EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Co-authored by - Brian Gelfand, Director, Technology Consulting and Sam Nazari, Senior Director, Strategy and Transactions, EY-Parthenon

FIs must experiment with central bank digital currencies (CBDCs) and understand how to anticipate, adapt and respond to new ways of transferring value in the economy.

In Brief

- Central banks in 105 countries representing 95% of global GDP are exploring central bank digital currencies (CBDCs).

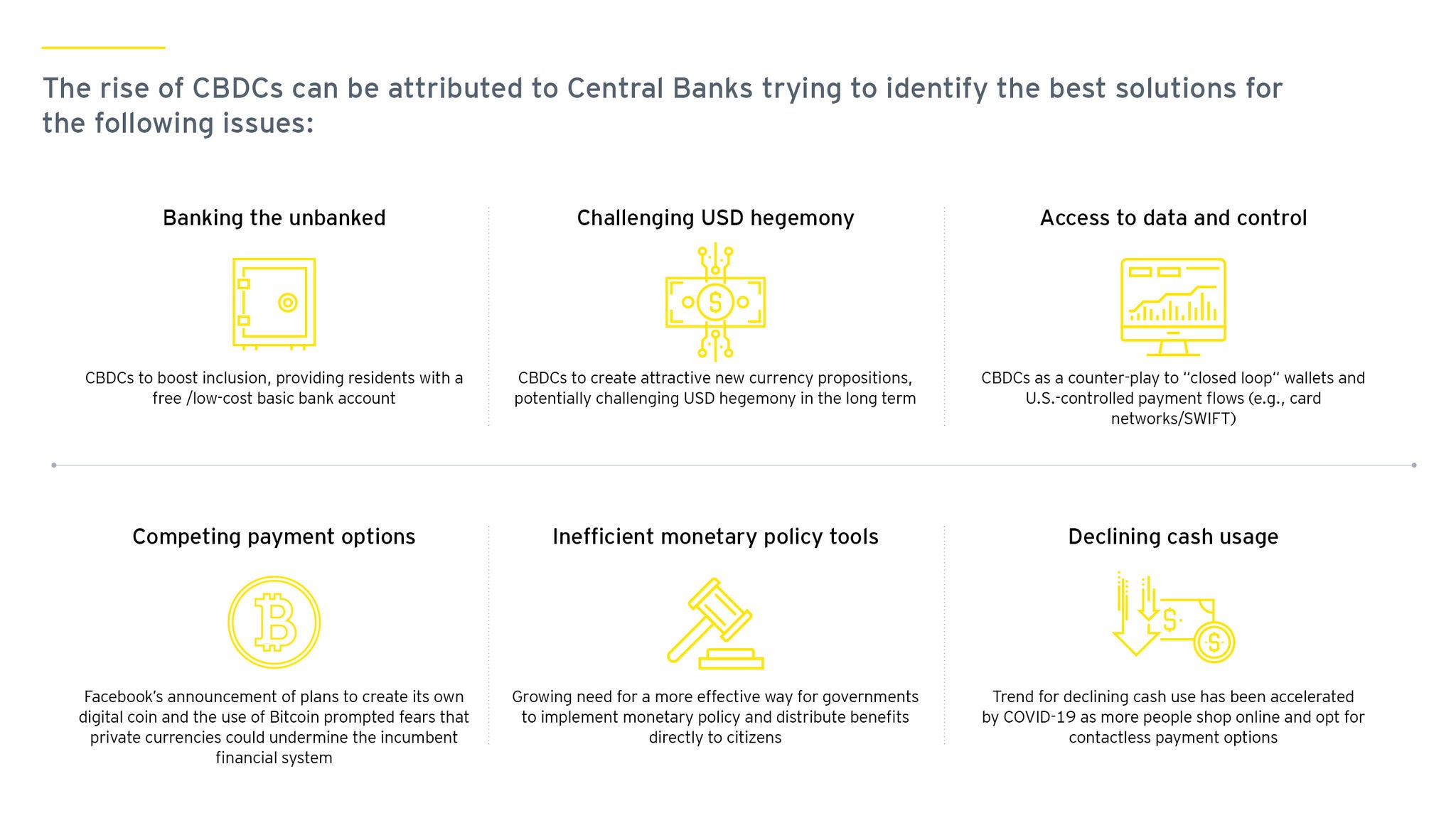

- Use cases include financial inclusion, more efficient monetary policy tools, competing payment options and declining cash usage.

- CBDCs will challenge banks’ traditional roles in the financial system, particularly in payments.

- Now is the time for banks and other FIs to engage with this new technology and with policy-makers and other financial system stakeholders to prepare for the challenges and opportunities of digitalized money

Central bank digital currencies (CBDCs) are digital versions of sovereign fiat currencies that represent direct claims on the central bank, similar to paper currency and deposits in reserve accounts. Currently 105 countries, representing 95% of global GDP, are exploring CBDCs and 4 central banks representing 10 countries have fully launched CBDCs.¹

There are several emerging trends driving the development of on-chain fiat currency:

Competing payment options: Central bankers continue to be concerned that the rise of privately owned and controlled currencies can potentially undermine existing financial systems and national sovereignty. A CBDC will provide a competitive alternative to these private currencies.

Declining cash use: A CBDC provides a substitute or complementary central bank liability in a world where cash use is declining and digital payments are growing in popularity, and will provide an important source of competition and market discipline for private networks and closed loop systems.

Financial inclusion: CBDCs can also provide a solution for many inequalities built into current financial systems. Lower-income individuals and families may have limited access to banking services due to high fees, minimum balance requirements and other exclusionary factors. A CBDC can provide a low-cost alternative to traditional bank accounts and payments capabilities for the unbanked and underbanked.

Targeted monetary and fiscal policy tools: Programmable CBDCs can provide a lot of precision in the delivery of program benefits and subsidies. This increases the allocative efficiency of budgets and ties outcomes to outlays. Programmable money also gives unprecedented flexibility in implementing monetary policy measures, including interest rate management and inflation control.

Wholesale use cases: CBDC trials are being run all over the world to increase efficiencies in the interbank payment space. This efficiency extends to cross-border payments by reducing the number of intermediaries required and the need for messy and cumbersome correspondent banking constructs. Several experiments have established the feasibility of using CBDCs in efficient cross-border transfers, even though the interoperability between central bank systems will require a significant lift from a policy, technology and operational perspective. Other important wholesale use cases include more efficient securities settlements where CBDCs can interact directly with tokenized securities on a distributed ledger.

Why CBDCs matter for banks

Banks serve two fundamental roles in the financial ecosystem; credit creation and acting as a medium of value exchange. The introduction of CBDCs is likely to have a significant impact on both of these, therefore fundamentally changing the role of banks . Banking could be more important in the economy than banks themselves.

A CBDC that is issued and managed directly by the central bank could pose the risk of disintermediating the commercial money and payments systems. While there are a range of outcomes that could manifest, the likely outcomes will be a result of deliberate design choices made by central banks.

To understand the design choices, we must first consider the central banks’ motivations.

First, central banks’ financial stability mandates make it very unlikely that they would intentionally disrupt banks’ credit creation function and intermediation function in the economy.

Second, most central banks are not contemplating managing millions of wallets and operating a client-facing retail banking system. It is therefore most likely that CBDC designs will preserve the banks’ intermediary role. Most experiments, in fact, propose an intermediated model where banks will be involved in the provision of wallets and manage customer services.

While most CBDC projects reflect this intermediated or two-tier model, banks still face the risks of new challenges as account holders move money out of their deposit accounts and into CBDC wallets. To the extent that this reduces deposit balances, banks will need to seek alternative sources of funding at potentially higher rates than they pay for deposits. In times of financial stress this movement could result in a run on bank deposits, resulting in financial instability. CBDC design choices in terms of whether a CBDC bears interest, or how much, and limits on transfers or balances will directly affect this risk.

CBDCs will most likely be a complete game-changer for payments. Providing an alternative to the current system of payment rails and correspondent banking would have a lasting impact on payment-related direct revenues such as fees, commissions and floats. Indirect revenues from cash management service offerings could also be affected. In anticipation of this disruption, companies in the payments industry are moving closer to banking or shadow banking business models as they start to redefine their role and value proposition in a CBDC world.

What are the fundamental design choices for central banks?

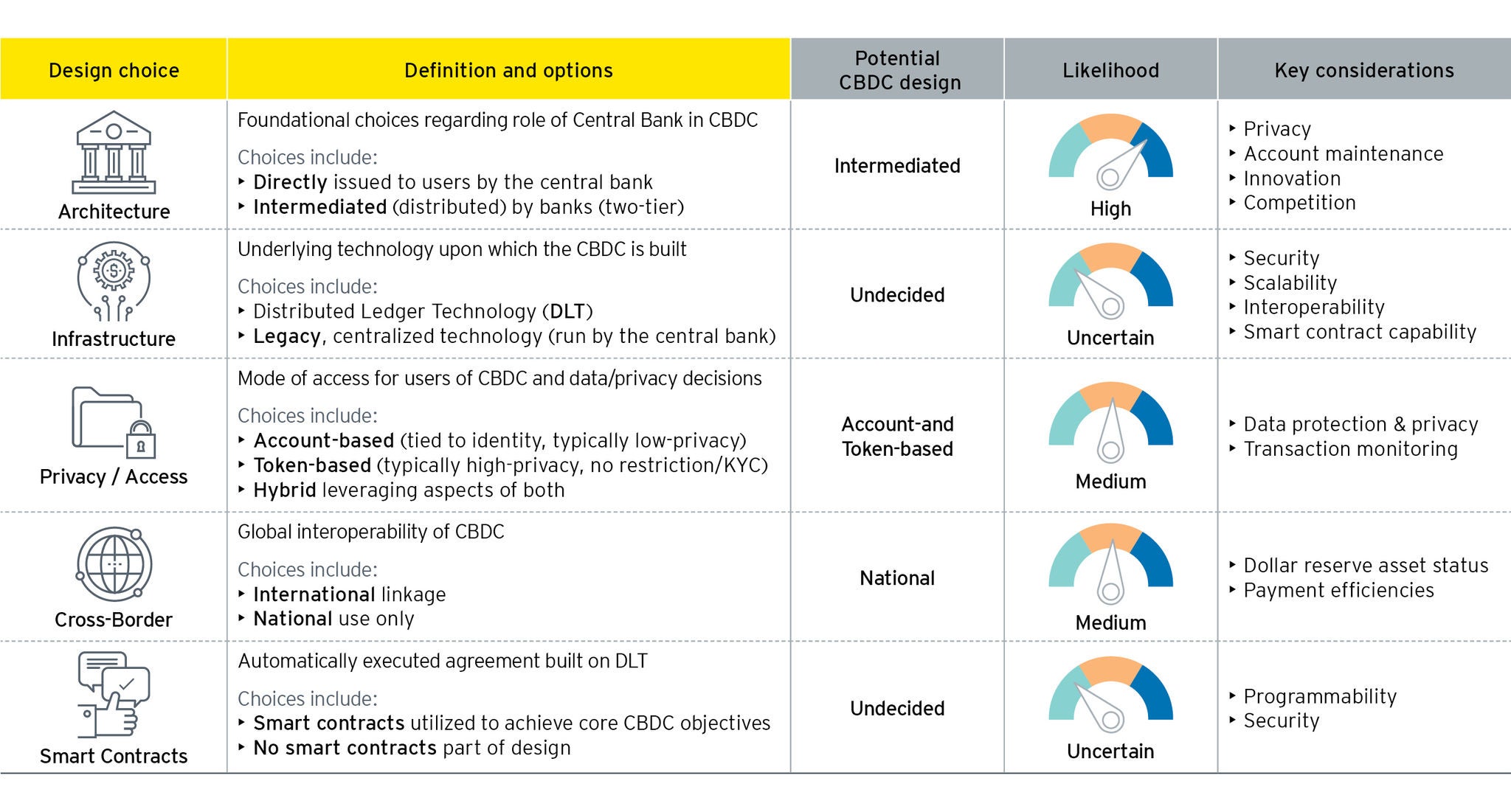

There are several design choices available for CBDCs that span the spectrum between a minimally disruptive form of payment that is integrated into existing infrastructure and financial institutions to a peer-to-peer transfer of value that operates on distinct infrastructure and can potentially disintermediate banks and disrupt the fractional reserve banking system.

As pointed out in the above illustration, the decision to offer a CBDC through financial institutions mitigates the risks of disintermediation of the banking system. Design choices that further limit risk include the decision to limit the amount of CBDC that can be converted, held or transferred at a given time, thus decreasing the amount of rapid and large conversions of deposits into a CBDC. Another design decision is whether a CBDC will bear interest. A CBDC that does not bear interest will make it less attractive than commercial bank money for many purposes.

Nonetheless, there will be some flow of deposit funds into a CBDC, and banks should be sensitive to the need to develop additional sources of funding.

How can banks prepare for the introduction of a CBDC?

The stakes are high for incumbent financial institutions and there is a clear need to understand the potential impacts of CBDCs on their business model. This includes the potential for more peer-to-peer transactions and potential impacts on bank funding models.

Opportunities for banks in the CBDC ecosystem include offering user-friendly customer experiences for transferring and transacting between commercial bank deposits and a CBDC, digital ID authentication, and using the enhanced data inherent in blockchain technology to develop new value propositions.

Financial institutions must engage with central banks, policy research, standard-setting organizations and other stakeholders to contribute actively in the development of CBDC design. The impact on financial institutions and the current financial system will depend on the form CBDC takes and the design choices involved, so banks must model potential impacts resulting from various design choices and prepare for how they will shape the bank’s future.

One way for banks to get ahead is by working with stablecoins. Stablecoins are tokenized payment instruments that are pegged to a currency or commodity. There are a variety of stabilization mechanisms that are used to maintain the peg, ranging from algorithmic stabilization mechanisms to full backing and convertibility into commercial bank money.

Establishing an experimentation framework for stablecoins can provide insights and experience that will support CBDC implementation. Working with stablecoins is an effective way for financial institutions to experiment, learn and develop an experience-based, informed view on the impact CBDCs could have on business. Committing resources to modeling potential impacts and participating in experiments and pilots will be very important to help prepare financial institutions for the discussions around competing design choices.

Another essential step for banks is to delve into the world of decentralized finance (DeFi), as it provides an early glimpse of potentially new business models, risks and operational impacts that need to be dealt with. Collateralized lending protocols, staking, market making and liquidity pools all present opportunities and challenges for incumbent institutions.

Around the world, prudential regulation is evolving for banks that are holding crypto assets on their balance sheets as opposed to purely providing custodial services. The Basel Committee on Banking Supervision (BCBS) has published two consultations on the prudential treatment of cryptoasset exposures, the most recent in June of 2022¹. In Canada, the Office of the Supervisor of Financial Institutions (OSFI) published an interim approach to crypto assets in August 2022. Banks need to engage with regulators to ensure that regulated financial institutions can play a role in the development of these markets and products, adding stability and transparency to the ecosystem.

Conclusion

The time to act is now. Financial institutions need to start exploring how they will custody, intermediate and innovate in the digital asset space. Participation and engagement in CBDC projects, experimentation with stablecoins, experimentation and mapping the effects of design choices, engagement with regulators and policymakers, and acquiring a solid understanding of the crypto and token economy will equip institutions for the future.

We can help guide and advise you on your digital asset journey, addressing strategy, technology, risk management, assurance, regulation and compliance.

At EY, we believe that digital currencies are one of the four forces driving monumental changes as a part of the great convergence. These include:

- Portable identity or self-sovereign digital identity

- Portable data

- Richer payments

- CBDCs

If you’re interested in discussing these topics further, please reach out to the authors.

Related article

The Great Convergence - Finding value with Real-Time Rails

The Canadian banking ecosystem is going through a revolution, with multiple forces driving monumental changes. The Real-Time Rail (RTR) is one of the services that will drive these changes

The Great Convergence - what financial institutions can do to get ahead

Read how FIs can gain momentum ahead of the great convergence by re-thinking their business model.

Summary

Central banks worldwide see valuable use cases for the introduction of a central bank digital currency (CBDC). But CBDCs will disrupt some of the fundamental roles banks play in the financial system.