EY si riferisce all'organizzazione globale, e può riferirsi a una o più delle società membri di Ernst & Young Global Limited, ciascuna delle quali è un'entità legale separata. Ernst & Young Global Limited, una società britannica a responsabilità limitata, non fornisce servizi ai clienti.

Author: David Oliveira, Head of Transaction Strategy Execution - EY Parthenon

In the current M&A transactions landscape, acquiring companies are grappling with a myriad of complex challenges regarding value capture.

During an acquisition process, buyers may contend with common obstacles such as integration expenses, value erosion and dyssynergies (e.g., cannibalization of revenue, loss of partners, harmonization of compensation), beyond the purchase price of the target and acquisition premium. To offset this integration induced value losses and secure a positive return on investment, organizations are increasingly pursuing value creation opportunities through synergies realization.

In our latest Buy & Integrate Barometer 74% of the executives confirmed the highlighted above, synergies and value creation opportunities are the most crucial factor on the target selection process, still they also confirmed that 70%-90% of M&A do not meet their objectives or reach sustainable value, mostly because of late identification of synergies, lack of due diligence and inadequate post-closing and integration considerations.

Identification of synergies and value creation opportunities are therefore critical, and having a clear understanding how these are going to be captured from is key since an early stage of the transaction cycle. In the survey conducted 62% of the respondents emphasized that synergy identification is the pivotal element during due diligence process, as it quantifies value, facilitates strategic decision making, and sets the path to unlock the deal’s full potential.

Typically, these opportunities are classified / identified in different categories, for instance:

- Cost: refer to the potential reductions of costs that can be achieved through the integration (or operational optimization) of two or more entities: for example, when two companies merge, they may be able to consolidate their back-office functions, such as finance and HR, leading to cost savings through the elimination of duplicate systems and roles;

- Revenue: involve leveraging the combined strengths and resources of different entities to generate additional sales and revenue growth opportunities. This can be accomplished through synergy initiatives like cross-selling or offering a new product to an existing customer base. For instance, the acquired company has a complementary product, they can cross-sell their products to each other's customer base, leading to an increase in revenue;

- Financial: focus on optimizing financial operations and capital structure to improve financial performance including working capital improvements or CAPEX savings. Considering an acquisition, the combined entity may have a stronger balance sheet, allowing them to negotiate better borrowing terms with financial institutions resulting in benefits such as lower interest rates.

In our perspective although executives recognize synergies as a priority both in terms of timing to trigger it and value creation opportunity, the drawback is that when there isn’t a structured process implemented throughout the whole lifecycle of the transaction the likelihood of failure is high, reason why 44% highlighted in the survey that they’ve achieved lower synergies than the ones they identified.

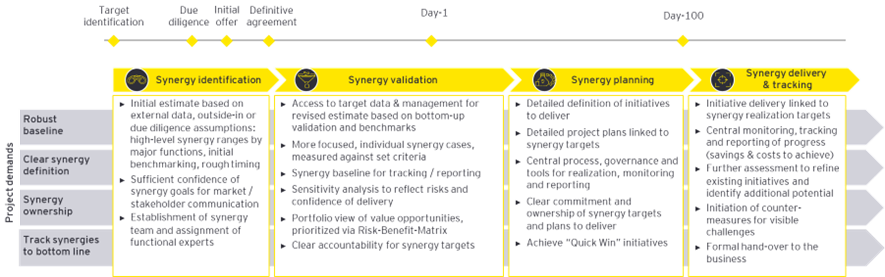

For this reason, the implementation of a structure process that ensures end to end visibility since identification to realization is key. EY’s a 4-Step-Synergy-Methodology supports companies to set realistic targets, achieve objectives and initiate counter measures in case of deviation in a timely manner.

- Synergy Identification: Companies should start with the identification of synergies during the pre-signing phase of a deal. The leadership or project team on the buy-side must identify and define synergy targets and commit to value capture objectives. The objective is to define the main synergy areas and develop top-down synergy estimates using benchmarking and internal/external know-how of the business and the target. It is important to be aware of the possibility that the transaction can also create dyssynergies in order to identifying them and create a plan with countermeasures to mitigate or decrease their impact;

- Synergy Validation: Once having access to internal target data and management the set synergy objectives must be validated and adjusted. Therefore, teams of the respective synergy areas must be mobilized to identify bottom-up value creation initiatives and develop individual synergy cases with clear accountability to be measured against target criteria;

3.Synergy Planning: In the pre-closing phase, the project teams need to plan the synergy realization setting-up defined timelines, keeping in mind existing dependencies, the overall integration plan and the daily business. This step must be planned carefully since it is crucial for the realization of the set synergy targets. Team members accountable for the synergy targets should be involved into this process to ensure their commitment and the feasibility of the realization plans and timeline;

4.Synergy delivery and tracking: Post-closing synergy delivery and tracking should be in progress and quick wins (easy to achieve synergies) must be realized. Furthermore, the progress of all synergy initiatives must be tracked against the set objectives. In case of deviation from the objectives, countermeasures can be launched to fill the gap.

It is important to keep in mind that the 4-steps are not completely separated from each other and can overlap. The earlier the process starts and the more consequent it is executed until the end, the higher will be the value captured, during an integration project.

Finally, it’s also significant to highlight that value creation through synergies is just one piece of a complex journey that needs to be combined and aligned as whole to ensure success. In the particular case of synergies, the integration process is a very relevant aspect, as alignment between the two workstreams enhances its realization. This, is also consistent with 60% of the surveyed executives who suggested that starting integration early in the transaction process is the most appropriate action to increase the chances of achieving deal synergies.

Sources

EY Europe West Buy & Integrate Barometer, November 2023

Alexander C., Banking and capital markets sector actively pursuing M&A, 2018, Global Capital Confidence Barometer

Summary

EY conducted research based on 278 life sciences transactions that closed between 2010 and 2017 and found that bolt-on deals outperformed other transaction types.