EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

We began to see inbound tourists return once the border control measures were eased in October 2022, but the influx of travelers has exploded after the new year - to the extent that it reminds us of the liveliness of tourism that was apparent before the breakout of COVID-19.

This report analyzes challenges that await tourism in Japan during the inbound recovery phase.

Tourist arrivals have been recovering after the easing of border restrictions. Here we analyze challenges on Japan’s road to full recovery.

In brief

- The recovery of the inbound market exploded in March, and we can have an optimistic outlook about future recovery with the Chinese market’s rebound.

- The short term rental (STR) market has grown thanks to the increased prevalence of digital nomads and remote work, however this growth has come with issues that are becoming increasingly apparent.

- Japan’s tourism industry is expected to take the lead in building on the efforts observed in Europe, such as implementing remanufactured products, and thereby spearhead the country’s ongoing transition to a circular economy.

We began to see inbound tourists return once the border control measures were eased in October 2022, but the influx of travelers has exploded after the new year - to the extent that it reminds us of the liveliness of tourism that was apparent before the breakout of COVID-19 (before the pandemic).

Current inbound demand

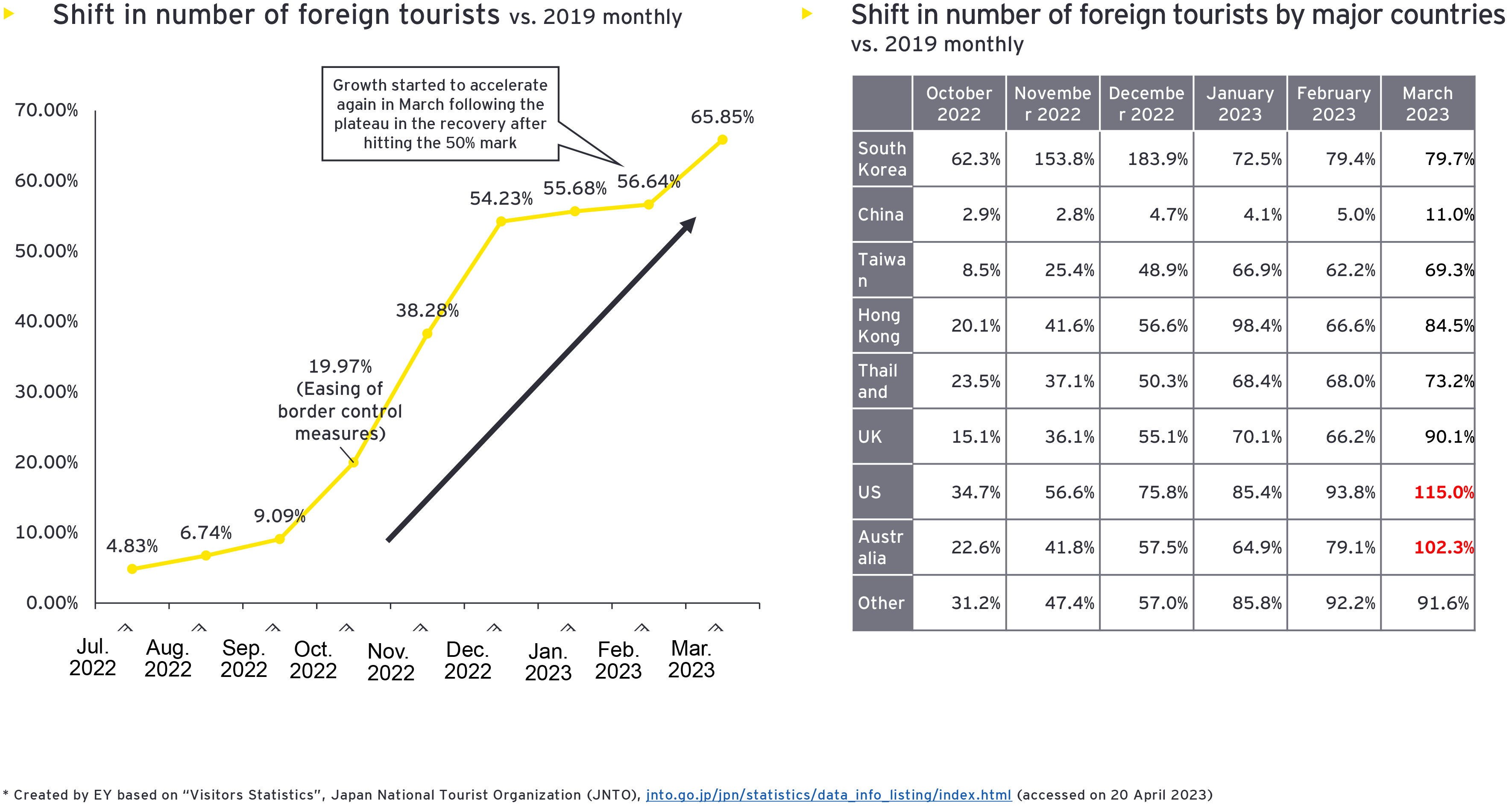

According to the publications of the Japan National Tourism Organization (JNTO), 1.81 million inbound tourists visited Japan in March, representing a 65.85% recovery from before the pandemic. Easing of the border control measures brought about a steady recovery to these numbers, and following a slow increase over three months after exceeding 50% year-over-year with 2019, the numbers dramatically increased in March. While Asian countries such as South Korea, Taiwan and Hong Kong have been the primary countries that have contributed to the recovery of the Japan inbound market, it is worth noting that inbounds from Europe, Australia, and especially the US are recovering rapidly. Local feedback from US conferences1 note that “Japan is at the top of the bucket list and a destination that tourists want to visit sooner rather than later”, and the allure of Japan is likely what led US tourists to return to Japan in large numbers after the border control measures in many countries have been relaxed.

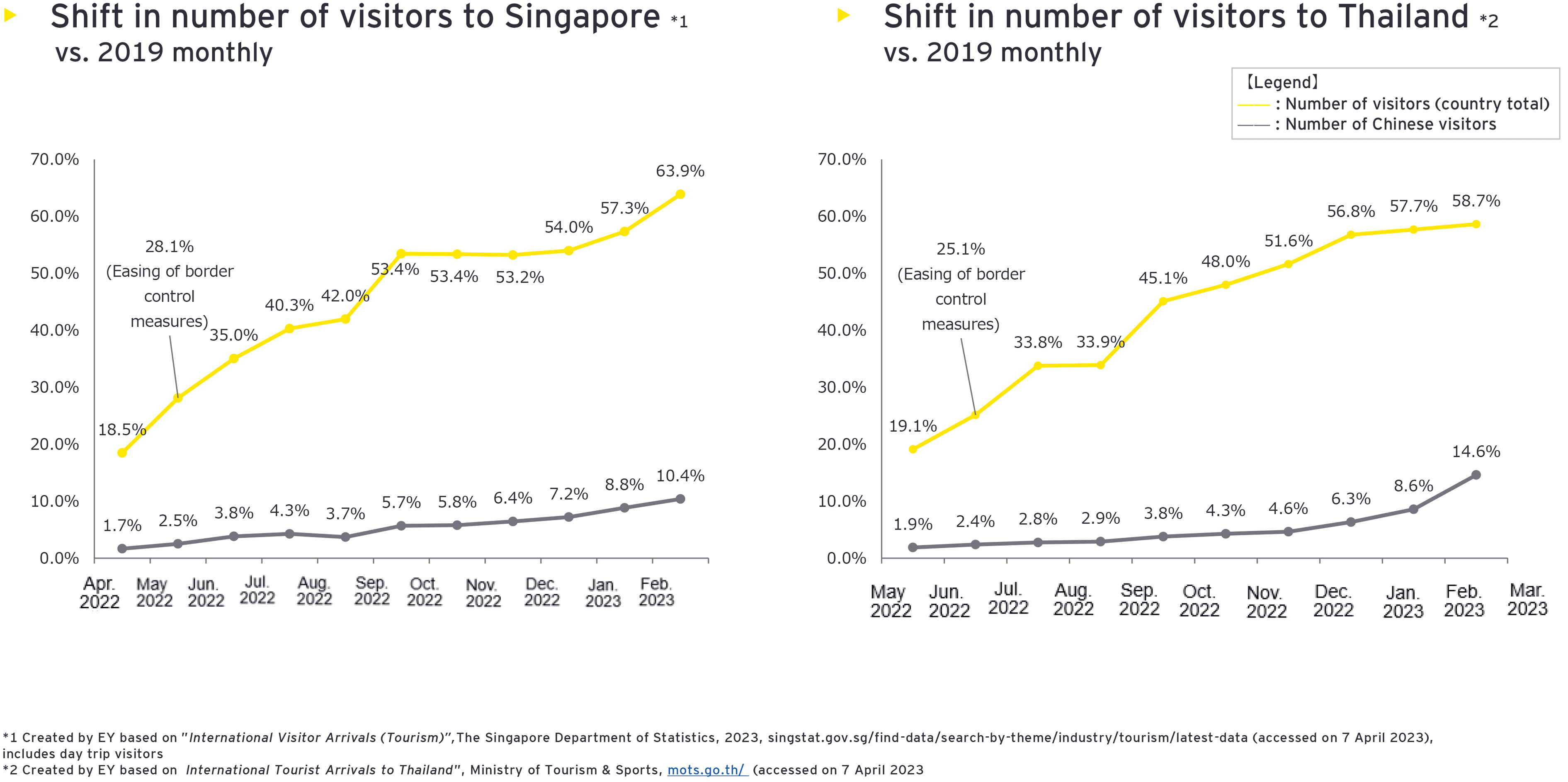

Japan is not the only country that experienced a slowdown in its inbound recovery after the numbers had reached a certain threshold following the easing of border control measures. When we take a look at other countries in the Asian region, Singapore's recovery is once again accelerating as of the beginning of 2023, but Thailand's recovery phase is lagging after border control measures were relaxed. The biggest reason for this is considered to be a delayed rebound from the Chinese market (still only recovered to approximately 10% compared to before the pandemic), which is anticipated to recover further in the future with measures to ease restrictions on the horizon, as well as international tourism by the Chinese population picking back up. On the other hand, the increasing labor shortage in the tourism industry is a worldwide trend, and it is safe to say that establishing systems that can accommodate this recovering demand is a pressing issue for the businesses and governments that will be welcoming tourists.

Noticeable global trends in the post-pandemic era

① Growth of short term rentals (STR)

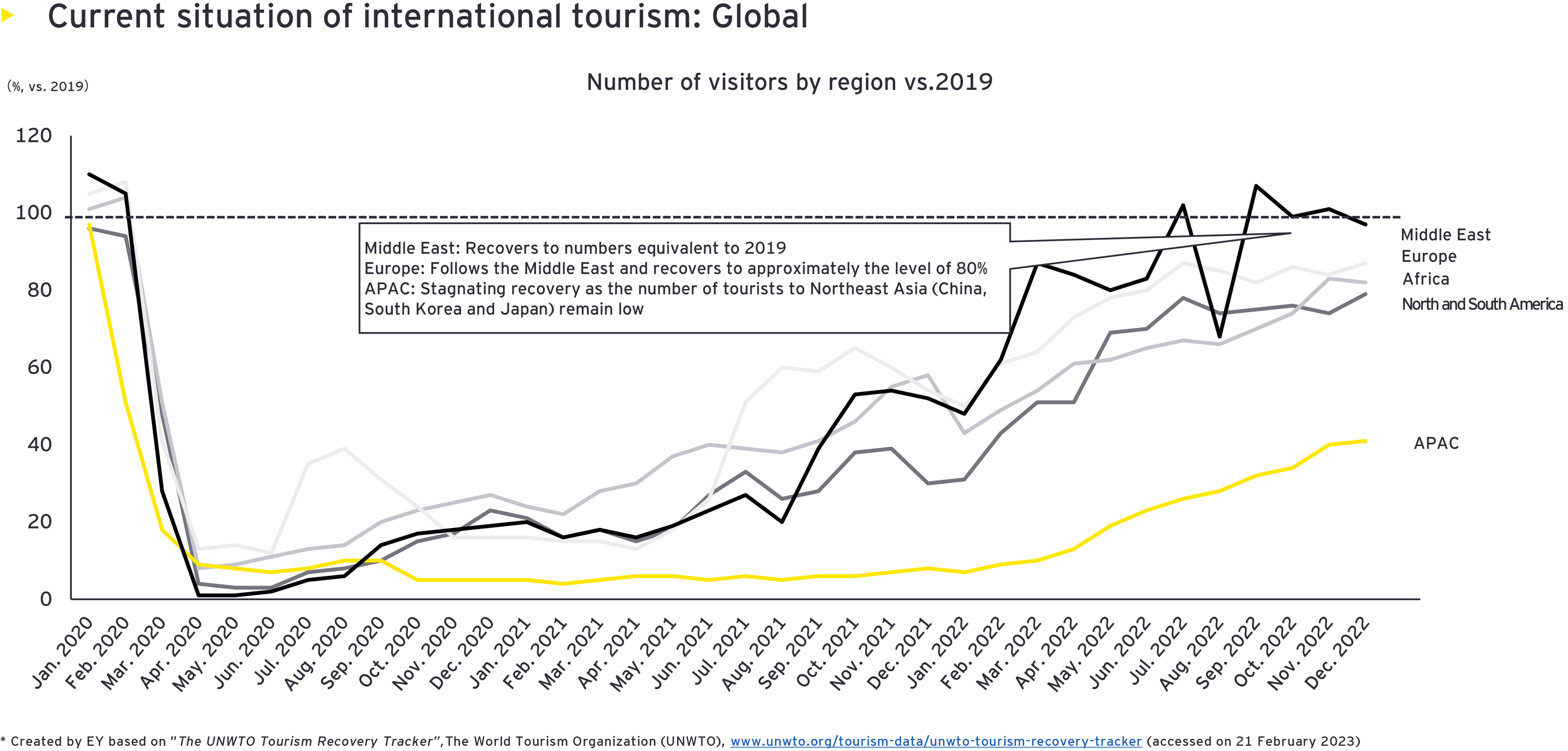

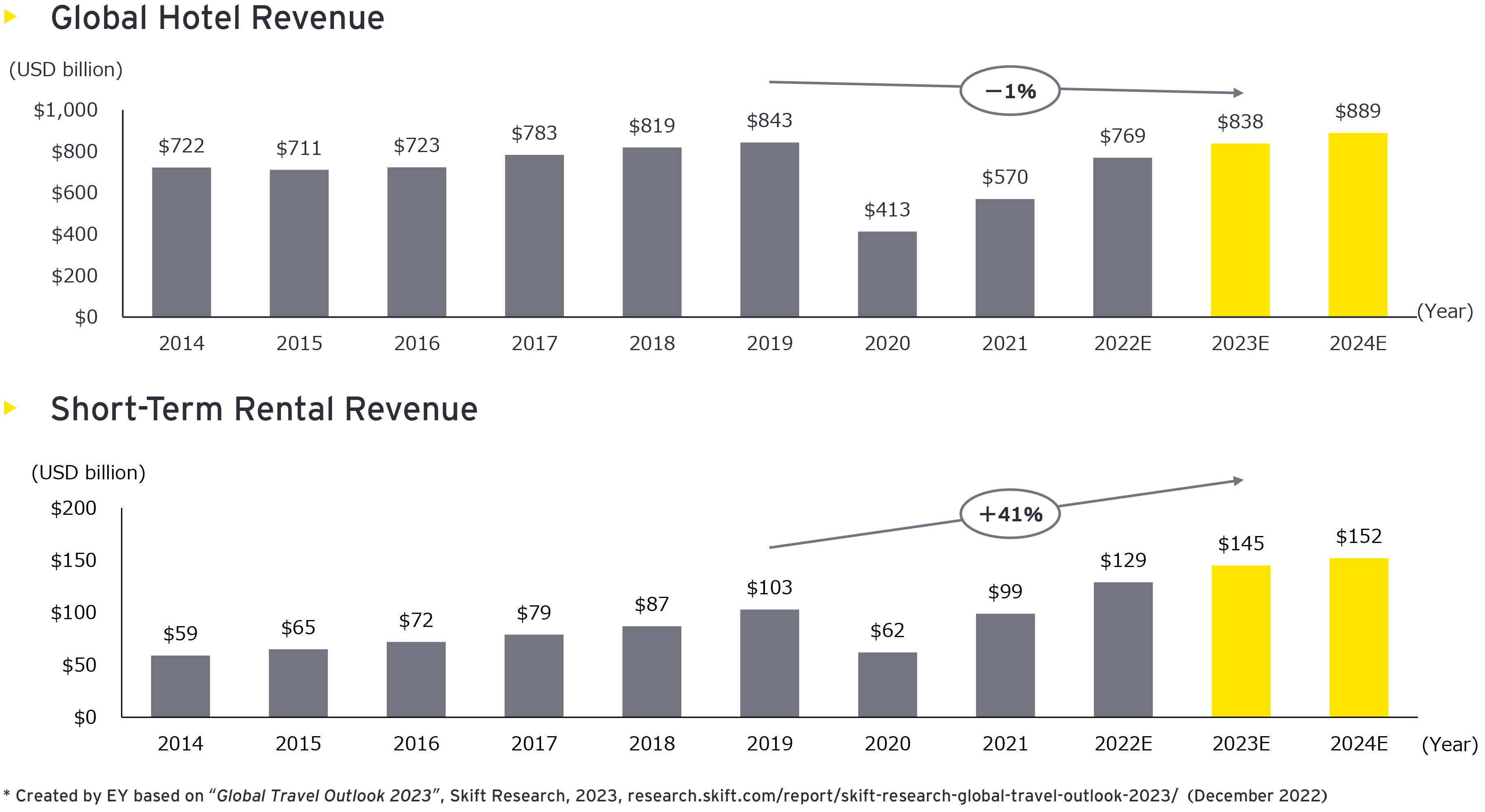

The travel restrictions resulting from sudden worldwide lockdowns and other restrictions on customers during the pandemic significantly affected the accommodation industry in particular. After such restrictions were lifted, the number of global inbound tourists has recovered to nearly 80% of 2019 numbers (excluding tourists from the Asia Pacific region (APAC)). Under these circumstances, when we take a look at the forecasted earnings for the accommodation industry in 2023 (year-over-year with 2019), while the hotel industry is projected to recover to -1%, the STR market, which provides accommodation for short term visitors, is projected to grow to +41% with the momentum it gained in the course of the pandemic.

One primary factor behind these developments is the rapid spread of remote work, which brings with it a lack of rules requiring that employees be physically present at their "workplace". Previous business styles centered around the critical assumption of working in the office, which made the mainstream of tourism “blended travel” - a combination of business trips and a vacation (this includes bleisure, where vacations are added on before and after a business trip). However, the necessity of being ever present at the “workplace” is declining day by day, and we can surmise that these numbers represent an increase in work styles in which people prioritize their preferred workplaces and incorporate traveling around domestic and international tourist destinations into their working life.

The world has welcomed this trend and countries have actively adopted initiatives for issuing visas to digital nomads (people who leverage IT technology to travel domestically and internationally while working).2 While conditions may slightly vary depending on the country, digital nomads who have acquired a visa (digital nomad visa) are able to reside in the visa-issuing country for a set period of time and work remotely. “Future of Tourism 2022 - 2031”3 notes that the relationship of tourists and tourism-related businesses will grow closer in the future, shifting towards a model wherein both parties offer their own expertise in a mutual exchange of services. Indeed, this new breed of initiatives likely holds the potential for accelerating the future development of how these parties interact with each other.

As digital nomads reside in a country for the mid- to long-term, it is easy to see why invigorating and enhancing the STR market is imperative alongside these initiatives. In addition, increasing interactions with digital nomads in local areas mean rural communities that are confronted with a lack of specialized human resources can acquire the world’s most innovative individuals, which could further open pathways to revitalizing their communities.

At the same time, a byproduct of STRs is the issue of conflicts between their users and the residents of local communities - a topic which has also sparked debates in Japan.

In Japan, businesses can provide accommodation services by submitting a notification based on the “Private Lodging Business Act” which came into effect in 2018 (private lodging), without obtaining a permit as required by the “Hotel Business Act”. As of March 2023, 18,760 private lodging businesses are permitted to provide accommodation services4. With that said, the conflicts between users of private lodgings and residents of local communities have become a major issue, and local governments have taken steps to prohibit these businesses by enacting ordinances and taking other measures. This trend is not only applicable to Japan, but has also been identified as a common issue occurring around the world, and all involved parties are currently working in various ways towards establishing a healthy market.

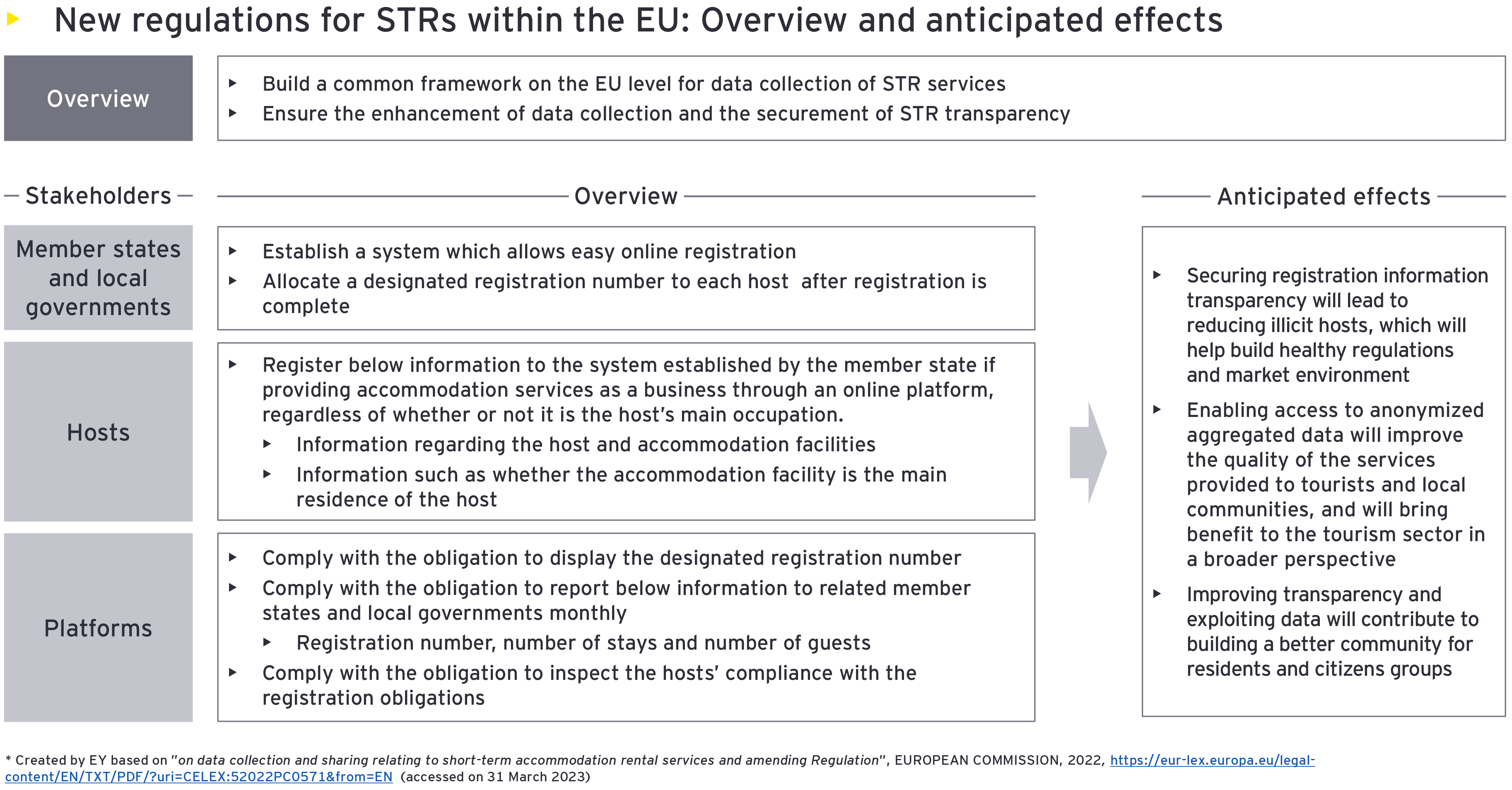

In Europe, as an example, a quarter of total accommodations in 2019 were provided by STRs, with 1.4 million customers and 512 million stays recorded5. However, in contrast to the booming market, tourist destinations are facing adverse effects such as overtourism and rising housing and commodity prices, all of which have accelerated the establishment of regulations for data collection and sharing in an effort to ensure the transparency of the STR market for healthy market growth. In March 2023, the EU regulatory authorities reached an agreement on a common approach to collect and share data from STR platforms such as Booking.com, Airbnb, Tripadvisor and Vrbo. This approach aims to ensure the transparency of the STR market by building a singular system which allows each EU member state to share their data and allocate a designated registration number to each host, and have the platforms share data with authorities such as the host’s registration number and number of stays. A transparent market brings us many aspects and benefits look forward to. It will lead to a reduction in illicit hosts, which means we can anticipate a regulated, healthy market. In addition, disclosure of data related to guest stays will allow related businesses to make rational management decisions and local citizen groups to engage in efforts that contribute to policymaking of local governments and protecting the quality of life within the community6.

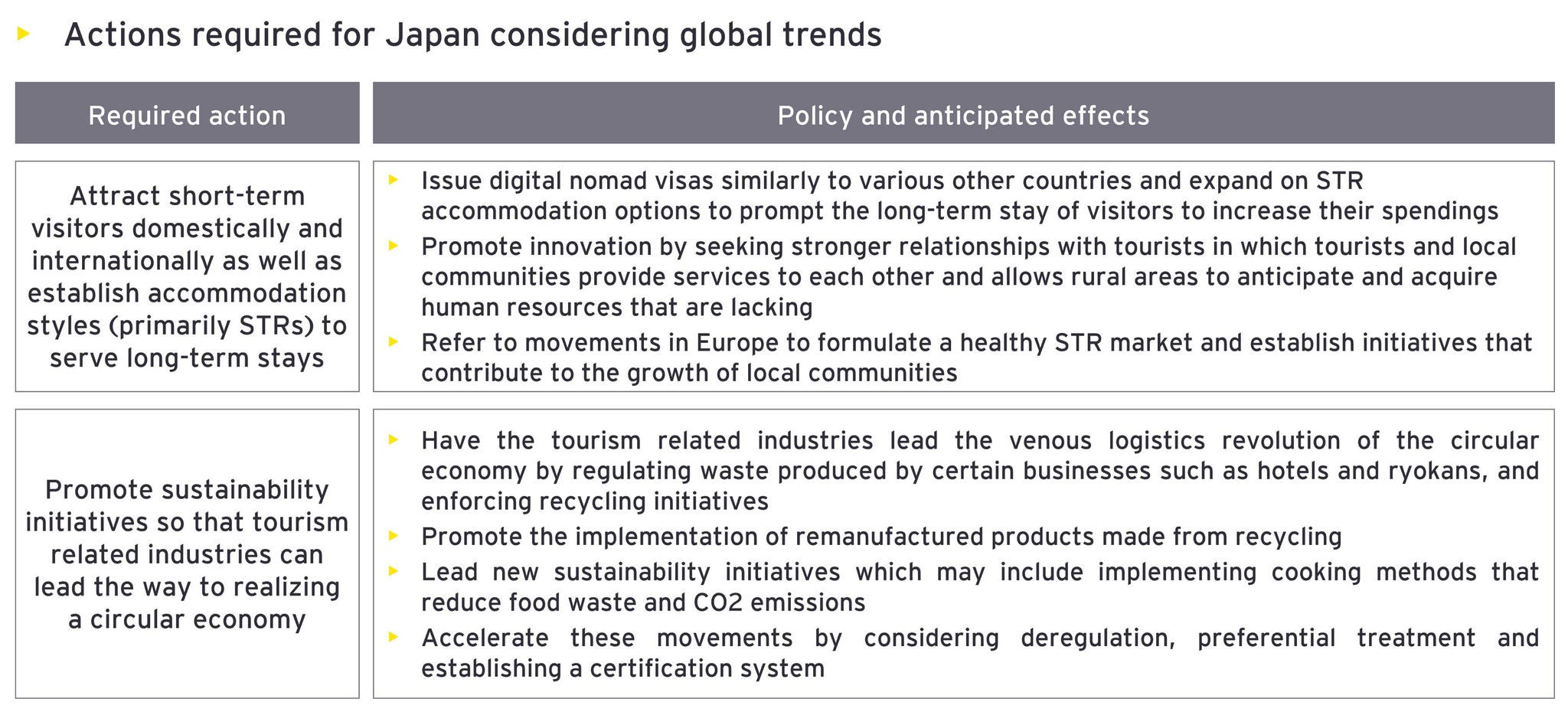

We expect Japan to follow these European trends and also make efforts to ensure transparency in the STR market, which will hopefully and in particular address the lack of accommodation facilities in rural areas, as well as promote increased interactions with talented human resources that stay for extended periods of time.

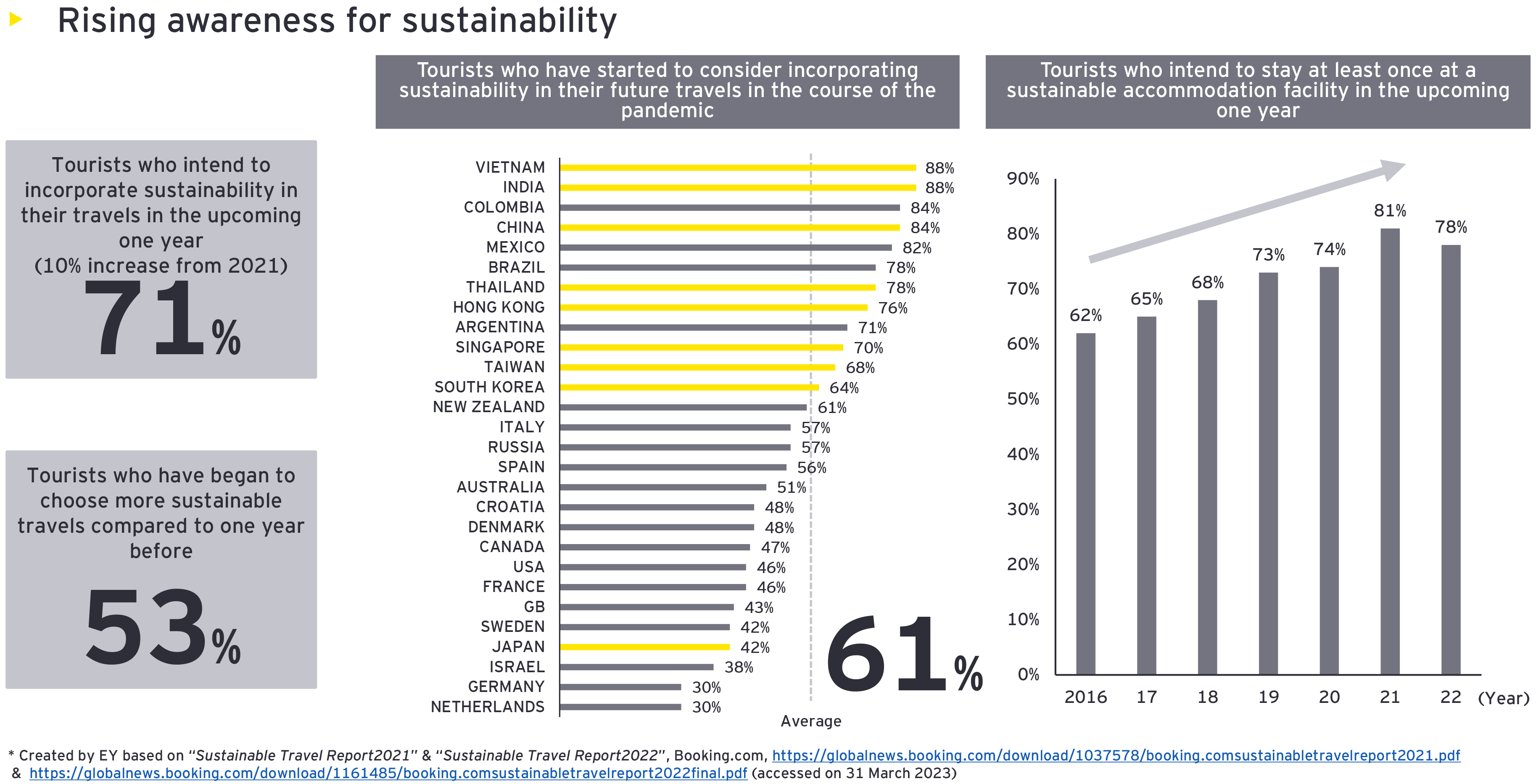

② Increasing awareness of sustainability

While awareness of the Sustainable Development Goals (SDGs) had been growing well before the pandemic, one can see that awareness increased even further over the course of the pandemic. Surveys regarding sustainability conducted by Booking.com show that tourists are increasingly seeking sustainability in their travel destinations. It is worth noting that the pandemic has catalyzed an increase of tourists - especially in Asia - who wish to incorporate more sustainability in their future travels.

Among the many initiatives in the tourism sector for working towards sustainability, the Global Tourism Plastics Initiative (GTPI), announced in July 2020, is demonstrating increasing efforts towards enhancing sustainability. Realized by the UNWTO’s participation in a movement led by the UNEP and the Ellen MacArthur Foundation, the GTPI takes existing approaches to eliminate the use of plastic and incorporates the perspective of various pandemic countermeasures, aiming to address the global increase in plastic waste and the escalation of marine pollution7.

Global hotel chains, among other businesses, are increasing efforts aimed at elimination of plastic, such as abolishing plastic straws, changing the provision style of amenity services (using dispensers instead of individual bottles for body soap and other products), no longer providing drinks in plastic bottles but rather equipping guest rooms with refillable bottles and introducing wooden or digital room keys. Efforts similar to these are expected to be seen in Japan as well.

In addition, Europe is attracting attention for initiatives that contribute to a more circular economy.

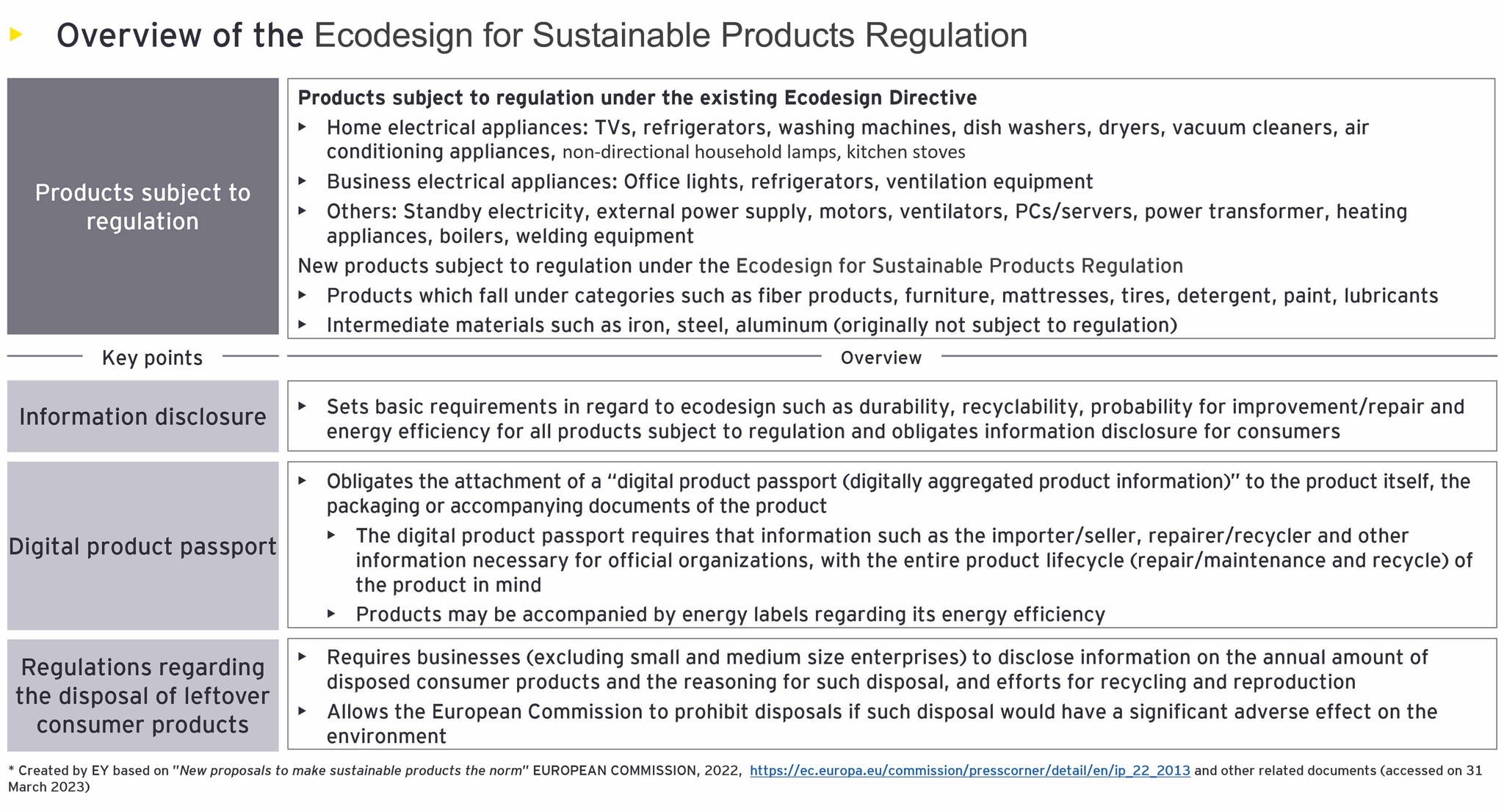

The European Commission, following their decision to set their priority areas to reducing plastic and food waste, announced the “Circular Economy Action Plan” in 2015, which includes initiatives regarding product manufacturing and consumption, and in 2019 launched “The European Green Deal”, a growth strategy for achieving a sustainable EU economy. Amidst these developments, in March 2022, the Commission proposed a policy package for the circular economy aimed at improving product sustainability, featuring the highly unique “Ecodesign for Sustainable Products Regulation8” 9. This proposal repeals the Ecodesign Directive enacted in 2009, and is considered progressive in the sense that it (1) obligates the attachment of a “digital product passport (digitally aggregated product information)” to either the product itself, the packaging or accompanying documents of the product and (2) includes regulations regarding the disposal of leftover consumer products.

While waste disposal and recycling regulations at the present mainly apply to home electrical appliances used within tourism-related industries, we can project that these regulations will have larger impacts as their scopes expand further to fiber products and beyond in the future. Despite all efforts that would be required under these regulations, the tourism industry domestically taking the lead in reducing the disposal of products and implementing the use of remanufactured products so as to initiate changes in venous logistics is an extremely important perspective for Japan (which is often thought to be far behind the West when it comes to sustainability).

YAMADA DENKI, a Japanese manufacturer, has proposed a plan to increase the recycling of home electrical appliances from 70,000 products a year to 300,000 products a year by 2025 by utilizing its new recycling plant (which was built in Gunma prefecture 2022 and is one of the largest in Japan) and by also planning to build two more domestic plants in the future.10. DAIKIN INDUSTRIES, another Japanese manufacturer, has been promoting sustainability efforts by recovering refrigerant and removing impurities for reuse when maintaining or replacing air conditioning appliances11. The Tourism industry is no exception from this trend. Engaging in sustainability efforts and appealing to both domestic and international tourists will be critical for Japan to become a “chosen destination” by tourists.

Other sustainability initiatives that have recently begun in Japan include commercial facility kitchens implementing hydrogen cooking appliances for the purpose of reducing CO2 emissions12. Using hydrogen for cooking has not only garnered attention for its ability to reduce CO2 emissions, but also for its application as a cooking method that can maximize the "umami" of ingredients. It will be important for the tourism industry to lead such initiatives if Japan wants to become an active gparticipant in the global community for sustainability efforts and a tourist destination that attracts the world’s attention.

Steps Japan must take

As we have discussed in this report, the travel styles and values of tourists have been changing over the course of the pandemic, and while demand for international travel is recovering, we can project that Japan will lose its ability to continue to attract tourists unless it keeps abreast of these changes. More importantly, as other Asian countries are already staying ahead of and addressing these changes, any lag in Japan's response will undeniably lead to this new generation of travelers gradually taking Japan off their itineraries, regardless of how spectacular Japan is as a destination13.

We strongly believe that STRs will play an important role within local communities when it comes to "everyday being a form of tourism" and "tourism being an everyday event," and are also the key to unlocking further innovations in developing communities14. As for the road to sustainability, it is safe to say that the world expects Japan to engage in sustainability efforts in which tourism related industries take charge of developing venous logistics in the circular economy and spearheading efforts to promote a truly circular economy and sustainable tourism.

Article references

- 1kift Global Forum, NY (21 to 19 September 2022) live.skift.com/skift-global-forum-2022/

- Web pages of each countries such as Digital Nomads Working in Thailand, Thai Embassy, (“thaiembassy.com/thailand/thailand-digital-nomad-visa-and-work-permit”) (accessed 31 March 2023)

- Future of Tourism 2022 - 2031, EY Strategy and Consulting Co., Ltd. (Nikkei BP, 2021) and ey.com/ja_jp/consulting/the-future-of-tourism-with-corona-and-post-corona

- “Enforcement status of the Private Lodging Business Act”, the Japan Tourism Agency, mlit.go.jp/kankocho/minpaku/business/host/construction_situation.html (accessed on 31 March 2023)

- Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on data collection and sharing relating to short-term accommodation rental services and amending Regulation (EU) 2018/1724, European Commission,2022, eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022PC0571&from=EN (accessed on 31 March 2023)

- Questions and Answers: New Rules on Short-term Accommodation Rentals, European Commission,2022,ec.europa.eu/commission/presscorner/detail/en/QANDA_22_6494 (accessed on 31 March 2023)

- ‟Recommendations for the Tourism Sector to Continue Taking Action on Plastic Pollution During COVID-19 Recovery” UNWTO, 2020, webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2020-07/200722-recommendations-for-tackling-plastics-during-covid-recovery-in-tourism.pdf (accessed on 31 March 2023)

- The proposal sets sustainable products as the standard within the EU market, and aims to contain the impact products cause on the environment and climate by abolishing the traditional production/consumption model of “resource extraction, product manufacturing, use and dispose” and instead considering any environmental effects during the designing phase of a product.

- REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL

establishing a framework for setting ecodesign requirements for sustainable products and repealing Directive 2009/125/EC, European Commission,2022, environment.ec.europa.eu/system/files/2022-03/COM_2022_142_1_EN_ACT_part1_v6.pdf (accessed on 31 March 2023) - “YAMADA DENKI builds the Japan’s largest home electrical appliances recycling plant” youtube.com/watch?v=KX87IC4mUq0 (accessed on 31 March 2023)

- DAIKIN CONDUCTS LIFE-CYCLE ASSESSMENT OF REFRIGERANT RECLAMATION, www.daikin.com/press/2023/20230131 (accessed on 31 March 2023)

- H2&DX Inc. collaborates with a Hakone onsen, “Gora Hanaougi Madokano-mori” considering the use of hydrogen energy as a means of decarbonization (accessed on 31 March 2023)

- “World Economic Forum: Japan becomes No.1 in the Travel & Tourism Development Index 2021, in which year sustainability was taken into account ”, yamatogokoro.jp, yamatogokoro.jp/inbound_data/46457/ (accessed on 31 March 2023)

- Future of Tourism 2021 - 2023, EY Strategy and Consulting Co., Ltd. (Nikkei BP, 2021) and ey.com/ja_jp/consulting/the-future-of-tourism-with-corona-and-post-corona

Our latest thinking

How to realize DX in tourism industry

COVID-19 has accelerated the need for Digital Transformation (DX) in travel and tourism, making it a top priority for destinations and tourism services. We can pave the way to overcoming this crisis by promoting DX in order to understand the diverse needs of tourists and redefining the attractions of destinations.

Tourism during the COVID-19 pandemic and the road to recovery

With demand likely to recover, this report examines tourist behaviors during the COVID-19 pandemic and considers the outlook for the tourism industry.

Tourism in the time of COVID-19

A recurring theme of the webinar is the need to redefine tourism. A “workation” lifestyle, popularized during the COVID-19 pandemic, has made tourism an everyday event. In addition, emerging digital technologies such as the metaverse have the potential to undermine the concept of mobility in travel. We need to explore a multi-layered concept of tourism which embraces travel in the metaverse and the real world.

Summary

Travel styles and values of tourists have been changing over the course of the pandemic, and Asian countries are already staying ahead of and addressing these changes. Any lag in Japan's response will make it unfeasible for Japan to continue to attract international tourists. What is expected from Japan now is efforts in regard to STRs and sustainability which will promote a truly circular economy and sustainable tourism.