EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Discover how our Corporate Venture Building team designs and delivers transformative new businesses by leveraging corporate endowments.

Read more

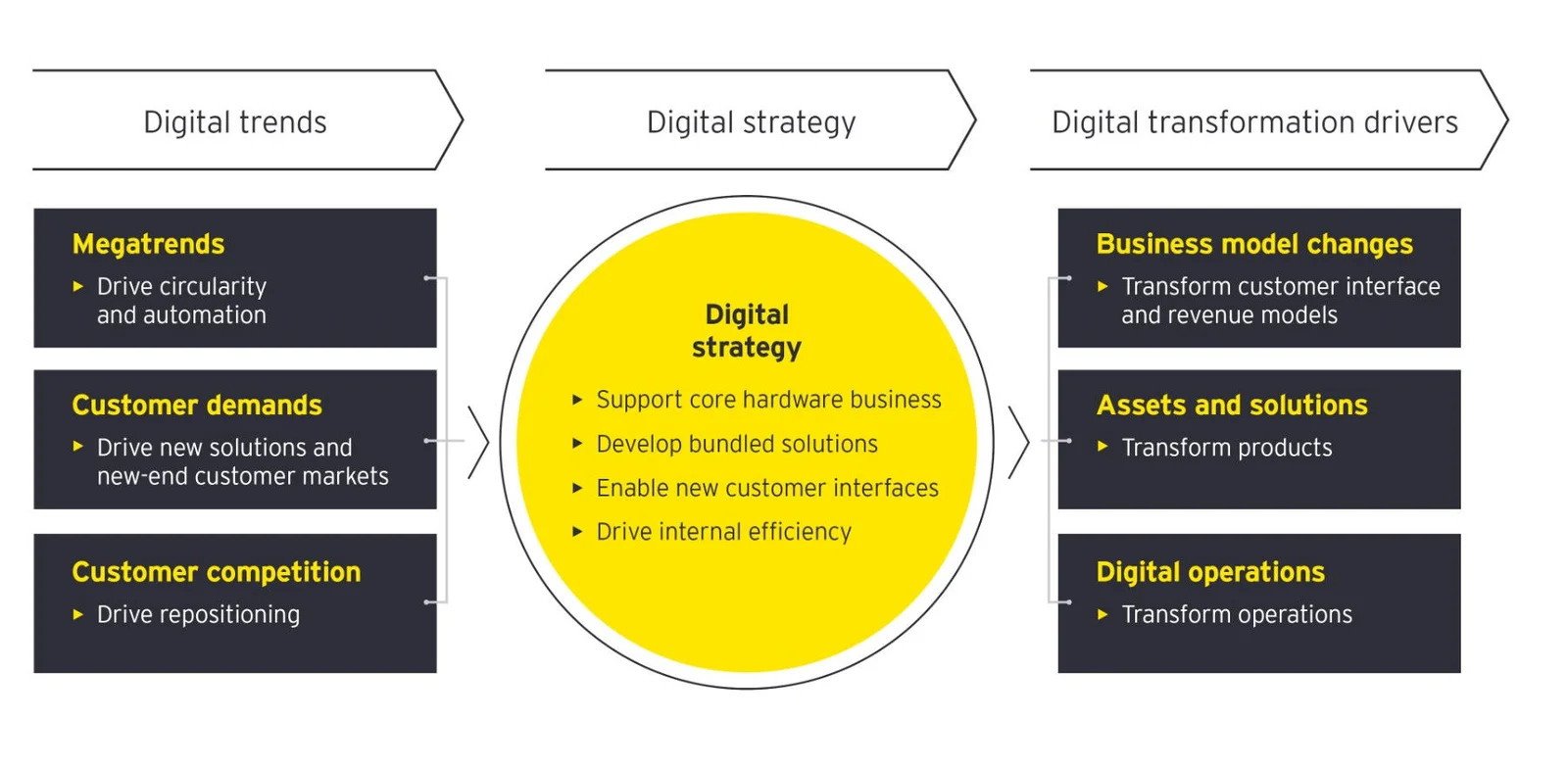

An enterprise-wide digital transformation can be a mammoth undertaking. By breaking it down into bite-size chunks, discrete manufacturers can more easily identify the digital strategy’s purpose and vision, as well as develop an execution plan that drives to the desired outcomes.

Support the current hardware business

For most industrial product companies, the legacy hardware business and its associated aftermarket services make up almost all revenues. It’s therefore crucial to understand how digital and new technologies can protect and grow the hardware sales as well as the often more profitable aftermarket services. This is often done by adding data capabilities to the product portfolio, such as sensors for data collection. A good and well-executed strategy maintains or increases profitability levels, which in turn can finance new digital assets and solutions.

Develop bundled solutions of hardware, services and software

New digital assets and solutions are either stand-alone, refined or repackaged solutions of existing hardware, services and software. One key question the strategy needs to answer is how to prioritize the plethora of opportunities that exist.

Most leading global discrete manufacturers are highly innovative companies that spend a significant share of turnover on research and development – often in the range of 5% to 10%. This provides a strong foundation from which to be successful. At the same time, it’s important to recognize the different requirements between hardware and software product development and sales. Some industrial product companies underestimate the industrialization and product lifecycle management of software, including training, upgrades and patches, as well as online support. Any digital strategy needs to include a careful analysis of make versus buy, ideally including a separate digital M&A strategy.

Enable new customer interfaces

To protect and improve access to customers’ buying process and decision-making, it is critical that digital assets and solutions support new ways of interacting and supporting customers, and possibly entirely new business models.

This is often a challenging part of the strategy since it requires not only the innovation and development of new solutions, but also a solid connection to the rest of the company to sell, deliver, service, and invoice for such solutions.

Digital strategies can also facilitate in a more cost-efficient way revenue growth from smaller customers, a market segment where margins are more likely to be compressed.

Improve internal operations efficiency

An integral but sometimes overlooked part of a comprehensive digital strategy is the digital operations strategy. Well-executed, such a strategy could lead to significant financial benefits by improving return on capital employed (ROCE) levers, such as reduced costs and improved inventory management.

During the transformation process, discrete manufacturers should include operations digitalization metrics in all regular board reporting. Ideally, reporting should include the manufacturer’s performance versus key competitors and leading practices among industrial peers. To be effective, these digitalization metrics should logically tie to well-known performance metrics, such as overall equipment effectiveness (OEE), to gain the right traction.