EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

A transformative solution that helps accelerate innovation, unlocks value in your ecosystem and powers frictionless business. Learn more.

Read more

Why embedded insurance, why now

Ubiquitous cloud-based digitization, rapidly decreasing cost of sensors and increasingly intelligent automation are driving down the barriers, primarily cost and complexity, to serving insurance customers efficiently and effectively, especially when it comes to simpler risks. By deploying enabling technology more holistically across the enterprise, rather than just via point solutions in specific functions and processes, insurers can become more agile and responsive in dealing with market shifts and evolving customer needs. This level of digitization, when augmented by advanced analytics platforms and design thinking, can give insurers clearer predictive visibility into the solutions that customers will adopt tomorrow.

Of course, other companies outside of insurance can access these capabilities too, which makes it more feasible for nontraditional “insurgent” players to jump into the insurance marketplace. That’s why embedded insurance must be viewed by insurers as both a massive growth opportunity and potentially a severe competitive threat. It naturally follows that insurance leaders must rethink how non-insurers will fit into the market landscape and the impact of embedding insurance on future business and operating models.

Looking at market dynamics, insurers looking for growth are obviously attracted to the upside of new business models, including embedded offerings, partnership-driven ecosystems and usage-based products. Many insurance executives recognize that new offerings and business models are critical to meeting new customer needs and rising expectations for value. In this regard, open digital platform-based curated ecosystems hold potential for insurance carriers to not only launch superior insurance offerings but also as a means for collaborative partnerships with potential insurgents. These potential insurgents, such as large firms in other sectors, are also looking to strengthen their customer relationships with more value-adding services and richer personalized experiences. They view embedded insurance as one such service, linking value propositions seamlessly as well as offering them at point of purchase or interaction, driving higher conversion.

These overlapping interests lay the groundwork for productive partnerships. However, many insurance brands are challenged by low levels of customer trust. Opaque pricing, the emphasis on profitable underwriting over delivering value to customers and the perception that insurers will use shared data against customers contribute to consumer skepticism toward the industry. According to Edelman’s 2022 Trust Barometer, of 16 industries, financial institutions rank near the bottom, above only social media. This, however, is not an insurmountable problem, with consumers across generations indicating and demonstrating in practice a willingness to share data in exchange for value. In 2022, a study by Global Data and Marketing Alliance (GDMA) showed that almost half (48%) of US consumers are data pragmatists — people who are happy to exchange data with businesses so long as there is clear benefit to doing so.

What embedded models can — and should — replace

For decades, insurers have sold their products via joint ventures or other partnerships with manufacturers and other companies. These distribution arrangements have been suboptimal in many ways, due to undifferentiated features, high costs and fragmented customer experiences. Asset owners are increasingly aware of the risk to their brand from the disconnect between business value of their customers and the underwriting risk they represented to an insurer. Because partners’ incentives weren’t necessarily aligned, customers frequently saw limited value; consequently, adoption rates remained low.

Increased digitization has exposed these shortcomings and motivated more non-insurers to explore embedded insurance. Typically, these brands enjoy higher levels of trust, have larger and more loyal customer bases, and face fewer legacy issues than insurers do. These are huge advantages for any company looking to expand its portfolios of offerings.

Ultimately, rather than acting as minor distribution channels for insurers, non-insurers want to take control of the product and overall experience. They have the capacity to build stronger value propositions and orchestrate the necessary ecosystems to deliver higher standards for customer centricity, reduced cost of insurance and increased pricing accuracy. To be clear: These are not InsurTechs; rather, they are well-established and well-capitalized brands accustomed to leading their markets. They will be aggressive in engaging InsurTechs and other partners to access the capabilities they need to succeed.

For insurers to compete with embedded offerings, on their own or with new partners, they will need to address various interconnected concerns and challenges, including:

- Undifferentiated products that aren’t based on the latest data or most useful insights, lack key features, or are delivered via subpar experiences

- Higher costs, both in core operations and across the value chain, with multiple intermediaries adding 30%–40% to costs

- Too little automation and too much manual processing

- Limited adoption rather than systemic use of artificial intelligence, machine learning and other enabling technologies

- Legacy system limitations in integrating the velocity, variety and volume of new data flows necessary to innovate in the embedded space

There’s no underestimating the last point: Replacing legacy systems is not an option for most insurers, given the high costs, and meeting the pace of market changes on legacy systems simply will not work. Thus, insurers need to develop entirely new ways of engaging in solution design and development, based on modern platforms that provide pre-built capabilities, make it easy to integrate with partners and support fast, secure data exchange.

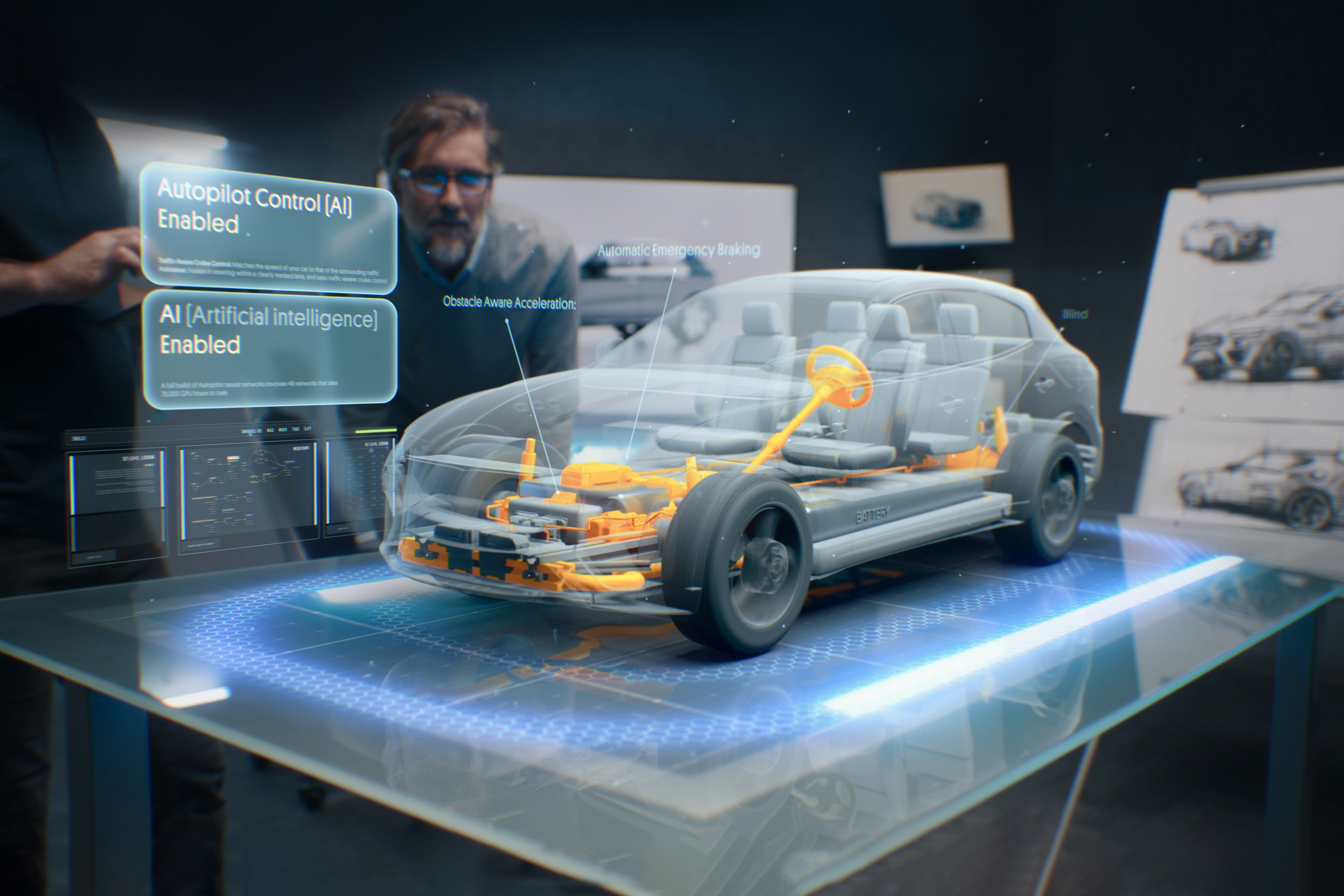

Other impediments to agility and responsiveness must be addressed. For instance, most property and casualty (P&C) insurers have yet to refine their offerings or underwriting models to account for the dramatic changes in mobility, including the rise of electric and self-driving vehicles. Similarly, relatively few commercial insurers have developed protection solutions that reflect the huge proportion of balance sheet value that is now linked to intangible assets (e.g., brands, patents, intellectual property, networks). Nor have they embraced data streams from sensors to transform their offerings to include sophisticated risk prevention services. The bottom line is that insurers have a great deal of work to do in prepping their tech, teams and operations, regardless of their embedded strategy.

Industries ready to go all in on embedded

The list of sectors and companies that see the appeal of embedded insurance is not short. It includes:

- Original equipment manufacturers (OEMs): automotive, agricultural equipment, appliances

- Health care and pharmaceuticals: life sciences firms, medical device manufacturers

- Real estate: property owners, investors, management firms

- Financial services: banks, credit card companies

- Travel and hospitality: airlines, cruise lines

- Retail: consumer electronics, restaurants

Instead of viewing these firms solely as just another channel, insurers should explore new partnership and collaboration options. Co-opetition is another prerogative to consider. After all, each of these sectors brings unique strengths, including extensive customer relationships and rich data stores, and they are motivated to innovate based on compelling use cases well suited to their customer needs. In automotive, for instance, manufacturers are looking at embedded insurance as just one element of a network of services, including payments, maintenance offerings and mobility subscriptions, rather than traditional ownership models.

Leaders in these sectors are already actively exploring their options and, in some cases, preparing minimally viable offerings. Future articles will take a closer look at each of these sectors to frame the specific opportunities and challenges.

Imperatives for winning in the era of embedded insurance

Insurers have stayed relatively safe from disruptions due to InsurTechs and other new market entrants through regulatory protection, aggressive pricing in startup markets and the acquisition of potential disrupters. The entry of larger firms, including Fortune 500 players with bigger balance sheets, stronger brands and higher degrees of customer trust, is a competitive challenge of much greater magnitude. Indeed, it will force insurers to upgrade their product portfolios with more dynamic offerings, more precise pricing and richer, analytics-enabled experiences. The static, traditional policies that have held sway for the better part of the century are facing the end of their shelf life.

And it’s not just what customers buy that is changing but also the underlying principles for designing insurance products. Insurers will use different data, largely based on actual usage patterns and real-time risk insights, to price products and dynamically adjust premium levels. How customers buy and consume products is also changing. All of these factors explain why the industry has reached a historical crossroads.

So what can insurers do to defend themselves from the heightening disruption, and how can they take advantage of the huge growth opportunity that’s right before them? A few key actions include:

- Use advanced analytics to actionably understand drivers of new product adoption and satisfaction and apply such insights into product and experience design on an ongoing basis

- Define the offerings and explore new business models based on multiple collaboration options, including B2B2B and B2B2C, and test the concept of OEMs as customers

- Own the platform and diversify into asset and service value enablement beyond underwriting

- Embrace design thinking to promote high-impact outcomes via new and higher standards for customer experiences

- Relentlessly drive out process and administrative costs via automation across the value chain and establish lean operations, with a relentless focus on a handful of core metrics, including pricing accuracy

- Honestly assess the culture in terms of readiness to innovate and self-disrupt, then define the necessary capabilities to innovate boldly and at scale — creative ideation, rapid prototyping, rigorous testing, data-driven product management — and make such innovation a repeatable process within ongoing operations

- Evaluate potential partners for joint success potential and devise strategies for post-brand futures

Taking these actions will enable insurers to future-proof their business models as they enter the era of ecosystems and embedded insurance.