Reporting period

In general, based on the EU Directive framework, the first fiscal year of reporting is the year starting on or after 22 June 2024. Therefore, for MNE Groups with a fiscal year equal to the calendar year, the first year of reporting would, generally, be 2025 and the report should be made public by 31 December 2026. However, EU/EEA Member States may choose to apply the rules earlier (e.g., Romania and Croatia, for fiscal years starting on or after 1 January 2023 and 1 January 2024, respectively). In addition, MNE Groups will typically need to publish a report within 12 months from the end date of the balance sheet of the fiscal year of the Ultimate Parent Entity (UPE). However, an EU/EEA Member State could choose to require an earlier publication (e.g., Hungary – five months, or Spain – six months).

Information to be reported annually

According to the EU PCbCR Directive, information generally to be disclosed includes:

- Name of the UPE undertaking, the fiscal year concerned, and the functional currency used

- Subsidiaries located in the EU or in any jurisdiction of the EU list of non-cooperative jurisdictions for tax purposes

- Nature of the activities

- Number of employees on a full-time equivalent basis

- Revenues (including transactions with related parties)

- Profit or loss before income tax

- Income tax paid on a cash basis

- Income tax accrued (not including deferred taxes or UTP)

- Accumulated earnings

As mentioned, the information must be disclosed on a disaggregated basis, e.g., on a country-by-country basis, for EU/EEA Member States and EU list of non-cooperative jurisdictions for tax purposes. Information related to other jurisdictions may be disclosed on an aggregated basis. EU/EEA Member States may allow for one or more specific items of information to be omitted when its disclosure would be seriously prejudicial to the commercial position of the MNE Group. However, information pertaining to tax jurisdictions included in the EU list of non-cooperative jurisdictions should never be omitted.

Furthermore, the EU Directive includes optional components, which grant individual EU/EEA Member States certain autonomy for the domestic implementation. Among these components is the option known as the “safeguard clause” to defer mandatory disclosure for up to five years when the information is considered commercially sensitive. In instances where firms decide to exercise this deferral, they are obligated to support the rationale for the postponement within the report and the information withheld is required to be subsequently disclosed in a future report. Additionally, companies are granted an exemption from publishing their reports on their own websites if they ensure that the report is publicly available, free of charge, to any third party within the EU/EEA via the official commercial registry's website. Information of group subsidiaries operating in non-cooperative jurisdictions do not have the right for applying the safeguard-clause, that is, postpone certain information for up to five years, or the website exemption to refrain from disclosure on the company’s website.

Where to report

For EU- and EEA-headquartered MNE groups, the UPE is responsible for European regulatory filings with the commercial registry and publishing it on its website. For non-EU and non-EEA headquartered MNE groups, the report needs to be published by the medium/large subsidiaries or branches in the EU/EEA. Exemptions could apply when the UPE publishes the report, including those subsidiaries and branches. The report should follow similar content as foreseen in the EU Directive and other certain requirements should be met.

II. Liechtenstein’s compliance path for the EU PCbCR Directive

As a member of the EEA, Liechtenstein incorporated the EU PCbCR requirements into its national framework, which for EU-based companies should generally affect fiscal years starting on or after 22 June 2024. Consequently, the EU PCbCR requirements have been transposed into local law (Liechtenstein’s legal framework on Law on Persons and Companies, “PGR” was amended accordingly) and entered into force on 1 July 2024, to incorporate new sections on income tax information reporting. It is important to point out that for the PCbCR obligation to become finally effective in Liechtenstein, approval from the EEA council is additionally required. Given that the EEA council approval is still outstanding, the obligations for the first year of the PCbCR obligation in Liechtenstein should be analyzed on a case-by-case basis.

Covered groups and entities

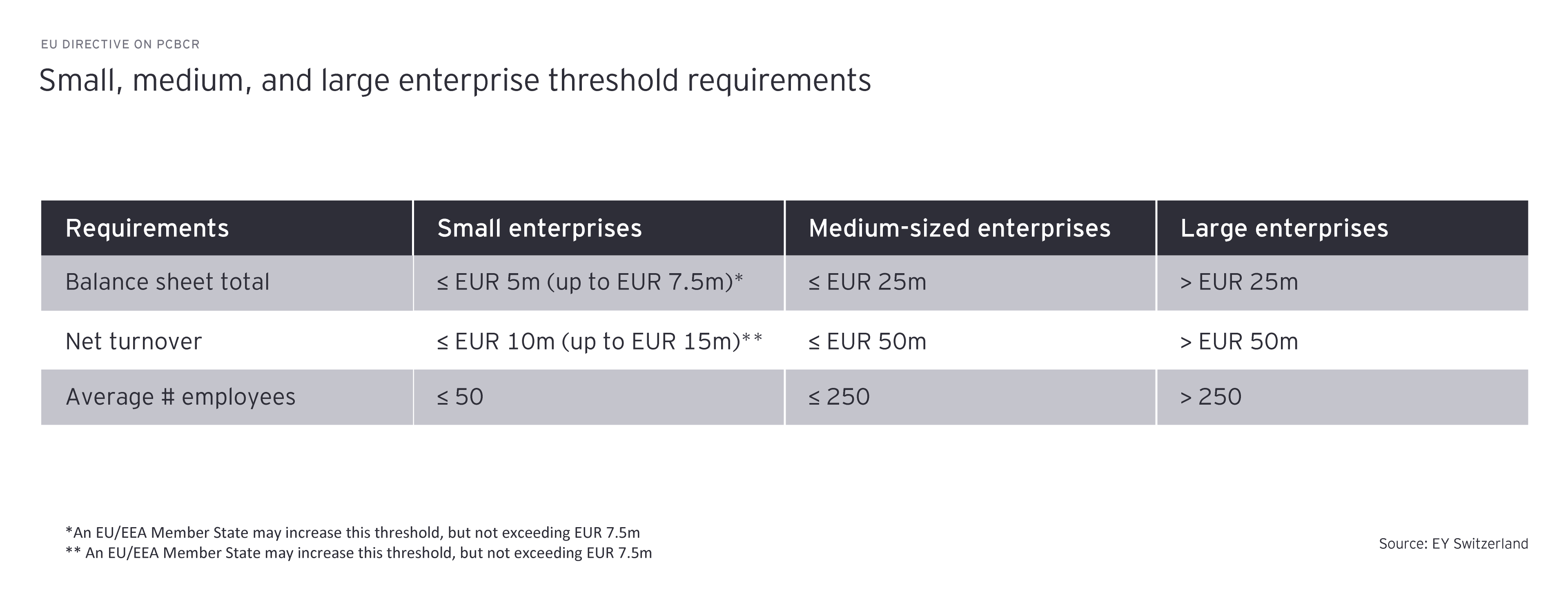

Based on the PGR, PCbCR in Liechtenstein requires the same information to be reported as stated in the EU Directive and will be applicable to all MNEs that fulfill the following criteria:

- The MNE (with a UPE in Liechtenstein2) has consolidated revenues exceeding EUR 750 million (in case of the application of another group currency, e.g., Swiss Francs, a conversion must be performed applying the respective annual average exchange rate) in the two last consecutive fiscal years, and

- The MNE’s UPE is located in Liechtenstein, which is responsible for reporting, or

- A medium or large subsidiary of a foreign MNE is located in Liechtenstein.

The threshold for compliance with the PCbCR in Liechtenstein is set at EUR 750 million, which is currently lower than the CHF 900 million threshold for the standard Country-by-Country Reporting (CbCR) in Liechtenstein. This means that MNEs that were previously not required to comply with CbCR requirements may now find themselves obliged to adhere to the PCbCR obligations. In this respect, it may be mentioned that the current threshold for CbCR purposes might be lowered to EUR 750 million in the coming years as well. However, it is momentarily not foreseeable whether this threshold will in fact be adjusted.

In addition to the abovementioned criteria, it is important to note that according to Liechtenstein’s local regulations on PCbCR, the law only targets EU harmonized legal forms (the “qualified entities”) such as Public Limited Companies, PLC (Aktiengesellschaft, AG), Private Limited Companies, Ltd. (Gesellschaft mit beschränkter Haftung, GmbH), and Associations by shares (Kommanditaktiengesellschaft, KAG). This limitation implies that other legal forms that exist in Liechtenstein (in particular the legal form of an “Anstalt,” “Stiftung” or a “Trust”) are not subject to the PCbCR.

PGR and ratification

The new set of regulations on Liechtenstein’s law on PCbCR are covered under articles 1140 to 1153 PGR. The articles include information on:

- Necessary definitions, scope of application, exceptions, and content of reporting obligations.

- Information on how to publicly disclose information (e.g., either on website of the parent entity (MNE), a group subsidiary, or a branch or subsidiary of the MNE

- Detailed regulations on the information required, currency and currency conversion, reporting format, and disclosure and accessibility of the income tax information

- Joint responsibility of the administrative, management, and supervisory bodies of the UPE or standalone company for the preparation, disclosure, and accessibility of the report

- Regulations on the auditor's statement on whether the obligation to prepare an income tax information report exists and, if so, whether such a report has been disclosed

For the PCbCR obligation to become effective, approval from the EEA council is required. The following provides an overview of important dates in relation the PCbCR in Liechtenstein:

- 22 June 2024 – PCbCR obligation requirement for EU-based MNE’s financial years starting on or after this date

- 1 July 2024 – effective date of the EU Directive being implemented into Liechtenstein PGR

- Effective date for Liechtenstein application – approval by EEA council

III. Special considerations for PCbCR in Liechtenstein

In general, the UPE of an MNE that is the responsible entity for preparing consolidated accounts is usually responsible for preparing the PCbCR. UPEs located in Liechtenstein principally have the following two approaches for preparing the PCbCR:

1. If applicable, a Liechtenstein UPE may follow the standard CbCR regulations for reporting, which may encompass not only EU harmonized legal forms, but under the “deemed listing provision” also other legal forms unique to Liechtenstein, such as “Anstalt”, “Stiftung” or “Trust”3, or

2. a Liechtenstein UPE prepares the PCbCR in accordance with the specific Liechtenstein tax law, which, for instance, is limited to the aforementioned qualified entities.4

The following examples aim to outline potential scenarios that could arise when preparing PCbCR for Liechtenstein purposes, considering only EU harmonized legal forms.

Anstalt, Stiftung or Trust as UPE located in Liechtenstein

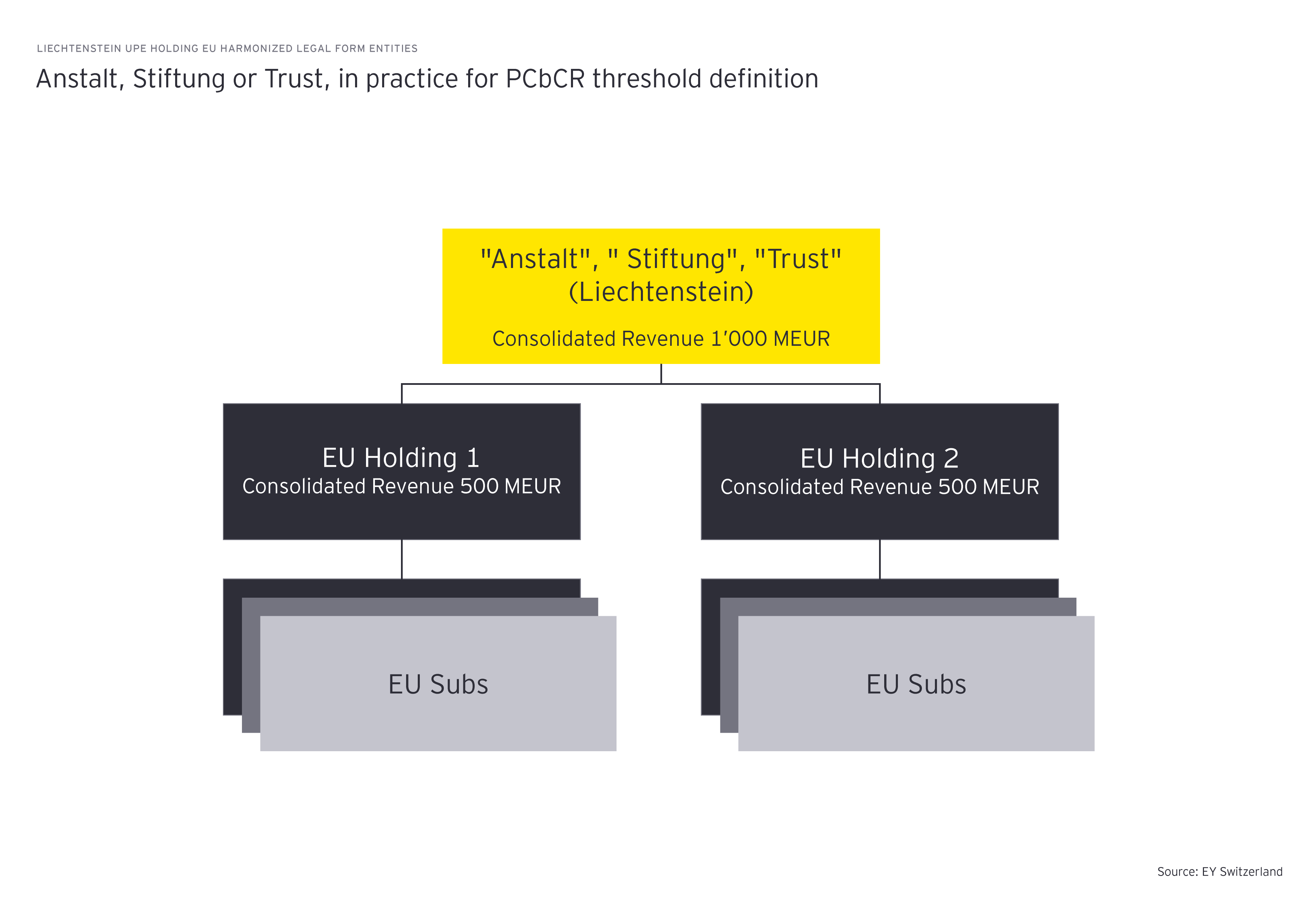

A challenge may arise when a Liechtenstein-based UPE has the legal form of an “Anstalt”, “Stiftung” or “Trust” itself, which are considered forms not covered by PCbCR rules in Liechtenstein. In such a scenario, and assuming that the MNE would meet the revenue threshold generally applicable for reporting obligations, the question may occur whether the entire group is exempt from reporting or not.

In case a non-qualified entity such as an “Anstalt”, “Stiftung” or “Trust” acts as UPE, these entities would generally be exempted from PCbCR obligations from a Liechtenstein perspective. However, in such a scenario, PCbCR obligations need to be reviewed on a case-by-case basis, considering all qualified entities involved. The obligation for reporting might fall to the next legal entity in the hierarchy of the group that is domiciled in EU/EEA and is incorporated as qualified entity. This legal entity would then adopt the UPE role for reporting. In case that this next legal entity within the group is yet again a non-qualified entity, the obligation descends further down until it reaches a qualified entity.

In conclusion, this means that the obligation for preparing PCbCR may exist regardless of the UPE’s legal form, provided the revenue threshold is met at the relevant entity level with an EU harmonized legal form.

Liechtenstein UPE holding several “EU harmonized legal form” entities

Clarification is also needed when a Liechtenstein UPE, such as an “Anstalt”, “Stiftung” or “Trust”, owns two or more entities (e.g., two EU-based holding entities which themselves hold several other entities) possessing an EU harmonized legal form. For example, if both these entities have an individual turnover of CHF 500 million, the combined turnover would generally meet the PCbCR threshold, as shown in the figure below.