EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

This report analyzes the state of tourism in Japan following the easing of COVID-induced travel restrictions, as well as the extent to which visitors are attracted to its rural areas. The report also brings together proposals for re-generative tourism, which aims to generate positive results to counter the negative impacts of overtourism, for example.

Summary

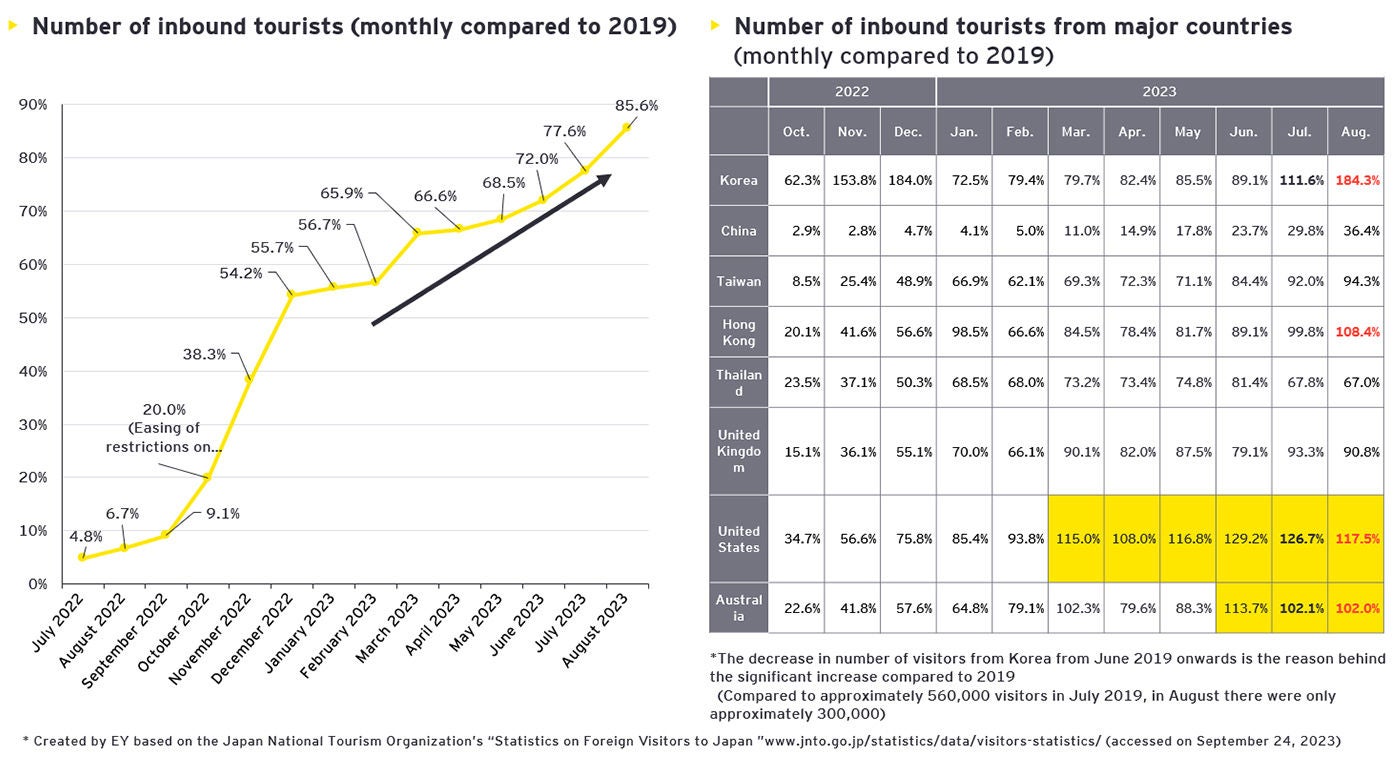

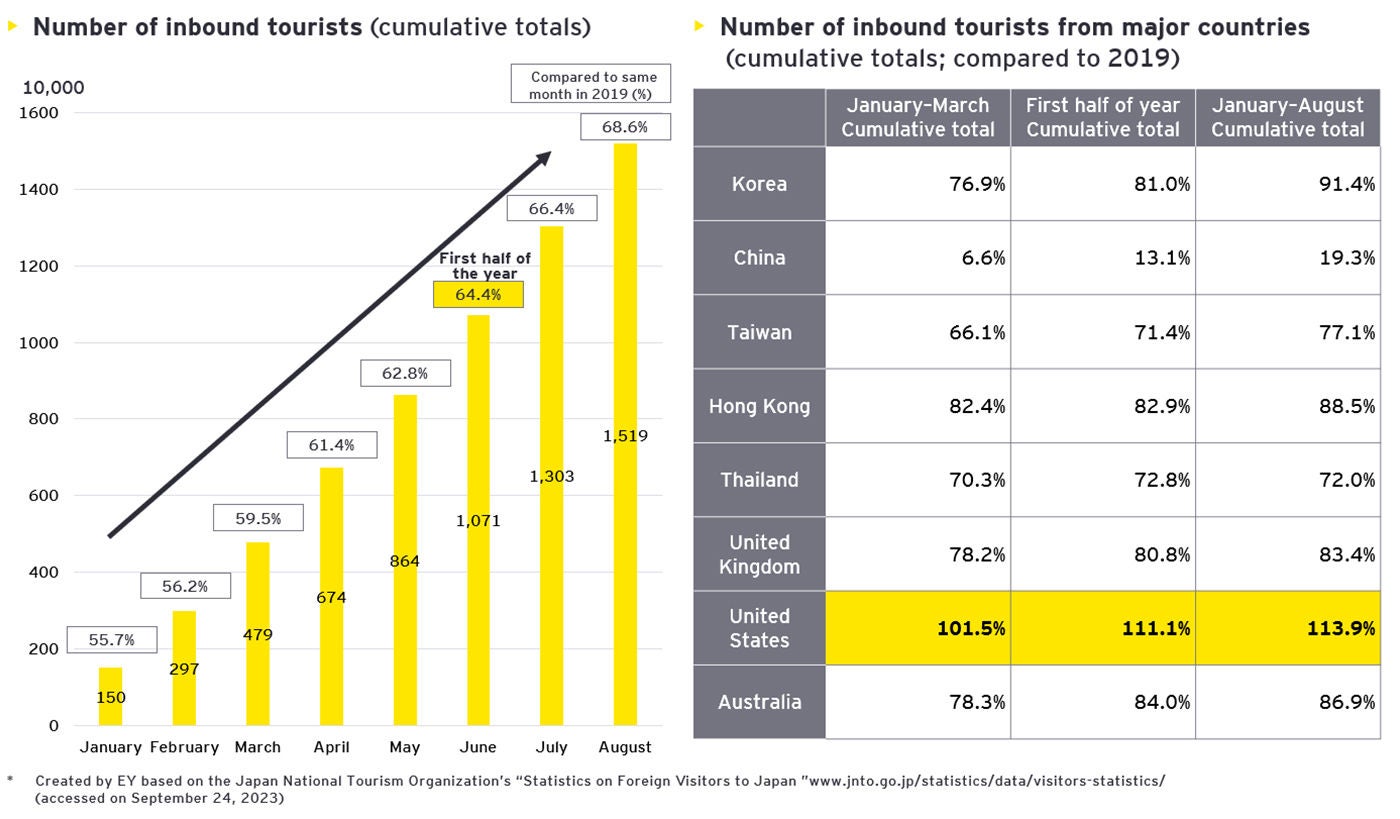

- In the first half of 2023, inbound tourism returned to around 64.4% of the same period in 2019

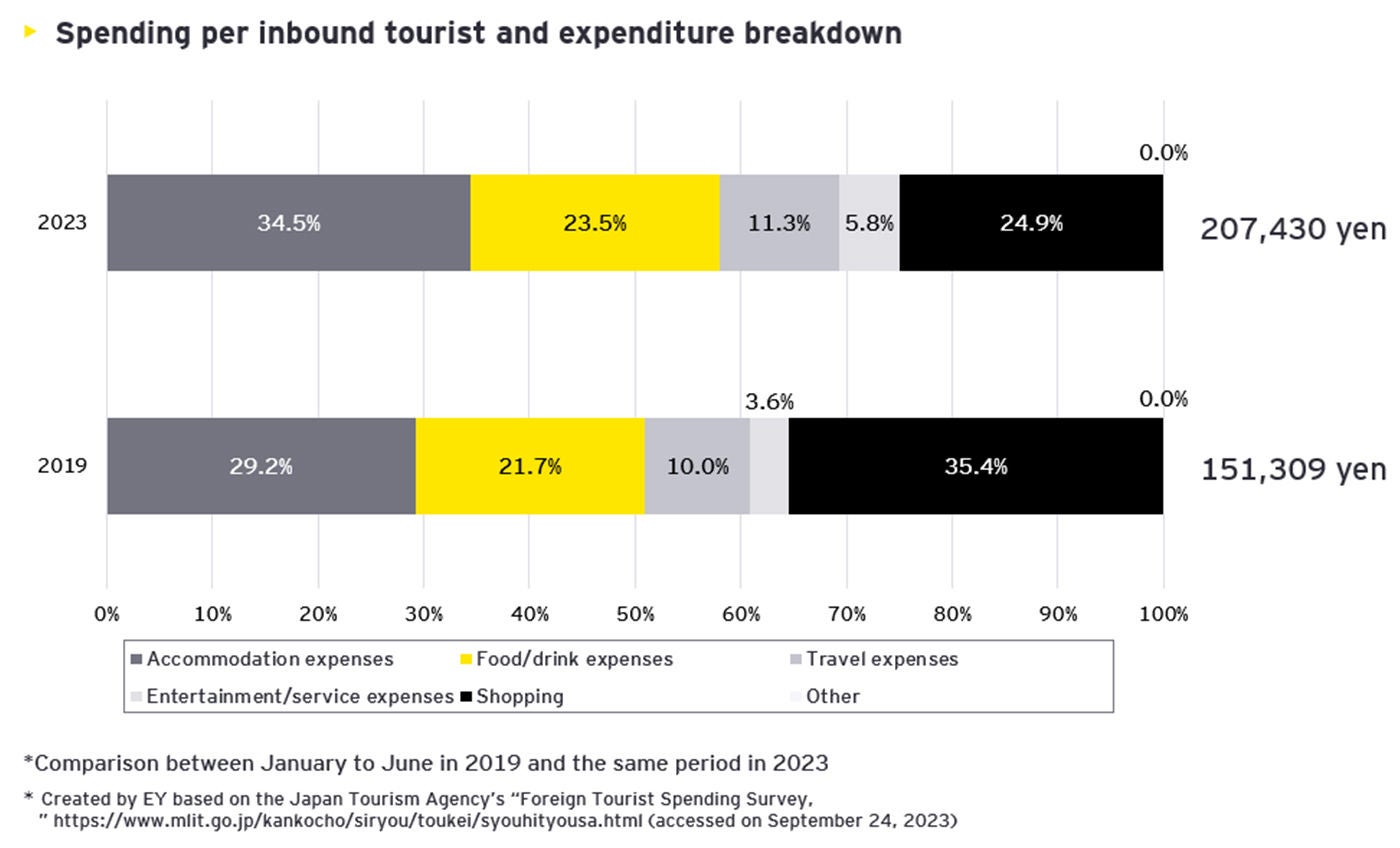

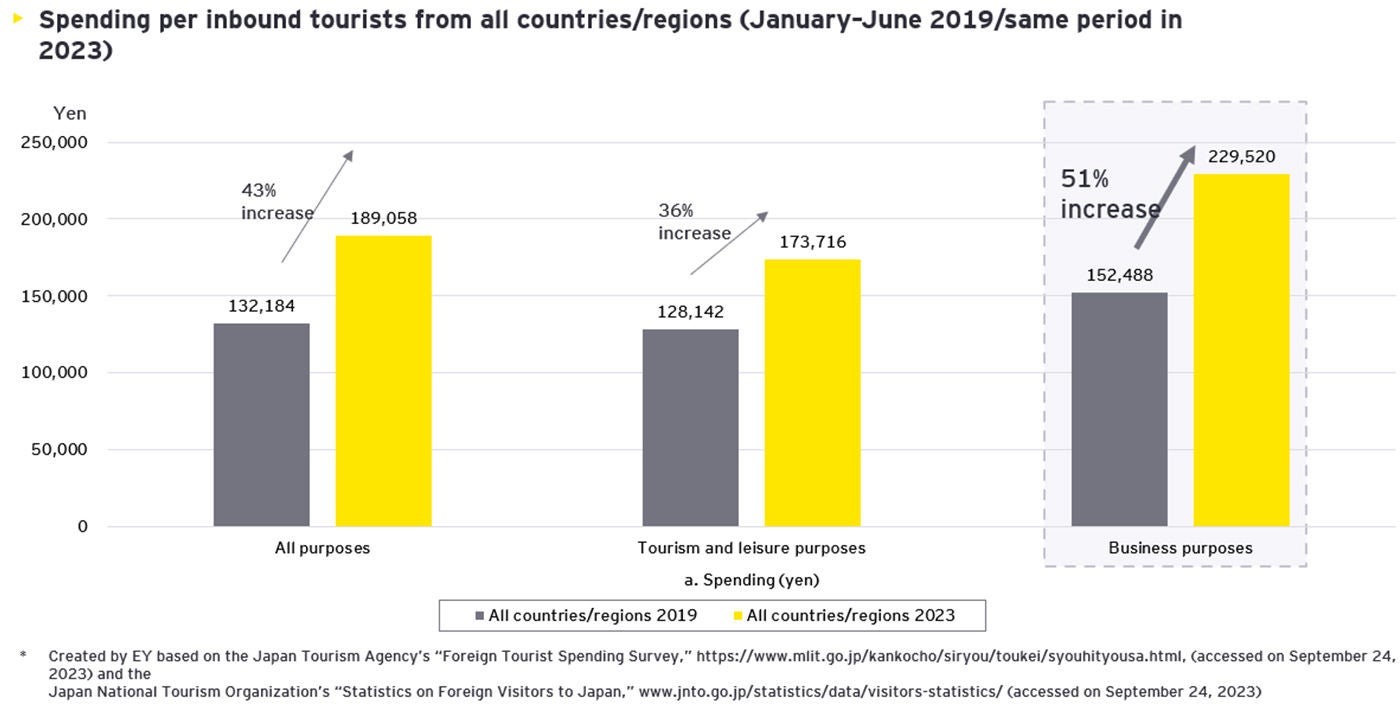

- Spending increased 40% compared to the same period in 2019, which is the equivalent of an approximately 50,000 yen increase Despite a weak yen, money spent on shopping decreased, while there was an increase in spending on accommodation, food and drink, activities, and other experiences

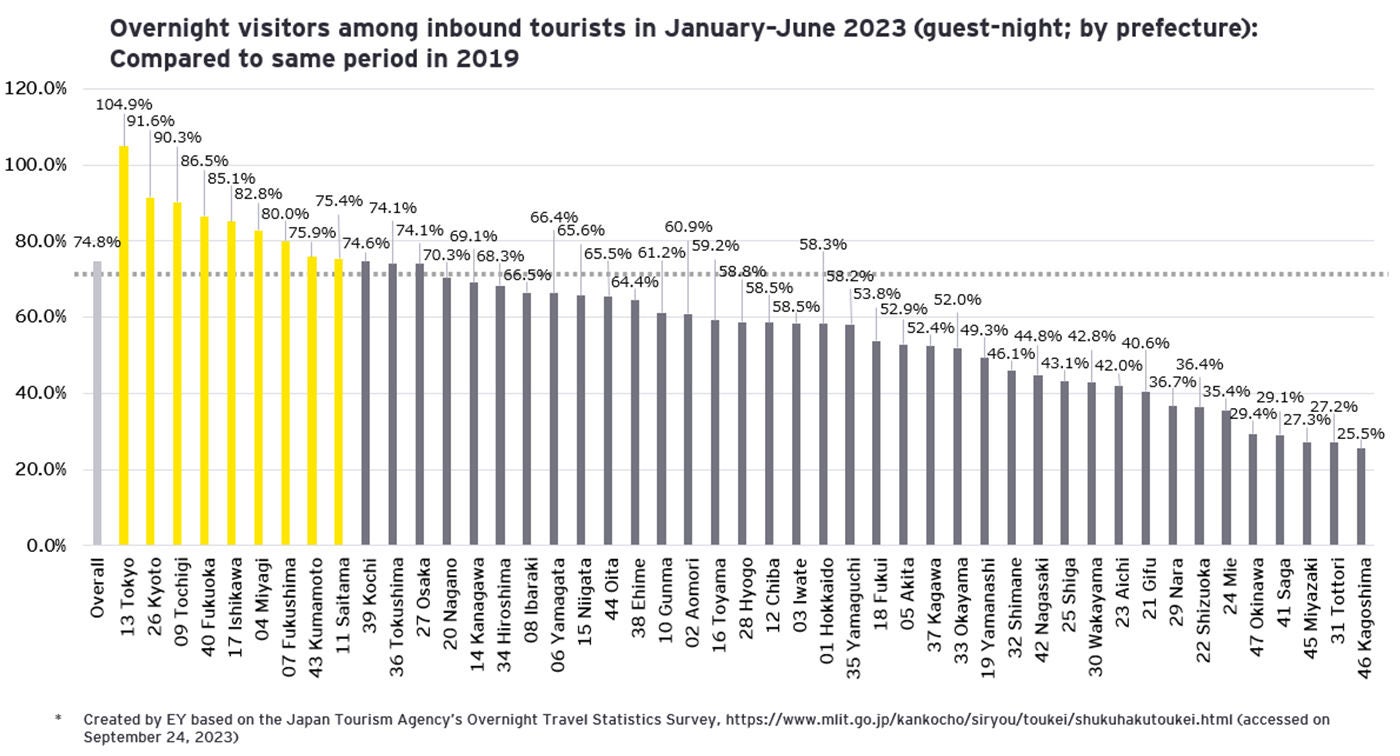

- In terms of overnights visitors, numbers in Tokyo have already exceeded pre-COVID levels, numbers in Kyoto and Tochigi have returned to more than 90% of pre-COVID levels, while in Fukuoka, Ishikawa, and Miyagi this is more than 80%

- Once inbound tourism has recovered completely, re-generative tourism initiatives will be essential to making a positive impact on tourist destinations

It has now been more than a year since the easing of restrictions on entering Japan caused by the COVID-19 pandemic.

When looking back over this time, although there was a period in which recovery slowed down, overall inbound demand has continued to recover. When looking at the latest inbound tourism figures from August 2023, inbound tourism has recovered to 85.6% of that in 2019, prior to the outbreak of the pandemic. This booming recovery has been particularly prominent among visitors from the US and Australia, from which numbers continue to exceed pre-COVID levels. Moreover, visitor numbers from Hong Kong, Taiwan, and Korea, who have made up the majority of inbound visitors to date, have almost completely returned to pre-COVID levels. When numbers from China recover, it is thought that the number of tourists visiting Japan from overseas will surpass those from before the pandemic.

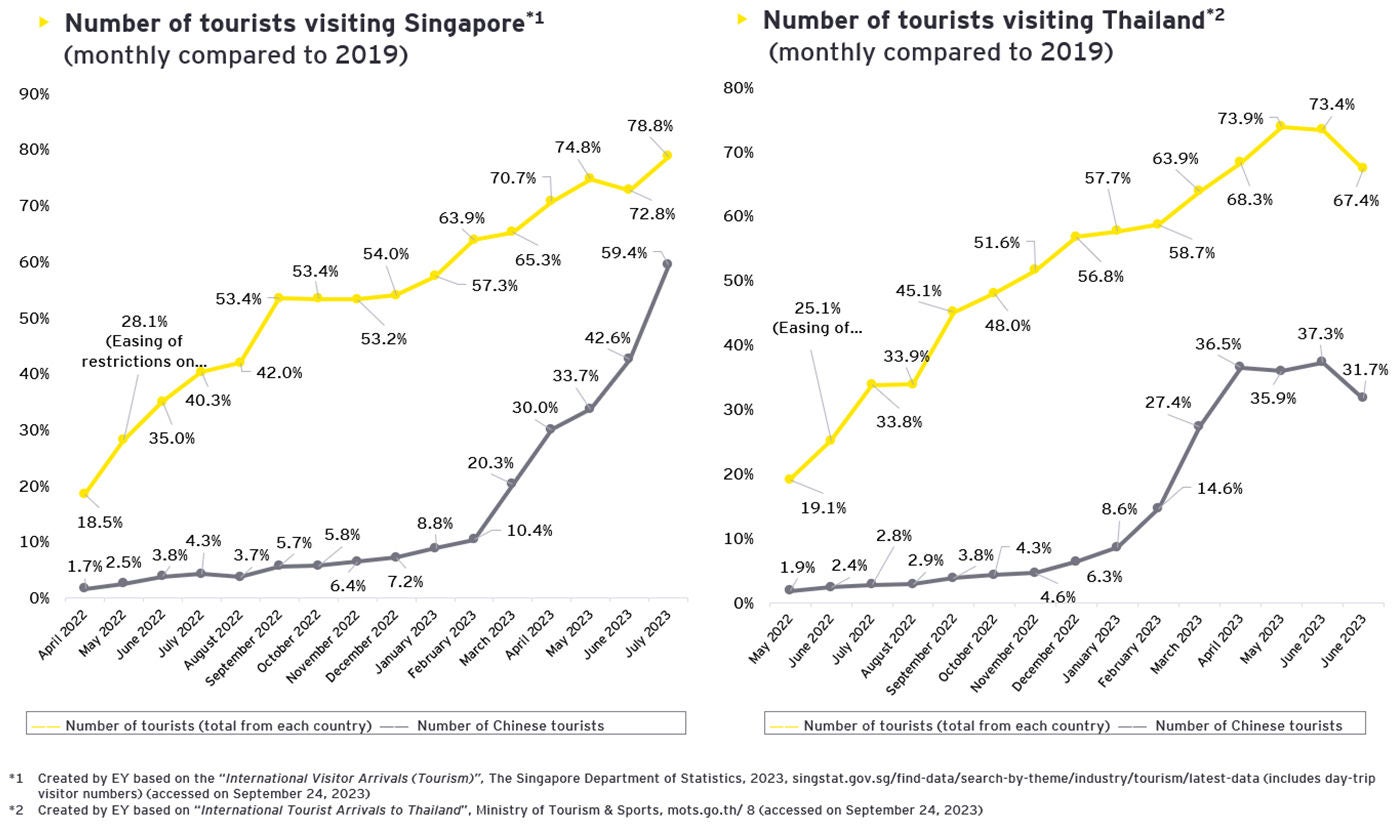

As for the Chinese market, although the ban on group travel has been lifted, at 36.4% the numbers still remain low compared to pre-COVID levels. Looking at the number of Chinese visitors to fellow East Asian countries Singapore and Thailand, numbers to Singapore are just under 60% of pre-COVID levels, while in Thailand it is the same as in Japan at below 40%. This suggests that rather than the slow recovery being limited to Japan, Chinese people still have little desire to travel overseas to Asia as a whole.

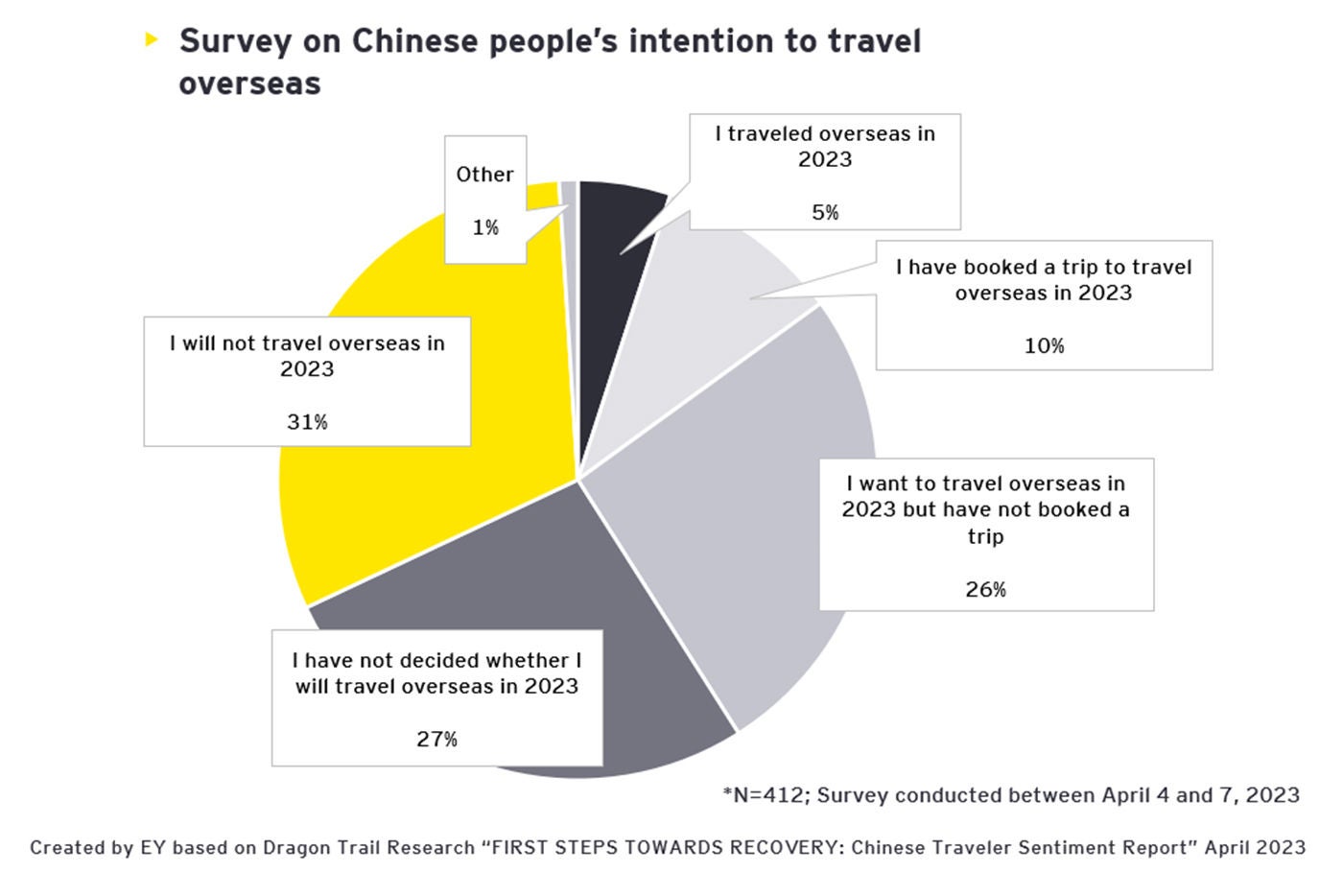

According to a survey by Dragon Trail Research which looked at the attitudes of Chinese people toward overseas travel, more than half of respondents said they had no clear plan to travel overseas in 2023. As to the reasons, a survey in January 2023 mainly revealed concerns surrounding health and economic difficulties caused by the pandemic. 1When looking at a survey from June, however, although impacts from the pandemic remained, the main obstacles to overseas travel had changed to personal safety and political Instability2.

In line with this circumstances, the full-scale recovery in Chinese visitor numbers to Japan is expected to be from next Chinese New Year (February) onwards.

Inbound Tourists in the First Half of 2023

We can now look at data from the first half of 2023 to study the actual circumstances and numbers in the recovering inbound tourism market.

The total number of visitors to Japan in the first of 2023 was 10.71 million. This shows a return to approximately 64.4% of the same period in 2019. This increases to 68.6% in August, and it is expected that the number will increase further to just under 80% by the end of the year. A recovery in visitors from the US is especially prominent, and numbers have already exceeded 2019 levels. Elsewhere, numbers from Korea and Hong Kong have recovered to around 90% and are expected to reach 2019 levels within the year.

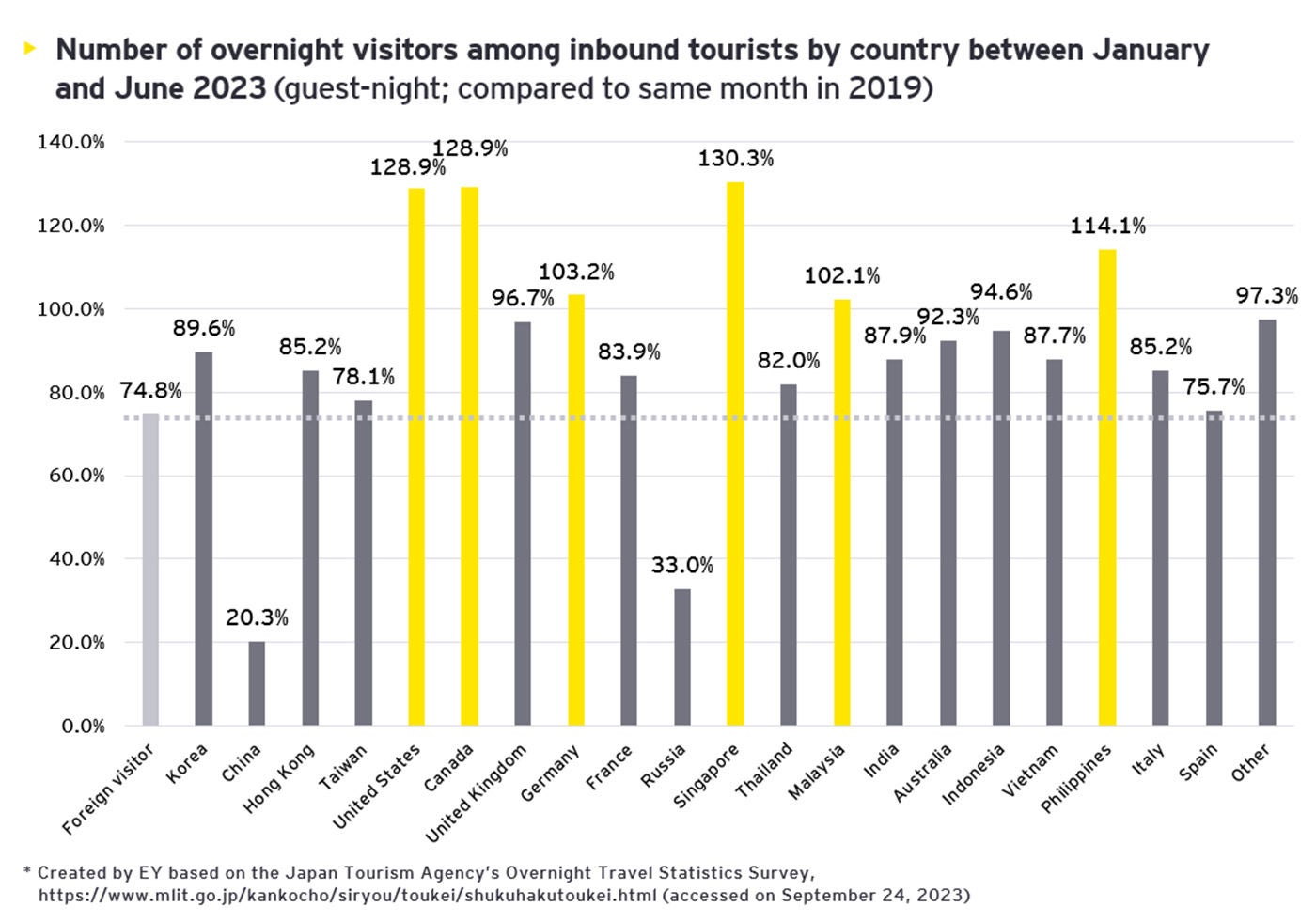

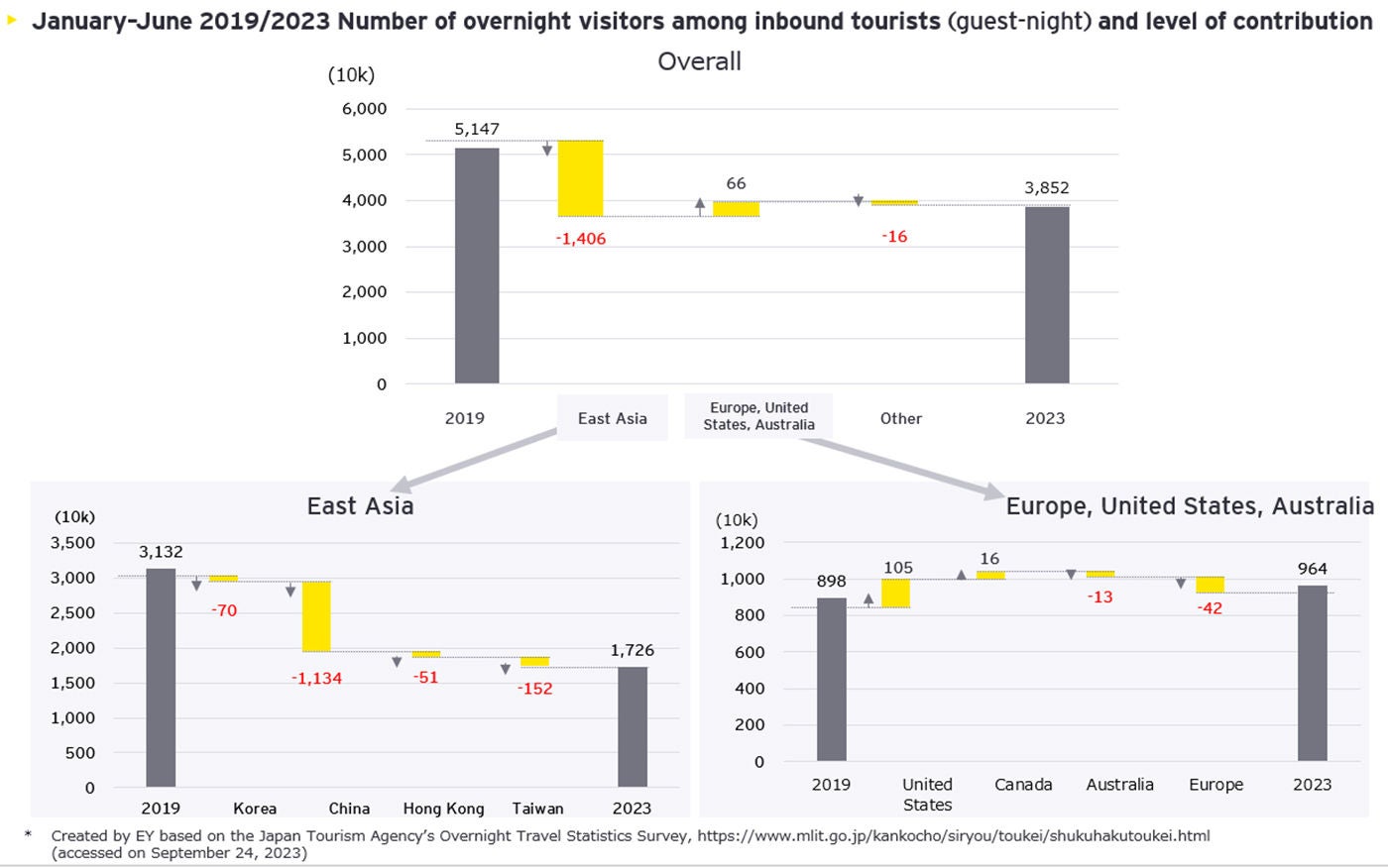

The total number of domestic overnight visitors (guest-night) among inbound tourists in the first half of 2023 was 38.52 million, which equates to around 74.8% of the same period in 2019. Numbers have surpassed 2019 levels among visitors from the US, Canada, Germany, Singapore, Malaysia, and the Philippines, while numbers from Korea, Hong Kong, and Taiwan (who previously made up the majority) have recovered to around 80%. Overall, while we are awaiting a recovery in numbers from East Asia, which previously accounted for a significant ratio of the total, with numbers from Europe, the US, and Australia already exceeded 2019 levels, changes are taking place in the overall distribution.

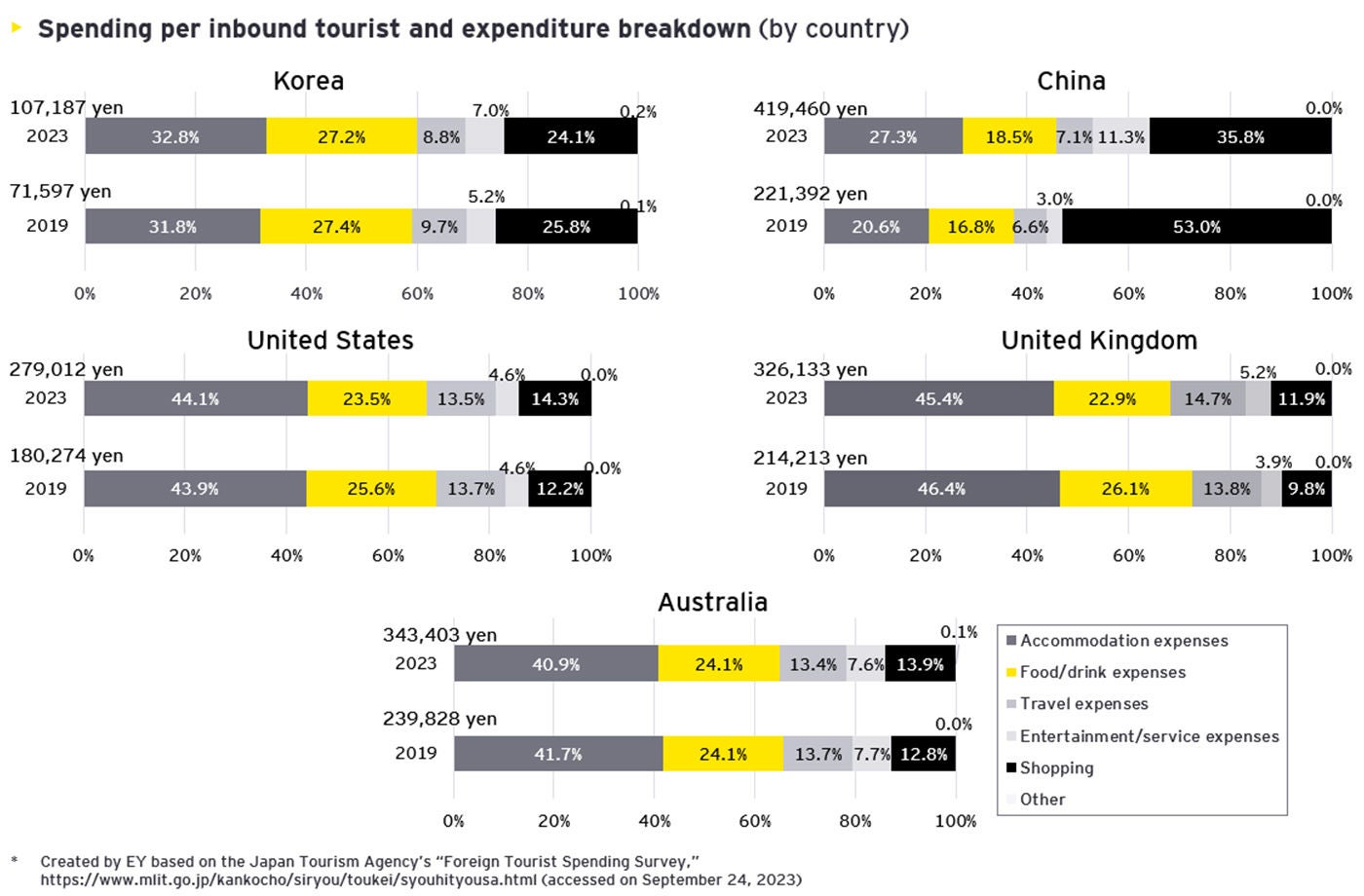

A breakdown of spending shows an average of 207,430 yen per person, marking an approximately 40% increase over the same period in 2019, equating to an increase in approximately 50,000 yen per person. It is worth noting that the amount spent on accommodation has risen 5% and that the amount spent on shopping has fallen 10%. Although an increase in shopping was expected due to the weak yen and the relative sense of affordability, actually, spending increased on accommodation, food and drink, activities, and other experiences. During the pandemic, accommodation facilities reviewed their conventional experiential value, and implemented a range of measures, including capital investments, aimed at increasing their added value. The rise in spending on accommodation is thought to be the result of these efforts.

Upon inspection of spending by visitor country, while we can see that the ratio of accommodation spending is increasing among visitors from many countries, we can also see that shopping spending is rising among visitors from Europe, the US, and Australia as they benefit from a weak yen. This can be said to be a characteristic of the current economic climate.

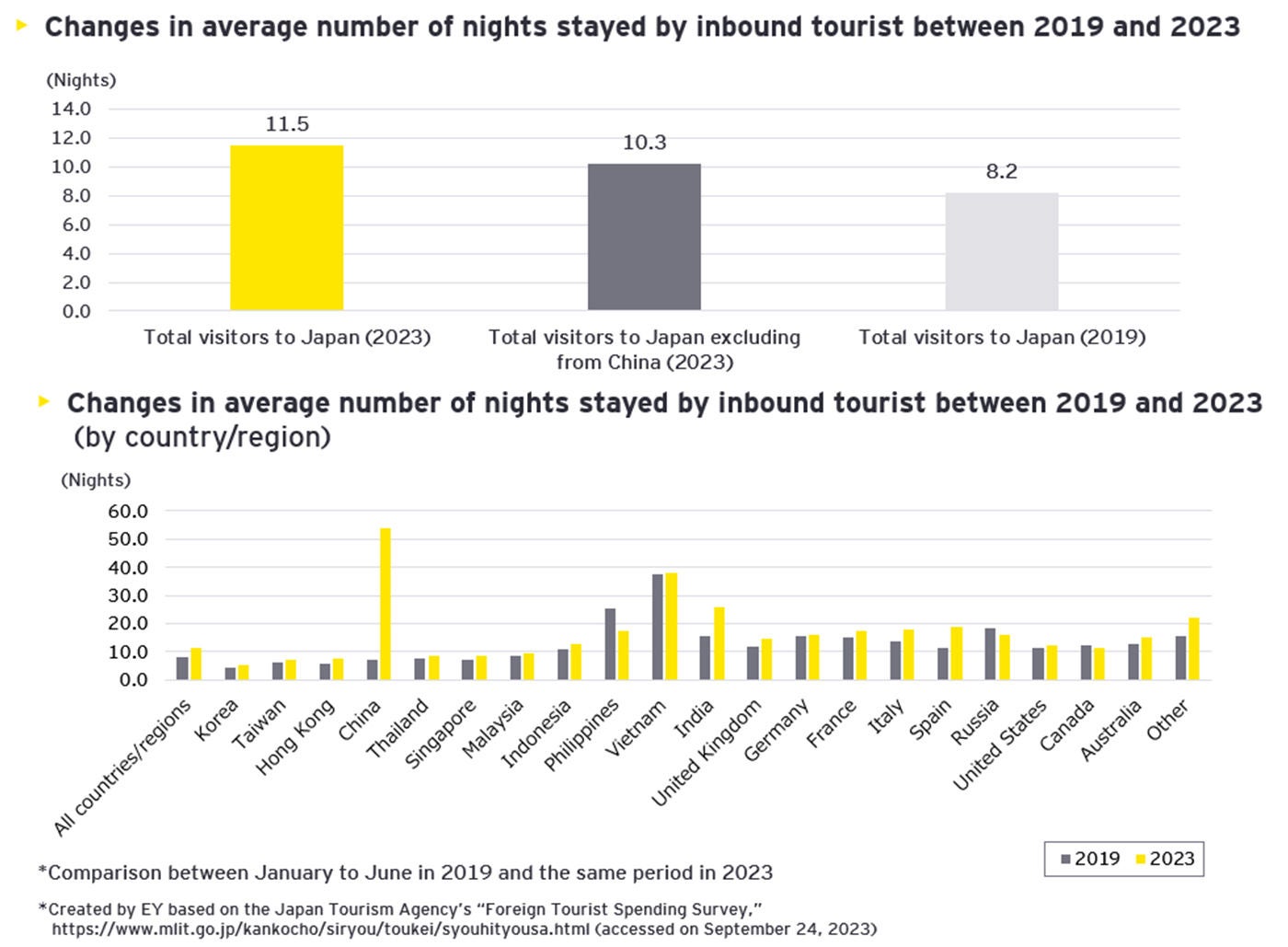

Elsewhere, the average length of stay for visitors to Japan in 2019 was 8.2 days, and this has increased by 3.3 to 11.5 in 2023. We can see that from almost all countries, inbound tourists are spending a longer amount of time in Japan. The average length of stay is prominently higher among Chinese tourists. When excluding this number, the average length of stay among inbound tourists as a whole falls to 10.3, marking a 2.1 day increase over 2019. Although at approximately 600,000 the number of tourists from China remains at a low level, their average spending in Japan is high. This suggests that comparatively wealthy Chinese tourists are staying in Japan for prolonged periods.

Inbound Tourists in Japan’s Rural Areas

While average spending and average length of stay have increased compared to before the COVID-19 pandemic, to what extent have these benefit been felt by Japan’s rural areas?

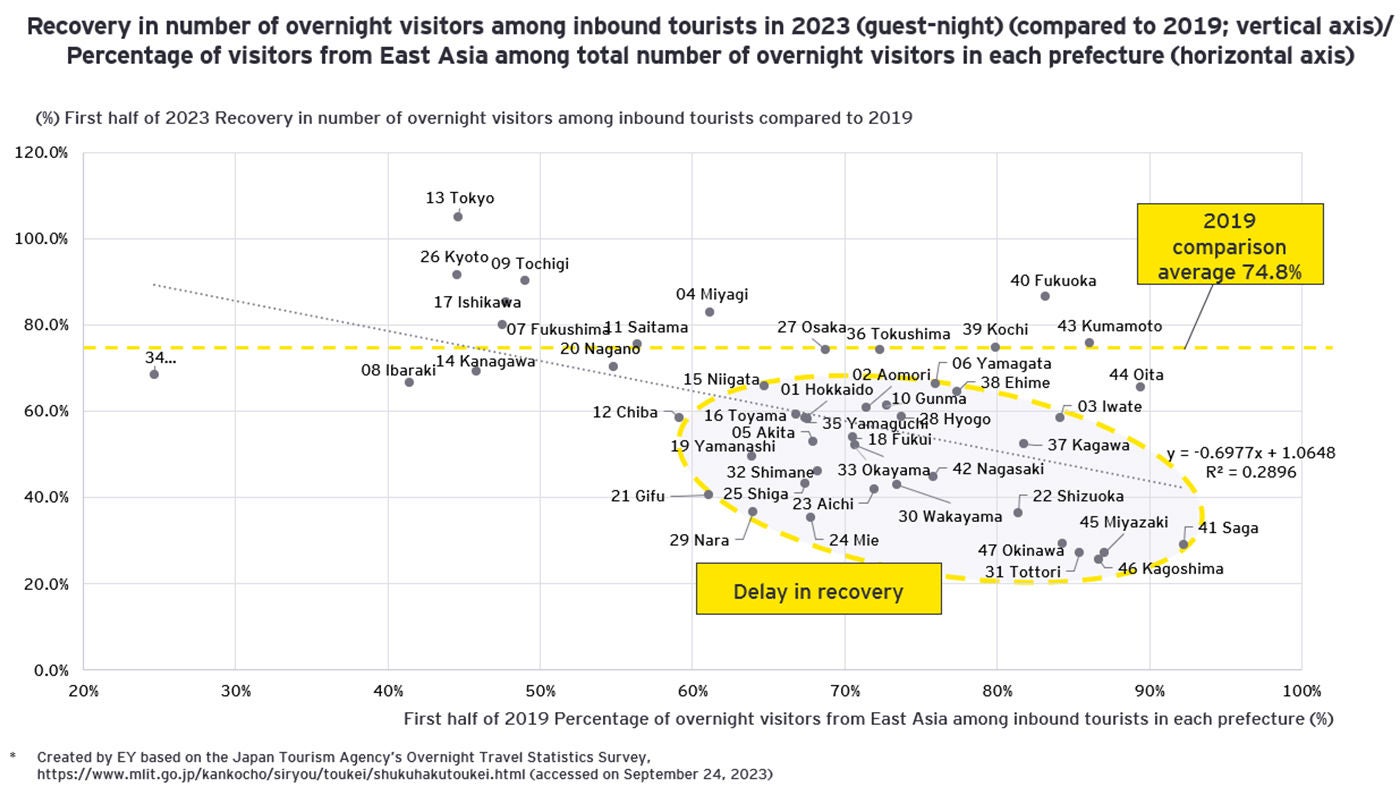

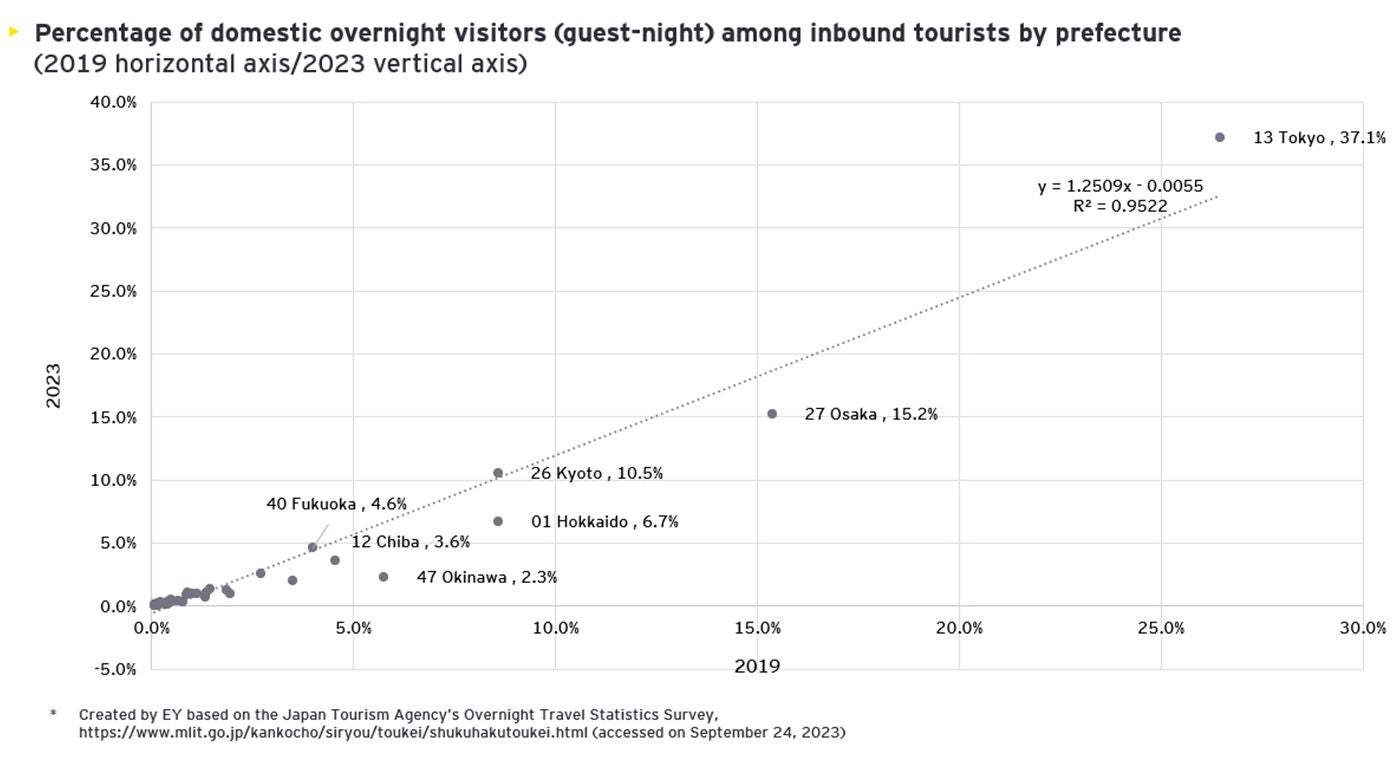

Of the total number of overnight visitors among inbound tourists in each prefecture, nine prefectures are above the nationwide level of recovery. Numbers in Tokyo have already exceeded pre-COVID levels, while in Kyoto, Tochigi, Fukuoka, Ishikawa, and Miyagi, numbers are at around 80% of pre-COVID levels. On the other hand, recovery in many rural areas is less than 60% of pre-COVID levels, and these areas are still a way off from experiencing a return in inbound demand. The slow return of tourists from the expansive East Asian market is impacting the recovery of inbound tourism in these regions. When plotting the percentage of inbound tourists from East Asia in each prefecture in 2019 on the horizontal axis against the recovery in inbound tourists in the first half of 2023 compared to 2019 on the vertical axis, the regression line is negative. This shows that the prefectures which relied on tourists from East Asia have been relatively slow to recover.

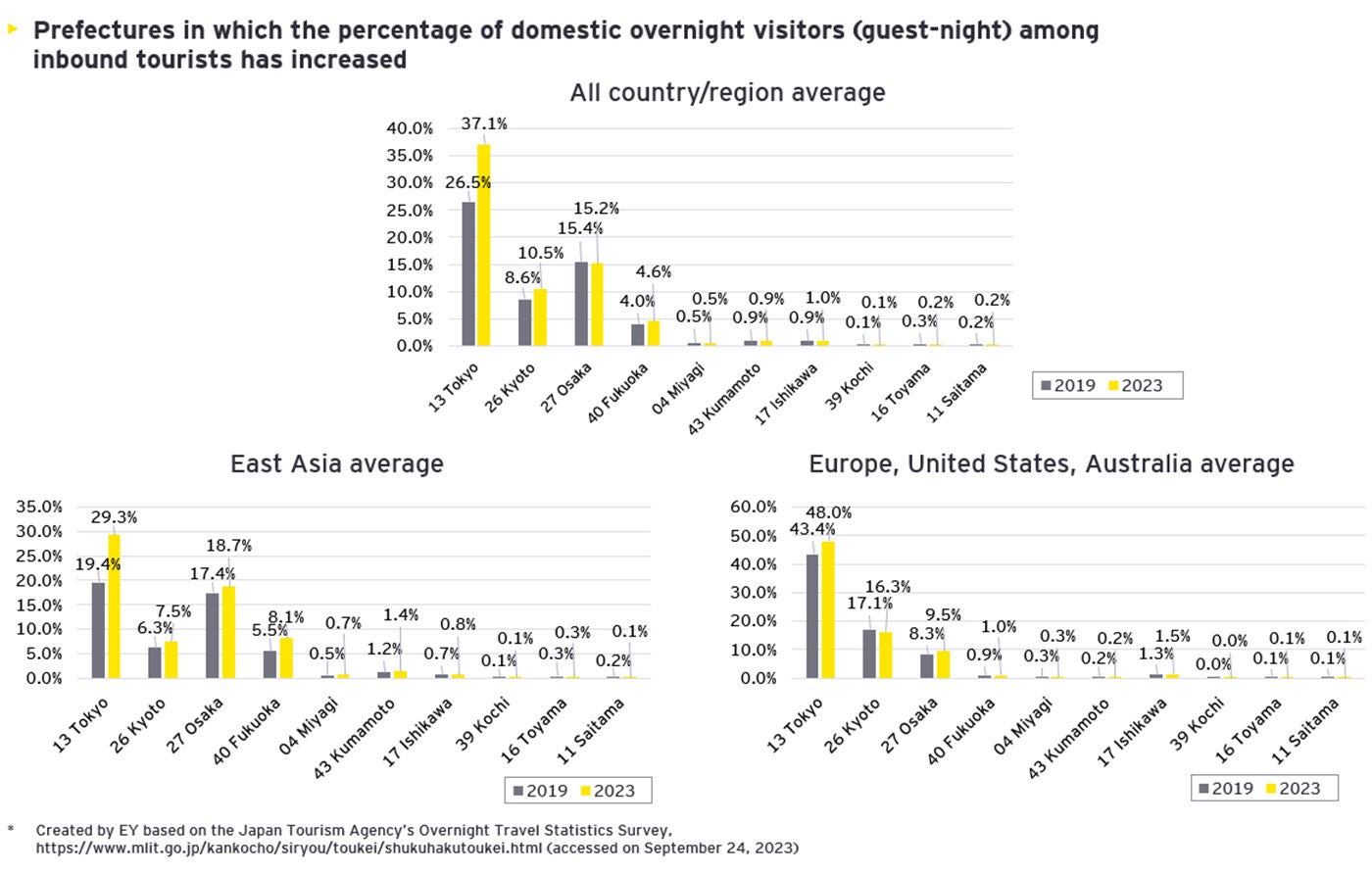

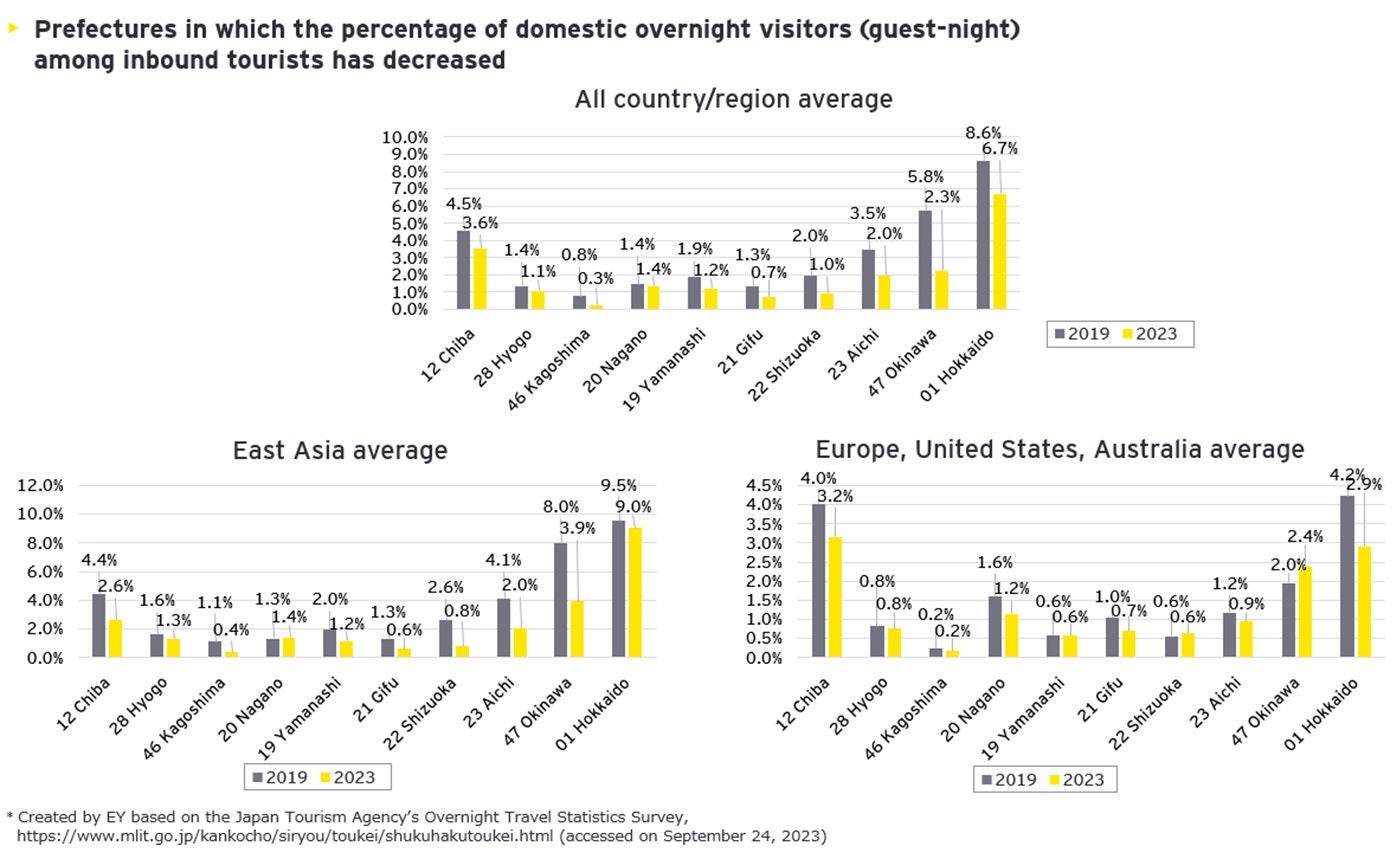

Moreover, looking at the distribution of inbound tourists in 2023 compared to 2019, the concentration of visitors to Tokyo has risen by around 10%, with just under 40% of the total number of visitors concentrated on Tokyo. Although Osaka, Kyoto, and Hokkaido have welcomed around the same percentage of inbound tourists compared to 2019, in other regions this percentage has decreased. It is these regions that are likely not experiencing the benefits of inbound tourism recovery.

Of the top 10 prefectures that have welcomed a greater percentage of inbound tourists than in 2019, in Tokyo, Kyoto, Osaka, and Fukuoka, tourists from East Asia account for 63.6%, showing a 15% higher concentration than in 2019. Visitors from Europe, the US, and Australia have increased 5% to 74.8%, accounting for three quarters of the total.

Of the bottom 10 prefectures that have welcomed a lower percentage of visitors than in 2019, the percentage has fallen significantly in Hokkaido and Okinawa. Whereas in 2019 the two accounted for 14.4% of the total, in 2023 this has dropped by 5.4% to 9.0%. While Okinawa’s share of tourists from East Asia has fallen 4.1%, its share of visitors from Europe, the US, and Australia has increased 0.4%. Hokkaido, meanwhile, has experienced a slight 0.4% decrease in visitors from East Asia, and a 1.3% decrease in visitors from Europe, the US, and Australia.

Although care must be taken when analyzing the share of visitors from each country due to differing circumstances, such as size and the return of direct flights, the situation should be closely monitored moving forward, including the decline in how attractive each region is.

Recovery in Inbound Visitors by Purpose

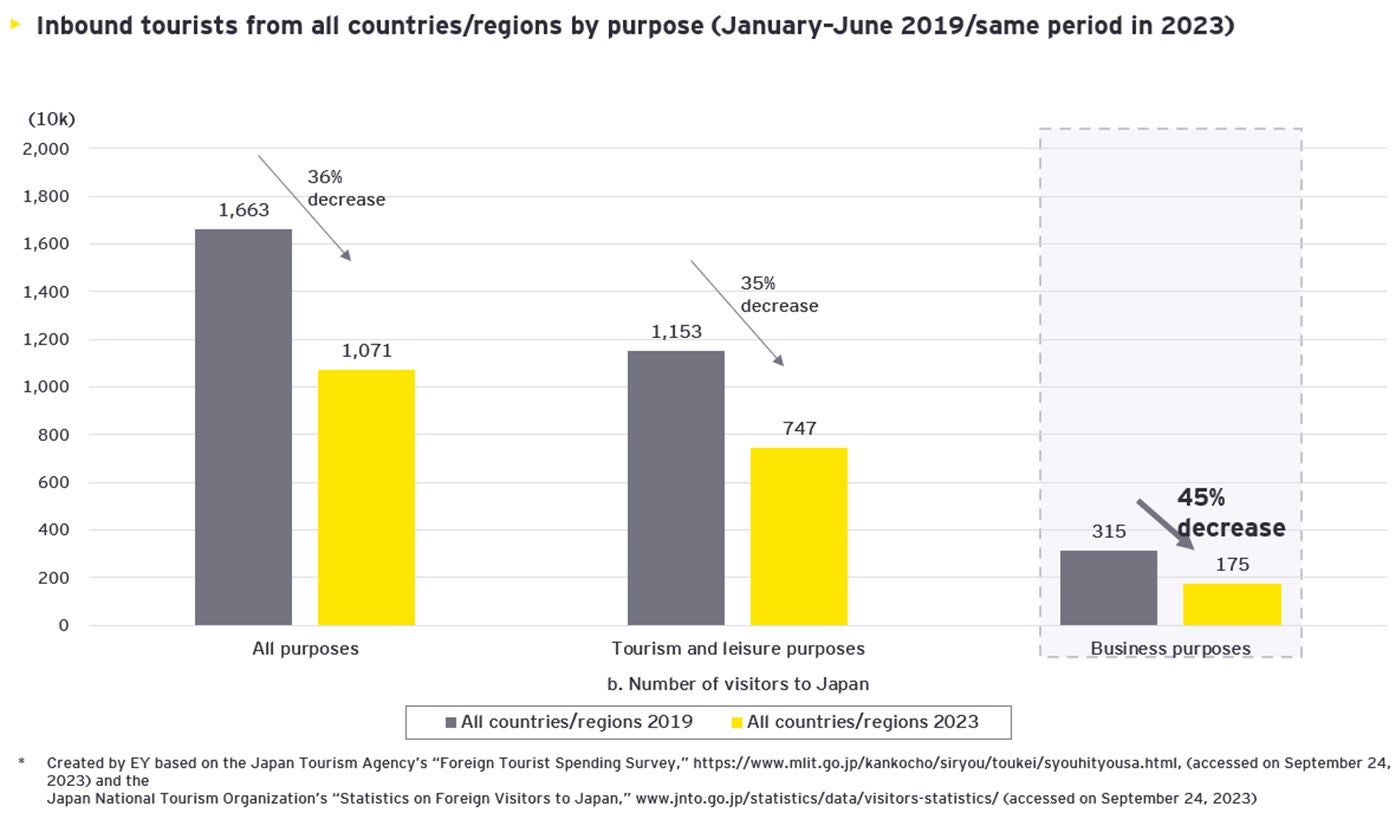

Let us now take a look at inbound visitors by purpose: tourism/leisure and business. While the percentage of those visiting Japan for business was under 20% between January and June 2019, when looking at levels of recovery compared to visits for leisure, a 45% decrease in number of visitors shows that a recovery to 2019 levels is still some way off. That said, spending per visitor has increased to approximately 230,000 yen, which is higher than the overall average. Moreover, compared to the approximately 40% increase overall, in business, spending has shown high growth with an increase of around 50%.

Attracting visitors for business is therefore an effective means to increasing spending per person. With the recent rise in blended travel, which combines business and leisure, attracting business visitors and promoting MICE will be essential to driving visitors to Japan’s rural areas.

Recovery of human resources in Tourism-related Industries

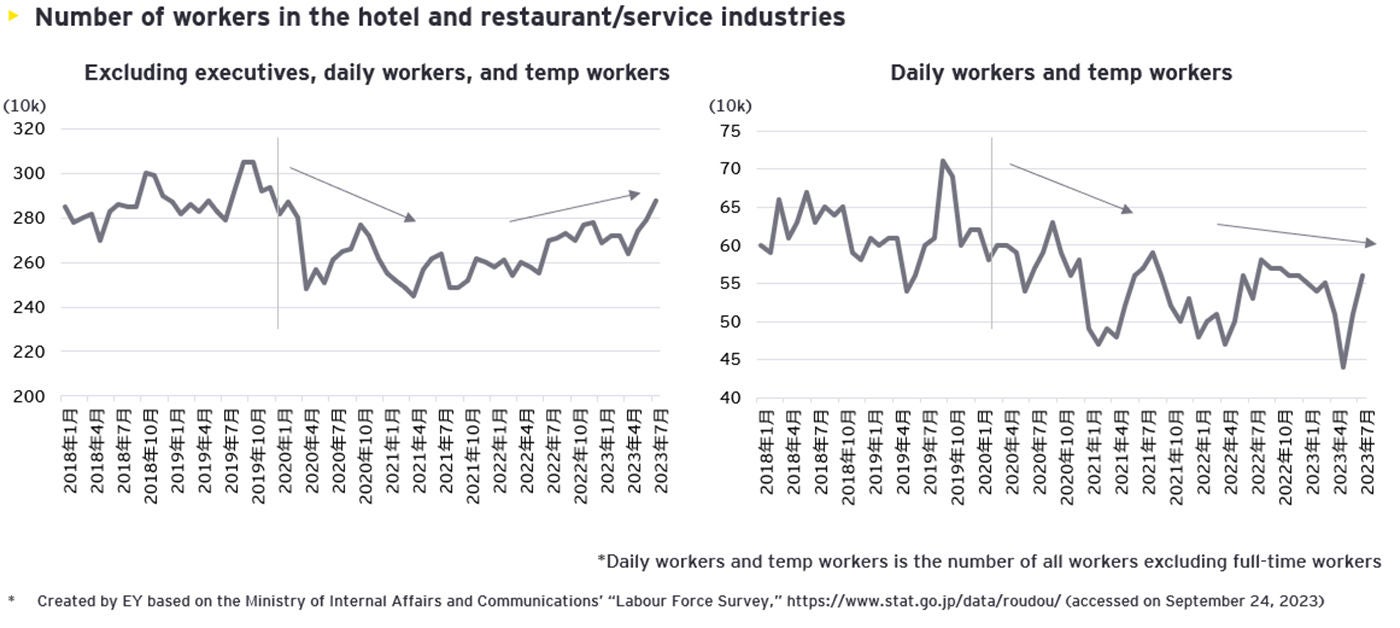

While Japan is still recovering from the effects of the pandemic, there have been concerns in tourism-related industries, in particular the restaurant and hotel industries, surrounding the shortage of human resources. Although there have been some improvements, frontline interviews show that full recovery is yet to come, and that with the current shortage of human resources it will not be possible to return to pre-COVID operation rates.

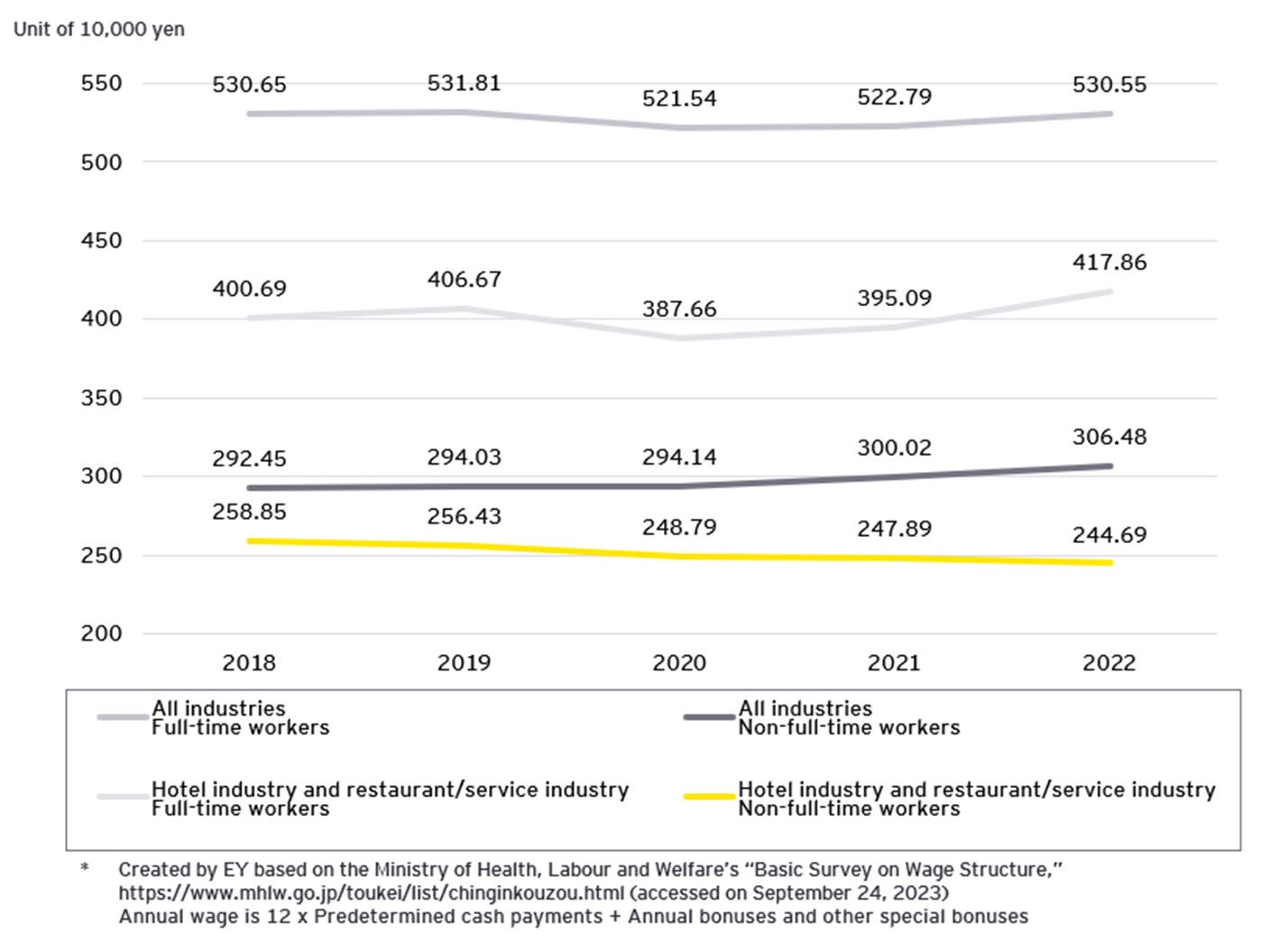

When looking at the available statistics concerning tourism-related industries, in the hotel and restaurant/service industries, the number of full-time employees has returned to pre-COVID levels. However, the number of non-full-time employees, such as daily workers, temp workers, and part-timers, is decreasing, confirming that these industries are still struggling to secure the necessary human resources.

In terms of wage levels for the hotel and restaurant/service industries compared to the average in all other industries, although wage growth is high for full-time employees, relative wage levels are approximately 1.1 million yen lower than the average in all other industries. For non-full-time employees, which the hotel and restaurant/service industries are struggling to hire, statistics show that wage levels are decreasing, which is the opposite trend to non-full-time employees in all other industries. Wage levels are approximately 600,000 yen lower than in other industries. While on the one hand an increase in wage levels will be key to securing the necessary human resources, moving forward it will also be important to throw away conventional notions surrounding days off and workstyles, for example, and review ways in which to secure human resources. This is due to the diversification of workstyles, including the spread of food delivery jobs and other gig work that allows people to work in their chosen locations, at their chosen times, and at their own discretion.

For tourism-related industries that have direct touchpoints with travelers, such as the hotel and restaurant/service industries, difficulties in securing human resources are expected to continue in the future. As such, to maximize added value, priority moving forward must be placed on digitalizing and streamlining back-office operations in other ways to help secure human resources for front-facing operations.

Negative Impacts from the Recovery in Inbound Demand

Levels of recovery in inbound demand can be seen from the above. However, particularly in Tokyo, Kyoto, Fukuoka, Ishikawa, and other regions where demand has returned to more than 80% of pre-COVID levels, in some areas there are concerns regarding overtourism. Excluding Tokyo, the number of inbound tourists has not recovered to 2019 levels. In line with this, it may be that the lack of human resources who can provide services, including at tourism facilities, may be causing a sense of overcapacity and in turn overtourism.

While issues with overtourism were frequently raised even before the pandemic due to the increase in inbound tourists, with the government’s plan of transforming Japan into a top tourism destination and attracting 60 million tourists by 2030, issues with overtourism will no doubt become even more apparent.

Overtourism is not only caused by inbound tourists, but also by the concentration of domestic travelers. In this area, it will be important to make preparations before domestic overtourism becomes a problem. To do so, visualization of the numbers and concentration of travelers will be paramount. Thoroughly understanding numbers that enter each region, numbers of facility users, and the distribution of movement through the digitalization of tickets and other means is essential, and based on this data, examining how to distribute these travelers will be an important topic for tourist destinations in the future.

During the pandemic, many regions limited their number of visitors to a certain extent by digitalizing tickets and requiring reservations. Now, however, as impacts from the pandemic continue to ease, there are various opinions regarding the control of visitor numbers, particularly from local businesses.

In 2023, for example, Yosemite National Park in the US announced that it would no longer continue with a reservation system that was introduced during the pandemic, implementing a different policy to other national parks. There are concerns that lifting restrictions on visitor numbers could prevent visitors from enjoying quality experiences, and at the same time cause damage to the park’s infrastructure and natural environment. On the other hand, in Mariposa County, where tourism-related industries employ approximately 50% of the population, revenue from tourism is only generated in the five months of summer, and so the lifting of restrictions is expected to improve the local economy. In this way, there are an array of different Opinions3.

Elsewhere, some regions have avoided overtourism through a uniform limitation on visitor numbers. In South Tyrol in the Alps of Northern Italy, for example, based on its peak numbers in 2019, the number of overnight stays has been limited to 34 million per year to reduce negative impacts on the environment. The region has also implemented other measures. For example, the opening of new hotels and guesthouses requires approval from the local council, which cannot grant approval if there are no spaces Available4.

Moreover, while some places like Venice are charging entry fees to limit the number of tourists, other regions that were already charging visitors have chosen to increase their fees to limit visitor numbers5. Based on actual conditions in tourist destinations, the course of action to prevent overtourism through destination management is not necessarily simply controlling quantity and improving quality. More specifically, it will be important for regions to hold discussions on how best to balance between quantity and quality.

Re-generative Tourism

to Re-define Tourism and Generate Positive Results

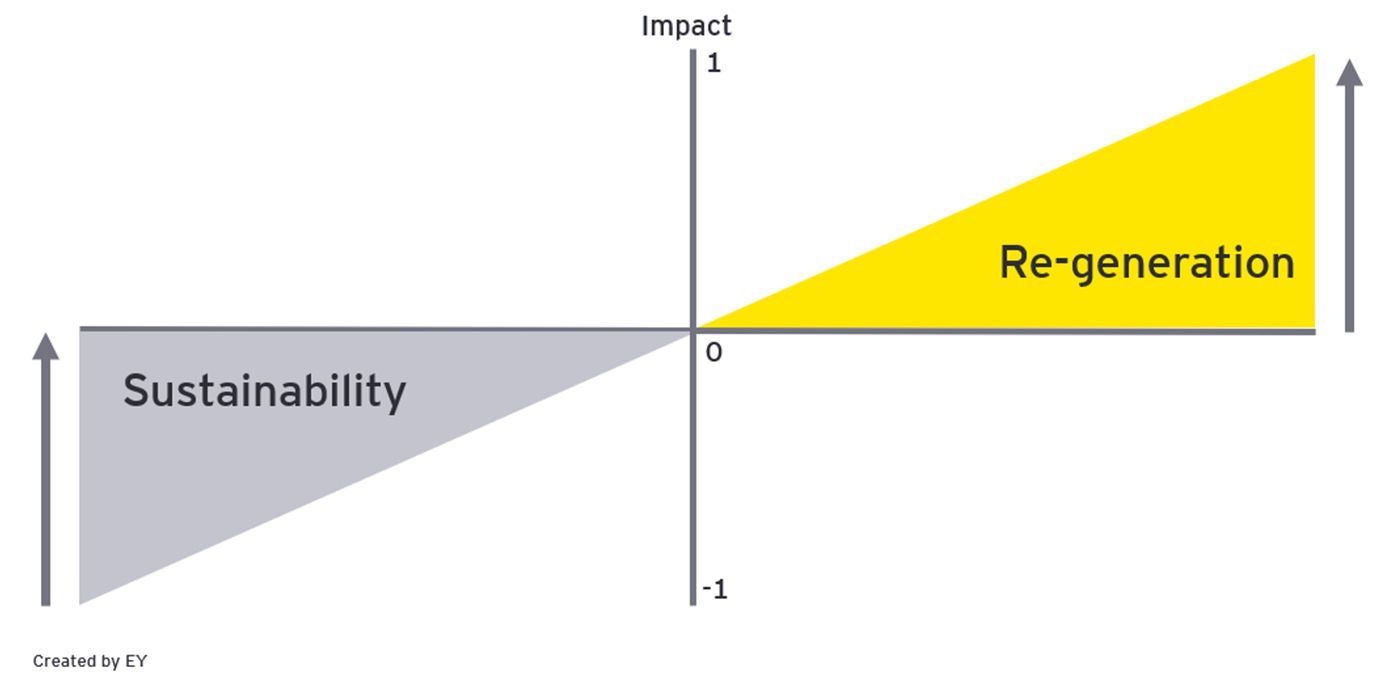

In efforts to reverse overtourism and the negative impact on natural and cultural assets due to a surge in the number of tourists, many host destinations worldwide are rolling out various measures to ensure sustainable tourism. Even in Japan, the term “sustainability” has garnered significant attention, particularly post-pandemic. However, questions have been raised in recent years about whether current sustainability initiatives to maintain the natural environment and local communities are indeed sufficient.

In fact, adverse effects of carrying out conventional economic activities while trying to maintain the natural environment and local communities are becoming increasingly undeniable. In response to this, a new approach focusing on “re-generation” is now emerging and gaining prominence in discussions, especially in Europe and the US. The World Economic Forum has also begun to delve deeper into the importance of re-generative business in creating long-term value6.

What is meant by re-generative initiatives? If sustainability initiatives are those required to return negative back to zero, then re-generative initiatives are often defined as those that seek to transform zero into positive. Transforming zero into positive using conventional approaches and business methods can be a challenge. Through re-generation, it is paramount that we reform ourselves to transform zero into positive, and to consider various stakeholders as we work to generate innovation.

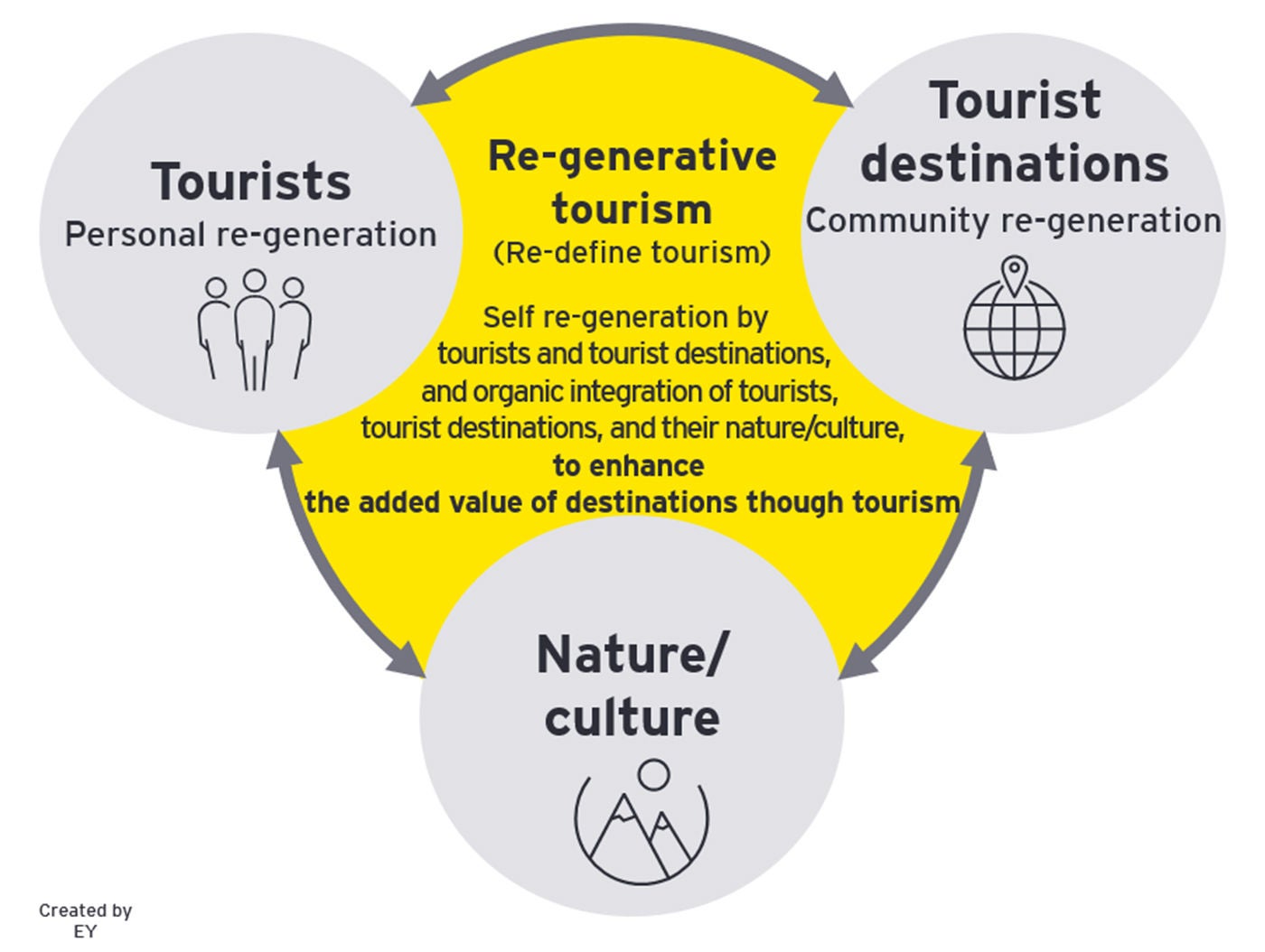

Now, what kind of implications can we expect through “re-generation” in the field of tourism? One pertinent example comes from Hawaii, a globally acclaimed tourist destination. In August 2023, the Hawaii Re-generative Tourism Conference was held, where the Hawaii Tourism Authority and other local entities discussed the state’s re-generative tourism initiatives. Consolidating the conference discussions, “re-generation” in tourism can be perceived as the process of rebuilding organizally harmonized relationships between tourists, tourist destinations, and the natural environment and culture. Also, it involves strategizing innovative ways to generate a mutually beneficial impact to all three. Of key importance in the re-generation is active engagement from every stakeholder.

Following the pandemic, people’s awareness towards well-being, wellness, and mindfulness that enhances one's inner-self or induces self-transformation has seen an upsurge. This movement is an exhibition of the growing interest in wellness tourism and can be considered a form of a personal re-generation. For tourist destinations, this highlights the need for fostering their own re-generation; they should focus on promoting local engagement in tourism, augmenting the understanding of tourism's economic impact, encouraging local businesses to participate, and increasing consumption of local goods and services to maximize benefits to all stakeholders. And what’s more, rather than simply maintaining and protecting nature and culture, it will be imperative to rebuild systems that enable tourists and tourist destinations to use these assets organically to generate positive results, and to re-define the value in travel.

To date, tourism has revolved around the provision of services based on tourists’ needs and regional assets. However, a shift is required from this individual-profit oriented approach towards a more integrated model. It's crucial to consider how to construct relationships where tourist spots, the residents, businesses, and even the local natural environment and culture can organizally unite. Here, tourists play a significant role as they enjoy the destination while also adding a positive impact to the place. As we move forward from the traditional understanding of sustainability, it's important to incorporate these new ideas and redefine the concept of tourism, which will shape tourist destinations that have even a greater value for future generations. This could signal the beginning of a new era in tourism - re-generative tourism, that breathes new life into the value of travel experience.

Footnote:

- Dragon Trail Research “READY TO SEE THE WORLD: Chinese Traveler Sentiment Report” January 2023

- Dragon Trail Research “FIRST STEPS TOWARDS RECOVERY: Chinese Traveler Sentiment Report” April 2023

- “Yosemite Ends Park Reservation Requirements to Evaluate Impact on Communities” Skift 2022

https://skift.com/2022/12/06/yosemite-ends-park-reservation-requirements-to-evaluate-impact-on-communities/(accessed on September 26, 2023) - “This Famed Alpine Region In Italy Is Restricting Tourist Numbers To Curb Overcrowding” Forbes 2023, https://www.forbes.com/sites/rebeccahughes/2023/04/29/this-famed-alpine-region-in-italy-is-restricting-tourist-numbers-to-curb-overcrowding/?sh=35e725cb10cf (accessed on September 26, 2023)

- “Tourist Destinations Face Dilemma Switching From Quantity to ‘Quality’ Visitor Strategies” Skift 2022

https://skift.com/2022/08/29/tourist-destinations-face-dilemma-switching-from-quantity-to-quality-visitor-strategies(accessed on September 26, 2023) - “Let's talk about 'regenerative business' not sustainability” World Economic Forum 2023

https://www.weforum.org/agenda/2023/03/regenerative-business-sustainability/

(accessed on September 26, 2023)

Our latest thinking

Is Japan ready for global trends as it welcomes back foreign tourists?

We began to see inbound tourists return once the border control measures were eased in October 2022, but the influx of travelers has exploded after the new year - to the extent that it reminds us of the liveliness of tourism that was apparent before the breakout of COVID-19. This report analyzes challenges that await tourism in Japan during the inbound recovery phase.

Okinawa takes the lead in tourism DX - how local innovation is driving long-term value

Capabilities in the areas of DX, data science and design thinking are vital to the structural transformation that tourism in Okinawa requires. This discussion highlights the potential of tourism to contribute to the promotion of human resources development and innovation which follow revitalization, and also deals with the future of the industry.

Tourism during the COVID-19 pandemic and the road to recovery

With demand likely to recover, this report examines tourist behaviors during the COVID-19 pandemic and considers the outlook for the tourism industry.

Tourism in the time of COVID-19

A recurring theme of the webinar is the need to redefine tourism. A “workation” lifestyle, popularized during the COVID-19 pandemic, has made tourism an everyday event. In addition, emerging digital technologies such as the metaverse have the potential to undermine the concept of mobility in travel. We need to explore a multi-layered concept of tourism which embraces travel in the metaverse and the real world.

Summary

In some regions, inbound tourism has recovered to the point that there are now concerns surrounding overtourism. To ensure this has a positive impact on tourist destinations, innovative initiatives that go beyond conventional frameworks will be essential. To do so, it will be important for stakeholders to re-define their mindsets and values toward tourism, and to link this to specific action. In this sense, re-generative tourism could be the key to unlocking new value in travel.