EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Authors: Munam Khan, Claire Patra, and Vicki Corker

Contributors: Robert Farlinger, Don Linsdell, and Clara Shin

In brief

- In the wake of the Canadian Sustainability Standards Board’s (CSSB) call for comments on its proposed standards, stakeholders submitted insights, concerns and recommendations.

- EY analyzed the feedback, which illustrates the complexity of implementing comprehensive sustainability reporting standards across diverse groups and sectors.

- The responses from investors and preparers are revealing differing perspectives in some aspects of the disclosures. While investors want more consistent, robust disclosures, preparers are requesting more time for implementation.

What’s happened so far?

The Canadian Sustainability Standards Board (CSSB) is developing Canadian Sustainability Disclosure Standards (CSDS) aligned with the global baseline developed by the International Sustainability Standards Board (ISSB). In March 2024, the CSSB released Exposure Drafts on Canada’s first sustainability standards, based on the ISSB’s standards issued in June 2023.

A call for public comments on the proposed standards was a significant step towards shaping the standards, ensuring they are fit for purpose and serve the Canadian public interest. This public consultation ended in June 2024 and the CSSB has since released the comment letters that were authorized for public disclosure.

Analyzing the feedback

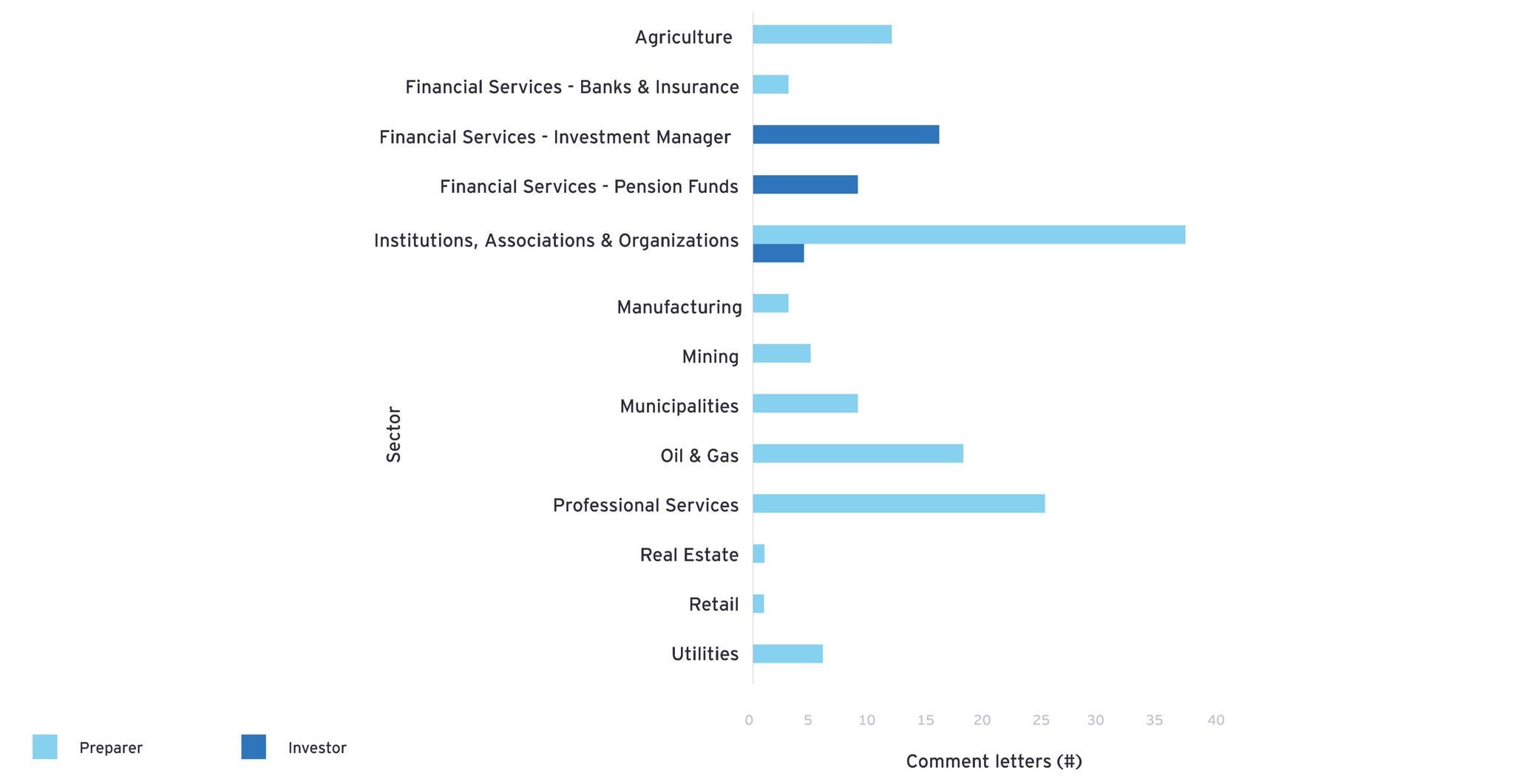

EY teams examined 149 comment letters/surveys to get a broad perspective of the feedback (publicly available responses). These responses comprised 120 submissions from preparers and 29 from investors.

Responses were received across sectors, as shown in the figure to left. The analysis showed several key themes reflecting stakeholder priorities, concerns and recommendations.

While the aim of the CSSB’s proposed standards is to provide consistent and comparable disclosures relating to sustainability, EY teams' qualitative analysis found differences in stakeholder opinions, most notably between preparers and investors. Aligning the timing of the sustainability-related disclosures to the timing of the release of the financial statements also represents a key issue – one where it may be difficult for the CSSB to find consensus.

Following is a summary of our observations and anticipated next steps.

Disclosures beyond climate-related risks and opportunities

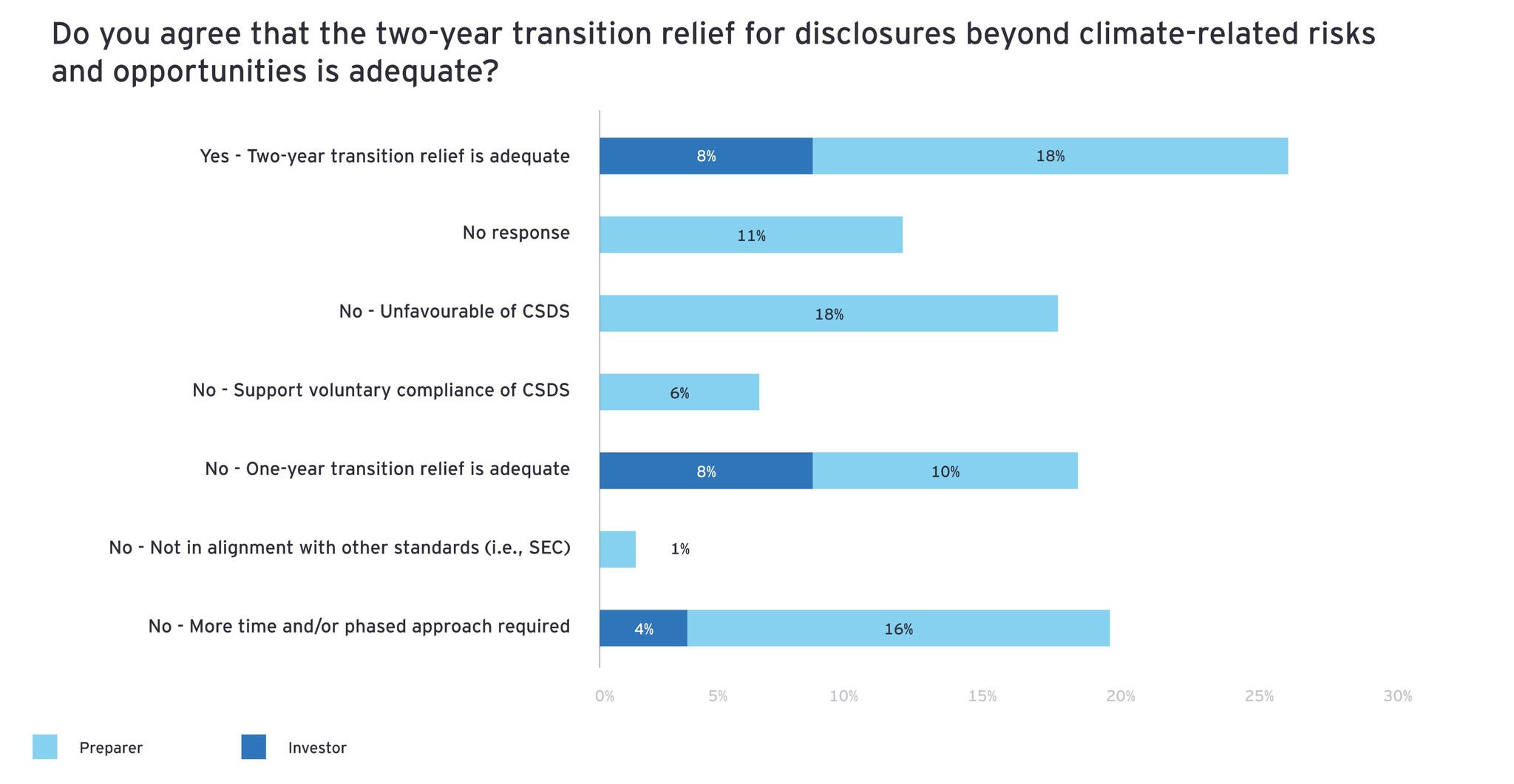

The proposed standards provide a two-year transition period in which entities may disclose information only on climate-related risks and opportunities.

Our analysis shows varying perspectives: more than one quarter of respondents (26%) agree with the proposed two-year transition relief, while 18% feel a one-year period is adequate – suggesting confidence in entities' abilities to adapt to the new standards within a shorter timeframe.

Some preparers are showing resistance or a desire for more time to comply with disclosures

Almost 20% of respondents, predominantly preparers, believe more time is needed than the proposed two years, or would like to see a phased implementation approach. Interestingly, 18% of preparers express an unfavourable opinion of the CSDS, reflecting concerns related to the proposed disclosure requirements. The CSSB now faces the challenge of reconciling these opinions in a way that is both practical and responsive to stakeholder needs. This next step will require careful consideration of the time needed for entities to comply with the new disclosure requirements on disclosures beyond climate.

Aligning the timing of sustainability-related disclosures to financial statements

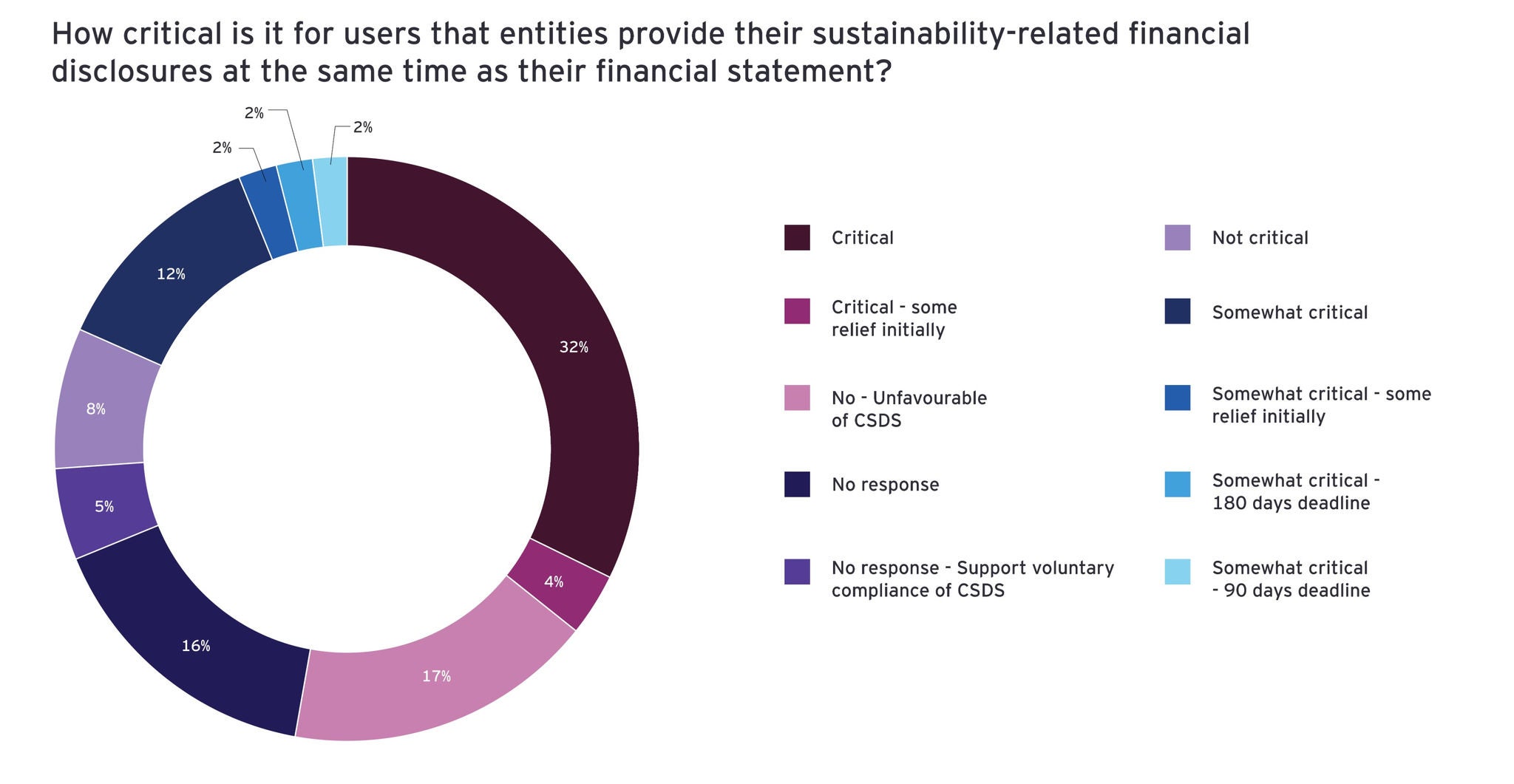

There is growing demand for integrated reporting that enables users to holistically assess an entity's financial and sustainability performance. This demand is illustrated by the fact that over 50% of the respondents deem it critical or somewhat critical for entities to provide sustainability-related disclosures concurrently with their financial statements.

However, 17% of respondents, all of whom were preparers, expressed an unfavourable stance towards the concept of CSDS, likely indicative of resistance or challenges associated with the adoption of these disclosures. These sentiments highlight further differences in stakeholder opinion and potential obstacles in the standardization and implementation of sustainability reporting.

Scope 3 GHG emissions reporting

The Greenhouse Gas Protocol, which provides a widely recognized accounting standard for greenhouse gas (GHG) emissions, categorizes GHG emissions into three scopes. Scope 3 includes indirect emissions (other than those from the purchase and use of electricity, steam, heating and cooling) that occur in an entity’s upstream and downstream activities.

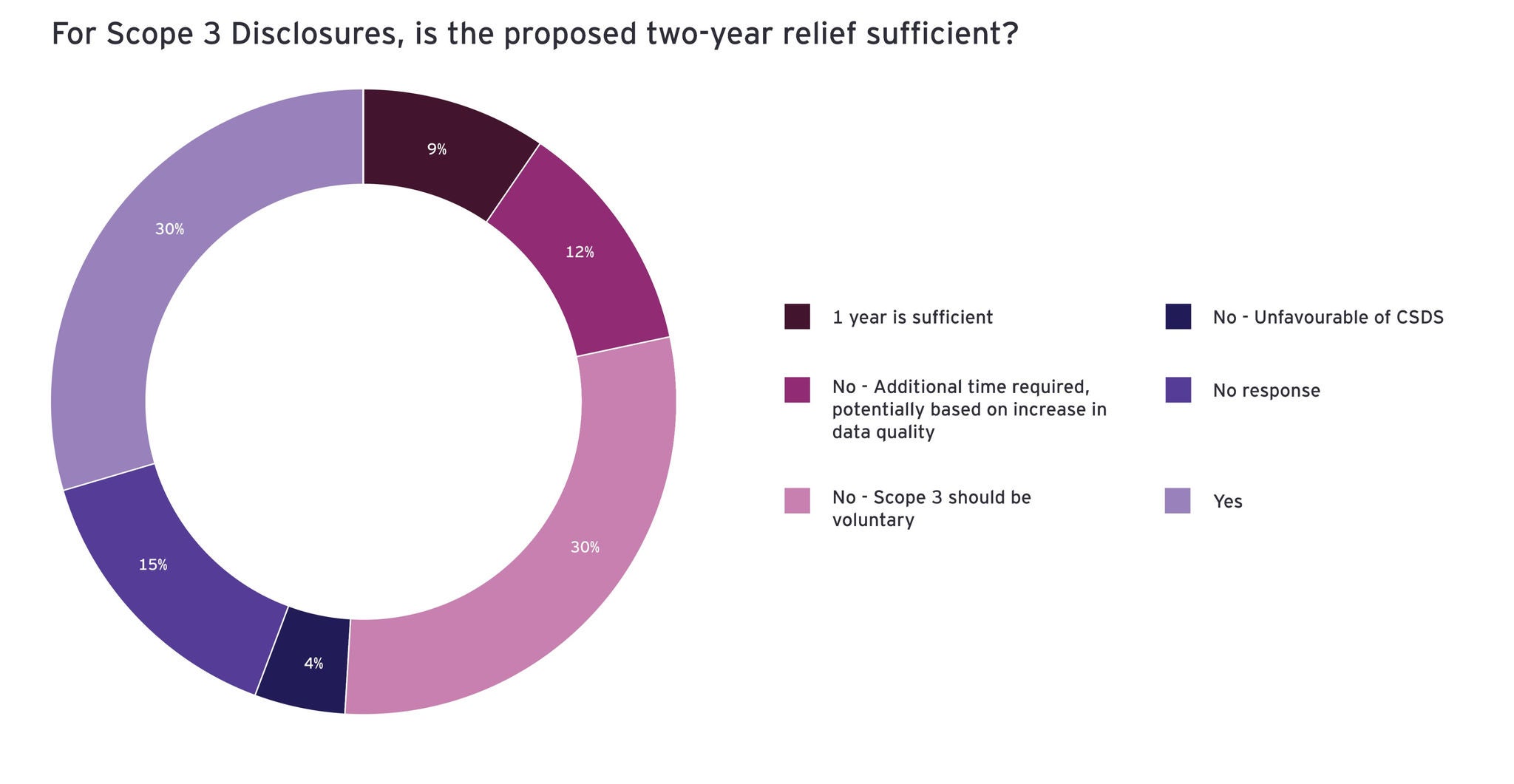

The disclosures of Scope 3 GHG emissions reporting are seen as critical in addressing climate-related risks and providing value chain disclosures to investors. However, the transition to this proposed reporting requirement poses significant challenges for entities, revealing a spectrum of opinions on whether the proposed two-year relief period is sufficient.

No agreement on the two-year relief period

A significant number of respondents (30%) support the two-year relief period, suggesting this timeframe is reasonable for these entities to build the skills, processes and capacity for Scope 3 emissions reporting. Conversely, another 30% of respondents argue that Scope 3 reporting should remain voluntary, reflecting concerns about the feasibility and usefulness of mandating such disclosures.

It’s worth noting that investors are mainly in agreement with the proposed timeline, whereas preparers show a significant inclination towards extending the relief period beyond two years. A smaller group (12%) believes time beyond the two-year relief is needed, with the extension potentially tied to improvements in data quality. While this percentage is statistically less significant, the feedback highlights the complexities of accurately measuring and reporting Scope 3 emissions.

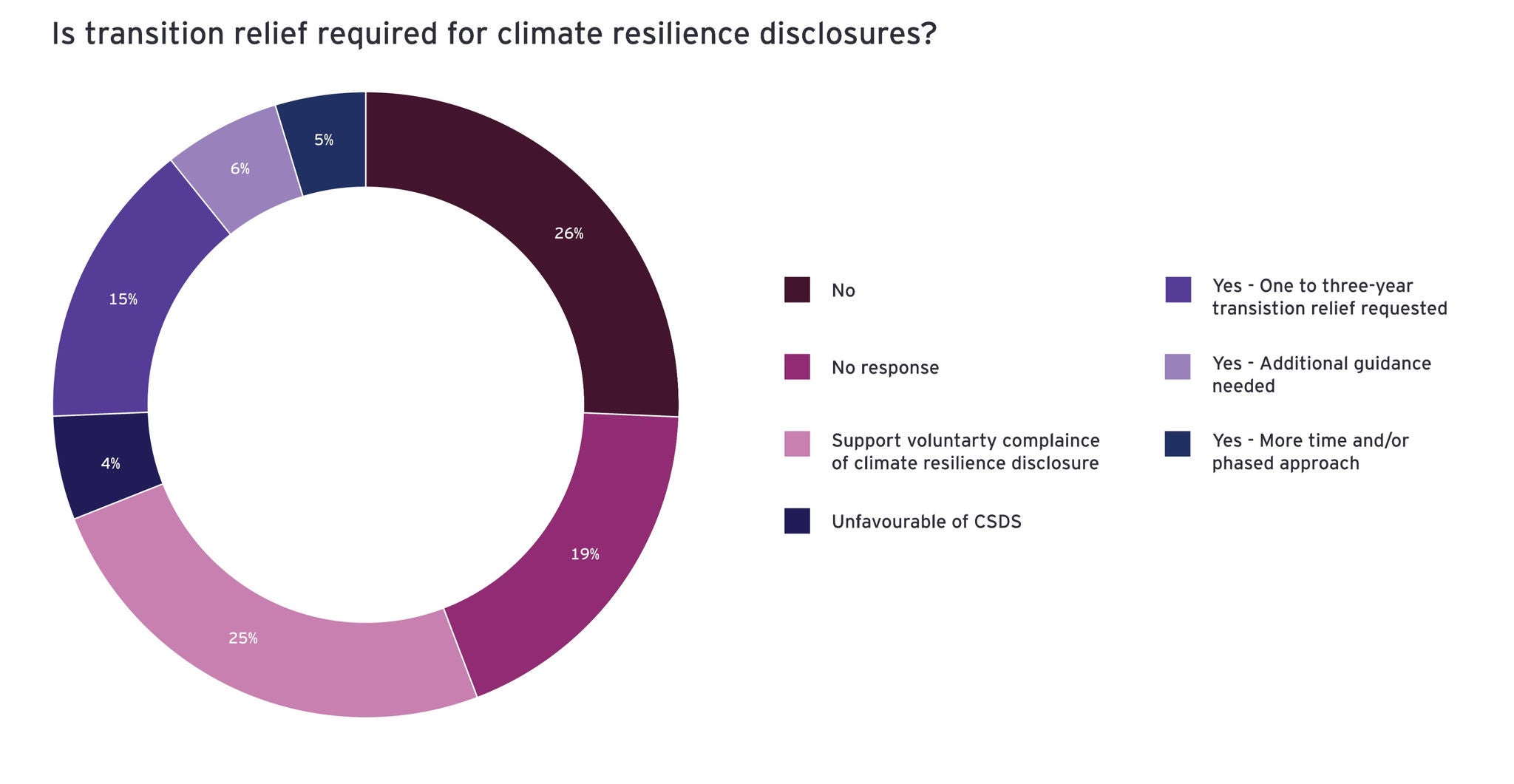

Transition relief on climate resilience disclosures

With respect to climate resilience disclosure, opinions vary on the need for transition relief. A notable 26% of respondents believe no transition relief is required, suggesting an appetite for the disclosures. This feedback indicates a need for climate resilience information, which may require enhancing existing capabilities to enable organizations to provide such disclosures.

However, one quarter of stakeholders advocate for voluntary compliance, reflecting a preference for a more flexible approach and allowing entities to opt in. As the CSSB considers this feedback, it is tasked with balancing the urgency of climate resilience disclosures against the practical realities faced by reporting entities. The challenge will be finalizing standards that are effective in promoting transparency and flexible enough to accommodate the diverse needs and capabilities of the public interest.

Additional recommendations

Respondents provided additional considerations for changes to the proposed Canadian Sustainability Disclosure Standards. Leading those considerations, 38% of respondents suggested the CSSB consider aligning with the US SEC climate rules. This recommendation underscores the close relationship between the Canadian and US capital markets, emphasizing the need for similar disclosures for consistency, comparability and reduced complexity for entities operating in both jurisdictions.

Feedback also highlighted the need to consider the inclusion of Indigenous Peoples' rights and interests, recognizing their significant expertise and contributions to climate and biodiversity matters, which are increasingly essential to sustainability reporting.

Other recommendations include additional guidance and provisions for small and medium-sized enterprises to ensure an accessible and practical framework for businesses of all sizes, further clarification on definitions and more guidance, and for industry-specific guidance to be optional.

What’s next?

As the CSSB moves forward with its Annual Plan for FY25, these insights will be crucial in shaping a balanced and effective approach to implementation. Once the CSSB standards are finalized, estimated to be in Q4 2024, the Canadian Securities Administrators (CSA) anticipates issuing for comment a revised rule setting out climate-related disclosure requirements.

Despite remaining uncertainties around the new sustainability reporting landscape, Canadian entities can use this crucial period for proactive preparation with no regret actions. This includes determining which sustainability disclosure regulations will affect an entity, determining the material information to report, and assessing current reporting practices and identifying potential changes to operating models.

The transformation journey to sustainability reporting is a strategic process that necessitates cross-functional collaboration, technology enablement, robust controls, risk management and contributions from diverse teams. Seizing this vital opportunity to prepare and collaborate in advance will be critical for Canadian entities to prepare for the transition from voluntary to mandatory reporting and position themselves for future success.

Summary

The comment letters illustrate the complexity of implementing comprehensive sustainability reporting standards that are robust and adaptable across industries. Opinions range from strong support for certain disclosures to calls for additional guidance, more time or phased approaches to implementation. The greatest differences tend to depend on whether the respondent is an investor or a preparer.

While the feedback does not offer consensus, it does highlight the importance of flexibility, clarity and alignment with other global regulations and a need to consider the diverse capabilities and resources of reporting entities.

While the implementation of the proposed standards may present challenges, the use of the proportionality mechanisms and the transitional relief provided will be helpful for preparers.