EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY’s Loyalty program services can help your business create and implement programs that focus on transforming connections and driving engagement.

Read more

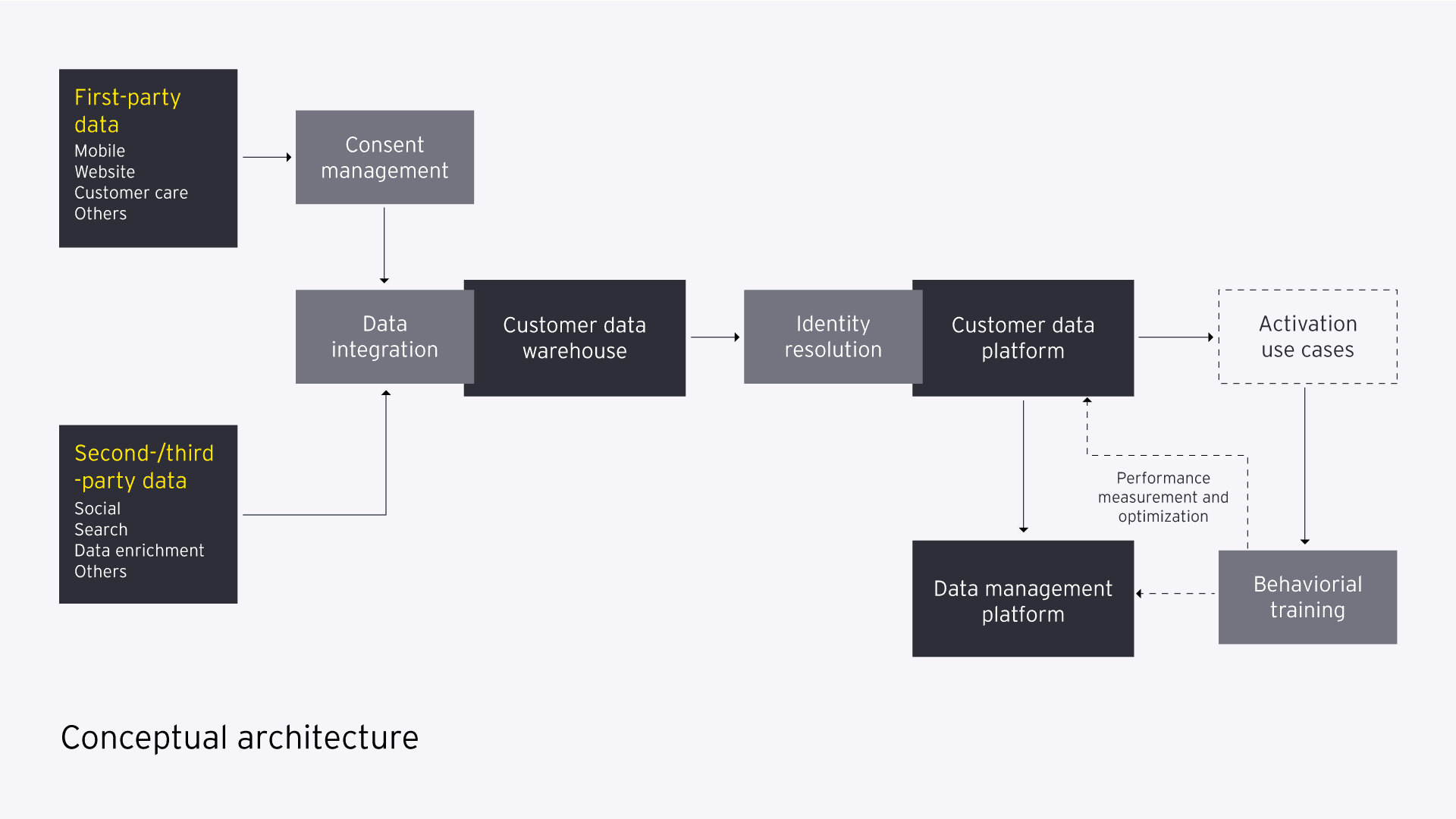

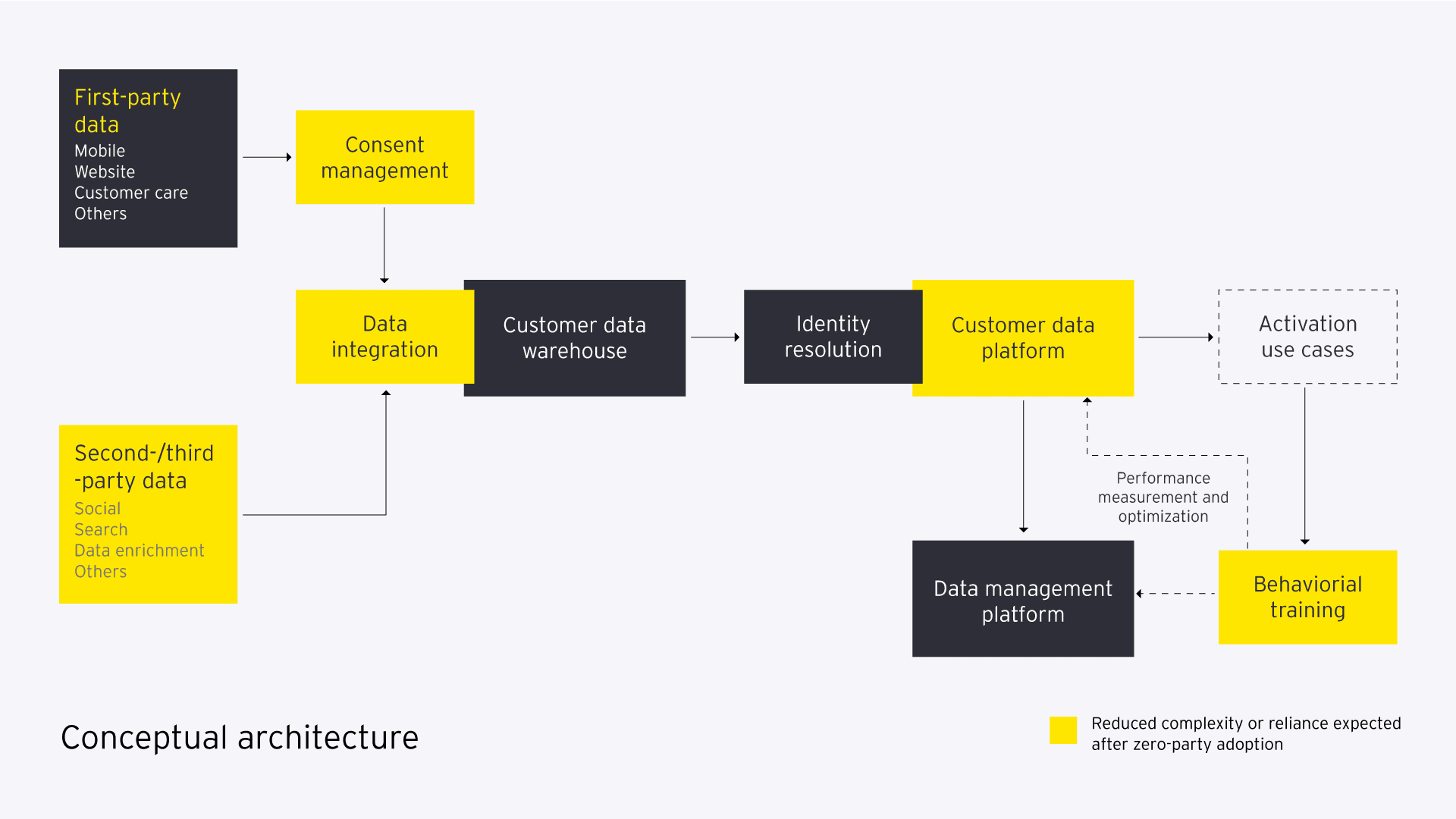

Companies have used loyalty programs as a primary vehicle for establishing ongoing touch points with their customers for decades. Of course, this has meant harnessing loyalty programs as a means of capturing first-party (1P) data from consumers. Complemented by second- (2P) and third-party (3P) data secured externally, these programs have given brands valuable insights into consumer behavior, preferences and intentions — all of which could be used to improve personalization.

In addition to enabling the highly personalized targeting of “known” loyalty members across marketing channels, loyalty programs provide a base of valuable data and insights that companies can use to build “look-alike” audiences they can also target. Companies with robust loyalty data use advanced analytics to identify common characteristics among customer cohorts, then build models for prospecting and re-engaging “unknown” consumers who could fit in known consumer groups.

This leads to generally higher click-through and conversion rates among the look-alike cohort, driving significant value for loyalty and CRM investments. In one EY-Parthenon program effectiveness study, the CRM-enabled loyalty program of a leading global beauty conglomerate generated 35% to 50% of its value from the precision-targeting of look-alike consumers.

Investments by companies in areas such as CRM, data enrichment, identity graphs and journey orchestration enabled by artificial intelligence (AI) have brought companies even closer to achieving intimacy with their customers.

External data, like demographic, socioeconomic and attitudinal data, has increasingly enriched the 1P data from loyalty programs to provide more clarity about customer decision journeys beyond companies’ “owned” properties, helping companies better understand their customers (and look-alike prospects) to reach new levels of intimacy, loyalty and advocacy. The integrated data has also improved the accuracy of segmentation efforts, enabled companies to better anticipate customer needs and even helped shape product and service portfolio and distribution strategies. This has resulted in improvements to the top line and increased internal efficiencies in many cases.