EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Discover how Canadian CEOs navigate the evolving business environment in Q2 2024.

As we enter the second quarter of 2024, there is a discernible shift in executive sentiment. Leaders are moving beyond tentative optimism and actively embracing transformation and sustainability as key business imperatives. Owing to expected regulatory changes in Canada, sustainability priorities are taking precedence over investments in technology and artificial intelligence (AI) as part of near-term business strategies.

1. Changing winds encourage a shift in strategic priorities

Following a period of uncertainty, the first quarter of 2024 showed relative resilience in economic activity. Globally, there are signs of moderate economic growth, while inflationary pressures are slowly easing.

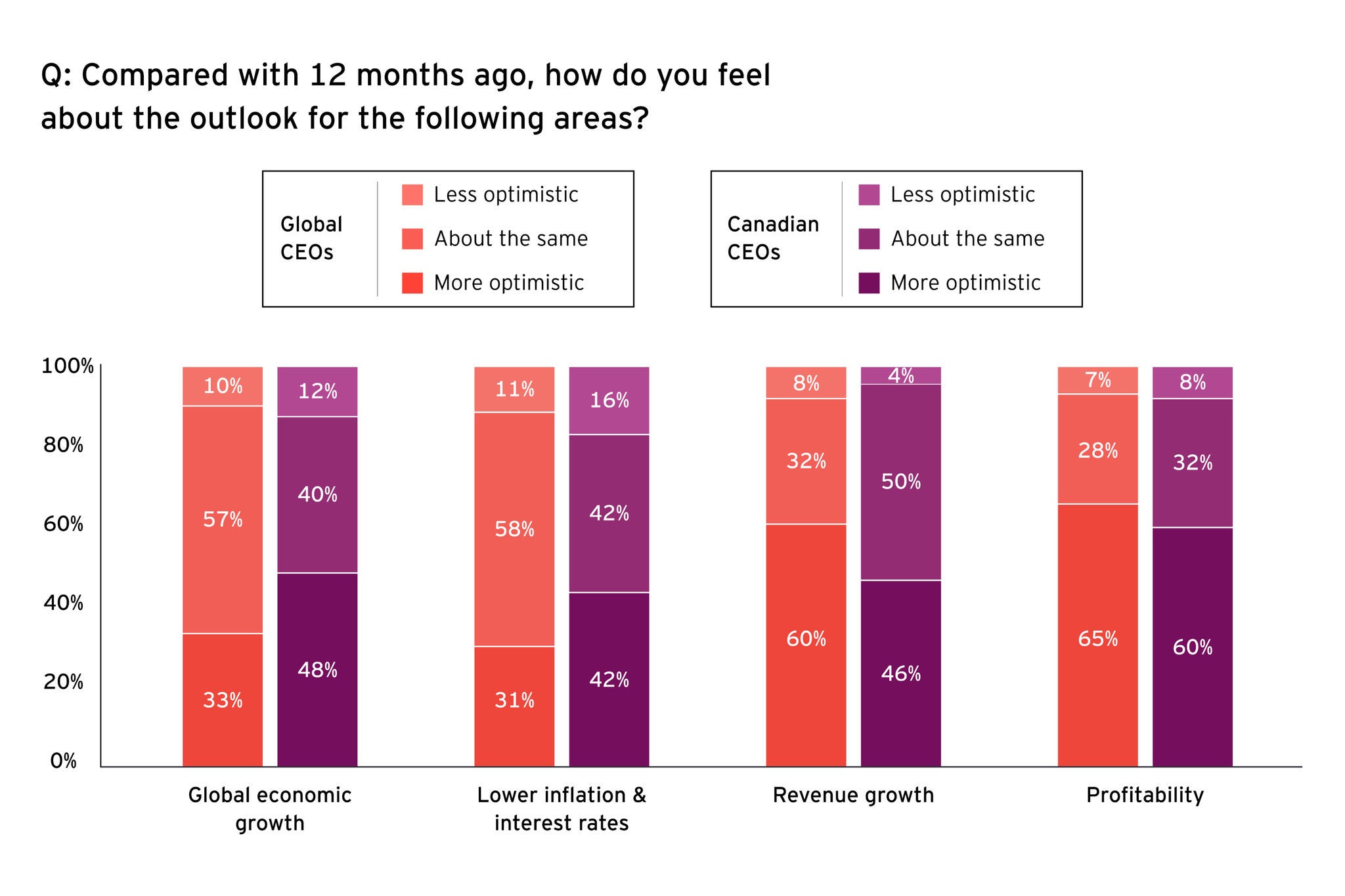

In early 2024, concerns of a “low or no growth” scenario were prevalent, with nearly two thirds of global and Canadian leaders holding the view that inflation and interest rates would be higher for longer, and economic growth would be limited. These concerns have begun to ease. The April survey data¹ suggests that nearly half of CEOs are now more optimistic about global economic growth than they were a year ago.

Recent economic trends show easing inflationary pressures in Canada and across the world. In line with this trend, inflationary expectations of Canadian leaders are markedly different from the beginning of 2024. Nealy half (42%) of Canadian leaders are more optimistic about inflation and interest rates, compared to 31% globally and 28% in the Americas. Canadian leaders are charging ahead with a more positive outlook, shedding their typically conservative expectations about broader economic activity.

However, despite taking on a more optimistic view about broader economic conditions, Canadian CEOs are still cautious about their own business performance. In contrast with the striking majority of respondents who expected higher revenues in Q1 2024 (84%), only 46% of respondents now indicate greater optimism about revenue growth for this year compared to last year.

This is lower than the Americas average, where 71% of leaders reported more optimistic expectations for revenue growth. This may hint at the lagging effect of tight monetary policy still working its way through the Canadian economy, with household budgets still constrained and the economy continuing to face a demand deficit. However, despite this cautious stance on revenues, leaders have a brighter outlook on profitability — 60% of Canadian leaders are relatively more optimistic about their profitability, trailing the global average of 65%.

Unsurprisingly, only a third of CEOs, both globally and in Canada, feel optimistic about geopolitical stability. Half (50%) of respondents indicated that their expectations about geopolitical stability are about the same as they were last year. Geopolitical concerns, a constant in recent quarters, are expected to remain at the forefront of business agendas for the foreseeable future.

In light of lingering geopolitical constraints, promoting national resilience and autonomy has been top of mind for leaders across the globe. Nearly half (48%) of Canadian CEOs indicated they are willing and planning to get involved in initiatives that support industrial sovereignty, with the top actions including development of domestic manufacturing ecosystems, as well as accepting carbon taxes for imports from countries with lower environmental standards.

However, fewer Canadian leaders have turned this plan into action, with only 20% of Canadian respondents already involved in such initiatives, significantly fewer than 57% in the Americas and 45% globally. This gap highlights potential challenges faced by businesses and policymakers to promote industrial sovereignty amid current geostrategic risks.

2. Continued appetite for business transformation

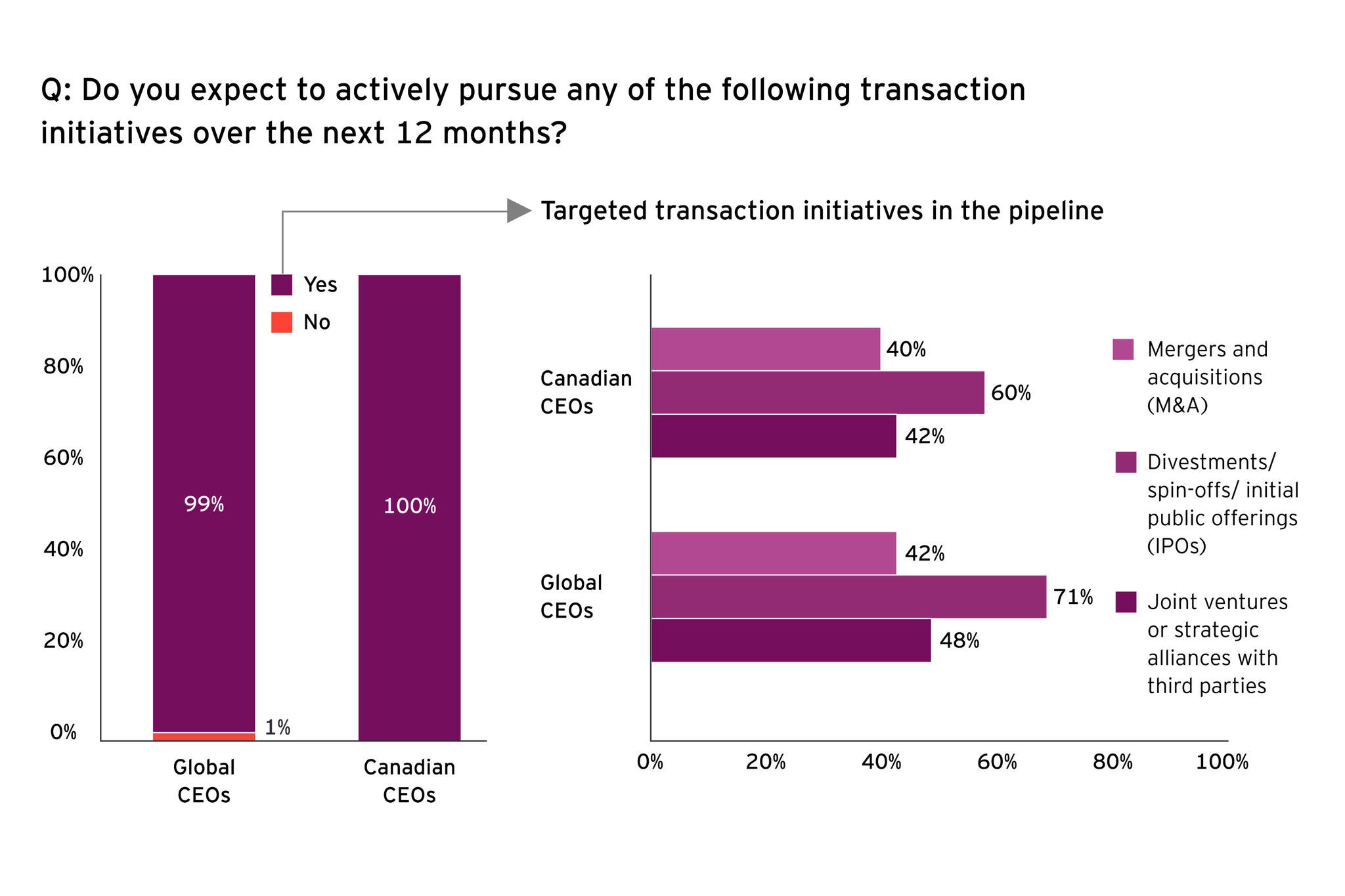

Amid more optimistic expectations regarding global economic growth, and lower interest rates and inflation, all Canadian CEOs confirm their commitment to business portfolio transformation. Nearly half (44%) of Canadian CEOs expressed confidence in capital market stability, adopting a more optimistic stance compared to their counterparts in the Americas (33%) and globally (32%).

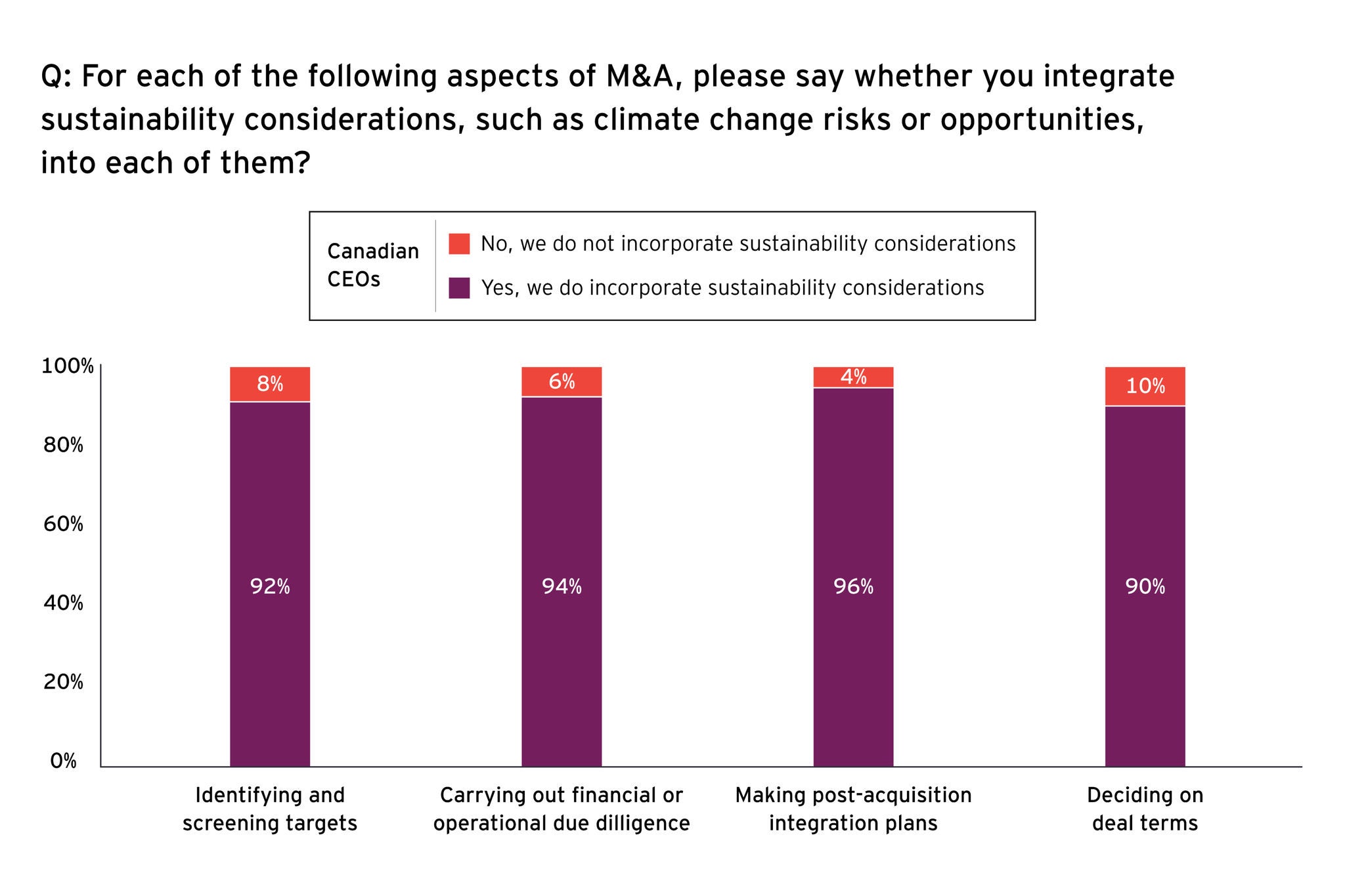

Forty percent of Canadian leaders are looking to leverage M&A as a key tool to meet short term goals, which include growing market share and acquiring technology, new production capabilities and innovative startups. This is aligned with global trends, as leaders look towards more capital markets transactions to stay ahead in the market. Sustainability is also at the forefront of M&A activity, with the vast majority of respondents indicating they are factoring in sustainability considerations in key M&A decisions.

3. Sustainability takes its place as a top business imperative

2023 was marked by a series of extreme weather events across the world, including droughts, wildfires and rising global temperatures, underscoring the need for appropriate climate action and reform. At COP 28, the “global stocktake” revealed that current efforts fall short of the Paris Agreement objectives and called for countries to triple their renewable energy capacity and double energy efficiency improvements by 2030. In response to such trends, the push for sustainability is growing stronger in the global context.

Sustainability remains a critical priority in the Canadian economy, showcased by increased demand for businesses to adopt more transparent sustainability reporting practices. In March 2024, the Canadian Sustainability Standards Board announced the first Canadian Sustainability Disclosure Standards for public consultation, a significant milestone in advancing sustainability reporting in Canada.² Business strategies are affected in the immediate term by such proposed regulation, and Canadian businesses cite sustainability concerns among their top three strategic priorities over the next year:

Looking beyond the next 12 months, Canadian CEOs are looking to boost productivity and growth, with the majority prioritizing tech and AI investments, along with an increased focus on geopolitical risk, as well as regulatory scrutiny and complexity.

Business strategy in Canada appears to be in contrast with global imperatives, indicating fundamental differences in growth strategies. For instance, immediate priorities global leaders reported include investments in technology and AI, data management and cybersecurity, and managing costs, while sustainability is only considered in longer-term strategic planning. Such differences in strategic direction may position Canadian businesses well from an ESG perspective, but the opportunity cost of prioritizing sustainability over business performance may be significant.

While Canadian leaders are preparing for sustainability reporting standards, they remain largely concerned by the potential impacts of ESG factors. The majority of Canadian respondents indicated that companies are leaning towards “green-hushing” due to greenwashing concerns, are anticipating risks of stranded assets or partial impairments due to new ESG regulations, and are also worried about the impact of sustainability issues on supply chains. The majority of Canadian leaders (70%) also regard sustainability mainly as a compliance and reporting issue, while they struggle to balance activism from shareholders more concerned with earnings rather than sustainability metrics.

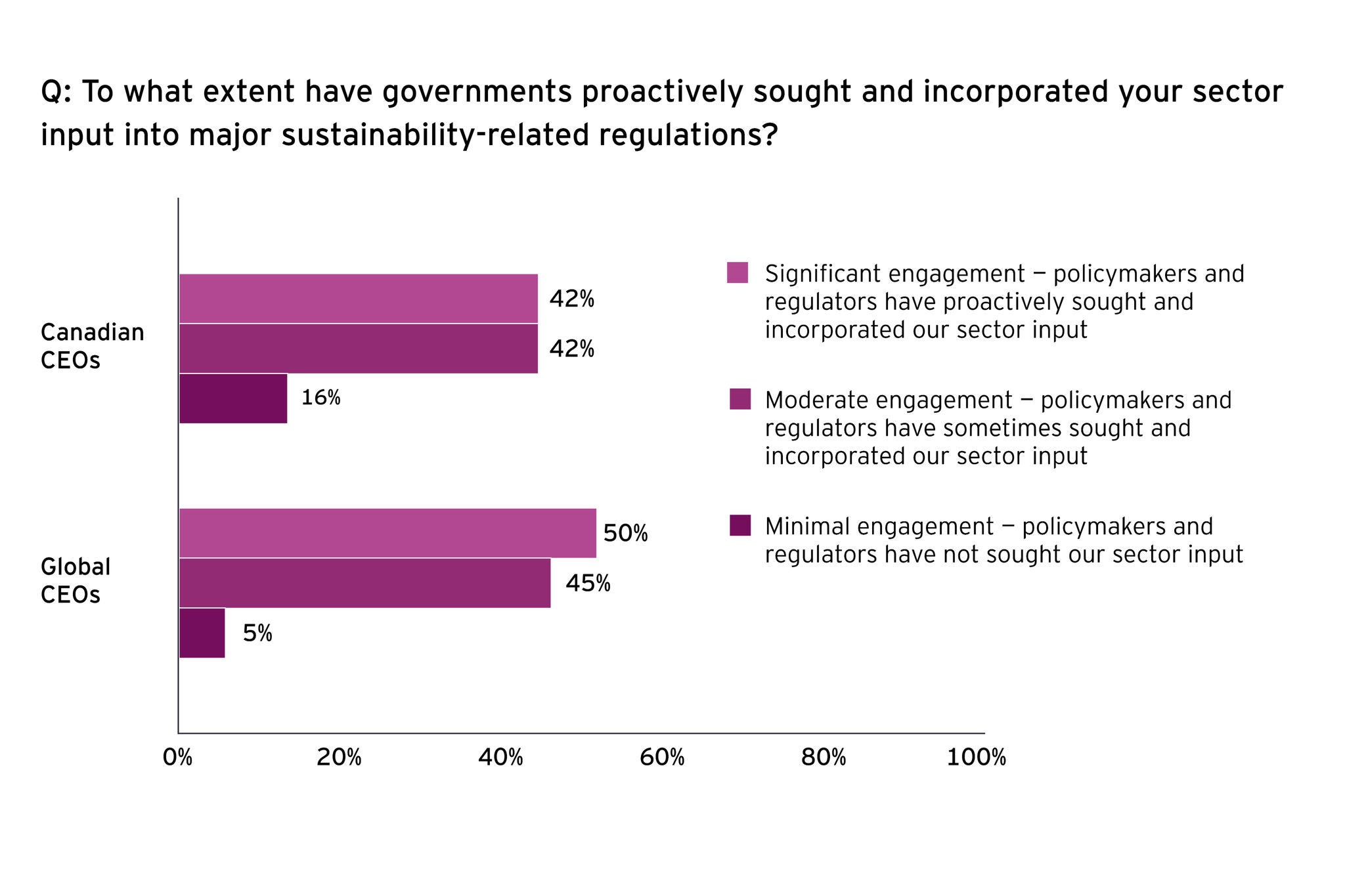

To succeed, it’s crucial that businesses pursue appropriate policy actions that support the growth and sustainability agenda. Canadian and global CEOs identify subsidies and tax relief for investment in green technologies such as the EU Green Deal or the US Inflation Reduction Act, and government investment in sustainable infrastructure as the most supportive policies to support this transition. Additionally, Canadian leaders also shared that the least helpful policies would be financial penalties for inaction on emissions reductions or disclosure requirements, followed by higher and more universally applied carbon pricing.

Canadian leaders also emphasize the importance of government investment in infrastructure to facilitate the energy transition, as well as investment in water and other infrastructure to support climate resilience. However, Canadian leaders also recognize that the top challenges for government in achieving their infrastructure plans include raising capital through greater taxes and the lack of sophistication in public-private partnerships and existing funding models.

Key Actions for Leaders

As concerns of an economic slowdown slowly lift, Canadian CEOs may benefit from gaining strategic alignment with peers, and update business strategies to stay ahead.

- Align with peers and industry leaders

While different markets are characterized by unique economic and regulatory environments, broad strategic alignment with global industry leaders is a critical imperative for success. - Seize opportunities in AI and innovation

The far-reaching impacts of AI and technological investments are expected to support the global technology transition and aid business success. Canadian businesses must look towards maintaining their competitive edge by ensuring timely investments in advanced technologies and leading processes and systems. - Adapt business strategies to futureproof your business

Leaders are encouraged to adopt dynamic business strategies that are based on an assessment of costs and benefits associated with competing imperatives.

Summary

Business leaders are embracing transformation with a sharp focus on sustainability, technology and AI.