EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

The EY Americas Mining and Metals Centre of Excellence offers companies access to cutting-edge services and innovation-led solutions.

Read more

Canada has a strong potential to grow in this segment by leveraging its leading position in lithium, cobalt, and nickel reserves.1 In 2022, the sector witnessed a 31% year-over-year increase in critical mineral export value, compared to an 8% growth in the total metal trade.2,3

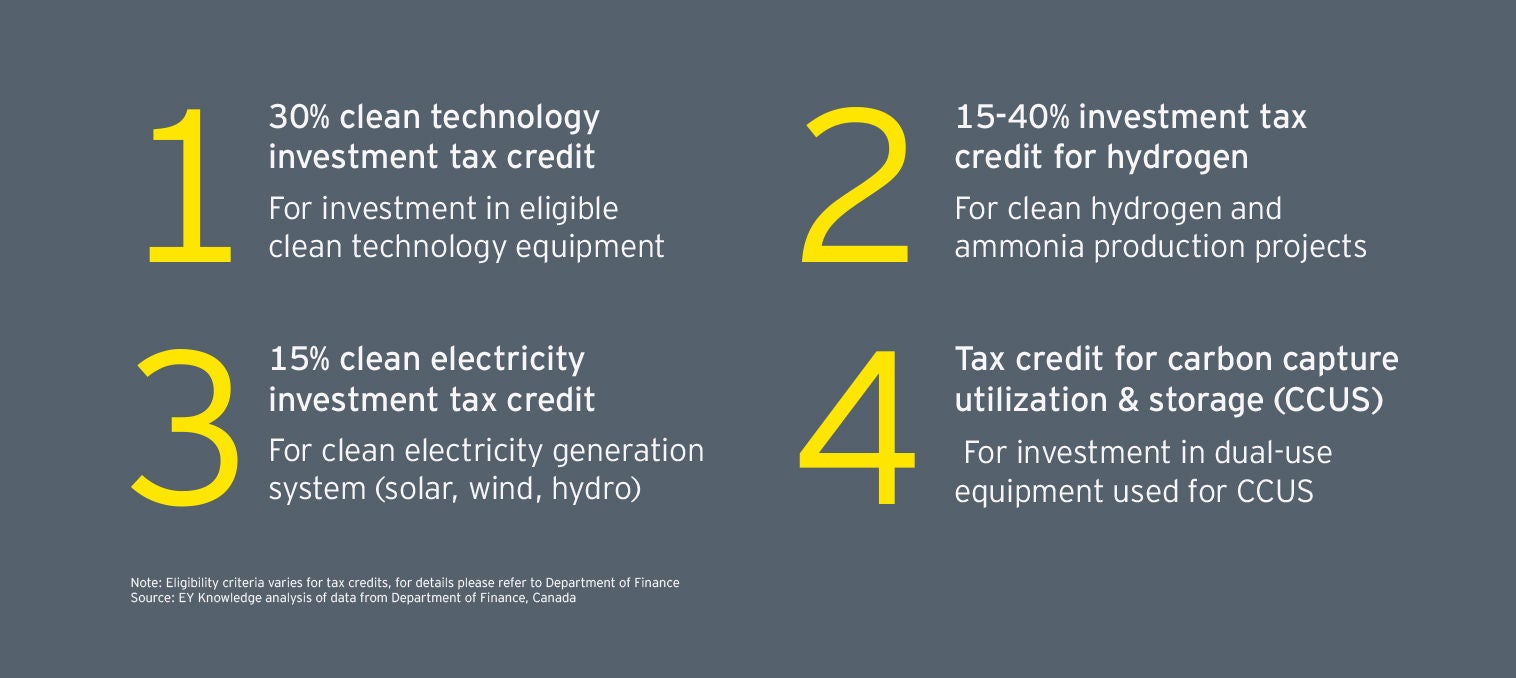

The Canadian Government announced several measures in its most recent fall economic statement and latest budget to support Canada’s energy transition to a clean economy. The incentives are designed to create a growth-conducive environment for the critical mineral industry in three ways:

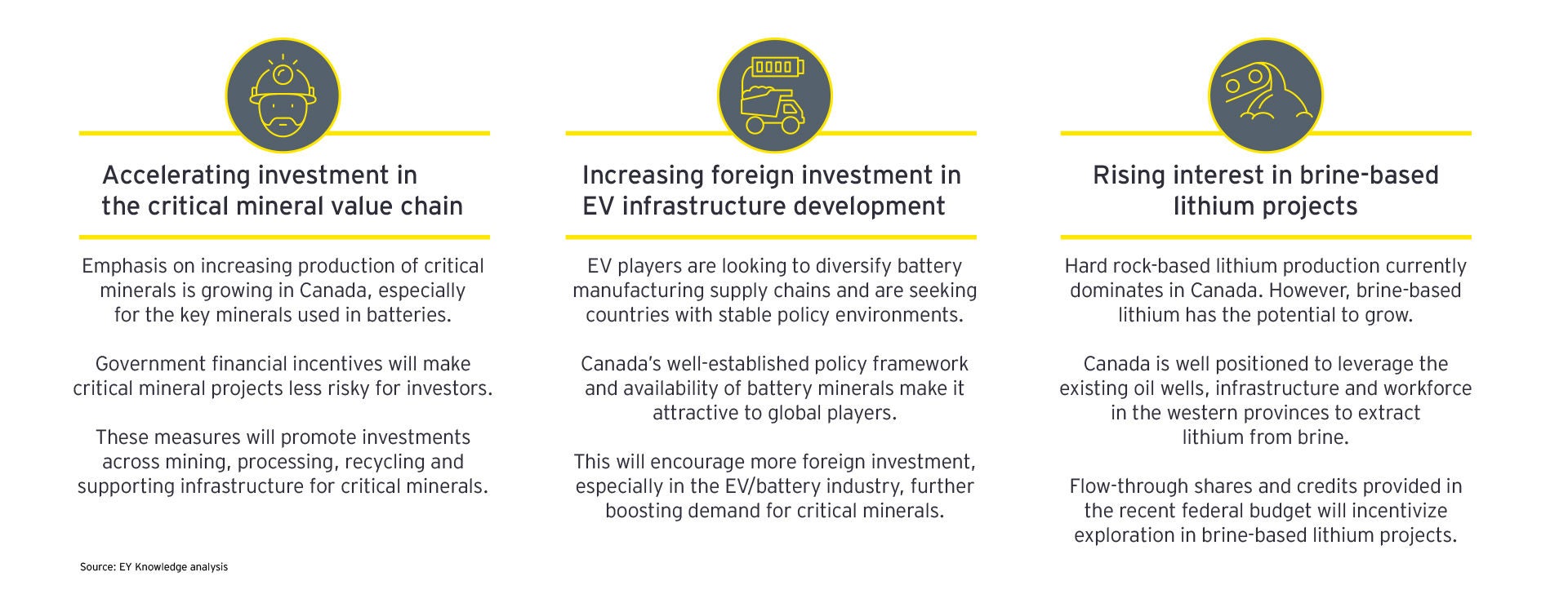

- Tax benefits will accelerate investments in the critical minerals value chain from mining to processing and recycling.

- The policies will attract foreign participation in developing EV infrastructure as companies look for opportunities to diversify supply chains.

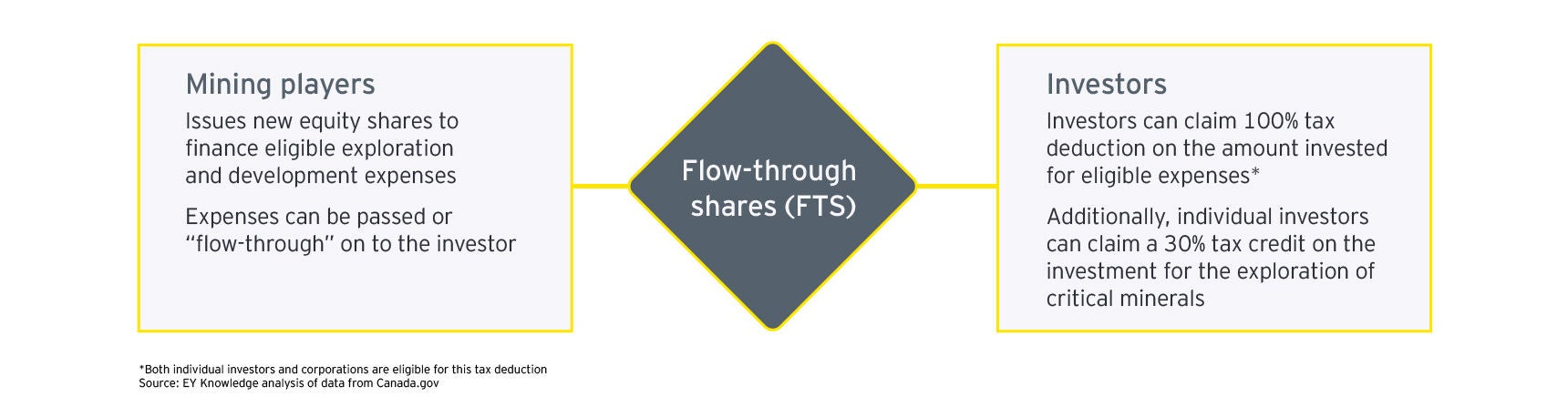

- Investments in brine-based projects are expected to rise, with players getting additional advantage through flow-through shares and tax credits.