EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

TaxMatters@EY is a monthly Canadian summary to help you get up to date on recent tax news, case developments, publications and more. From personal and corporate tax issues to topical developments in legislation and jurisprudence, we bring you timely information to help you stay in the know.

Is your biggest tax obligation the one you can’t see?

Tax issues affect everybody. We’ve compiled news and information on timely tax topics to help you stay in the know. In this issue, we discuss:

- Proposed measures to update the disability tax credit rules with respect to long-term eldercare

- A recent Québec Court decision on what constitutes a taxable benefit concerning business travel expenses where Revenu Québec questioned a taxpayer’s decision-making

- Recent Tax Alerts – Canada

Chapter 1

Long-term eldercare – attendant care and the proposed disability tax credit rules

Krista Fox and Lucie Champagne, Toronto

As Canada’s population continues to age, families are increasingly faced with decisions concerning long-term eldercare of family members, including the increasing costs related to attendant care. Tax assistance, in the form of non-refundable tax credits, helps alleviate some of the burden for families, but the relief available depends on the level of care provided and whether the individual is eligible for the disability tax credit. Depending on the circumstances, there may be an opportunity to optimize the credits.

The 2021 federal budget announced a number of measures intended to improve access to the disability tax credit (DTC) for 2021 and subsequent taxation years. In fact, the federal government estimates that an additional 45,000 individuals will qualify for the DTC and related benefit programs linked to its eligibility each year as a result of the new measures.1 As such, once enacted into law, these proposed measures may justify a re-examination of the available federal tax assistance available to families based on the specific circumstances of an individual’s situation to ensure prior and future filing decisions maximize available assistance. For example, an individual who qualifies for the DTC under the proposed measures may now be able to claim eligible part-time attendant care expenses where certain conditions are met.

The following discussion briefly explores the proposed changes to the DTC and how the DTC interacts with the tax credits available in respect of attendant care for elderly individuals who live at home, in a nursing home or in a long-term care facility.

The basics – medical expense tax credit

Eligible attendant care and nursing home or long-term care facility fees may generally be claimed as a qualifying medical expense eligible for the federal Medical Expense Tax Credit (METC). The federal METC is a non-refundable credit computed by applying the lowest marginal tax rate (currently 15%) to eligible medical expenses in the year in excess of the lesser of

- 3% of net income; and

- $2,479 (2022 amount).

The provinces and territories provide a comparable non-refundable credit.

An individual, or their spouse or common-law partner, may claim eligible attendant care expenses in respect of the couple. As such, it may be more beneficial for the lower-income spouse or partner to make the claim (due to the 3% net income threshold) provided the lower-income spouse or common-law partner has sufficient tax payable to claim the METC.

An individual may also claim attendant care expenses incurred for an adult dependent relative (e.g., adult dependent relatives such as a parent, grandparent, brother, sister, aunt or uncle), subject to certain limitations. There is no requirement that the individual requiring care live with the supporting relative or be claimed as a dependant for any other purpose; they must, however, be dependent on the claimant for financial support. The determination of whether an individual is dependent on the claimant for financial support is a question of fact, but generally that determination entails providing the basic necessities of life (e.g., shelter, food and clothing) regularly and consistently, and showing that the individual’s income is insufficient to meet their basic needs. The claimant may provide support voluntarily or pursuant to a legal commitment. The Canada Revenue Agency (CRA) may request proof of payment, such as grocery receipts or a lease agreement.

Attendant care expenses for a dependent relative other than a spouse or common-law partner is limited to the total of eligible amounts paid in excess of the lesser of 3% of the dependant’s income and $2,479 (2022 amount).

More than one person may claim the METC in respect of the same person, but the total amount claimed by all supporting persons cannot exceed the total expenses paid by them.

The basics – disability tax credit

A person who requires long-term care will likely be eligible for the DTC, which is a non-refundable tax credit. However, as explained below, the DTC is not available if you claim full-time attendant care or nursing home care as a medical expense for the disabled person.

In very general terms, the DTC is available when an individual is certified by an appropriate medical practitioner as having a severe and prolonged mental or physical impairment (or a number of ailments) such that the individual’s ability to perform a basic activity of daily living is markedly restricted or would be without life-sustaining therapy.2 Basic activities recognized by Canadian tax authorities include walking, feeding or dressing oneself, having the mental functions necessary for everyday life, seeing, speaking, hearing and eliminating bodily waste. A marked restriction is one that inhibits the individual from performing the activity almost all the time or results in the individual having to take an inordinate amount of time to perform the activity.

To claim the credit, the individual (or a representative) must file Form T2201, Disability Tax Credit Certificate, which must be signed by a specified medical practitioner.

Understanding the eligibility requirements for the DTC and obtaining the required approval from the CRA is not always simple. The CRA provides helpful guidance in guide RC4064, Disability-Related Information 2021, and in Income Tax Folio S1-F1-C2, Disability Tax Credit.

The federal DTC base amount for 2022 is $8,870, resulting in a non-refundable tax credit of $1,331. The provinces and territories provide a comparable credit. For 2022, the total tax benefit of the DTC ranges from approximately $1,650 to $2,825, depending on the province or territory of residence.

If the disabled individual does not require the full amount of the DTC to eliminate taxes payable, the unused portion may be transferred to supporting relatives.

Proposed changes to the DTC requirements

The following proposed amendments, announced in the 2021 federal budget, are intended to improve access to the DTC (and to other tax measures requiring a DTC certificate) for the 2021 and subsequent taxation years. The new rules will apply in respect of DTC certificates filed with the minister after the enacting legislation receives Royal Assent.

While these measures were included in draft legislation proposals released for public comment on February 4, 20223, as at the date of writing they have not been tabled in a related bill.4 We anticipate these proposals will be enacted in 2022; as such, individuals who qualify for the DTC under the new rules may be required to file a T1 adjustment request to claim the DTC for the 2021 taxation year once they receive approval from the CRA, unless they have requested (when completing Form T2201) that the CRA adjust their return automatically for all applicable prior taxation years.

If a supporting person is claiming the DTC for an individual 18 years of age or older, or the DTC is being claimed by the individual’s spouse or common-law partner, it will be necessary for the supporting person or spouse to file a T1 Adjustment Request, with the Form T2201, to claim the DTC once approval is received from the CRA.

Mental functions necessary for everyday life

The list of recognized mental functions necessary for everyday life has been expanded to include attention, concentration, memory, judgment, perception of reality, problem-solving, goal-setting, adaptive functioning, verbal and non-verbal comprehension, and regulation of behaviour and emotions. Under the current rules, memory and adaptive functioning are included in the list of mental functions necessary for everyday life. However, problem-solving, goal-setting and judgment are required to be considered together. Thus, this amendment helps ensure that eligibility for the DTC better articulates the range of mental functions necessary for everyday life.

Minimum therapy requirements

The measures include a reduction in the requirement for therapy to be administered a minimum of three times per week to a minimum of two times per week (the requirement that the duration of therapy must average at least 14 hours per week remains unchanged).

Time spent receiving life-sustaining therapy

The measures also include recognition, in determining the time spent receiving life-sustaining therapy, of time that is reasonably required by another person to assist an individual who is unable to perform the therapy on their own due to their disability.

In addition, the following will be recognized as time spent receiving life-sustaining therapy:

- Time for medical appointments to receive therapy or determine the appropriate daily dosage of medication

- Time for recuperation that is medically required after receiving therapy

- Reasonable time spent determining dietary intake and/or physical exertion (this information must be essential to and performed for the purpose of determining the dosage of medication that requires daily adjustments)

- If therapy requires daily consumption of a medical food or formula to limit the intake of a specific compound to required levels for proper development or functioning, reasonable time spent on activities directly related to determining the safe amount of the compound that can be consumed

Nursing home or long-term care facility fees

Although not defined for tax purposes, the CRA considers a nursing home to be a public facility offering 24-hour nursing care to patients. Generally, all regular fees paid for full-time care – including food, accommodation, nursing care, administration, maintenance, social programming, and activities – qualify as an eligible medical expense. To claim these expenses, the individual receiving the care must either qualify for the DTC, or have medical certification that they are, and will continue to be dependent on others for their personal needs and care due to lack of normal mental capacity.

Additional personal expenses that are separately identifiable, such as hairdressing fees, are not allowable expenses.

An individual who resides in a nursing home may have supplementary personal attendants. The salaries paid to these attendants may be considered a qualifying medical expense (up to $10,000 annually, $20,000 in the year of death), along with the institution’s fees.

A retirement home will generally not provide the care that is required to be classified as a nursing home, and thus the fees would not qualify as an eligible medical expense. To the extent that the attendant-care component of the fee can be set out separately in an invoice, that portion of the fee will qualify as an eligible medical expense (proof of payment must be provided). However, it may only be considered part-time care (and limited to $10,000 annually or $20,000 in the year of death), as discussed below.

A particular floor within a retirement home may qualify as a nursing home. For example, the home may provide independent or semi-independent accommodations but have certain floors dedicated to full-time care. Whether the specific floor qualifies as a nursing home will depend on the size of the facility’s staff, the staff’s qualifications and the equipment available to provide 24-hour nursing care to patients.

Full-time in-home attendant care

Eligible in-home attendant care expenses are not limited to assistance with basic living needs, such as dressing and bathing. Assistance with personal tasks such as cleaning, meal preparation, shopping, transportation and banking may also be claimed. Attendant care can also include providing companionship to an individual. However, costs for such services purchased individually or from a commercial provider (e.g., cleaning agency or transportation service) do not qualify.

To claim these expenses, the individual receiving care must either have an approved Form T2201, or certification from a medical practitioner that the individual is, and will likely, continue to be dependent on others for their personal needs and care due to a mental or physical impairment, and needs a full-time attendant.

Full-time in-home attendant care expenses can be claimed for only one attendant in a given period, although an individual may have several attendants over a period of time. The attendant must be 18 or over at the time the wages were paid and cannot be the spouse or common-law partner of the claimant. This means that an individual can pay one parent to care for the other parent, and possibly claim the amount paid as an eligible medical expense, as the amount is not paid to the claimant’s spouse. The parent providing care would be required to include the amount in taxable income; thus this option may not be desirable if the individual is subject to a marginal income tax rate in excess of 15%.

A private attendant hired for in-home care is generally considered to be an employee. The payer should ensure that appropriate payroll deductions and remittances are made to the CRA. Although the source deductions and the employer portion of Canadian Pension Plan, Quebec Pension Plan and Employment Insurance contributions qualify as attendant care costs, in the case of a live-in attendant, imputed salary (e.g., the cost of board and lodging) does not qualify, as it is not considered to be an amount paid.

Full-time care restriction on the DTC

If full-time attendant care or nursing home care expenses are claimed under the above-noted provisions of the METC, the DTC cannot be claimed by anyone in respect of the individual. Since these expenses generally far exceed the DTC base ($8,870 in 2022), it may be more advantageous to forego the DTC in favour of the METC.

Part-time attendant care

Where in-home care is not claimed, or perhaps not eligible under the above full-time provisions (for example in the case of a part-time attendant), an individual may be able to claim up to $10,000 annually ($20,000 in the year of death) for part-time attendant care provided in Canada. Again, the individual must be eligible for the DTC, but the DTC can be claimed along with the METC for these expenses instead of under one of the full-time care provisions. The combination of the METC claim and the DTC provides relief in respect of $18,870 of related costs for 2022. Depending on the expenses incurred, claiming attendant care expenses under this provision to benefit from the DTC may result in a higher combined non-refundable tax credit amount (e.g., full-time attendant costs were only incurred for part of the year).

Since eligible medical expenses may be claimed by supporting relatives and the $10,000 limit applies to each claimant, it may be beneficial to claim the costs under the part-time care provision to reap the benefit of the DTC as well.

Planning considerations

Because of the interaction between the DTC and the METC, and the ability for supporting relatives to claim certain expenses, it’s important to consider and choose the most advantageous combination each year, particularly in light of the proposed changes to the DTC requirements outlined above. In making this determination, other medical expenses paid during the year, as well as other non-refundable credits, must be considered to maximize the benefits available.

Interaction between the METC and the DTC

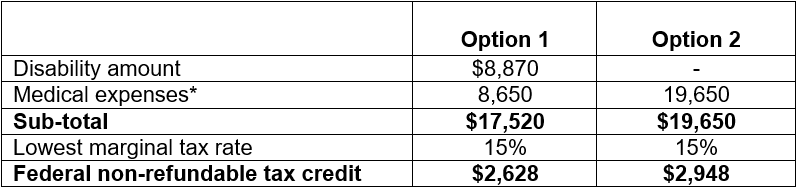

Example one

Lauren is 75-years old and she resides in a retirement home where she receives full-time attendant care. Lauren has an approved Form T2201 on file with the CRA.

In 2022, Lauren earned pension income of $45,000. The retirement home provided Lauren with a receipt indicating that she paid $21,000 of eligible attendant care expenses during the year.

Lauren has the following two options to consider when preparing her 2022 tax return:

- Claim $10,000 of attendant care expenses (under the part-time care attendant provision) and the DTC; or

- Claim the full amount of eligible attendant care expenses and no DTC.

Analysis

* Eligible medical expenses in excess of the lesser of (1) 3% of net income ($45,000 * 3% = $1,350); and (2) $2,479. Thus, eligible medical expenses total $8,650 and $19,650, respectively.

Conclusion

Option two yields a higher federal non-refundable tax credit.

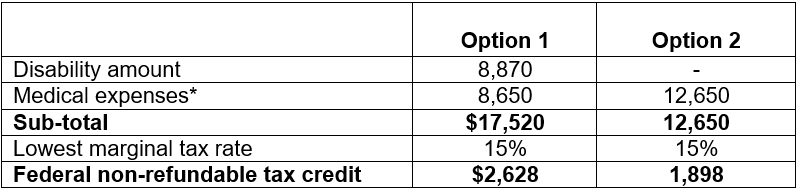

Example two

Assume the same facts as above, except that Lauren’s eligible attendant care expenses total $14,000 since the expenses were incurred for only a portion of the year.

Analysis

* Eligible medical expenses in excess of the lesser of (1) 3% of net income ($45,000 * 3% = $1,350); and (2) $2,479. Thus, eligible medical expenses total $8,650 and $12,650.

Conclusion

Option one yields a higher federal non-refundable tax credit.

Other considerations

The conclusions reached could change if Lauren is financially dependent on her two daughters. In this case, Lauren could claim the DTC and each of her daughters could claim up to $10,000 of attendant care expenses paid to the retirement home (under the part-time attendant care provision). As such, up to $20,000 of attendant care expenses would be claimed for the METC (in excess of the threshold of 3% of Lauren’s net income or $2,479) in addition to the DTC. If Lauren does not require the full amount of the DTC to eliminate taxes payable, the unused portion could be transferred to her daughters.

Learn more

To learn more about medical expenses and other personal tax topics related to long-term eldercare, refer to our publication Managing Your Personal Taxes: a Canadian perspective or contact your EY tax advisor.

Chapter 2

Court of Québec rejects the second-guessing of an employer’s business acumen; reverses taxable benefit

Lussier c. Agence du Revenu du Québec, 2022 QCCQ 9

Lindsay Turcotte and Alexandra Auger, Montréal

In a recent decision by the Québec Court, it was pointed out that tax authorities cannot second-guess taxpayers’ business decisions unless their decisions are unreasonable. The principle that the Minister has no right to substitute his judgment and advance his own business alternatives has been well established since the Gabco decision rendered by the Exchequer Court in 1968.1 Despite the well-established status of this principle, determining what is a reasonable decision is not easy and hence it continues to be called into question.

In this decision, Revenu Québec assessed the employee for a taxable benefit after his employer had sent him on a business trip. However, the Court rejected Revenu Québec’s arguments and allowed the appeal.

Facts

Mr. X had been an employee of Opco since 2012. Opco was in the insurance business. Necessary to the carrying on of that business were the brokers and financial advisors who sold Opco’s products. Opco dealt with the brokers and financial advisors through managing general agents (MGAs) who acted as intermediaries. Since Opco did not have a direct relationship with the brokers and the financial advisors, its relationship with the MGAs was crucial to its business model.

During the 2015 taxation year, Opco was solicited by an MGA to sponsor a conference to be held in Mexico. The sponsorship included airfare, hotel accommodations and the opportunity for the sponsor to present its insurance products. As several of Opco's competitors were already sponsoring the conference, Opco also accepted, seeing it as a business development opportunity. Mr. X, being responsible for the relationship between his employer and the MGA organizing the conferences, was chosen to represent Opco.

Throughout the conference, a variety of activities were offered. Some were directly related to work and others were planned to entertain and offer a business development forum. Mr. X consequently made a presentation regarding his employer's products, but also participated in organized leisure activities. Despite attending the conference, Mr. X continued to answer his work emails and calls. As soon as he returned, Mr. X reported to his employer on his participation in the conference activities and business development he accomplished.

In 2016, Revenu Québec audited the MGA that had organized the conference, focusing on the expenses incurred for the participants. At the conclusion of the audit, Revenu Québec determined, based on sections 32, 36 and 37 of the Taxation Act,2 that the trip constituted, in the proportion of 62.5%, a taxable benefit for Mr. X. As a result, Mr. X was assessed for an amount of $1,871.54.

Analysis

The Court rejected all of Revenu Québec’s arguments and allowed the appeal. As a first argument, Revenu Québec pointed out that Mr. X had participated in social activities, such as a catamaran ride, which indicated a personal component to the business trip. However, according to the Court, the jurisprudence has been sufficiently consistent with respect to the fact that, while certain activities may be of an entertaining nature, the trip can still be characterized as a business trip. The Court held that, in analyzing such an expense, auditors should refrain from compartmentalizing each individual activity of the trip and should rather consider its overall purpose. Accordingly, one should not make a strict calculation to determine the leisure proportion of the activities of such a trip as was done in Mr. X’s case.

Secondly, Revenu Québec argued that the conference could have been held in Québec rather than in a foreign country. The Court rejected this argument, stating that the Opco had no input into the location of the conference and, in any event, the location where an expense is incurred does not impact the application of the Taxation Act.

Last, Revenu Québec noted that Opco was under no obligation to send a representative to the conference and it could simply have displayed its trademark at the conference and in the conference materials. Relying on established case law, the Court cautioned that [unofficial translation] “…tax authorities must not dictate how a taxpayer should conduct their business unless their decisions are unreasonable.”3 The Court noted that in a competitive environment, business development is crucial, stating that it would have been odd, to say the least, for Opco not to take advantage of this opportunity, all the more so given that Opco’s competitors were sending their own representatives.

Under these circumstances, the Court reiterated that one should refer to the words of Justice Bowman in Rachfalowski,4 where he indicated that the question is whether the expense is primarily for the benefit of the employer or the employee.5 The fact that Mr. X went to the conference by himself as opposed to with his family and the fact that he continued to manage his normal work responsibilities for the duration of the trip indicate that his attendance at the conference was for the benefit of Opco. The conference was a business opportunity for Opco to strengthen its relationship with the MGA and the brokers. Mr. X’s participation in the conference was not the result of a prize or an award. Furthermore, Opco considered the entire trip as regular working days. Based on the above, the Court concluded that Revenu Québec had not appreciated the importance or the means of business development and had substituted its view of an acceptable business model for that of Opco. Accordingly, attendance at the conference in Cancun could not be characterized as an employee benefit for Mr. X.

Lessons learned

In 2002, the Supreme Court of Canada, in Stewart v Canada,6 implied that tax authorities should abstain from second-guessing taxpayers’ business decisions.7 Indeed, their perception of the business decision is prejudiced by the benefit of hindsight, which may result in an unfair analysis of the taxpayer's decisions.8

Similarly, in Ankrah,9 the Minister disallowed business expenses based on the view that a business experiencing operating losses should reduce its spending. However, the Court concluded that, as long as the taxpayer incurred the expenses in an honest belief that they would eventually lead to profits, the reasonableness of the expense should not be questioned.

This appears not only to be a consequence of the fact that the term “reasonable” is not defined in the Taxation Act or the Income Tax Act (Canada), but also because the courts have repeatedly cautioned the tax authorities not to substitute their judgment for that of a taxpayer in determining the reasonableness of an expense.10

- Gabco Ltd. v Minister of National Revenue, 68 D.T.C. 5210 (Exchequer Court of Canada), confirmed more recently by Petro-Canada v The Queen, 2004 FCA 158. See also Jolly Farmer Products Inc. v The Queen, 2008 TCC 409.

- RLRQ, c. I-3. Corresponding sections of subsections 5(1) and 6(1) of the Income Tax Act, RSC., 1985, c. 1 (5th Supp.).

- At para. 37.

- Rachfalowski v The Queen, 2008 TCC 258.

- Ibid., at para. 22.

- 2002 SCC 46.

- Ibid., at para. 47.

- Rachamalla v The Queen, 2000-2416(IT)I, at para. 22.

- Ankrah v The Queen, 2003 TCC 413.

- Stewart, note 9, at para. 55; Corbett v The Queen, [1997] 1 C.T.C. 2 (FCA), at para. 12; Tonn v. The Queen, [1996] 1 C.T.C. 205 (FCA), at para 61; Keeping v The Queen, 2001 FCA 182; para. 5; Drouin c. The Queen., 2013 TCC 139, at para. 260; Kyard Capital 2007 inc. c. Agence du revenu du Québec, 2019 QCCQ 1617, at para. 35; Wise v. The Queen, 2019 TCC 196, at para. 61.

Chapter 3

Recent Tax Alerts – Canada

Tax Alerts cover significant tax news, developments and changes in legislation that affect Canadian businesses. They act as technical summaries to keep you on top of the latest tax issues.

Tax Alerts – Canada

Tax Alert 2022 No. 22 – Federal budget highlights

Tax Alert 2022 No. 23 – Federal budget

Tax Alert 2022 No. 24 – Newfoundland and Labrador budget

Tax Alert 2022 No. 25 – Manitoba budget

Tax Alert 2022 No. 26 – Government of Canada to repeal the Certain Goods Remission Order (COVID-19)

On April 14, 2022, Canada Border Services Agency (CBSA) Customs Notice 22-08 announced that the Certain Goods Remission Order (COVID-19) will be repealed and entitlement to relief under the order will end on May 7, 2022.

Tax Alert 2022 No. 27 – Ontario budget 2022‑23

Tax Alert 2022 No. 28 – Highlights from the CRA’s 2020 Mutual Agreement Procedure Report

On 4 March 2022, the Canada Revenue Agency (CRA) released its Mutual Agreement Procedure (MAP) Program Report for calendar year ended 31 December 2020. The report provides an overview of the operations of the MAP program, including statistical analyses of cases completed and in progress, covering cases dealing with resolution of double taxation or taxation not in accordance with a bilateral tax treaty.

Publications and articles

Summary

For more information on EY’s tax services, visit us at https://www.ey.com/en_ca/tax. For questions or comments about this newsletter, email Tax.Matters@ca.ey.com. And follow us on Twitter @EYCanada.

Direct to your inbox

Sign-up to receive TaxMatters@EY by email each month.

Related content

TaxMatters@EY: Family Wealth Edition – April 2023

In this issue, we discuss the tax treatment of RRSPs when the annuitant passes away

TaxMatters@EY: Family Wealth Edition – February 2023

In this issue, we provide an update on recent developments in the federal government’s initiatives to tackle housing affordability.

Managing Your Personal Taxes 2023‑24

Explore Managing Your Personal Taxes: a Canadian Perspective for helpful tax-saving ideas

In this issue: Proposed measures to update the DTC rules with respect to long-term eldercare; Québec Court decision on taxable benefit concerning business travel expenses.

In this issue: tax filing tips and reminders; personal tax deductions and credits; TCC decision on deductibility of employee travel expenses

In this issue: Personal tax return tips; Tax Court decision on post-mortem pipeline planning

In this issue: Federal and provincial budgets; carpooling could lead to unintended tax consequences; taxpayer’s ignorance of tax rules doesn’t constitute reasonable error

TaxMatters@EY: Family Wealth Edition – April 2024

In this issue: Important considerations for your registered retirement savings plan (RRSP) as you prepare for retirement

In this issue: Personal tax filing tips for 2023 T1 returns; Tax Court decision that charitable donations without donative intent do not qualify as gifts for tax purposes

TaxMatters@EY: Family Wealth Edition – February 2024

In this issue: Tax considerations when planning for the next generation to take over the business.

In this issue: better questions for year-end tax planning; employee travel allowances based on a standardized starting point are taxable

TaxMatters@EY: Family Wealth Edition – October 2023

In this issue: Family Wealth Edition, we provide updates on tax strategies and related topics for preserving family wealth.

TaxMatters@EY – September 2023

In this issue: tax relief for students; FCA case concerning ineligibility for GST/HST new housing rebate due to other names on the title

In this issue, we discuss the tax In this issue: choose the most suitable instalment payment method for your circumstances; Tax Court decision on alternative assessment challengeof RRSPs when the annuitant passes away

In this issue: Year-end tax planning tips; year-end remuneration planning tips; Tax Court decision allowing deduction for employee travel between home and worksites

TaxMatters@EY: Family Wealth Edition ‑ October 2022

In this issue, we discuss the savings account options for new home buyers in Canada, including the proposed new tax-free first home savings account (FHSA).

TaxMatters@EY – September 2022

In this issue: Multigenerational home renovation tax credit; income tax changes for charities; amount paid for use of corporate boat as sufficient for personal benefits

TaxMatters@EY: Family Wealth Edition – July 2022

In this inaugural issue of TaxMatters@EY: Family Wealth Edition, we provide updates on tax strategies and related topics for preserving family wealth.

In this issue: METC for fertility and surrogacy benefits; prescribed rate loan update; court decision on what’s protected by solicitor-client privilege

In this issue: Can a loss on the sale of a home after a death be claimed; status update on trust filing and reporting requirements; Tax Court denies ABIL claim