EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

How EY can help

-

Our indirect tax compliance service professionals can help you meet your compliance obligations and business goals around the world. Find out how.

Read more

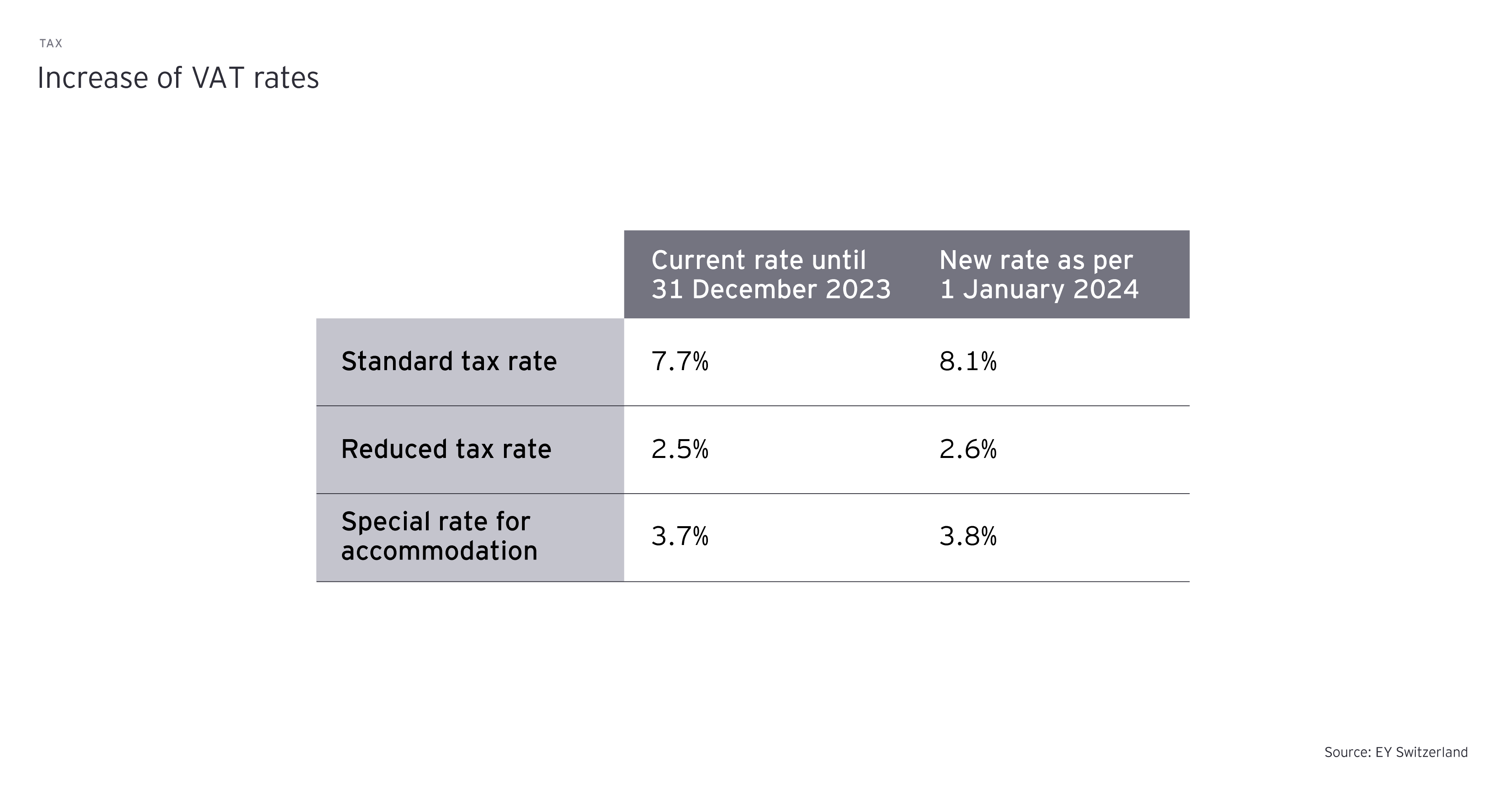

The effective date of 1 January 2024 seems a long way off – deceptively so, because taxable businesses who provide cross-period supplies may already have to ask themselves at the beginning of 2023 to what extent they will have to apply the new VAT rates.

Background: Determination of the applicable tax rate

Regardless of the applicable VAT rate, the VAT liability continues to arise at the time of invoicing or with the prior receipt of payment (assuming VAT is reported based on considerations agreed). For the determination of the applicable VAT rate, however, neither the date of invoicing nor the receipt of payment is to be considered, but the date or the period of the supply.

The date of supply is therefore of central importance in the context of the VAT rate increase – it determines whether the taxable business can still account its supply at the old (lower) VAT rate or must already apply the new (higher) VAT rate. In principle, supplies rendered before 1 January 2024 are taxable at the current VAT rates, while supplies rendered after 31 December 2023 are subject to the new higher VAT rates.