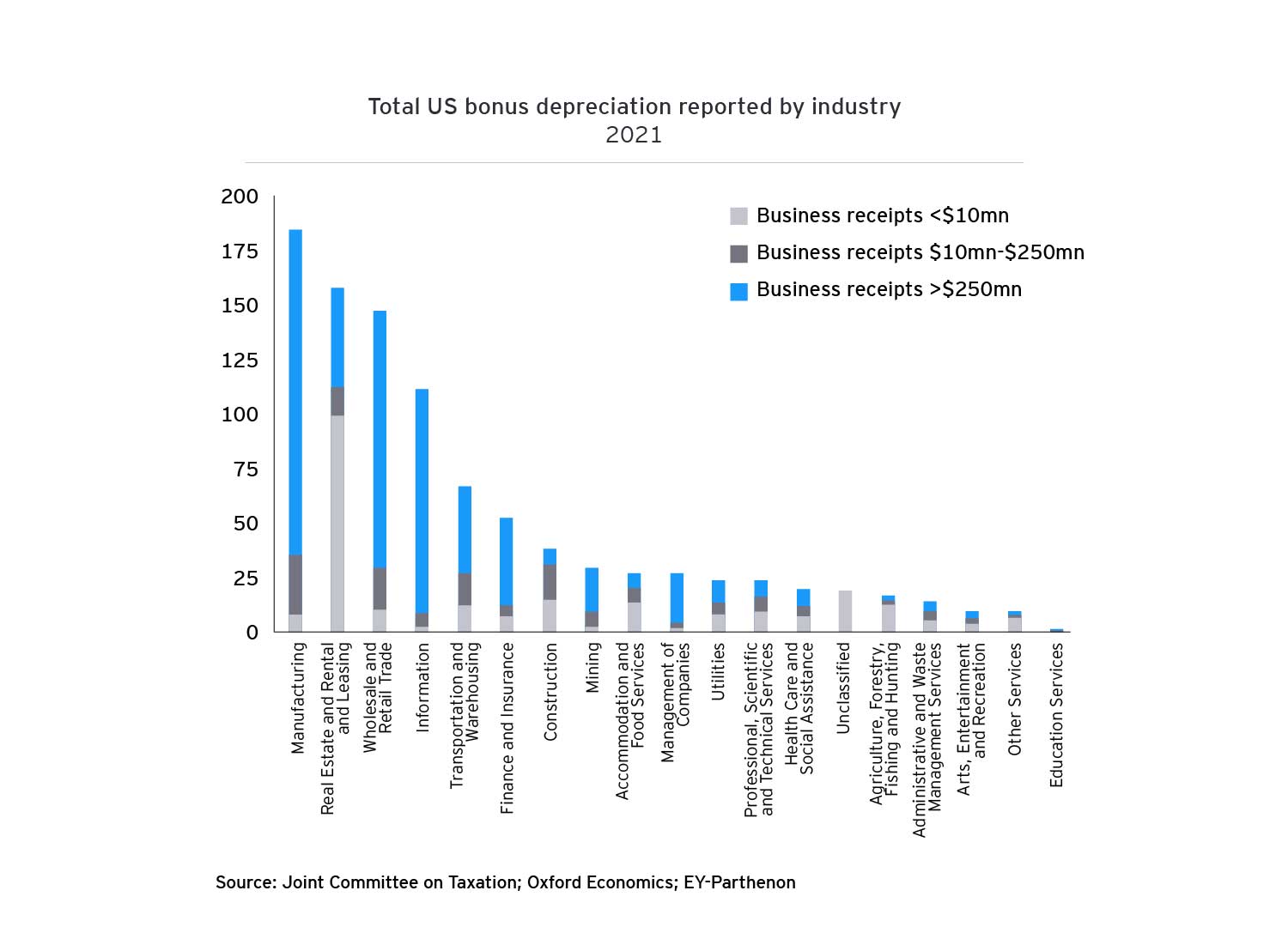

- Reinstating full bonus depreciation and immediate R&D expensing could lift GDP by 0.1% from late 2027 onward. This would significantly benefit capital-intensive sectors like manufacturing and real estate, potentially driving continued or increased investment in these areas.

The tax policy outlook will be influenced by the new balance of power in Congress post-election. Since tax bills can be voted into law by a simple majority in Congress, tax legislation could be passed if one party controls both Congress and the White House.

But even with a split Congress and White House, the main debate will center around the looming expiration of the 2017 TCJA. With numerous individual and small-business tax provisions slated to expire in 2025, Congress will have to decide on how to manage the incoming fiscal cliff. Extensions may require new revenue generation, and Congress could decide to reopen corporate provisions, including the 21% corporate tax rate, bonus depreciation, and research and development expensing.

As our public policy team reports, the debate around tax policy will likely pit priorities like domestic spending, deficit reduction and economic growth against each other. Former President Trump publicly supports an extension of the TCJA and, in contrast, President Biden has laid out a series of proposed tax increases on corporations and wealthy individuals to fund other programs. These were recently detailed in his FY25 budget proposal and include increasing the top US corporate tax rate to 28% and corporate alternative minimum tax (AMT) to 21%, imposing ordinary income rates on capital gains for high income earners, and creating a 25% “minimum income tax” on income earned by wealthy taxpayers.

2017 Tax Cuts and Jobs Act

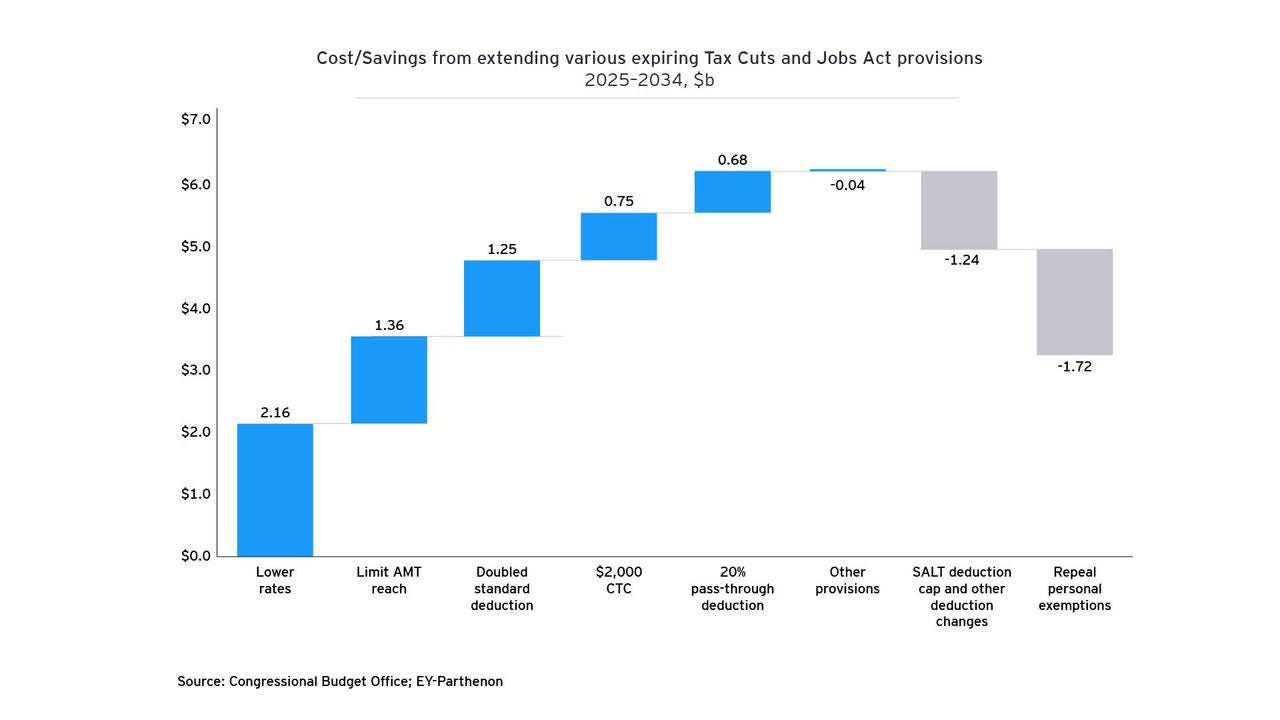

Extending the expiring provisions of the TCJA would cost $4 trillion through 2034 (see figure 1), according to new estimates from the Joint Committee on Taxation (JCT) and Congressional Budget Office (CBO). The major elements of the TCJA that are scheduled to expire include individual income tax rate cuts, a near-repeal of the Alternative Minimum Tax (AMT), expansions of the standard deduction and child tax credit, limits to the state and local tax (SALT) tax deduction and other itemized deductions, and cuts to the estate tax.