EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The unprecedented environment has resulted in an increased focus on optimization, growing the need to drive efficiency across the business.

Three questions to ask

- Why are firms investing in developing an enterprise wide optimization strategy?

- What are they key enablers and capabilities needed to achieve their optimization objectives?

- How do you compare to your peers in regards to optimization capabilities?

With costly increases in financial resource requirements following regulatory reform, intensified margin pressures and volatility driven by the COVID-19 pandemic, collateral optimization presents a significant opportunity to drive greater efficiency. In a revenue-constrained environment, financial institutions (FIs) have an essential need to make informed decisions to maximize profitability while remaining compliant with regulatory requirements.

With this objective in mind, FIs are investing in data and infrastructure enhancements that will position them for long-term growth and profitability. More specifically, they are developing capabilities to manage and prioritize the source and use of collateral across the following areas: liquidity buffer reserves, regulatory lockups, margin requirements, prefunding obligations and maximizing internalization.

Download the full article

Many of the opportunities discussed in this paper are applicable to both buy- and sell-side institutional market participants. Based on Ernst & Young LLP’s experience in supporting these types of initiatives, opportunity exists to drive $150m+ funding cost optimization for large global sell-side organizations annually; $75m+ for smaller global and regional sell-side organizations and the largest global buy-side organizations; and $25m+ for other institutional buy-side firms.

When FIs embark on collateral and funding optimization initiatives, it is critical for them to view profit and loss (PnL) from an opportunity cost lens across their obligations at the enterprise level. This is a shift from the traditional desk-level cost of carry PnL; however, this is the most effective methodology to not only identify and quantify optimization opportunities but also understand the capabilities and investment required to realize opportunities and measure performance.

The return on investment (ROI) can be very attractive for high-priority, short-term opportunities with a 10x annual payback achievable — the so-called “low-hanging fruit.” The opportunity cost methodology can help FIs to clearly identify and quantify opportunities, understand the underlying driver of the inefficiency and develop a portfolio of short-, medium- and longer-term initiatives to reduce inefficiencies in their collateral and funding portfolio. Leading FIs leverage investments in regulatory initiatives to support the realization of optimization objectives with marginal additional investment. This mix of opportunities helps FIs to achieve quick wins and self-fund longer-term initiatives.

The identification and quantification of the opportunities provide the transparency and incentive for financial institutions to act.

The opportunity cost methodology can help FIs to clearly identify and quantify opportunities, understand the underlying driver of the inefficiency and develop a portfolio of short-, medium- and longer-term initiatives to reduce inefficiencies in their collateral and funding portfolio.

Chapter 1

What needs to be optimized

There are opportunities to optimize both the funding requirements and pledge considering both collateral’s supply and demand

FIs have several financial resource constraints in need of optimization, with the binding constraints varying by firm. There is a broad set of levers to optimize the consumption of these resources. Collateral management, in its broadest definition, is a high-value set of levers that FIs can optimize to drive significant benefits.

Buy-side and sell-side firms are subject to similar financial resource constraints, the optimization of which is a complex puzzle. FIs need to juggle competing demands across their organizations for collateral to effectively optimize these constraints. Many FIs currently managing their financial resources in silos by business, region and/or function have the greatest opportunity to optimize their collateral supply and demand by refocusing their thinking to an enterprise level.

Collateral optimization inefficiency is observed in and driven by two primary areas: the requirement (the amount to be funded) and the pledge (how the requirement is met).

The requirement:

FIs should look to optimize the channels through which they execute on a pre- and post-trade basis to enable decision-making on new trades in the context of the broader portfolio to reduce overall financial resource consequences. Opportunities exist to optimize the requirement by enhancing capabilities at the enterprise level in determining the trade type, market and trading counterparty that is most efficient. This capability enables FIs to consider the initial margin (IM) impact, carry cost, X-value adjustment counterparty considerations, impact to prefunding requirements, and the broader liquidity and capital impact when determining the appropriate execution strategy. For the buy side, this would include opportunities to benefit from cross-margin offerings from dealers and prime brokers in reducing the net margin requirement to be posted.

The pledge:

FIs should then turn their attention to optimize the collateral delivered to satisfy their requirements. FIs have requirements spanning from margin calls (initial margin (IM) and variation margin (VM)), prefunding and guarantee fund requirements at financial market utilities, regulatory leverage and lockup requirements (15c3-3, FCM, 40 Act, etc.), secured funding and securities lending activity, and internal segregated accounts to satisfy capital and liquidity obligations (LCR, HQLA, etc.). FIs that build teams and infrastructure to view and optimize across a broad scope of these requirements can achieve the greatest economic benefits, increase internalization and reduce liquidity drag.

Historically, FIs have considered these requirements and the appropriate pledge in isolation by product, desk, geography or other constraint. FIs should consider taking a more centralized and real-time approach by considering collateral supply and demand, and the appropriate management of resources at the enterprise level. Optimizing larger pools of collateral and requirements can achieve greater portfolio efficiency and cost savings.

Chapter 2

Drivers of inefficiency

Operational, infrastructure, operating model and data constraints limit a firm’s ability to mobilize collateral and realize optimization opportunities.

Factors such as limited transparency and operational, infrastructure and organizational constraints are major drivers of optimization inefficiencies. An effective collateral optimization program needs to identify inefficiencies in PnL form and develop a deep understanding of the drivers. Without developing a detailed understanding of why the inefficiency exists, FIs fail to sustainably realize benefits.

Transparency constraint

The transparency constraint can be attributed to a firm’s legacy approach to collateral management. Many FIs manage collateral across multiple groups separated by product or desk using inconsistent data and infrastructure. These siloed teams are left to develop their own toolkit to optimize solely the collateral within their remit.

Siloed collateral management analytics:

Siloed collateral management functions and the resulting fragmented infrastructure limit the ability to view available inventory, requirements and eligibility at the enterprise level. Many FIs have upward of 10 organizations responsible for managing collateral and meeting funding requirements. Many of these groups lack basic analytics to identify overcollateralization or inefficient collateralization, and they do not have the operational capability to remedy identified issues.

While FIs have invested in individual businesses and desks, there has been a lack of investment in building centralized analytics and data capabilities at the enterprise level to identify opportunities across siloed functions. As a result, there is limited capability and significant fragmentation in the optimization decision process across the organization.

An effective collateral optimization program needs to identify inefficiencies in PnL form and develop a deep understanding of the drivers. Without developing a detailed understanding of why the inefficiency exists, FIs fail to sustainably realize benefits.

Operational and infrastructure constraints

Operational and infrastructure constraints have been observed that limit a firm’s ability to mobilize collateral and execute on identified opportunities. In addition, several market structure frictions hinder the ability to optimize (e.g., settlement timing conventions). Infrastructure constraints that limit collateral mobility, such as settlement and post-trade operational processes (e.g., corporate actions), need to be minimized and should be a focus of targeted firmwide investment.

Siloed settlement and post-trade infrastructure:

Historically, financial institutions have developed settlement and post-trade infrastructure that is specific for a particular asset class, business, desk or market. As a result, the optimal position for specific collateral usage may lack the infrastructure and operational capability to be traded, processed or managed by the business or region with the demand.

Fragmented structure:

FIs with a highly fragmented depo and nostro structure often have a higher cost and complexity in their settlement and reconciliation process, undermining their ability to efficiently mobilize collateral. For many FIs, this fragmented structure is driven by a business architecture that is perceived to be efficient by allowing each desk and subdesk to have its own physical account structure.

Market structure frictions:

There are industry and market structure frictions such as market open times, settlement cycles, client lockups and regulatory controls that can limit a firm’s ability to optimize. It is important for FIs to differentiate between true market structure frictions and internal frictions, such as timing lags and constraints to mobilize collateral across desks, regions and entities. These frictions should be inventoried and leveraged to assist in the quantification of the opportunity cost PnL and in understanding where an opportunity can be realized by eliminating or mitigating the friction.

Manual allocation decisions:

FIs have upward of 10 functional teams managing and optimizing collateral and funding. Many groups lack the systemic capability to select and execute collateral allocations, relying on “offline” or manual processes. For these groups, collateral allocation decisions are made manually, with incomplete information and focus on operational expediency over financial optimization. These manual allocations result in missed optimization opportunities of significant economic value and in many cases result in significant overcollateralization.

Given the complexity of the optimization challenges across many competing factors, FIs that leverage optimization engines or algorithms to make and execute the allocation decision have a significantly greater level of efficiency over FIs that have manual processes. The objective of FIs should be to create the data and infrastructure ecosystem that facilitates an optimization algorithm to automatically manage the allocation of collateral to meet the requirements. The most effective algorithmic solutions can inventory and store all relevant frictions and constraints across the enterprise and can be flexibly adjusted to prioritize multiple constraining factors to recommend the optimal decision based on the FI’s collateral inventory and overall requirements.

At the industry level, the use of the triparty model as a mechanism for collateralizing requirements will also enhance efficiency and remove many operational constraints. FIs on both the buy side and the sell side should explore the expanded adoption of the triparty model and use it across a broader set of obligations.

The objective of FIs should be to create the data and infrastructure ecosystem that facilitates an optimization algorithm to automatically manage the allocation of collateral to meet the requirements.

Organizational constraints

To achieve optimization, management across business lines needs to agree to the program’s objectives and understand the goal of optimizing for the enterprise. Migrating to an enterprise view requires the individual teams to redesign legacy processes and coordinate across functions. Mobilization of a cross-functional enterprise program requires a shift in mindset, but the new way of thinking will support FIs in achieving significant economic benefits.

Cultural barriers:

At many FIs, the siloed businesses and supporting operations functions lead to a culture of optimizing their desk constraint as opposed to optimizing for the enterprise. There are also difficulties scaling existing optimization processes from a desk to an enterprise level, as the constraints and datasets differ.

Varying definitions of optimal:

With the disparate ownership across organizations, some FIs have differing levels of focus on delivering optimal collateral and varying definitions of what optimal collateral means. In some parts of organizations, there is a lack of appreciation for the need to optimize, differing levels of what is optimal, and competing binding constraints across desks. In some cases, the definition has been focused on operationally expedient delivery of collateral over economic factors.

Lack of incentive:

From an operational perspective, many individual teams struggle to adjust from their legacy processes or operationalize new technologies. Similarly, where operations teams are manually allocating collateral, there may be limited incentive to change their methods. It is important for leadership to agree to program strategy and effectively communicate the purpose and benefits of enterprise optimization.

The use of the opportunity cost PnL to identify enterprise-level inefficiency is a critical first step in sustainably overcoming the siloed culture and mentality. The approach not only enables the identification of internalization opportunities but also creates ongoing transparency for leadership to support the shift in organizational structure and incentivize greater collaboration and communication across desks.

While it is important that the operational cost and feasibility be embedded in the optimization decision, it is equally important that the financial resource impact be weighed heavily against this to determine the overall optimal position. Building a consistent view of optimal collateral through clear incentives, such as transfer pricing methodology, can significantly uplift the understanding of the teams and encourage the optimal allocation.

Given the constraints, building an opportunity cost PnL and embedding it into the daily reporting provide insights and incentives for teams to aim for greater efficiency. Once a process is developed that is sustainable for the PnL, the uplift to create an algorithmic view of the optimal allocation recommendation is relatively straightforward, although it must include the market structure and operational frictions to be of value. Leading FIs have embedded such solutions into the process to automatically allocate collateral and remove the human decision-making process.

Chapter 3

Capabilities to enable optimization

Many FIs lack the foundational, advanced, and operational capabilities undermining the ability to sustainably realize optimization opportunities

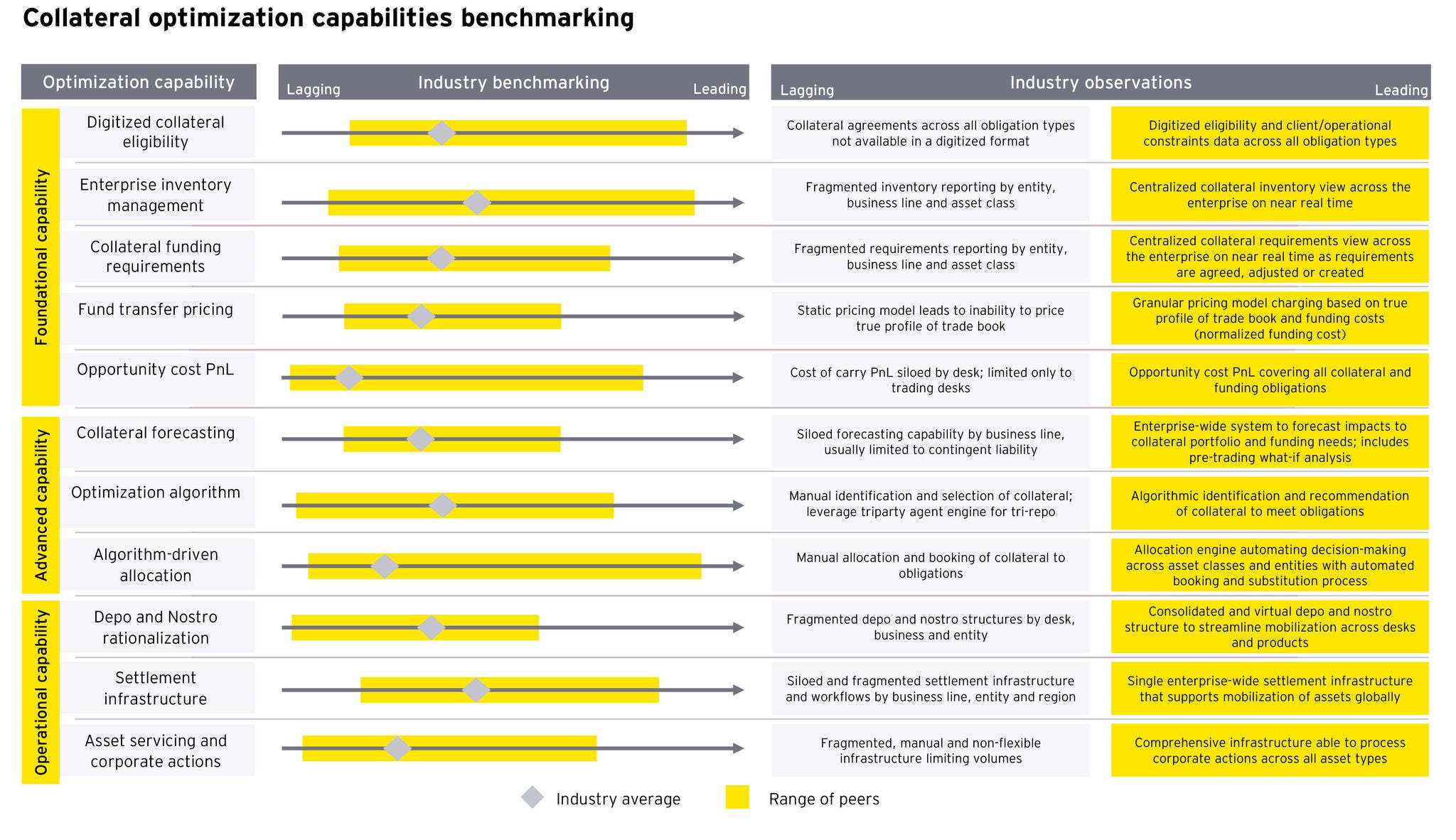

Informed by our work with buy- and sell-side FIs, we show in the figure below the relative maturity of FIs’ collateral optimization capabilities across the industry. While not all FIs need to have a leading suite of capabilities to achieve optimization, the capabilities highlighted as “Foundational” and “Operational” are the primary areas for investment. The capabilities that are flagged as “Advanced” are differentiating for FIs with complex multi-asset-class portfolios.

Based on this benchmarking methodology, we invite you to self-score your organization to determine your FI’s capabilities. Based on our experience, only a few FIs are truly meeting the leading-class capabilities but generally have been able to achieve significant efficiency when measured using the Opportunity Cost PnL methodology.

Foundational capabilities

Foundational capabilities form the groundwork for effective collateral optimization at the enterprise level. The data strategy and structure that FIs adopt to facilitate the consolidated enterprise view are essential investments. FIs can leverage initiatives such as collateral asset traceability, contract digitization and stress testing/forecasting as a baseline for enabling optimization capabilities. FIs should see these capabilities as entry-level requirements to achieve collateral optimization:

- Inventory management: FIs should maintain the ability to have a consolidated view of enterprise-wide collateral and cash inventory, otherwise known as collateral sources and uses. Although an end-of-day consolidated inventory view is the baseline capability, FIs should ideally work toward near real-time analytics at the enterprise level with clear asset traceability, to understand the availability of collateral and liquidity at multiple points throughout the day. Developing a trader platform with a view of collateral used consistently across product and entities to help manage inventory, shorts coverage and secured funding activity will provide FIs with a holistic picture of the available inventory.

- Requirements: FIs should have the ability to have an enterprise-wide consolidated view of all collateral and funding requirements. FIs should also include an operational flag as to who owns the requirement operationally and a risk flag to identify if this is a volatile or relatively stable need. Leveraging firm stress testing to support this information adds further strength to the capability.

- Eligibility: FIs should have the ability to have at the enterprise level a consolidated view into contractual, regulatory or operational eligibility for all requirements to identify optimal collateral fill. Having the additional ability to overlay contractual rights with operational constraints on an asset class level enhances the ability to operationalize this data.

- Funding cost and funds transfer pricing: FIs should be able to assign a cost of funding to all assets, based on funding market prices and the firm’s secured or unsecured funding costs. Consideration of each asset’s funding cost will inform optimal allocation and measure the cheapest to deliver assets.

- Opportunity cost PnL: FIs should have the ability to combine the base capabilities at the enterprise level to determine the inefficiency in the collateral portfolio. FIs with the ability to layer in the root cause behind the inefficiencies can derive a plan to adjust the management approach and associated infrastructure to realize the optimization goal.

Advanced capabilities

The advanced capabilities are those that FIs can leverage to drive greater optimization, which enable FIs to sustainably achieve optimization of their collateral and funding portfolio on an ongoing basis.

- What-if modeling and forecasting capability: FIs should be able to project the collateral need and perform what-if analysis on trading activity to determine the optimal venue and counterparty for trade or portfolio of trades. Leading FIs have the capability to analyze both pre-trade (e.g., best execution) and post-trade (e.g., compression) analysis. Forecasting capabilities of leading FIs extend to both intraday and end-of-day capabilities considering market frictions, internal frictions and intraday and multiday funding flows to identify available collateral and liquidity at multiple points during the day.

- Optimization algorithm: An optimization algorithm helps FIs conduct a point-in-time review of the collateral posted against requirements, considering the constraints, and receive suggested substitutions and actions to drive greater efficiency into the portfolio. This type of tool can be used ad hoc to identify opportunities and has the flexibility to adjust constraints such as pure PnL vs. balance sheet impacts at both month-end and quarter-end.

- Algorithm-driven allocation: An FI’s ability to embed the algorithmic allocation (e.g., linear program, Monte Carlo) directly into daily processes can help reduce the human element for the broadest set of requirements to that of an exception management and trade execution role. Such an engine can assist FIs in facilitating optimization of the portfolio on a near real-time and continuous basis.

Operational capabilities

Operational capabilities are focused areas where FIs tend to have frictions in their ability to optimize collateral due to their operational and technological structure. FIs tend to have infrastructures focused on specific asset classes, entities and regions. Targeted investments create a more open and flexible architecture and enable FIs to maximize the realized benefits from optimization. Adoption of a global triparty model to support pledging and movement of collateral is an opportunity the industry should pursue as a mechanism to drive operationally efficient collateral optimization.

- Depo and nostro rationalization: FIs should streamline their depo and nostro structure to enable more efficient mobilization of collateral across desks, entities and regions; FIs that have a “virtual” structure have greater ease in mobilizing and avoid the operational burden and cost of internal collateral movements. Such capability reduces the need for carrying excess liquidity, limits the complexity of intraday management and significantly reduces operational cost.

- Settlement infrastructure: FIs can invest in simplification of their cash and securities settlement infrastructure to achieve a product, entity and region-agnostic model. While it is desirable to have a single global asset class-agnostic settlement and post-trade infrastructure, this is not required to achieve mobilization across desks, businesses, entities or geographies. Targeted standardization by asset classes and entity can be made to maximize ROI where FIs do not today have a single standardized settlement infrastructure. This is also a critical enabler of managing intraday liquidity needs proactively.

- Asset servicing and corporate actions: Similar to the settlement infrastructure challenge, FIs tend to have a corporate actions infrastructure that is product-, entity- or region-specific, resulting in specific securities requiring manual support and undermining the ability to optimize in a sustainable manner. FIs should make targeted investments to develop corporate action asset class-agnostic infrastructure.

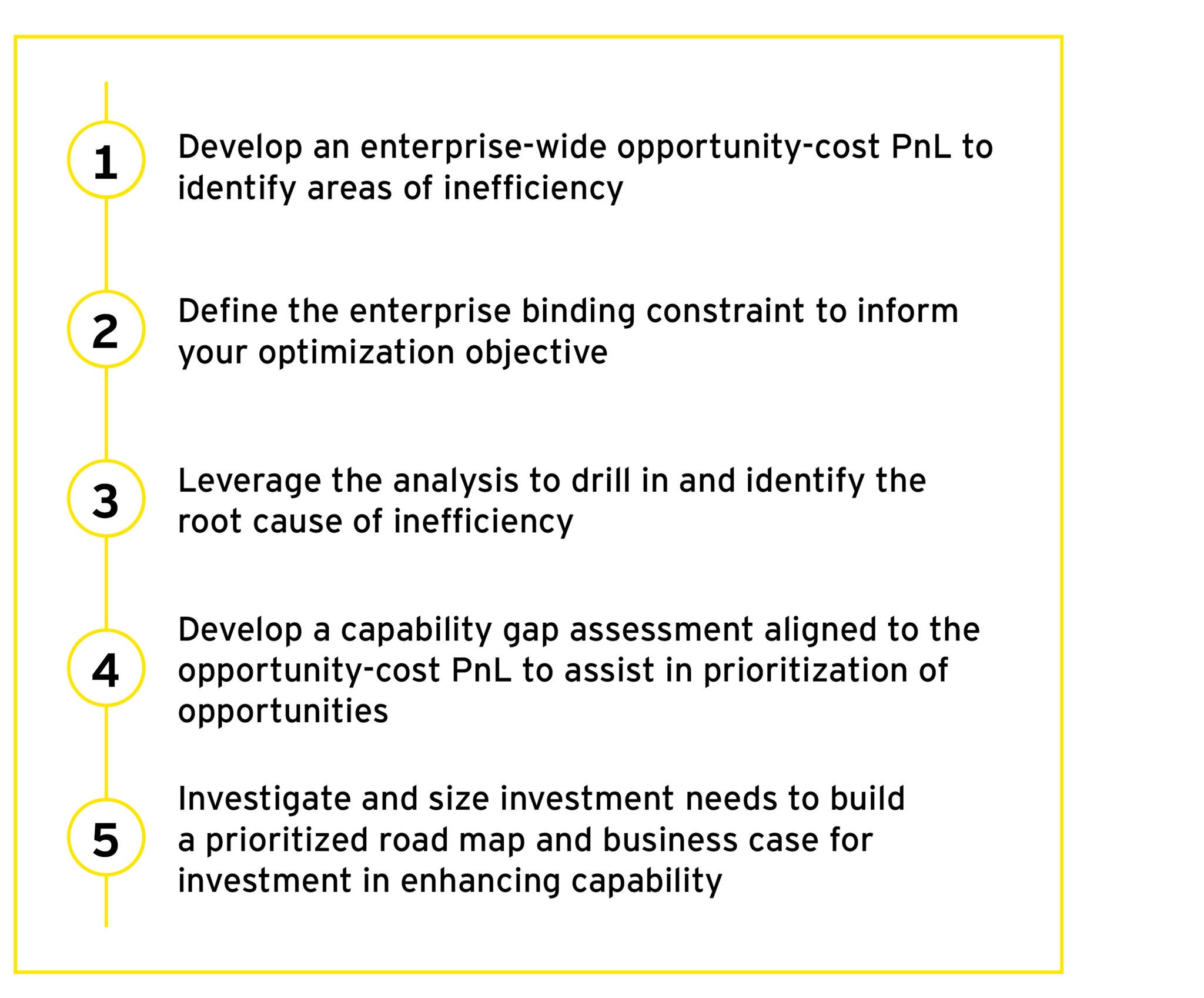

We advocate that FIs perform an assessment of these capabilities aligned with their opportunity cost PnL analysis. This can help FIs to attribute the collateral portfolio inefficiencies at a constraint level and quantify the opportunities by capability. FIs can use this method to develop their strategic road map, prioritizing short-term opportunities, requiring little to no investment.

Chapter 4

Operating model considerations

Organization structure, incentives and technology considerations must be designed to achieve optimization of the enterprise level constraints

In addition to the infrastructure capabilities required to achieve optimization, the organizational operating model is a vital consideration. FIs need to be aligned in their optimization objectives at the enterprise level. Failing to establish the appropriate operating model can impede an FI’s ability to fully realize optimization opportunities, even with significant investment in infrastructure.

FIs need to consider how they will govern the collateral optimization efforts of the firm. Various models have been observed; however, the most common and effective are detailed below. Regardless of the model that is selected, it is imperative that the team has strong alignment, communication and common incentives.

Centralized:

A centralized model provides a consolidated function integrating all financing desk activities across lines of business and treasury into a single unit, with a dedicated framework to provide front-office, back-office and technology support.

Federated:

A federated model can help FIs establish a cross-functional committee to set the strategic direction of the program, with execution occurring within functions.

Hybrid:

A hybrid or partnership model, with co-ownership between trading desks and treasury, can help FIs establish the strategic objectives and develop the required supporting technology and operating framework.

When considering the appropriate operating model, FIs should consider their organizational structure in context of ownership and resource alignment with trading (equities, FICC, XVA, etc.), treasury and operations all playing a key role. While treasury does not need to be the functional owner, it should have a strong voice due to its role in defining funds transfer pricing (FTP) and steering incentives. FIs also need to determine if the optimization function will be a cost or revenue center, as this alters how the function is viewed across the enterprise and informs how the FTP structure is applied.

Technology and infrastructure considerations:

FIs need to determine if they are going to leverage existing infrastructure or explore new platforms to enable their optimization capabilities in addition to considering the technology resource alignment. FIs can leverage the significant investments that have been made in data and infrastructure from regulatory and other business initiatives related to collateral and liquidity to accelerate their optimization. FIs have also used a mix of vendor technology platforms coupled with existing internal capabilities. There is a growing set of technology vendors in the market that offer the foundational capabilities and some with scalable advanced capabilities. Many FIs have found success through a hybrid model of leveraging a mix of internal technology and data capabilities, partnering with the strat/quant teams, and connecting to vendor technology offerings.

For the buy side, in addition to the technology platform vendors providing trade and life cycle services, there has been a rise in asset servicers providing optimization as a service. Such servicers are structuring their analytics capabilities, collateral administration services, agency securities financing and custody solutions to provide a comprehensive offering and positioning buy-side FIs to maximize alpha potential through their collateral optimization and financing solutions, thus minimizing the investments needed by the buy side to realize optimization benefits.

Chapter 5

How to accelerate realizing optimization goals

Firms should align the optimization strategy to regulatory and existing business initiatives to streamline efforts and accelerate implementation

FIs should review and leverage data and technology investments being made across collateral and liquidity initiatives, many of which will form a base for more advanced optimization capabilities. As part of this review, FIs should review both regulatory and business-driven initiatives across regions, desks and products to identify commonalities in features, function and capability. Through such a review, FIs can identify efficiencies in investment that can streamline the build efforts, support building infrastructure that is consistent at the enterprise level and ultimately accelerate the realization of optimization goals.

Regulatory initiatives such as Reg YY, resolution planning, uncleared margin, transition to interbank offered rate (IBOR), qualified financial contract (QFC) and resiliency form the core building blocks upon which many FIs have expanded with limited marginal investment to achieve baseline optimization objectives. Additionally, navigating the complex technology landscape can be a challenge. FIs that formulate a technology and data strategy that leverage a mix of internal build and external partnerships tend to achieve both rapid and outsized gains relative to their peers.

Across a broad set of FIs, it has been demonstrated that investment in collateral optimization has a significant and rapid annuity payback. Many FIs realize annual ROI in excess of 10x the investment, and typically 40% of the opportunities are realized within the first year, enabling same-year payback. This allows investment in the advanced capabilities to be self-funded through near-term savings.

Across a broad set of FIs, it has been demonstrated that investment in collateral optimization has a significant and rapid annuity payback. Many FIs realize annual ROI in excess of 10x the investment, and typically 40% of the opportunities are realized within the first year, enabling same-year payback. This allows investment in the advanced capabilities to be self-funded through near-term savings.

Chapter 6

A final word

There is an opportunity to achieve significant efficiency and alpha generation through optimization of firm’s collateral portfolio

Collateral optimization is far from a new phenomenon. The focus on optimization has picked up traction with increased revenue pressure as funding spreads widened, growing the need to drive efficiency across the business. FIs have become increasingly more sophisticated in how they manage optimization; however, wide variance still exists across FIs’ capabilities and success.

FIs on both the sell and buy side have the opportunity to achieve significant efficiency and alpha generation through optimization of the collateral portfolio. During this time of revenue and margin pressure, FIs should invest in realizing such efficiencies.

Given the potential opportunity size that we have identified in excess of $150m+ annually in funding cost for the largest FIs coupled with the ability to drive liquidity, capital and RWA benefits, collateral optimization remains an area in which FIs on both the buy side and sell side should be focusing investment.

FIs on both the sell and buy side have the opportunity to achieve significant efficiency and alpha generation through optimization of the collateral portfolio. During this time of revenue and margin pressure, FIs should invest in realizing such efficiencies.

Summary

With costly increases in financial resource requirements following regulatory reform, intensified margin pressures and volatility driven by the COVID-19 pandemic, collateral optimization presents a significant opportunity to drive greater efficiency. In a revenue-constrained environment, financial institutions (FIs) have an essential need to make informed decisions to maximize profitability while remaining compliant with regulatory requirements.

FIs are investing in data and infrastructure enhancements that will position them for long-term growth and profitability. They’re developing capabilities to manage and prioritize the source and use of collateral across the following areas: liquidity buffer reserves, regulatory lockups, margin requirements, prefunding obligations and maximizing internalization.

How EY can help

-

EY helps global institutions prepare for the imminent transition away from Interbank Offered Rates (IBORs) to Alternate Reference Rates (ARRs). We also play a leading role in supporting regulators, trade associations and others to increase awareness and education.

Read more

Related articles

Uncleared margin rules: 10 actions to help firms prepare

This is not the time to slow down, but an opportunity to reassess and make sure you meet your long-term needs.