What do the announced duties entail and when will they take effect?

On February 10, 2025, President Trump placed 25% tariffs on all steel and aluminum imports, representing nearly $60b in value, reinforcing his administration’s commitment to increasing domestic production. The tariffs apply broadly across all foreign suppliers, including Canada, Mexico, China and the EU.

This policy covers both raw metals and finished products and is intended to prevent transshipment and tariff evasion. The new tariffs are scheduled to go into effect March 12.

What is the administration’s reasoning?

The administration is expanding steel and aluminum tariffs under Section 232 of the Trade Expansion Act, citing national security concerns. This legal authority, which Trump used in 2018, allows the president to restrict imports to safeguard critical domestic industries.

The White House argues that restricting foreign metal imports is critical to protecting US production capacity and preventing unfair trade practices. The administration has set an 80% capacity utilization target for domestic production, much higher than the current 70% rate for iron and steel products. However, alumina and aluminum capacity utilization is already at 83%, meaning that further domestic demand pressures could strain capacity, potentially driving up costs.

How do these tariffs differ from 2018 duties?

The new tariffs go further than the 2018 measures, which primarily targeted raw steel and aluminum, by covering a broader range of finished metal products. The administration is also tightening enforcement and closing transshipment loopholes that allowed some countries to reroute metals via third-party economies to evade duties.

Another key distinction is the tariff rate itself. In 2018, aluminum faced a 10% tariff, while steel was hit with a 25% duty. The newly announced rate is 25% for both steel and aluminum, and it will be layered onto existing trade restrictions, including a 10% tariff on all imports from China and the (currently paused) 25% tariffs on Canada and Mexico. This expands the scope of trade barriers, and is likely to make foreign sourcing more expensive across multiple industries.

Are there any exemptions or exclusions?

The new tariffs apply universally, with no automatic exemptions, even for Canada and Mexico, which previously secured relief. Unlike in 2018, when the US permanently exempted Australia and applied import quotas for Brazil, South Korea and Argentina, this round offers no broad carveouts.

At the same time, while past deals replaced some steel and aluminum tariffs with tariff rate quotas (TRQs) for the EU, UK and Japan, no similar arrangements have been announced this time. As a result, all imports will face the full tariff rate unless explicitly exempted at a later date, adding to supply chain uncertainty and forcing businesses to rethink procurement and cost-cutting strategies.

Case-by-case exemptions and product exclusions may still be available, but with a stricter approval process, businesses should expect fewer opportunities for relief. Additionally, product-specific exclusions granted under Biden and the first Trump administration are eliminated, at least for now.

Which jurisdictions are most impacted by the steel and aluminum tariffs?

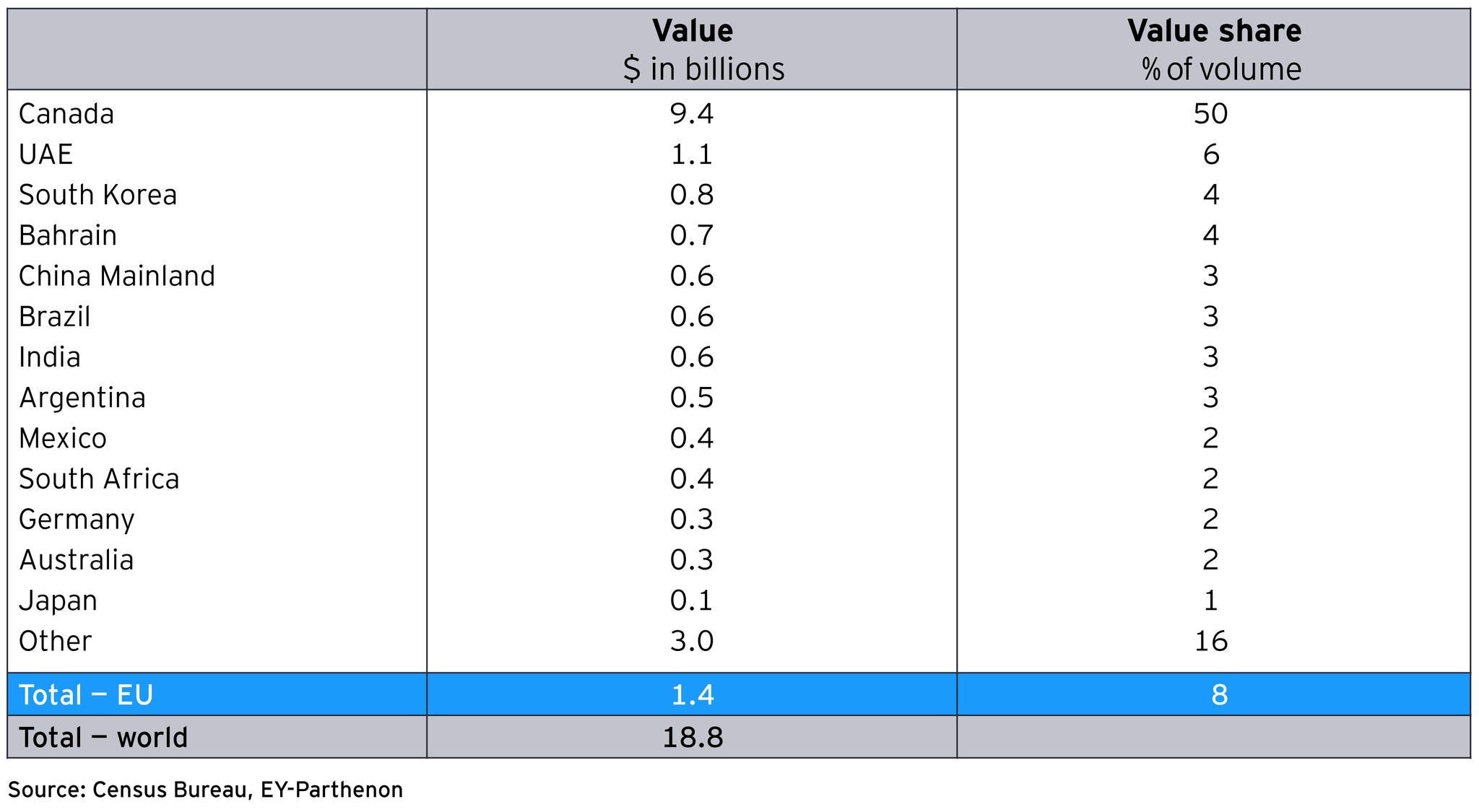

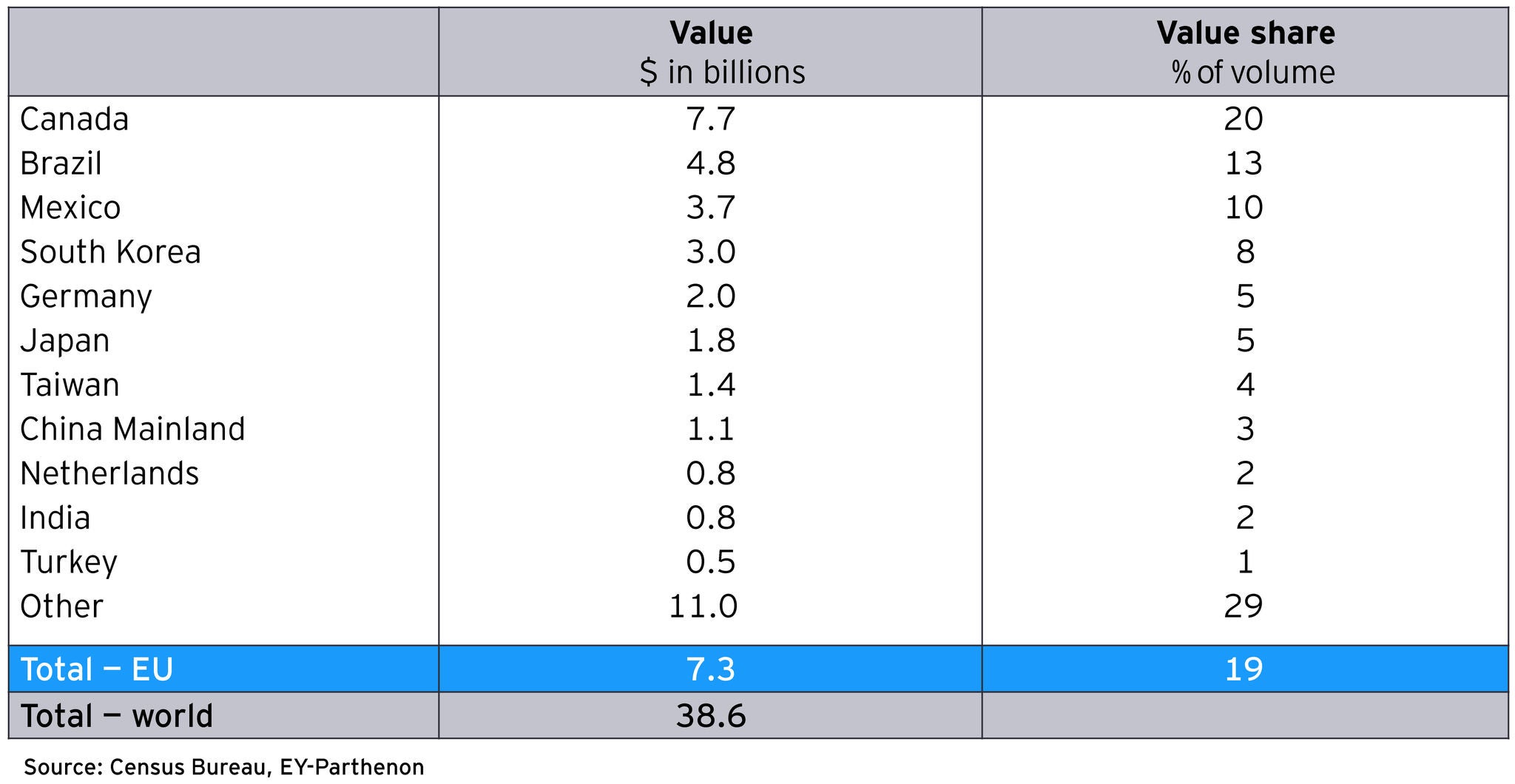

The new tariffs on steel and aluminum will have widespread global consequences, but Canada is most affected. The country supplies 50% of US aluminum imports ($9.4b) and 20% of US steel imports ($7.7b), making it the most exposed trading partner under this policy shift.