EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Co-authored by Amar Sharma

Amar is building the future of digital identity in Canada. He is involved with large identity transformation programs for public and private sectors, spanning across multiple industries including

banking and insurance as well as key digital identity initiatives at provincial and federal organizations. He is a senior manager in EY’s Digital Identity practice with in-depth experience in Customer IAM and Decentralized identity. He has advised clients on their customer identity architecture, solution design and migration strategies. Before switching to consultancy and advisory services, he was leading an engineering team to build authentication product suite for a top cybersecurity firm with a strong focus on “identity as the new security perimeter”.

Co-authored by Sam Nazari

Sam is Senior Director of Strategy at EY-Parthenon, part of EY’s Strategy and Transactions practice. He has several years of experience and an extensive record of success in delivering innovative and thriving business solutions. He is highly skilled in developing and executing strategies that create value and competitive advantage. Previously, Sam led EY Canada's banking innovation practice, where he advised clients on various topics, including the future of banking, the future of money and identity, open banking, technology strategy, AI and emerging technologies strategy, digital assets, performance improvement and mergers and acquisitions.

The adoption of digital identity could present a drastic change in the way customers interact with online services. Banks and FI’s can be a driving force for this change.

In brief

- A digital identity revolution or self-sovereign identity- puts the control of identity back in the individuals’ hands and provides opportunities to strengthen security and privacy which can enhance trust.

- Convergence of Public and Private sector means one connected ecosystem and portable digital identity for all digital services. Beyond efficiency, this will unlock the digital economy.

- Financial institutions should think beyond access management; they can rethink and transform customer and employee relationships.

Digital identity is the anchor across a customer’s journey. If the financial system is considered a mirror of the real economy, identity mirrors the unique individuals who interact with the financial system. Digital identity represents humans at the center of modern financial services.

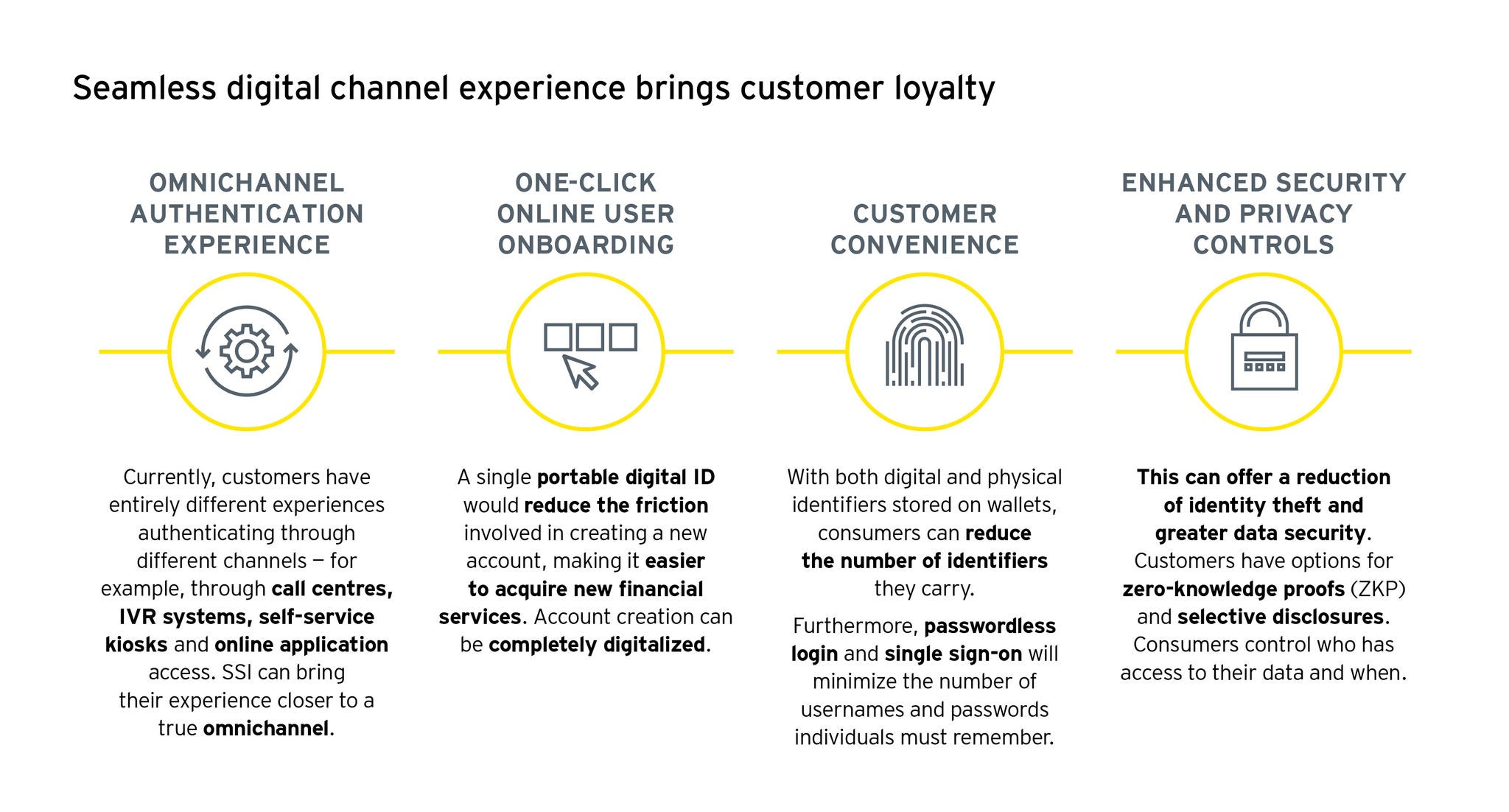

Providing seamless access, supporting hyper-personalization, enabling risk and fraud management, all while reducing friction, are expectations that cannot be met with a simple “personal profile.” And there’s more to the challenge. An increasingly shrewd customer population expects security, values privacy, and demands control over their identity.

The modern digital identity augments personal attributes with other pieces of information that represent the unique individual at every touch point. Device types, locations, and customer and corporate behaviours are connected to profile the individual as well as how they interact. As a financial institution, think beyond access management: with digital identity, you can reimagine your customer-corporate relationships and build trust. This trust will be the new anchor to tether customers to your business. Failure to build this new tether would most likely result in your customers gravitating towards other providers.

Evolution of digital identity models

Everyone who’s reading this article has likely experienced the maturing of digital identity in their day to day. In each transition, advancing security, privacy, customer experience and control have been the main drivers. What’s the endgame? Customers will hold their verifiable credentials in their digital wallets and will bring them to every single transaction that needs their identity verified. Beyond that, some see a world where digital identities and digital assets are all held and connected in the same wallet. A predicted future we don’t see far from reality, and a decentralized identity system will be at the core of this transformation.

Rush to decentralized?

Not so fast. Centralized and federated identity models have been around for many years. Most of our public and private sector business constructs have been built around these models. We have established frameworks and processes to manage objectives like know your customer (KYC) and anti-money laundering (AML); our legal, regulatory and compliance frameworks need adjustments to accommodate the flexibility offered by decentralized identity.

It’s quite clear that we’re moving towards a self-sovereign identity model (SSI) underpinned by decentralized networks. However, in the interim we are likely to adopt a national federated identity model in Canada. This transition will be gradual and through adoption of priority use cases. For example, business owners can share identity attributes with other business partners securely via single application for cross-jurisdictional domains and secure identity proofing (e.g., AML/KYC check references, passwordless login using digital wallets).

Self sovereign identity and financial institutions

The self-sovereign identity (SSI) model has emerged as the leading approach to a decentralized system that enables a connected ecosystem of public and private digital services. That is through a common piece of digital identity for all digital touchpoints of a citizen. Whether it’s providing e-government services or digital services from providers in different industries, the same piece of digital identity will be used for identification, authentication and authorization across all different use cases.

Moving towards portable identity

A series of developments across the public and private sectors encourages a move towards SSI. Policy interventions to promote enhanced privacy and data portability, technology advancement and a strong consumer demand for better experience and trust have resulted in the rampant growth of SSI adoption across the globe. Most notable implementations have been in the government, banking, health care, retail, human resources and higher education sectors.

Various large banks in different geographies across the globe, have been exploring SSI for a few years now. Seven Korean institutions, including some of the largest banks in the region, have already gone live with the decentralized identity model and a longer list is following. We anticipate the customer-driven nature of this transformation to further fuel its popularity, much like Apple Pay or other solutions that brought more power to customers’ digital wallets.

In Canada, the demand is being met both at the provincial and federal levels through the sponsorship, development and rollout of various digital identity initiatives. Some notable examples are digital identity programs in the provinces of Alberta, British Colombia and Ontario. These provinces are using decentralized identity to streamline their services and cut red tape. Beyond these examples, the momentum is rapidly growing at the global level: the EU, Norway, UK, Australia, New Zealand, UAE, India, Argentina and Colombia have also started their journeys.

These models represent some of the early avatars of SSI and there is a long path ahead. But what is crystal clear at this point is that SSI is a natural evolution of how we will manage identity. Organizations across all sectors need to develop and execute on a clear strategy that bridges their existing CIAM programs with SSI — this is table stakes.

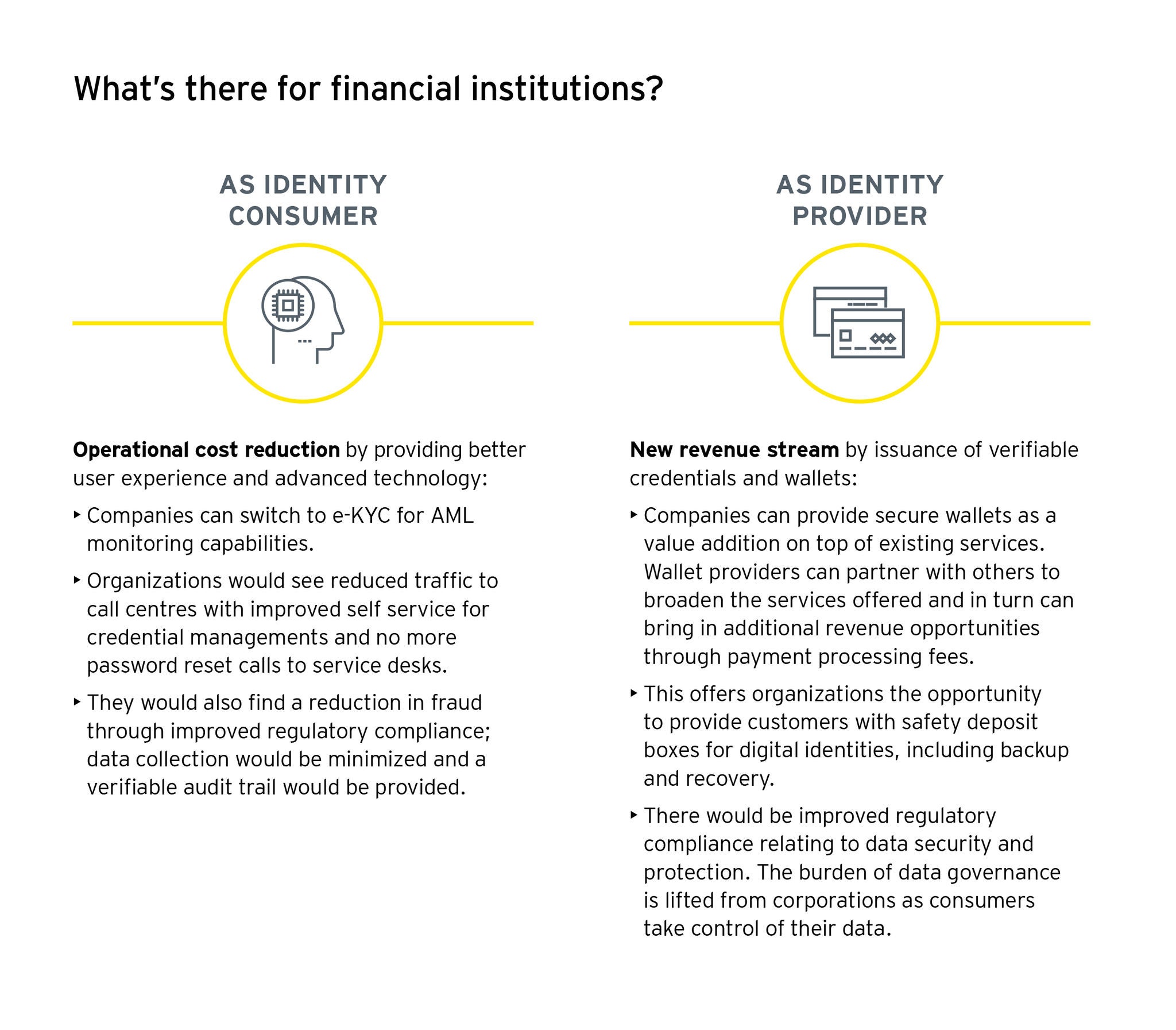

Driving value and convenience

Every conventional business model is evolving in a world where consumers are pushing for greater convenience, security and ownership over their data. Banks must also strive to evolve how business is conducted if they’re going to stay relevant. Those that can deliver will experience greater efficiency, effectiveness and growth.

Still figuring out – immediate next steps

Data portability regulations and standards-related initiatives are redefining the role of financial institutions globally. In Canada, the CIO Strategy Council has been engaged by the Standards Council to define minimum requirements and a set of controls to create and maintain trust in the digital system. Open banking is also gaining popularity in the digital space following the appointment of the open banking lead by the federal Minister of Finance in March 2022.

SSI brings a user-centric approach to portable digital identity; financial institutions need to re-think their approach towards digital identity to remain relevant in this new paradigm of managing digital identities.

Immediate next steps are:

Reimagine your role in financial services: Digital identity will continue to disrupt financial services. Organizations that want to retain their position as industry leaders will investigate how they can remain a reference point for consumers in a progressively decentralized world.

Explore interoperable solutions: It’s likely we’ll see more identity models emerge from different geographies and with different technological foundations. Developing a solution that can connect the dots within the new identity framework will help put your organization in a competitive position.

Think capabilities, data and people: Understand your current state and determine how to apply your internal capabilities in order to start developing a decentralized solution. Seize the opportunity to get involved in the early stages of these initiatives and help shape the digital identity framework to your advantage.

Consider partnerships and co-investment opportunities: Developing a digital identity solution can be challenging and costly. However, partnerships and co-investment initiatives can not only be beneficial to take advantage of technological synergies, they can also help early adopters launch a comprehensive service offering, covering the end-to-end customer journey experience.

Related articles

The Great Convergence - Finding value with Real-Time Rails

The Canadian banking ecosystem is going through a revolution, with multiple forces driving monumental changes. The Real-Time Rail (RTR) is one of the services that will drive these changes

The Great Convergence - what financial institutions can do to get ahead

Read how FIs can gain momentum ahead of the great convergence by re-thinking their business model.

Summary

The financial services and payments environment is changing drastically – organizations that seize digital identity as an opportunity to re-imagine their business model will maintain relevancy in the future.