EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Co-authors: Shelley Cornforth, Associate Partner, Technology Consulting and Jennifer Davidson, Senior Manager, Consulting

Economic uncertainty and substantially higher interest rates mean it’s critical to go back to a cash-focused mindset.

In brief

- In the last quarter of 2022, working capital increases — driven by accounts receivable — began trapping cash and impacting free cashflow results.

- Increasing debt and interest rates are making working capital funding more expensive, with interest expenses increasing 26% year on year, further draining cash resources.

- Economic uncertainty is impacting potential 2023 growth projections, with early signs and margins starting to feel the impact.

- Leading companies are taking control by focusing on the impact to firm liquidity of customer, sales, marketing and product operations.

For many tech firms — especially start-ups and high-growth companies — cashflow and the availability of working capital are critical for the business. It can dictate the rate of growth and the ability to withstand shocks and challenges. As software companies grow and begin to get to scale, an increasing array of priorities can potentially cause a shift in focus from liquidity to revenue growth, driving up the cost of running the business and the associated burn rate. At a time of uncertainty, it’s important to re-establish some of the management traits that made these companies successful in the first place.

Signs of potential stress ahead

Over the last two to three years, technology companies have operated in a growth environment — whether in remote work enablement, e-commerce, process improvement or the increasingly evolving use of AI. Digital transformations have provided excellent opportunities for the industry, with balance sheets of North American companies being flush with cash and a need to invest it. However, economic uncertainty and substantially higher interest rates mean it’s critical to go back to a cash-focused mindset.

To better understand the effects of a changing economic environment and related impacts, EY teams analyzed the financial performance of 160 leading North American software companies in the last quarter of 2022, compared with prior years’ performance. Several key observations stood out:

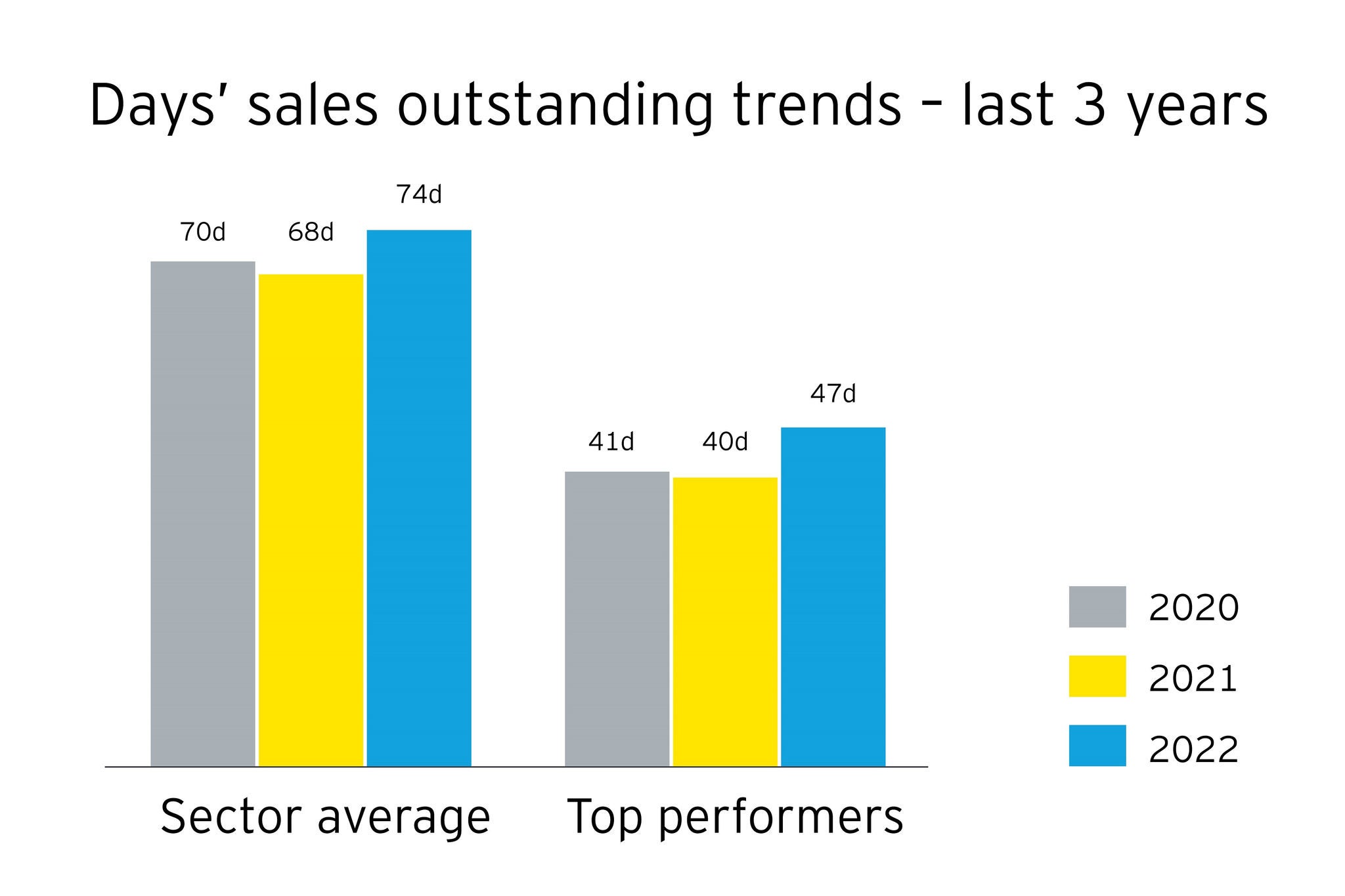

- Software sector average days’ sales outstanding increased by six days (9%) compared to the prior year, equivalent to an additional $10b of incremental cash trapped on balance sheets. Results of top performers deteriorated by seven days, revealing the challenges were not restricted to laggards.

- Cash conversion cycles increased for larger companies (+7%, >$1b revenue) compared to smaller peers (+2%).

- The cost of funding this working capital also increased. Although net debt only increased by 10%, interest expense rose by 27% for software companies in the last quarter of 2022. This represents an additional $750m cash drain and is expected to increase further through 2023.

- While growth has remained robust, with a 15% revenue increase year over year, both gross margin and EBITDA margin saw slight reductions of 1%. In addition, the revenue to operation cashflow conversion ratio fell from 28% to 24%, partly driven by the increase in accounts receivable.

Focus on the “controllables”

Management teams face plenty of competing priorities. While many external challenges may be outside your control, there are tangible ways to get a grip on cashflow:

1. Cultivate a proactive understanding of customer portfolio health. Use analytics to better understand the performance and profitability of customers across the product portfolio and, if applicable, by geography. Leading tech firms are evolving their approach for measuring customer relationship strength — for example, through net promoter score — to focus on operational metrics such as predicting revenue potential, customer defection and payment risks.

Tools can be created quickly to gather the right selection of key performance indicators (KPIs) to determine whether customer health is deteriorating, if credit rules need to be adjusted or risk-based pricing premiums should be adopted (and where intervention may be required) to prevent bad debt. A shareholder-endorsed, disciplined focus on cash can also help identify the potential of revenue and cash leakage to drive additional returns.

2. Re-evaluate the effectiveness of the quote-to-cash cycle. Over the last few years, there have been major advances in digital transformation of the quote-to-cash (Q2C) cycle. Greater collaboration between sales and accounts receivable teams, supported by more robust customer relationship management (CRM) systems, can reduce credit risks and avoid invoice disputes that delay cashflow. Additional gains can be realized with technology enhancements such as e-commerce interfaces, more efficient billing solutions and increased automation throughout the broad process.

Despite this availability, many companies continue to operate with their sales and accounts receivable functions in silos and ineffective integration of data, as well as legacy capabilities that haven’t matured with their offerings. Consider how robustly your Q2C process is operating today — whether through contract management, payment and collections mechanisms or portal capabilities. Evaluate and make investments, which will likely have higher payoffs in 2023 compared to other years.

3. Evolve commercial strategies: licensing, payment terms and sales incentives. There are different schools of thought on the optimal commercial and pricing structures for products and solutions. With the shift from traditional license models to software as a service (SaaS), there has also been a shift in the commercial impact of cashflow. Companies that would once have received cash annually or quarterly in advance are now collecting it monthly, in arrears. In addition, sales incentivization strategies are often driving lumpy cashflow, with too much focus on the number and size of deals — vs. the revenue and cash potential — and bookings are skewed towards financial quarter ends.

Now is the right time to re-evaluate whether alternative commercial strategies can be employed to level out cashflow while supporting steady sales and robust commission plans.

4. Reset measurement of sales and marketing effectiveness to include impact on cashflow. As tech companies mature, there is a shift in spending and investment as firms measure sales and marketing effectiveness based on customer acquisition rate, product usage, and share of wallet and market share. While these are established metrics for tech firms, they negatively impact cashflow. Leading tech firms are starting to ramp up efforts behind key account-based sales and marketing programs that have a lower cost to convert, resulting in stronger cashflow. Marketers are tracking metrics beyond the number of customers and licenses sold to include the incremental impact of these results on cashflow.

We recently investigated a software company’s product portfolio and found that not every product should be consumption based. In fact, some customers preferred a subscription model to both provide budgetary certainty and prevent the need for paying invoices every month. Ultimately the benefits extended beyond cashflow, as it enabled enhanced customer experience and reduced administration.

Questions to ask

Assessing these areas and determining how they apply to your business begins by asking five key questions now:

- How effective are the revenue cycles and incremental cashflows across channels and customer segments?

- How robust are quarterly cashflow forecasts, and do we have sufficient understanding of the variances?

- Are we easily able to understand the relationship of bookings to billings and how they convert to cash?

- Do we understand the reason for increasing days sales outstanding (DSO) and are we taking action to stem the potential risk?

- Is management incentivized on cashflow metrics, and are these KPIs cascaded into the organization?

Taking control

Looking forward, there are several enablers that can help companies execute their plans in 2023:

Elevate cashflow accountability.

In organizations where free cashflow performance lags, there’s typically an accountability vacuum outside of the finance function. Consider how to educate and elevate the importance of cashflow against other priorities and determine the top five actions that can have an immediate effect, gaining the necessary buy-in at all levels of the organization — including shareholders and investors.

Enhance visibility.

Most leading companies have a significant amount of data but are unable to synthesize it to focus on the key issues to address. Leading companies have developed richer customer intelligence that can focus on profitability, renewal probability, credit risk and delinquency risk, differentiating between their consumer and business channels. With the right metrics, actions and accountability can be derived to take a more proactive approach to mitigate risks or enable value creation.

Evolve incentivization.

Money is no longer free. There’s a cost of doing business. Consider how the cost of working capital is considered in margins and whether that factors into pricing and discount strategy. It may be a good time to evaluate the breakdown of commission realization and ensure that it balances the booking value and cash timing to align organizational objectives.

A finance executive at a client recently highlighted how it is becoming more common for sales to negotiate a backloading of multi-year deals, including the deferral of consulting fees, with the rationale being competitiveness. This continues to impact the relationship between booking and billings, revenue and cash at a time when cash is becoming more important.

Summary

By enhancing visibility and gaining a company-wide understanding of the influenceable drivers and impacts of cashflow, software companies can gain the resilience they need to face the economic uncertainties of 2023. The most proactive will not just see these actions as risk mitigation, but as an opportunity to differentiate and leap over their competition in an increasingly competitive marketplace.