EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

R&D Tax Services

How does the R&D regime work?

The research and development (R&D) regime provides for a tax credit or cash refund worth 30% of your R&D expenditure in respect of R&D activities incurred by a company within the charge to Irish tax operating in the EEA.

The credit or cash is in addition to any existing deduction or capital allowances for R&D expenditure, in other words, for every €100 spent on qualifying R&D activity (revenue or capital expenditure), a company could be entitled to €30 cash back which is in addition to the 12.5% (15% for companies that fall into BEPS Pillar 2) corporate tax deduction. Therefore, up to 42.5% (45% for BEPS Pillar 2) effective tax relief could be obtained for R&D expenditure, if it falls within the scope of this regime, equating to €42.50 (€45 for BEPS Pillar 2) for every €100 spent.

This coupled with the availability of grant support can help companies significantly reduce their cost of doing R&D in Ireland.

What EY can do for you

Our dedicated and multi-disciplinary R&D team has a proven track record of offering a uniquely integrated service to clients across a range of industry sectors by combining the skills of engineers, scientists, industry specialists and qualified tax advisors. We have a proven methodology for building robust R&D tax claims and helping clients maximise those claims. We also have an excellent track record on R&D Revenue audits, which is the envy of our peers.

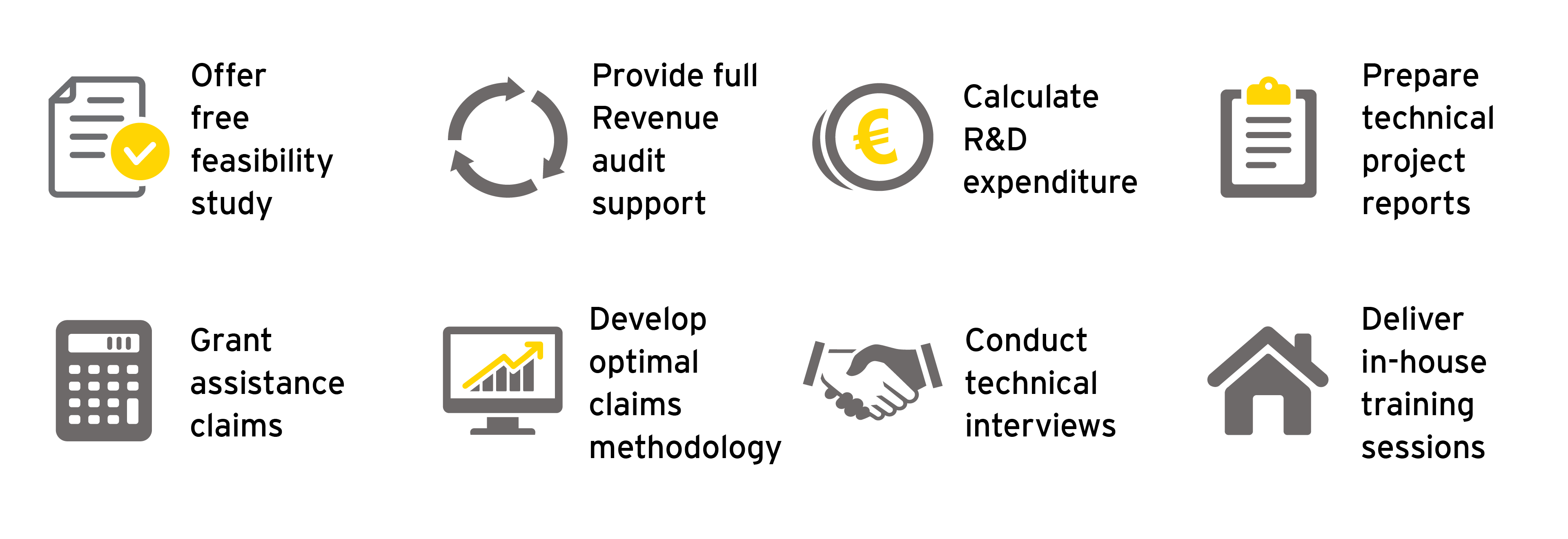

Our tailored approach can include:

Our team has over 20 years’ experience helping Irish multinational companies and SMEs claim R&D tax benefits. We have extensive experience in successfully agreeing claims with Irish Revenue on audit and we engage with Irish Revenue and the Department of Finance on R&D tax credit matters including: audit approach, application of Revenue guidance and potential legislative improvements in this area. Our experience includes securing the first Irish Revenue pre-approval for a client in the software sector, which encompassed a technical review by an industry expert engaged by Irish Revenue.

How EY can help