EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY government and public sector consulting services provide support to transform programs and optimize operations to achieve better outcomes for the public.

Read more

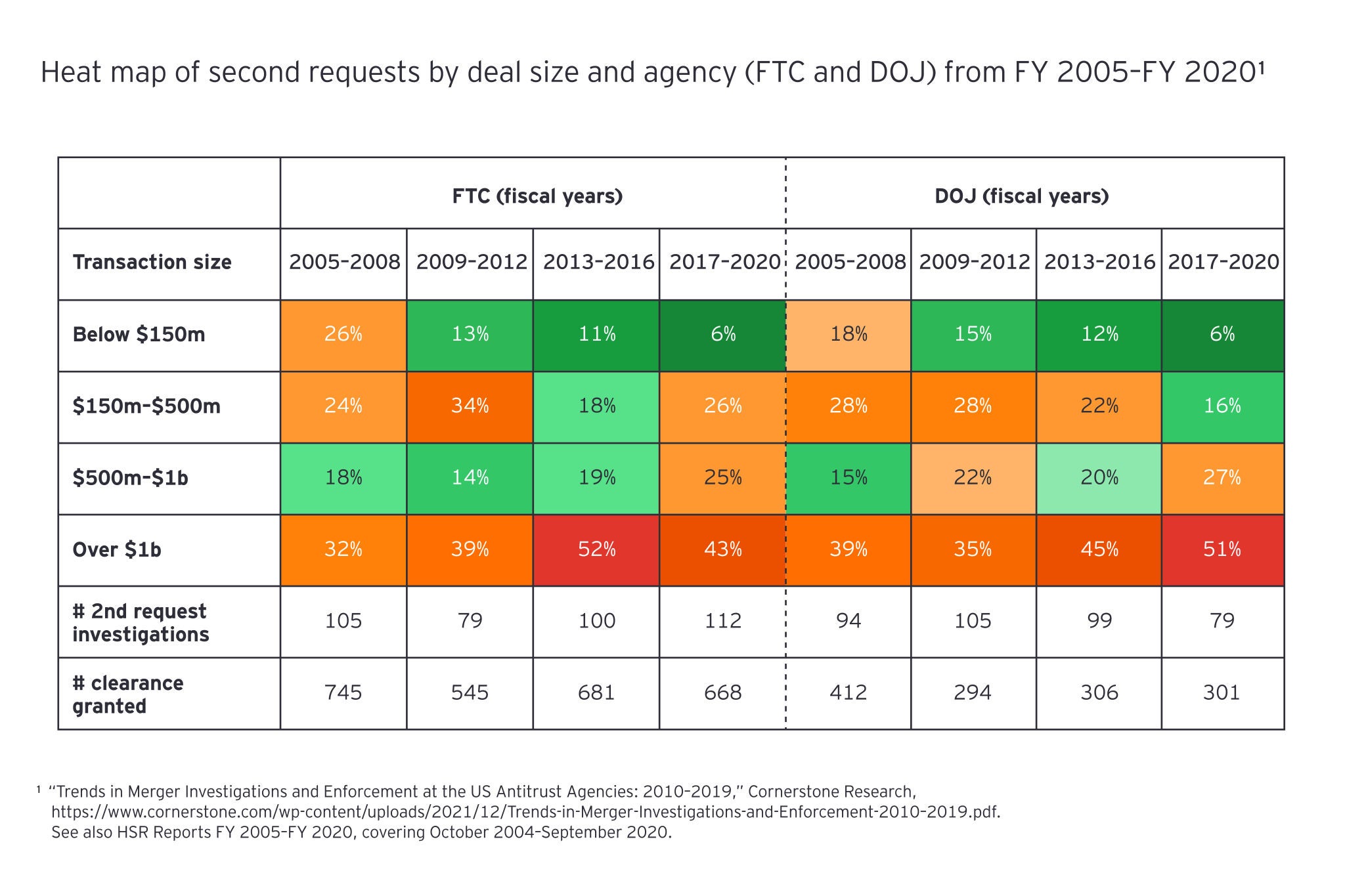

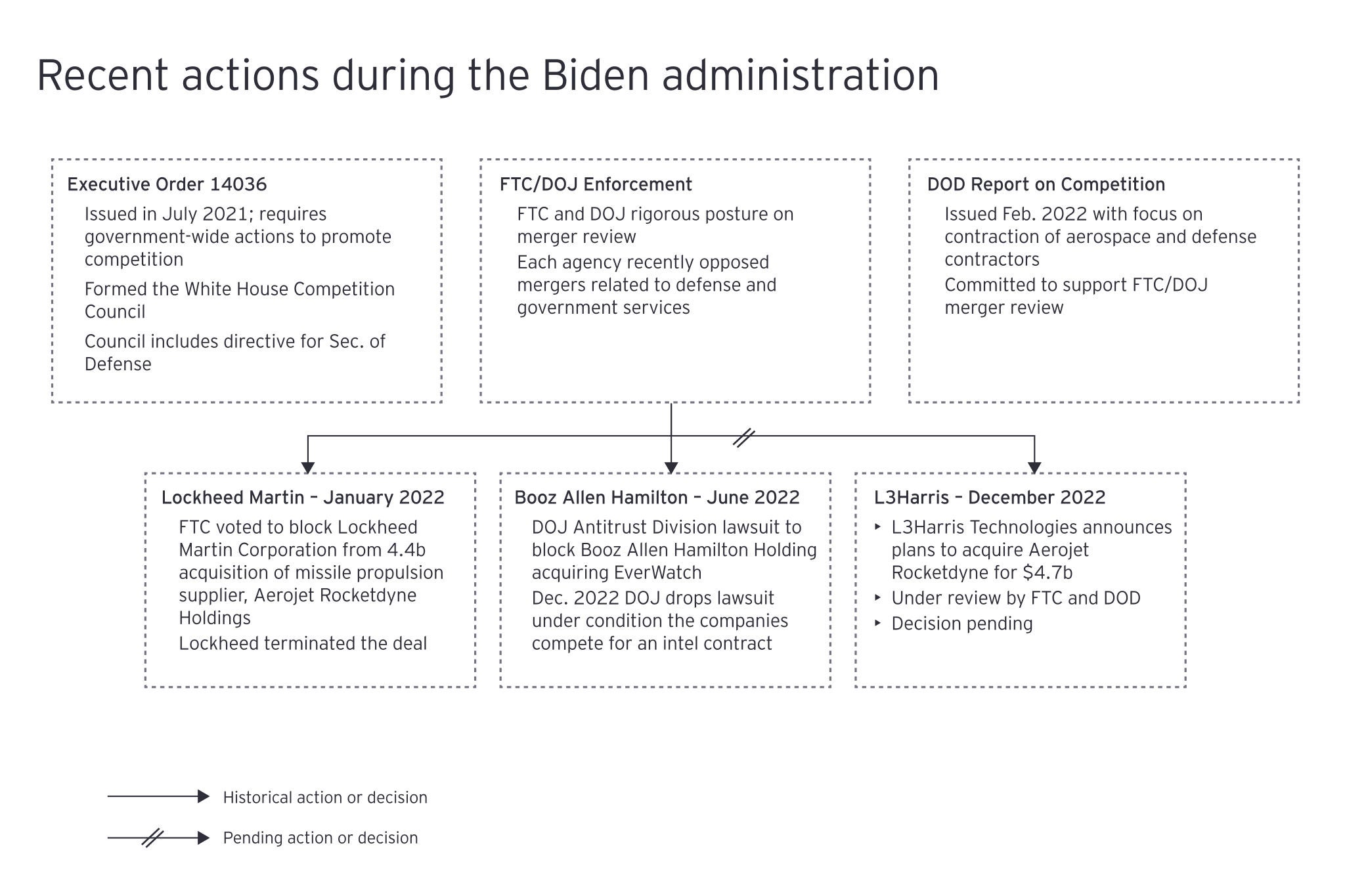

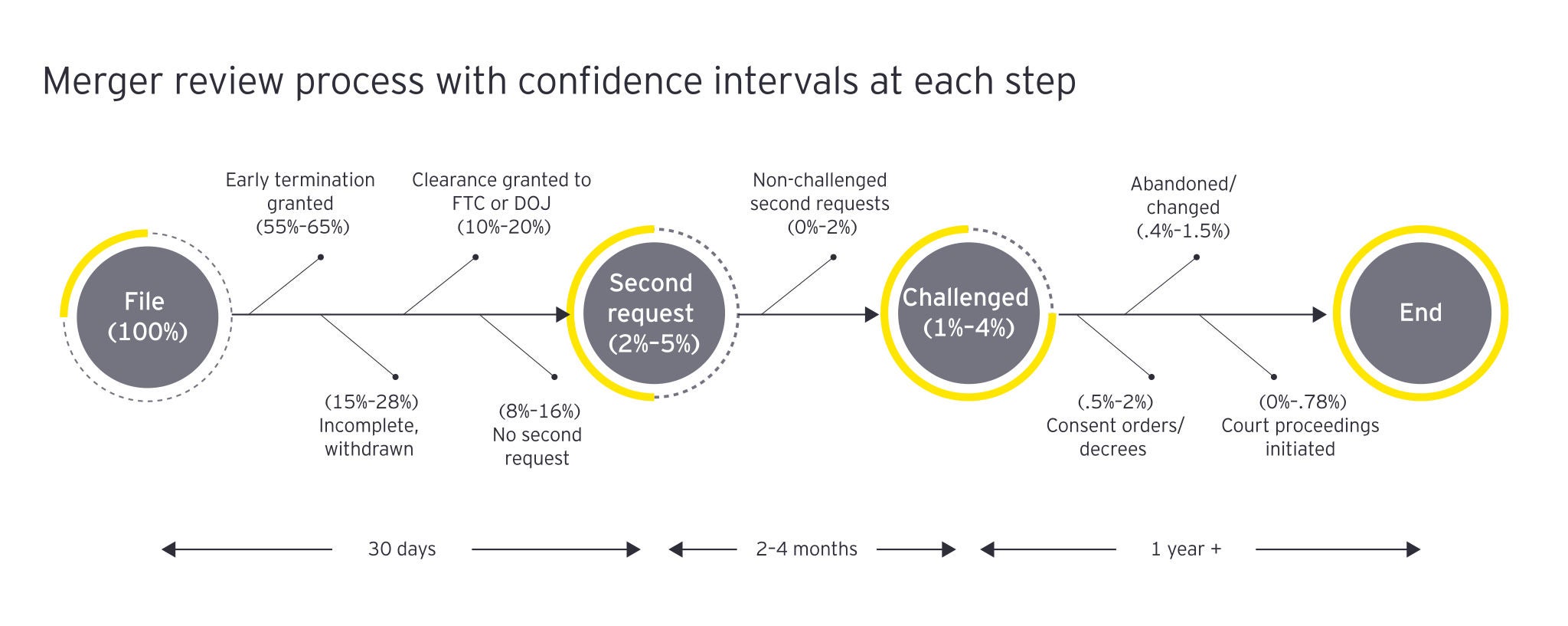

Sector leaders see a world where geopolitical conflict is on the rise. Two main contributors are the war in Ukraine and ongoing tensions between the US and China.² In efforts to support the US National Defense Strategy (NDS) and the National Security Strategy (NSS), A&D companies seek investments in technology and talent to maintain their competitiveness in a rapidly evolving market. These companies have typically viewed mergers and acquisitions (M&A) as an effective tool in this effort. However, given that antitrust agencies can reopen an investigation and that the FTC is issuing "Pre-Consummation Warning Letters" to prolong the merger review waiting period, A&D companies continue to face regulatory risks that potentially burden their ability to engage in M&A activities.³

Antitrust agencies, however, are concerned about a defense sector that has become too consolidated.⁴ The U.S. Department of Defense (DoD) shares this concern, with supply chain resiliency, data rights and intellectual property (IP) driving its growing involvement in the defense industrial base.⁵ From a business standpoint, IP protection establishes a form of limited monopoly to commercialize new technology and protect investments in R&D. While innovation is critical to driving growth in A&D, the DoD thinks IP protection could be limiting the ability of companies to build on new ideas and take innovation even further.⁶ A shortfall of skilled workers in defense manufacturing and a federal-wide push to use commercial items are also hindering market competitiveness for traditional defense players.⁷