EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Retailers that start developing cashflow predictability models early can prevent surprises and can build essential resiliency.

In brief

- Turbulent market dynamics, changing consumer expectations and evolving buyer behaviours pose a host of interrelated challenges for retailers in Canada.

- Building resiliency in this uncertain environment requires retailers to double down on cash flow. All internal stakeholders across the business need to buy-in on the absolute importance .

Retailers have remained resilient through pandemic shutdowns, supply chain disruptions, labour turnover and spiraling inflation. Even so, with government subsidies now well and truly spent, excess cash in both consumer bank accounts and retailer balance sheets is gone and new headwinds are on their way. As consumer demand softens, retailers that double down on three key areas can build resilience while the market continues to weather uncertainty and volatility as 2024 begins.

Globally, economic activity is generally subdued, desynchronized and potentially facing a correction as increasing interest rates and relatively high prices weigh more heavily on the consumer. Here in Canada, 29% of consumers feel worse off about their situation than they did a year ago¹.

How is that playing out in the market?

The Canadian consumer is in a complex situation, one characterized by both risk and prudence. With Equifax citing all-time high credit card debt in Canada² alongside increasing credit card/auto-loan delinquency rates and higher mortgage payments, consumers are now more willing to wait for deals in an effort to stretch tighter wallets further.

In recent times, consumers have become expectant, even trained, to wait for discounts, and this is pushing the need for deeper cuts to stimulate demand. This is going to have a very real impact on margins and cashflow entering 2024.

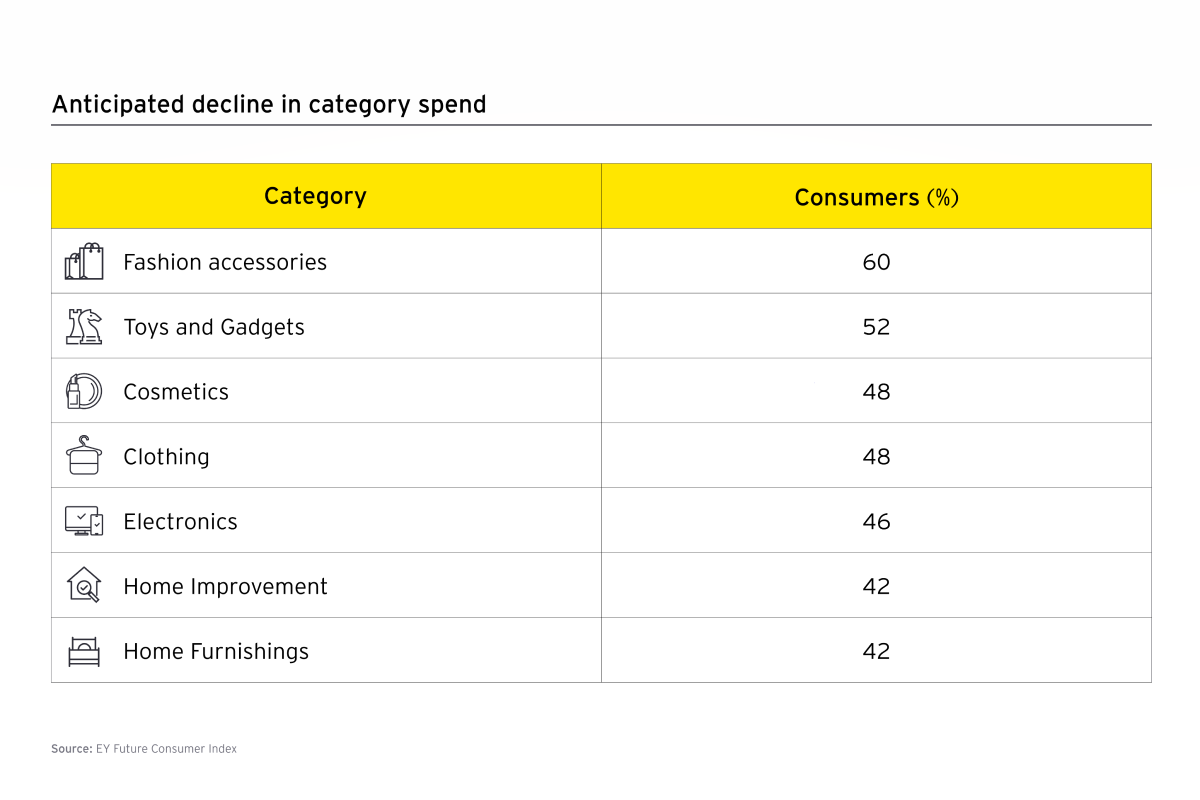

This November, EY Future Consumer Index painted a conservative picture for the retail landscape in Canada. After several months of flat retail sales, there is a more concerning view on demand. Whereas spending on consumer staples like groceries and fuel in the next three to four months is expected to remain stable, consumers are likely to cut back significantly on discretionary categories such as fashion accessories (60% responders expect to reduce category spend), toys and gadgets (52%), cosmetics (48%), clothing (48%), electronics (46%), home improvement (42%) and home furnishings (42%).

The decisions Canadian retailers make now will have a direct impact on their future results. Remaining resilient in the face of so much complexity requires retailers here to take three critical actions:

- Treat allocation of working capital more seriously to make all inventory dollars work harder and reconsider cost-first trade-off decisions. Dollars trapped in inventory would be better deployed with investments in customer experience.

- Enhance visibility to cashflow through more granular forecasting and upgrading models that make use of external macro information over historical models. This will provide greater insights to treasury and financial planning and analysis (FP&A) for managing liquidity.

- Embed cashflow into decision-making through all functional areas, including the merchant and operations teams, and be willing to make course corrections as the environment changes to balance both short- and long-term results.

Of course, rolling out a strategy to tackle these three areas requires a coordinated approach, one that connects these levers with an eye to making a holistic impact.

What should Canadian retailers keep in mind to make the most positive possible impact and build the greatest possible resilience?

1. Capital deployment needs a broader lens

Capital availability will be a differentiator for retailer performance in Canada. In a softer market, capital allocation becomes even more critical. Every inventory dollar must work harder. We know that cost of capital is increasing and will remain higher for the longer term. On the one hand, emerging technologies and tools offer up new routes to productivity and profitability. On the other, cash deployment into investments is going to be under more scrutiny and potentially require quicker payback.

For example, generative artificial intelligence (gen AI) has the potential to help retailers across a range of use cases, from customer experience and engagement through to operational efficiency and discounting strategies. But early adopters are bearing significant costs and there may not be short-term payback. Embracing gen AI requires technology and application investments at a time when capital is more expensive and available cash is already under pressure.

Meanwhile, retailers also face challenges balancing inventory correctly, with long planning horizons and equally long supply chains and purchasing commitments with manufacturing partners. The most recent quarterly results saw 41% of North American retailers report an average days inventory outstanding increase of 15 days.³

Canadian retailers fared worse, with 73% of retailers experiencing an average 13-day increase, suggesting a more challenging environment north of the border. With cash conversion cycles extending, this will put more pressure on free cashflow in the runup to year ends.

Clearly, it isn’t easy to determine how to navigate competing priorities in this environment to maximize return on investment.

How can Canadian retailers take strategic steps to build resilience now?

- Take a differentiated approach across the product portfolio to balance risks and enhance medium-term forecasting insights. This can make high-turning items readily available.

- With inventory flowing or sitting in warehouses and stores, carry out a more critical analysis on how discounts could help move high or excess inventory, with a special focus on identified products expected to remain in excess in the months ahead.

- Be prepared to challenge historical pricing and promotion strategies and differentiate to protect margin on more resilient products. A fair balance will need to be struck between dead net profit and inventory turns.

- Refresh thinking around how you work with suppliers. With the pace of change, shorter product lifecycles, more tailored demands and traditional minimum order quantities, lead times may need to change and become more agile. In addition, review the working capital requirements of agreements between inventory and payment terms to understand whether they can be driven towards cash neutrality.

- Explore overall contractual relationships, including pricing, allowances and payment terms, to find ways to balance capital demands without significantly impacting landed product margin.

2. Forecasting requires a more granular approach

Absent a crystal ball, data can help retailers in Canada make more realistic decisions. That’s crucial in this environment, where right-sizing demand can make all the difference between short- and long-term wins.

Successful retailers put the consumer at the heart of their strategy. That said, consumers are becoming increasingly difficult to predict, with changing preferences, shortening product lifecycles and increasing optionality. In this softening market, that makes it even harder to balance variability of demand with the requirement to meet customer experience expectations. Forecasting demand — and with it, the expectations on how sales will ultimately turn to cash — has never been more complex.

The good news is that enhanced demand planning solutions, even those supported by AI, do not require a new ERP or planning solutions. Simpler applications and analytic tools can now employ a broader data array, functionality to integrate a greater spectrum of demand signals, local consumer behaviours and macroeconomic trends. This helps make forecasting more accurate. Incorporating enhanced predictive analytics in inventory management could result in forecasting improvements of 20% to 27% and boost sales by 2% to 15%.⁴

At EY, we see the uplift in practice every day. For example, an existing retail client using an indirect cashflow model did not have the ability to explain the reasons for large cashflow variances to their forecast, with 30% to 50% monthly errors.

Following quarterly results that posted negative cash from operations, with no drilldown capabilities, FP&A couldn’t use the large volumes of data — purchase orders, inventory levels, disbursements — to address the performance issues and pinpoint where enhanced controls were required.

Working with the client to construct a forecasting framework and rapidly deploy a data model, we helped improve 30-day cash forecast accuracy to 98%.

Many similar companies aren’t fully using the capabilities data can provide.

How can Canadian retailers take strategic steps to build resilience now?

- Transition from indirect monthly cashflow models towards a hybrid of direct and indirect, using bottom-up transactional data and integrating company-owned data with external sources linked to consumer, competitor, supply chain factors and end markets intel. This can provide rich business insights and reporting capabilities to explain the big-picture view to executives and management.

- Embrace effective new models to provide a hub for scenario planning and the understanding of decisions and strategies on cashflow. This can be critical when looking at levels of investment or funding requirements looking forward. It also offers a greater level of prudence if demand is softening, helping the business manage cash appropriately.

- Enhance the use of data to better enable the finance function, including treasury and FP&A, to act as a counterweight to merchant decisions. With available purchasing capital becoming tighter, finance must be able to act as a business partner to provide enhanced performance insights. Linking product strategy to organizational cashflow can not only mean better, data-driven decisions, it can also support working capital optimization and enhanced margin.

3. Base major decisions around cashflow

Especially now, merchant-driven organizations must be more cash conscious. Recent economic trends suggest for a company to remain resilient in the years ahead, it must take a hybrid approach to balance both profitability and cash conversion.

In one recent EY study of 5,000 companies, analysts reflected on a series of historical market setbacks, assessing performance resilience in the early stages of market downturns. What did they find? Cash management was a key factor in both the prevention of and early response to these shocks.⁴

This is already playing out across EY client base in Canada, and beyond. Where strong cash management disciplines were employed over the last four downturns, companies were 21% more likely to prevent deteriorating performance in the first place due to the indirect benefits of a cash-conscious culture. In addition, leaders in cash management were typically 25% better at mitigating initial shocks due to having additional liquidity as a buffer to the impacted operations.⁴ Ultimately, companies with cash-conscious cultures and better cash management are statistically proven to be more resilient.

Numbers aside, shifting the corporate culture to centre decisions around cashflow often requires a significant shift. How so? A cash-focused culture is a mindset built into a company’s policies, procedures and controls to prioritize free cashflow generation. This cannot be solely a finance approach. Rather, all functions across the organization — including merchants, buyers and operations — must work together and be measured against specific metrics related to the cash and capital performance of the entire organization. This mindset requires commitment and buy-in from all employees.

How can Canadian retailers take strategic steps to build resilience now?

- Kickstart change at the very top of the house and reframe the paradigm on cashflow results, including short-term performance. Leaders and others beyond finance will need to become more accountable for working capital levels and cashflow results, including profitability. Although in the current state, finance may manage the balance sheet, they don’t always have much influence over it. Merchants have a key role in the success, having a deep understanding of the consumer and market, deploying digital marketing strategies or enhanced promotion strategies. However, merchants tend to be optimistic in nature and our typical experience in downturn markets is that finance needs to act as a counterweight to channel optimism where it is most viable.

- Engage all teams through clear, compelling and consistent communication to increase financial awareness and understanding. Although accountability lies with leaders, sustaining change of this magnitude requires all business functions to be held responsible for their impact on the organization’s financial health.

- Motivate people to contribute to this shift through incentive frameworks that tie employee efforts to cashflow results. Consider adapting incentivization over time, aligning to longer-term results or lowering thresholds around certain decision-making reviews. While these changes may not be embraced by all, they are critical and good for the company as a whole.

Summary

Adopting a cash-focused mindset is a no-regrets move. Retailers that start developing cashflow predictability models early can prevent surprises and can build essential resiliency. Begin now, and ensure all key decision makers are on board. Then, engage the entire organization in a sustained culture shift to generate the strongest possible results.