Political developments have dominated the all-island economy since our last report. The Republic of Ireland (ROI) election resulted in an unprecedented outcome that, at the time of writing, has not resulted in the formation of a new government, while after three years, the Northern Ireland (NI) Executive has returned. Meanwhile, the Conservative Government in the UK are preparing their first budget since achieving a greatly-enhanced majority at the December election. If economic growth was all that mattered, the political outcomes would be very different. ROI’s growth is expected to be close to 6% in 2019 and the UK’s just 1.3%, yet the electorate endorsed the Conservatives in the UK, but did not do the same for Fine Gael.

Little reward for prudence

The measure of success in an economy and how citizens experience economic growth is being reassessed. The quality of public services and state of the environment are fast becoming the most important issues, and the disconnect with GDP as a measure of success is greater than ever. The newly-formed NI Executive made its first order of business to call out the need for increased funding to deliver services.

The Fiscal Council in ROI has been warning against excessive spending, but the reward for the level of prudence shown by Fine Gael has not been evident at the ballot box. Only in the US does the maxim “it’s the economy stupid” still hold. The nexus of economic, social and environmental considerations is the new paradigm that is reshaping the political landscape.

Who funds public services?

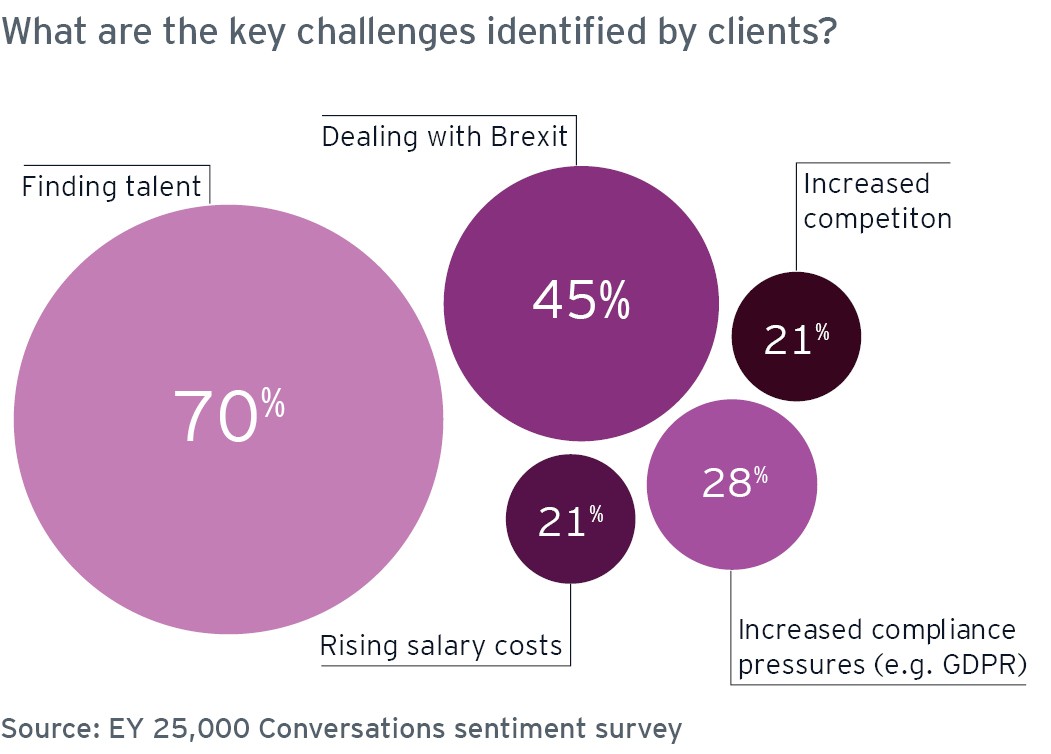

Responding to citizens’ desire for enhanced public services is not easy. The need to unwind austerity, increase staff numbers and invest in facilities is expensive and comes at a time when labour supply is very limited. The rapid population growth in Ireland (276,100 over the last five years) has exerted pressure on public services and infrastructure, similar to the UK experience. The question of who pays for enhanced services and infrastructure is an issue across the island.

The UK Government is suggesting that the NI Executive will need to look at ways to raise more revenue locally, and there is growing evidence that tax increases may be palatable across the island if ring-fenced for frontline services. Government bonds have proved popular and can be issued at a low cost by the ROI and UK Governments, but the overall debt burden for both, to date, makes most political parties reluctant to do so.

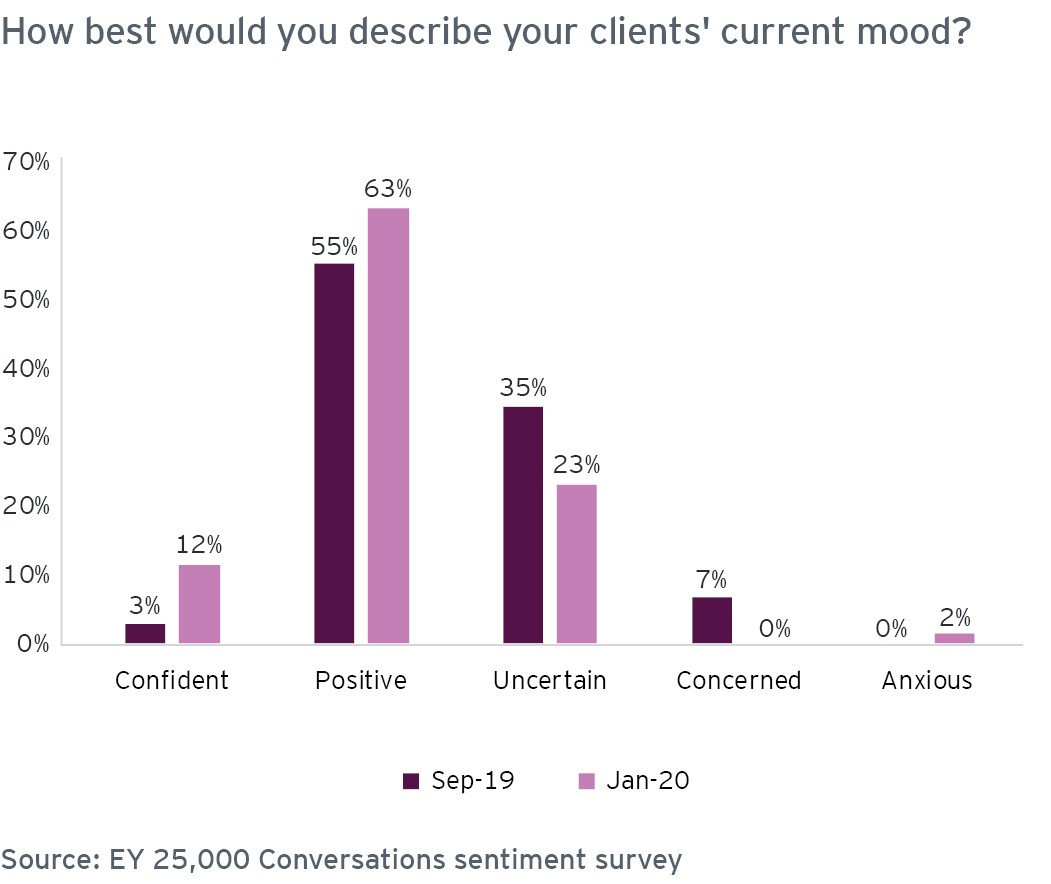

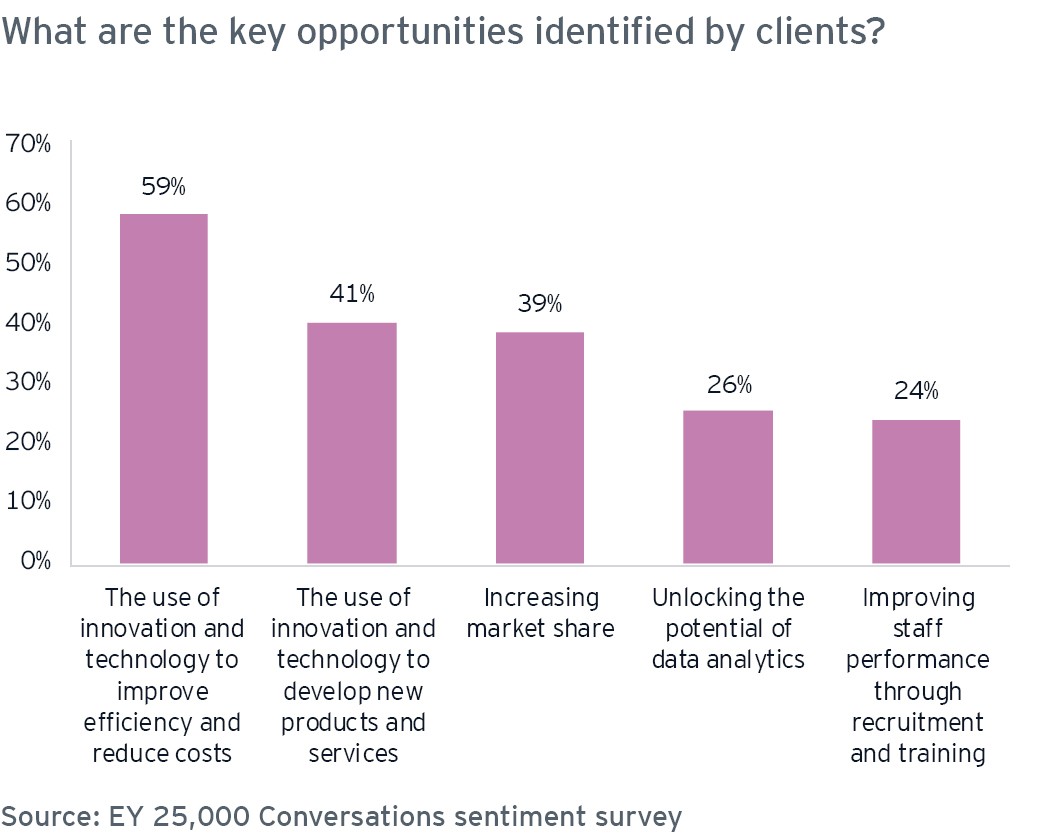

Reasons for business optimism

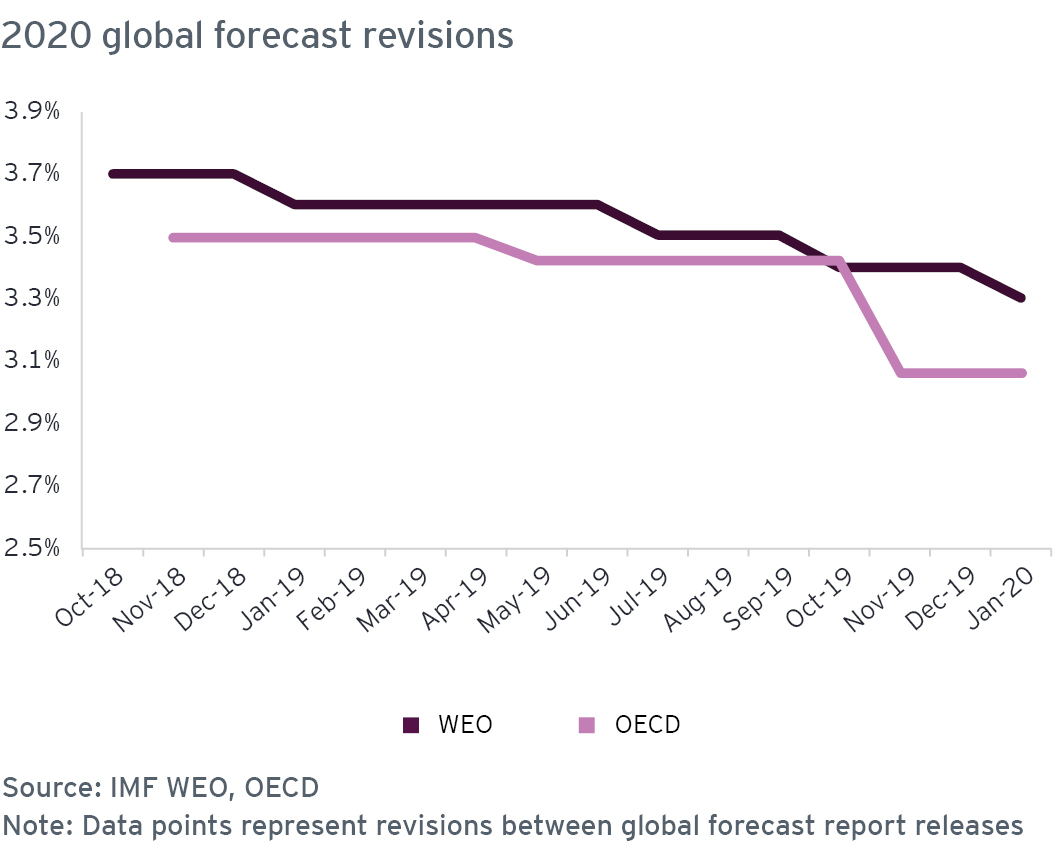

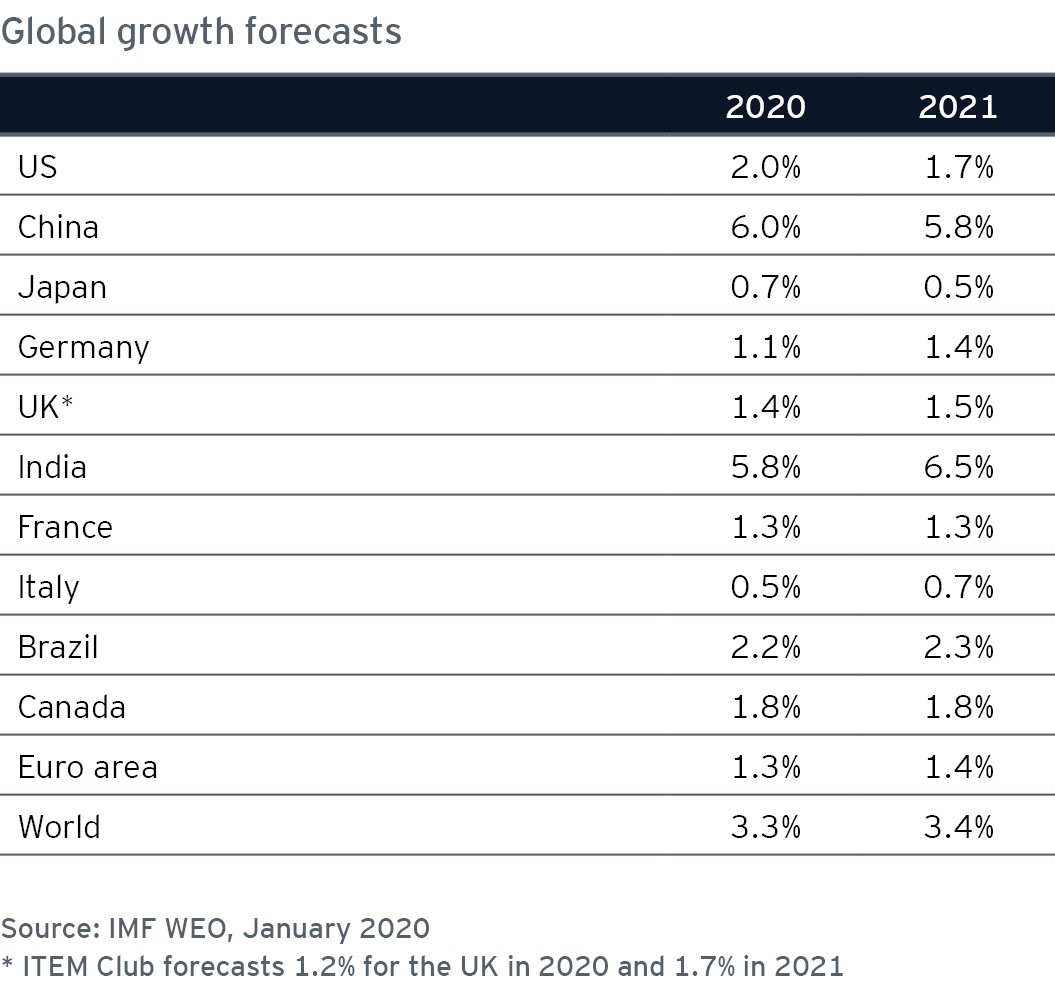

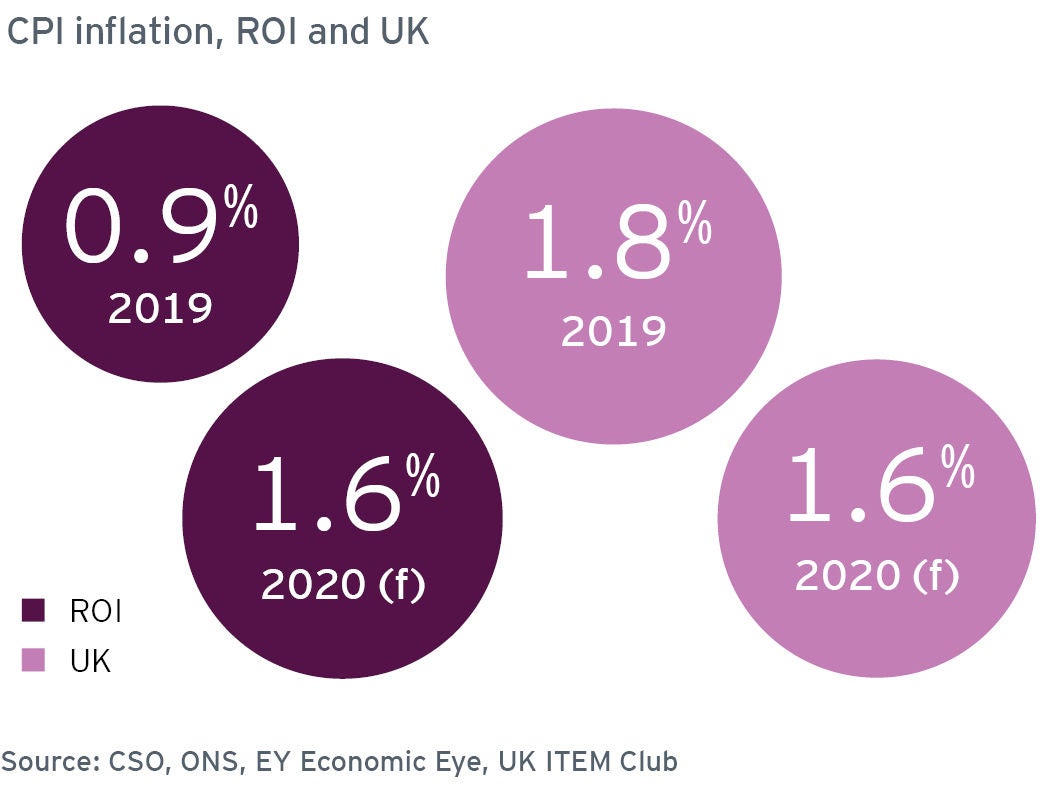

The level of global anxiety has edged back very slightly in recent months, as trade tensions cool somewhat, and fears of an oil price hike dissipate. Looking at the macro fundamentals, there are reasons for optimism. Interest rates are historically low, inflation remains muted, more people are in work and pay growth is picking up. Growth rates in NI support low inflation, but ROI’s sustained high growth at a time of negligible inflation is unusual. With debt servicing costs low and strong levels of job security, the island’s domestic consumer market is relatively buoyant. When coupled with mildly expansionary government spending, this offers a degree of comfort for businesses.

Forecasts edge up slightly

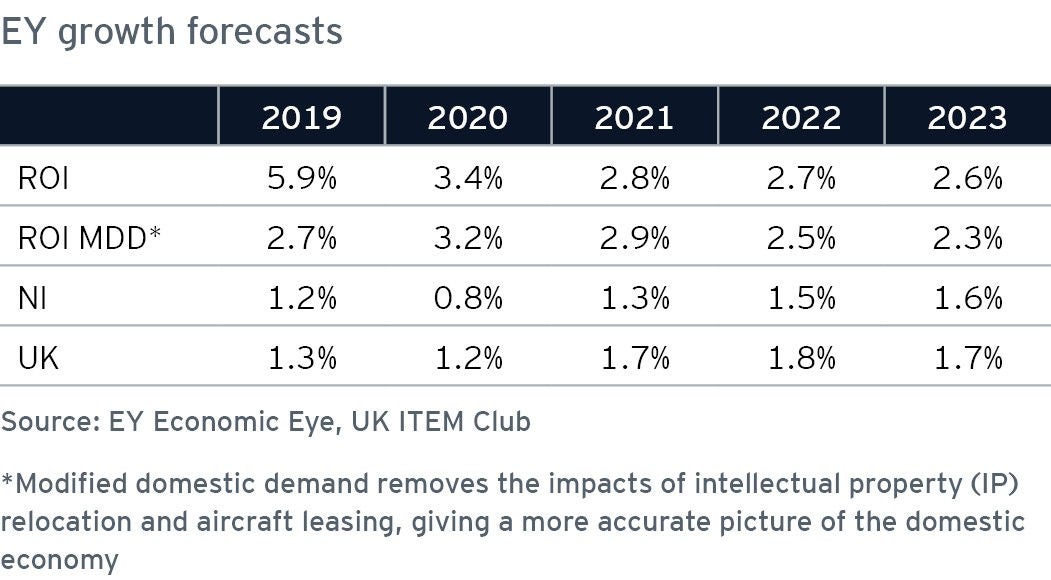

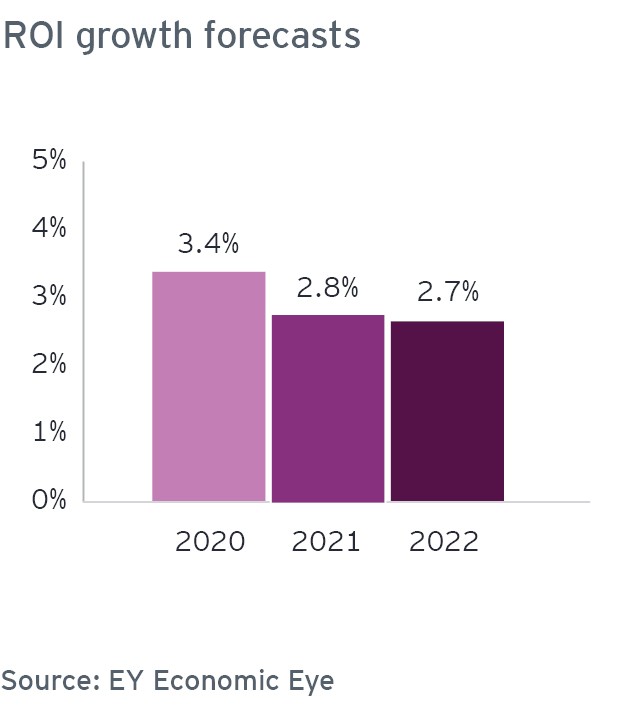

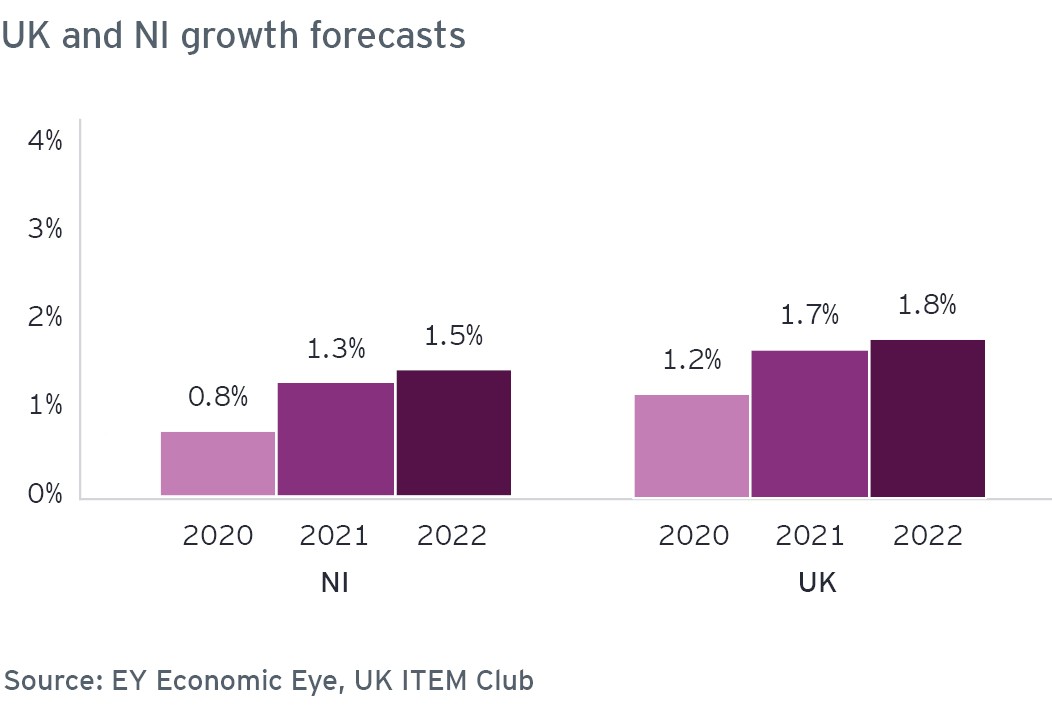

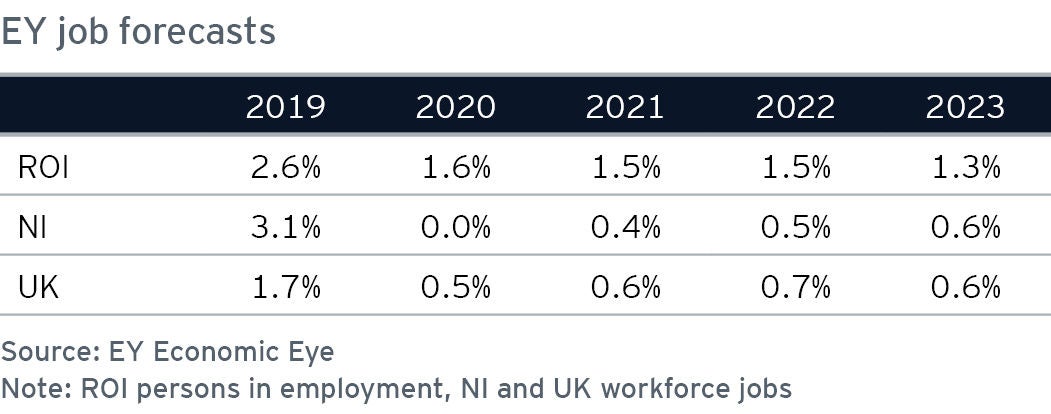

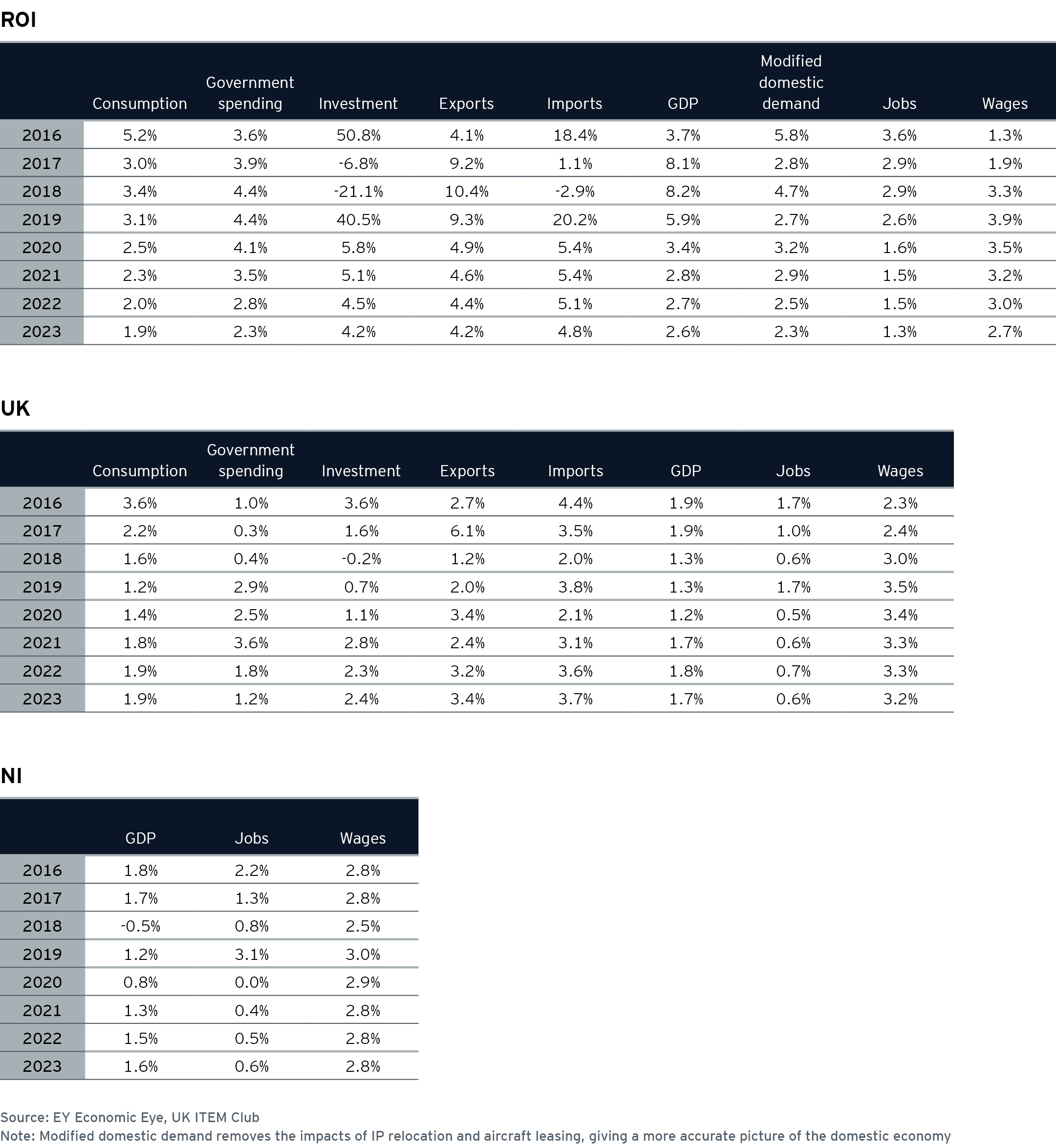

ROI forecasts have been revised up since we published our last report and although the UK and NI are lower, they have improved on our monthly pulse forecasts released between issues. The modest improvement in global conditions and the persistent strength in the domestic sector have led to the upward revision in the ROI outlook. In NI, the planned increase in government spending and high levels of job growth have improved the employment forecast and helped to prevent the growth outlook from slipping into negative territory. Growth of 3.4% is forecast in ROI in 2020 and 0.8% in NI.

The labour market is still projected to slow in NI in 2020, though not to contract as previously forecast, and the moderation of ROI job growth (to 1.6%) largely reflects tighter labour supply. Downside risks are mostly external; a weakening local economy, a deterioration in the progress of the Brexit trade negotiations and the recent outbreak of the coronavirus. Within the Brexit trade negotiations, it is the specific terms of NI to Great Britain (GB) and EU trade that are of particular importance for the all-island economy.